Real-Time Rate Monitoring for Arvada Home Loans: Lock at the Right Time

Real-time rate monitoring technology automatically tracks mortgage pricing across multiple lenders and sends instant alerts when rates drop, eliminating the need for manual checking that can miss intraday fluctuations. Studies show that rates can swing multiple times daily, and platforms like Chestnut's AI system compare over 100 lenders simultaneously to capture optimal pricing windows before they close.

At a Glance

• Real-time monitoring platforms pull live pricing feeds from actual locked rates covering 35% of all mortgage transactions nationwide

• AI-powered systems reduce mortgage processing time from 30-45 days to just eight minutes, enabling faster rate locks

• Borrowers who compare multiple lenders save an average of 10-20 basis points on their mortgage rate

• Automated alert systems send email notifications when favorable pricing appears, eliminating constant manual checking

• Technology-driven monitoring helps borrowers achieve approximately 0.5% lower rates compared to traditional single-lender shopping

Mortgage rates in Arvada can swing multiple times in a single day. For buyers watching a competitive Front Range market, those intraday shifts mean the difference between locking a favorable rate and leaving thousands of dollars on the table over the life of a loan. Real-time rate monitoring replaces guesswork with data, alerting you the moment pricing dips so you can act before markets move again.

Why Real-Time Mortgage Rates Matter in Arvada's 2025 Market

Real-time mortgage rate monitoring pulls live pricing feeds and tracks changes minute by minute. Unlike static weekly averages, these tools reflect what lenders are actually offering right now.

Why does that matter in Arvada? Mortgage rates can fluctuate due to market conditions and lender policies, often changing multiple times within a single day. A rate you saw at breakfast may be gone by lunch.

The current 30-year fixed rate hovers around 6.19 percent, significantly below the 7.2 percent 40-year average. That gap creates opportunity, but only for borrowers positioned to move quickly. Chestnut's AI compares rates from over 100 lenders simultaneously, helping to cut the borrower's rate by approximately 0.5%.

For Arvada buyers, real-time monitoring is not a luxury. It is how you capture fleeting price windows in a market where hesitation costs money.

Key takeaway: Intraday rate swings make real-time monitoring essential for Arvada borrowers who want to lock at the lowest available price.

How Much Can Mistiming a Rate Lock Cost You?

Locking too early means missing a potential dip. Locking too late means watching rates climb while you scramble to finalize paperwork. Both scenarios drain money from your budget.

Research from the Federal Housing Finance Agency illustrates the stakes. For every percentage point that market mortgage rates exceed the origination interest rate, the probability of sale decreases by 18.1%. That lock-in effect prevented an estimated 1.33 million home sales between 2022Q2 and 2023Q4.

Volatility amplifies the risk. The current mortgage rate volatility index stands at 102.20, indicating moderate fluctuation that savvy borrowers can leverage with proper timing strategies.

Consider the math:

Scenario | Potential Impact |

|---|---|

Lock 0.25% above trough | Thousands added over 30 years |

Lock-in effect (1 pp gap) | 18.1% lower sale probability |

2022 rate dispersion | Averaged about 50 basis points |

Mistiming a lock does not just affect your monthly payment. It can constrain your future mobility and reduce the equity you build.

How Does Real-Time Rate Monitoring Work?

At its core, real-time rate monitoring connects borrowers to live pricing engines and alert systems that watch the market around the clock.

Data feeds: Platforms like Optimal Blue calculate indices from actual locked rates across 35% of all mortgage transactions nationwide. That volume produces a granular, accurate snapshot of where pricing stands at any given moment.

Automated alerts: A rate monitoring service automatically tracks market trends relative to your existing loan terms. When it detects an opportunity, it sends an email notification so you can act immediately.

API integration: Commercial providers offer live feed APIs starting at $500 per month, enabling lenders and brokers to embed real-time pricing into their own platforms.

For individual borrowers, the benefit is simple: you no longer have to refresh websites or wait on hold with loan officers. The system watches, you receive an alert, and you lock.

Chestnut's AI vs. Manual Rate Shopping: A Point-by-Point Comparison

Manual rate shopping means calling lenders, refreshing websites, and hoping you catch the right moment. It is slow, inconsistent, and exhausting.

Chestnut's AI flips that model. As one industry analysis noted, "AI-based underwriting reduces the mortgage application processing time from an average of 30-45 days to just eight minutes."

Factor | Manual Shopping | Chestnut AI |

|---|---|---|

Lender comparison | 2-5 calls, hours of research | 100+ lenders in seconds |

Pre-approval speed | 6-10 days at traditional banks | Under 2 minutes |

Rate advantage | Varies by effort | ~0.5% below national average |

Ongoing monitoring | Requires manual checks | Automated alerts |

Introducing automation into the mortgage process leads to a superior borrower experience and cost reduction available to all participants. Manual shoppers simply cannot match the speed or coverage of an AI-driven platform.

Chestnut's system tracks interest rate changes and proactively notifies clients when it might be a good time to refinance or lock in better terms. That continuous vigilance is impossible to replicate with phone calls and browser tabs.

What Data Sources Power Live Mortgage Rate Feeds?

Reliable rate monitoring depends on high-quality, real-time data. Several key sources fuel the industry's most trusted feeds.

Optimal Blue: The Optimal Blue Mortgage Market Indices are uniquely positioned to provide unparalleled transparency into mortgage rates by utilizing observed, real-time lock data from approximately 35% of the market. That direct-source approach beats survey-based estimates.

Optimal Blue Market Analytics: As the technology platform supporting over 35% of all mortgage rate locks, Optimal Blue sits atop a sea of mortgage data that is extremely unique, explicitly granular, and highly predictive of home prices, rate trends, and volumes.

Pricing Insight tools: With access to more than 900 mortgage lenders, Pricing Insight provides actual rates and live pricing so lenders can compete smarter and more effectively every day.

These feeds enable platforms like Chestnut to compare offers from 100+ lenders instantly, ensuring Arvada borrowers see the full competitive landscape rather than a handful of advertised rates.

When Should Arvada Borrowers Lock a Mortgage Rate?

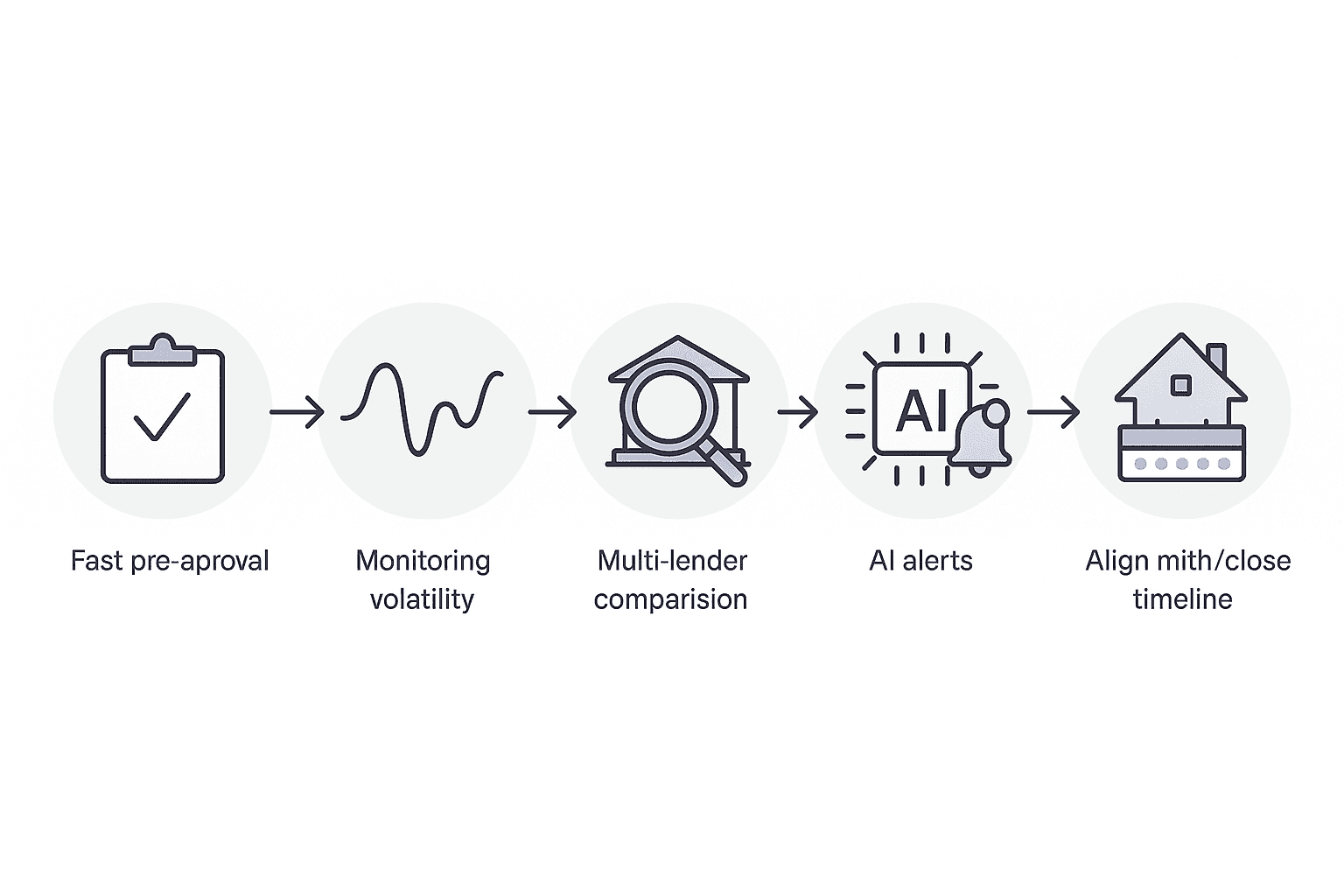

Timing a rate lock requires balancing market conditions, your purchase timeline, and the strength of your pre-approval.

Step 1: Secure a fast pre-approval. In the current market, 48% of homes for sale receive three or more offers, making a strong pre-approval delivered fast more critical than ever. Chestnut issues fully documented pre-approval letters in under 2 minutes.

Step 2: Monitor volatility indicators. When volatility is moderate, strategic timing can capture intraday dips. When volatility spikes, locking early may protect against sudden increases.

Step 3: Shop multiple lenders. Between 2010 and 2021, borrowers who applied with two different lenders reduced their mortgage rate by an average of 10 basis points. During rapid rate increases in 2022, that benefit doubled to 20 basis points.

Step 4: Use AI-assisted alerts. With 73% of respondents identifying data verification as a key area where AI can improve loan processes, technology-driven monitoring gives you an edge over borrowers relying on manual checks.

Step 5: Confirm your closing timeline. Rate locks typically last 30 to 60 days. Align your lock with your expected closing date to avoid extension fees.

Key takeaway: Combine rapid pre-approval, active multi-lender comparison, and real-time AI alerts to lock at the optimal moment.

Quick Answers on Live Rate Tracking & Locks

How do rate monitoring services alert me to opportunities?

When a service detects an opportunity to lower your mortgage rate, it reaches out with an email notification. You can then decide whether to lock or continue watching.

Can I trust AI to assess my mortgage needs?

Consumer skepticism persists. One survey found that "83.37% of respondents confirmed that they would not trust an AI Mortgage Broker to accurately assess their mortgage wants and needs" (Chestnut). Chestnut addresses this by pairing AI-driven processing with experienced mortgage experts.

Does instructing AI to make unbiased decisions improve outcomes?

Research indicates that simply instructing an LLM to make unbiased decisions eliminates racial approval gaps and significantly reduces interest rate disparities. Responsible AI design matters.

What if rates drop after I lock?

Some lenders offer float-down options that let you capture a lower rate if pricing improves before closing. Ask your loan officer about this feature.

Real-Time or Bust: The Future of Rate Locks in Colorado

Colorado became the first state to enact a statute governing AI tools in mortgage lending in May 2024. That regulatory clarity positions the state as a proving ground for technology-driven home financing.

For Arvada borrowers, the takeaway is clear: real-time rate monitoring is no longer optional. Manual methods cannot keep pace with intraday swings, and the financial cost of mistiming a lock compounds over decades.

Chestnut's AI compares offers from 100+ lenders, delivers pre-approvals in under two minutes, and sends alerts the moment favorable pricing appears. That combination of speed, coverage, and vigilance helps you lock at the right time.

Ready to see what rate you qualify for? Explore Chestnut's platform and learn how mortgage rates work to make your next move with confidence.

Frequently Asked Questions

What is real-time rate monitoring for mortgages?

Real-time rate monitoring involves tracking live mortgage pricing feeds to alert borrowers of favorable rate changes instantly, allowing them to lock in the best rates before they fluctuate again.

Why is real-time rate monitoring important for Arvada homebuyers?

In Arvada's competitive market, mortgage rates can change multiple times a day. Real-time monitoring helps buyers capture the lowest rates available, potentially saving thousands over the life of their loan.

How does Chestnut's AI improve the mortgage rate locking process?

Chestnut's AI compares rates from over 100 lenders simultaneously, providing borrowers with competitive rates and automated alerts, which helps them lock in favorable terms quickly and efficiently.

What are the risks of mistiming a mortgage rate lock?

Mistiming a rate lock can lead to higher interest rates, increasing the overall cost of the loan and reducing future financial flexibility. Real-time monitoring helps mitigate this risk by providing timely alerts.

How does Chestnut ensure unbiased mortgage rate assessments?

Chestnut combines AI-driven processing with experienced mortgage experts to ensure accurate and unbiased mortgage rate assessments, addressing consumer skepticism about AI in mortgage lending.

Sources

https://chestnutmortgage.com/resources/how-chestnut-ai-can-cut-your-rate-in-a-rising-rate-market

https://www.federalreserve.gov/econres/feds/shopping-for-lower-mortgage-rates.htm

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://datarade.ai/data-categories/mortgage-rates-data/apis

https://www.rate.com/resources/ai-and-the-future-of-mortgage-lending

https://hiretop.com/blog4/ai-mortgage-lender-chestnut-overview

https://www.rate.com/news/guaranteed-rate-enables-loan-approvals-in-5-minutes-or-less

https://chestnutmortgage.com/resources/how-mortgage-rates-work-(and-how-to-get-the-best-one