Instant Mortgage Quote for Arvada Home Loans: Compare 100+ Lenders

Getting an instant mortgage quote in Arvada takes under two minutes with AI-powered platforms that compare 100+ lenders simultaneously, versus the 30-45 day traditional approval process. This speed advantage matters in Arvada where homes sell in around 9 days, allowing you to make competitive offers before other buyers finish their paperwork.

At a Glance

Traditional mortgage approval takes 30-45 days while AI platforms deliver quotes in under 2 minutes

Arvada homes sell in just 9 days on average with 41.6% going above asking price

Not comparing lenders costs borrowers over $1,200 annually according to Freddie Mac research

AI adoption in banking could improve operational efficiency by 22-30% per Accenture's 2024 report

Current Colorado 30-year mortgage rates average 6.38%, below the national 6.81%

Arvada's median home price sits at $650K, up 3.2% year over year

Buying in Arvada moves fast. Homes here receive multiple offers and sell in around 9 days on average. An instant mortgage quote can shave weeks off the process, giving you the edge you need in this competitive market. Below, we show local borrowers how Chestnut's AI gets you from shopping to signing before most lenders even download your file.

Why Instant Mortgage Quotes Beat Traditional Timelines in Arvada

Traditional mortgage approval is notoriously slow. According to Navy Federal, the mortgage approval process typically takes 30-45 days, and the average time to close across all loan types ranges from 48 to 53 days according to ICE Mortgage Technology. In a seller's market like Arvada, where desirable listings disappear in days, that timeline can cost you the home you want.

The bottleneck often comes from manual reviews and missing paperwork. Underwriting alone averages 3-10 business days, and nearly 15% of applications stall for missing paperwork, per Agave Home Loans. Meanwhile, Chestnut uses proprietary technology to speed up mortgage preapproval, cutting through the usual delays.

Generative AI is changing what's possible. According to Accenture's 2024 Banking Trends report, the banking industry could see operational efficiency improve by 22% to 30% through AI adoption. That translates to faster quotes, fewer errors, and a smoother path to closing.

Key takeaway: While traditional lenders measure timelines in weeks, AI-powered platforms can deliver personalized quotes in minutes.

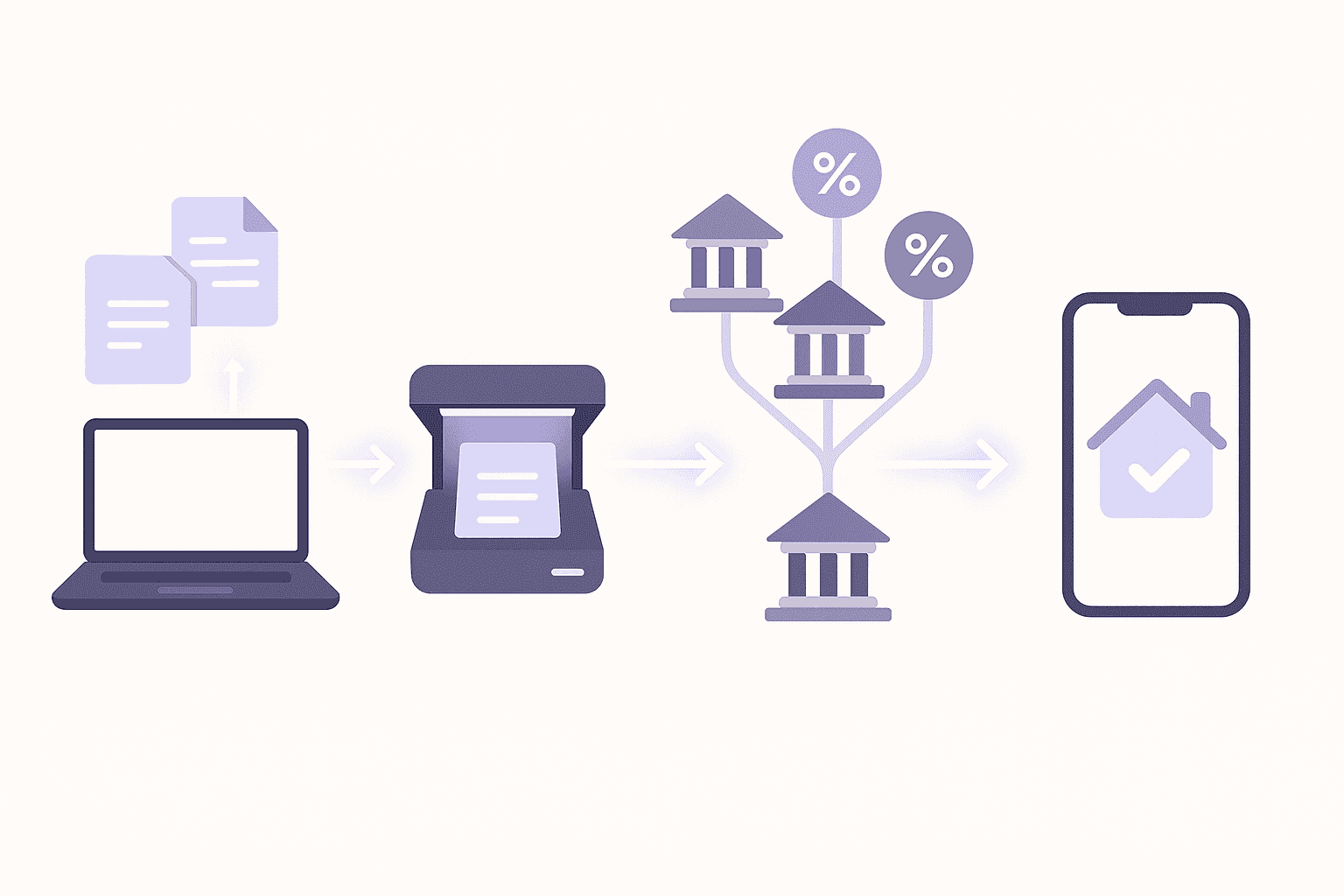

How Chestnut's AI Delivers a Quote in Under Two Minutes

Chestnut's speed advantage comes from a technology stack built for modern borrowers. Here's how it works:

AI-powered document processing: OCR technology can extract and analyze data from hundreds of loan documents in seconds, eliminating manual data entry.

Real-time rate comparison: Our proprietary AI compares offers from over 100 lenders simultaneously, identifying the most competitive options for your profile.

Automated underwriting integration: AI algorithms analyze borrower profiles and predict loan performance in real time, flagging potential issues before they cause delays.

The industry is catching on. A 2023 Fannie Mae survey found that 73% of senior mortgage executives cite improving operational efficiency as their primary motivation for AI adoption. As Alex Trott of Accenture noted: "With the recent leaps forward in generative AI technology, there is genuine optimism that a truly digital 10-minute mortgage will become the industry norm rather than the exception it is today." (Mortgage Professional Australia)

Chestnut's team has handled over $85 billion in loan volume, combining that experience with cutting-edge automation to deliver quotes in under two minutes without affecting your credit score.

Get Your Arvada Home Loan Quote in 4 Quick Steps

Obtaining an instant quote through Chestnut is straightforward:

Answer a few questions online. Basic information about your income, employment, and target purchase price helps our AI match you with the right loan programs.

Let the AI compare 100+ lenders. Within seconds, our system scans offers across our lender network to identify the most competitive rates for your situation.

Review your personalized quote. You'll see clear terms without jargon or hidden fees. No credit pull required at this stage.

Move forward with confidence. Getting preapproved isn't just a formality - it's your ticket to shopping with confidence and making competitive offers.

For borrowers wanting to strengthen their position further, consider our 5 steps to get preapproved fast guide. As Navy Federal Credit Union advises: "We advise obtaining preapproval early in the process and being ready to provide requisite documentation in a timely manner, along with maintaining effective communication with your lender, to minimize any potential delays." (Navy Federal)

It takes just minutes to see what rates you qualify for.

Why Comparing 100+ Lenders Saves You Thousands

Most borrowers leave money on the table by not shopping around. According to research from Freddie Mac, a mortgage borrower loses out on over $1,200 a year on average by failing to comparison shop for their mortgage loan.

Over a 30-year loan, those annual losses compound into tens of thousands of dollars in unnecessary interest payments. Users of AI-powered comparison tools have already saved thousands of dollars annually by investing just one minute of their time.

The data is clear: borrowers' mortgage knowledge and shopping behavior strongly correlate with the rates they secure. Research from the Federal Reserve Bank of Philadelphia also found substantial variation in how expensive lenders are, without any evidence that expensive loans provide a better borrower experience.

Chestnut's approach automates this comparison process. Instead of calling multiple lenders and juggling paperwork, you get a comprehensive view of your options instantly. Learn more about how mortgage rates work to maximize your savings.

Key takeaway: Comparing lenders isn't optional - it's essential to securing the best possible rate.

Current Colorado & Arvada Mortgage Landscape at a Glance

Understanding local market conditions helps you make informed decisions. Here's where things stand:

Metric | Value | Source |

|---|---|---|

Colorado 30-year fixed rate | 6.38% | |

Colorado 15-year fixed rate | 5.75% | |

Colorado avg. vs. national (30-yr) | 6.51% vs. 6.81% | |

Colorado median home price | $590,000 | |

Arvada median sale price | $650K (up 3.2% YoY) | |

Arvada avg. days on market | 9 days |

Arvada remains a competitive seller's market. The median home sold price was $627,117 in March 2025, up 0.7% from last year. Homes move quickly, with 41.6% selling above asking price.

Colorado borrowers benefit from rates slightly below the national average. The most common interest rate range for 2024 originations was 6-7%, with over 51,000 loans in that bracket. Ready to explore your buying options?

AI, Transparency & Fair Lending: What Borrowers Should Know

AI in mortgage lending brings tremendous efficiency gains, but it also raises important questions about fairness and oversight.

The good news: automated systems do not have the final say in mortgage lending decisions. Licensed loan officers remain responsible for each application, and human review is required before approval or denial. The introduction of Automated Underwriting Systems in the 1990s has proven effective for expanding access to credit while driving efficiencies.

However, concerns exist. Research from the Urban Institute notes that AI could amplify existing racial disparities if the data used to train algorithms reflects historical biases. Firms must ensure their AI models are designed intentionally to avoid perpetuating inequities.

Customer satisfaction also matters. According to J.D. Power's 2024 study, overall customer satisfaction with mortgage lenders is 727 on a 1,000-point scale. Lenders who combine AI efficiency with strong human support consistently outperform those relying solely on automation.

For first-time buyers navigating these considerations, our guide on what to know before buying your first home provides essential context.

Fast-Track Your Arvada Home Purchase with Chestnut

In Arvada's fast-moving market, speed matters. Chestnut's tech spots potential hiccups early and keeps things moving, so you're never waiting on paperwork while another buyer swoops in.

With proprietary AI comparing 100+ lenders in seconds and a team that's processed over $85 billion in loan volume, Chestnut combines experience with innovation. Get your instant quote in under two minutes and move forward with confidence.

Ready to see what you qualify for? Compare rates now and take the first step toward your Arvada home.

Frequently Asked Questions

How does Chestnut's AI technology speed up the mortgage process?

Chestnut's AI technology accelerates the mortgage process by using OCR to quickly analyze loan documents, comparing offers from over 100 lenders in real-time, and automating underwriting to predict loan performance and flag potential issues early.

Why is an instant mortgage quote beneficial in Arvada's housing market?

In Arvada's competitive housing market, where homes sell quickly, an instant mortgage quote can significantly reduce the time needed to secure financing, giving buyers a competitive edge over others who may be waiting for traditional loan approvals.

What are the steps to obtain an instant mortgage quote with Chestnut?

To get an instant mortgage quote with Chestnut, you need to answer a few questions online, let the AI compare offers from over 100 lenders, review your personalized quote, and proceed with confidence knowing you have competitive rates without a credit pull.

How does comparing 100+ lenders save money on a mortgage?

Comparing offers from over 100 lenders helps ensure you secure the most competitive rates, potentially saving thousands of dollars over the life of the loan by avoiding unnecessary interest payments that result from not shopping around.

What should borrowers know about AI and fair lending practices?

While AI improves efficiency, it must be used responsibly to avoid perpetuating biases. Licensed loan officers still oversee applications, ensuring fairness and compliance with lending standards, while AI helps streamline the process.

Sources

https://navyfederal.org/makingcents/home-ownership/mortgage-approval-process.html

https://learn.saferate.com/announcing-beat-this-rate-mortgage-comparison-shopping-made-easy/

https://www.agavehomeloans.com/learn/mortgage-basics/home-loan-underwriting-process/

https://chestnutmortgage.com/resources/how-refinancing-can-save-you-money

https://www.capco.com/intelligence/capco-intelligence/implementing-ai-in-mortgage-originations

https://chestnutmortgage.com/resources/5-steps-to-get-preapproved-for-a-mortgage-fast

https://chestnutmortgage.com/resources/how-mortgage-rates-work-(and-how-to-get-the-best-one

https://www.jdpower.com/business/press-releases/2024-us-mortgage-origination-satisfaction-study

https://chestnutmortgage.com/resources/what-to-know-before-buying-your-first-home