How AI Mortgage Lenders in Aurora CO Save Borrowers 0.5% on Rates

AI mortgage lenders in Aurora reduce rates by approximately 0.5 percentage points through automated comparison of over 100 lenders simultaneously and elimination of manual processing costs. This technology cuts traditional underwriting time from 45 days to 8 minutes, while maintaining compliance with Colorado's new AI Act requirements for fair lending practices.

TLDR

AI platforms scan 100+ lenders instantly, identifying rates approximately 0.5 percentage points below traditional offerings

Automated underwriting reduces approval times from 45 days to 8 minutes with 94% first-attempt approval rates

On a $400,000 mortgage, the rate reduction saves borrowers over $20,000 across the loan term

Colorado's AI Act classifies mortgage decisions as "high-risk," requiring transparency and bias testing by 2026

Research shows AI bias can be eliminated by instructing models to ignore race in lending decisions

AI mortgage lenders use advanced algorithms to compare offers from more than 100 lenders simultaneously, identifying the lowest available rates and fees for each borrower. In Aurora, Colorado, this technology is helping homebuyers secure rates approximately 0.5 percentage points below what traditional lenders typically offer.

With the national 30-year fixed rate hovering around 6.19%, that half-point reduction translates to thousands of dollars in savings over the life of a loan. AI achieves this by eliminating bloated back-office processes and automating tasks that traditionally require manual intervention, passing those cost savings directly to borrowers.

This guide explains exactly how AI mortgage technology works, what Colorado's new AI regulations mean for borrowers, and how to evaluate whether an AI lender is right for your Aurora home purchase.

Why Are Aurora Homebuyers Turning to AI for Lower Rates?

AI mortgage lending refers to platforms that use machine learning and automation to handle rate comparison, document processing, and underwriting tasks that human loan officers traditionally perform. The core advantage is efficiency: by automating up to 99% of manual tasks, AI lenders slash operational costs and share those savings through reduced rates.

For Aurora buyers, the timing matters. When used in the lending process, AI can speed up approvals and communications while personalizing service to each borrower's financial profile. Rather than waiting days for a loan officer to manually compare a handful of options, AI platforms scan offers from over 100 lenders in seconds.

The result is a documented rate advantage of roughly 0.5 percentage points. On a $400,000 mortgage, that savings compounds to more than $20,000 over the loan term. For Colorado buyers navigating a competitive market, those dollars can make the difference between affording a home and being priced out.

To understand exactly how rates work and what factors influence your specific offer, see our guide on how mortgage rates work.

Rate-Comparison Algorithms: The Math Behind the 0.5% Savings

AI platforms achieve consistent rate reductions through three core mechanisms:

Multi-lender scanning: Rather than checking rates from a single lender or small network, AI compares offers from 100+ lenders simultaneously, ensuring borrowers see the full market.

Fee optimization: AI analyzes not just interest rates but the complete cost structure, including origination fees, points, and closing costs. This prevents scenarios where a low rate masks high fees.

Real-time monitoring: Rates fluctuate daily. AI platforms track market movements and alert borrowers when conditions favor locking in.

The operational savings are substantial. Traditional mortgage origination costs have risen from $5,100 in 2012 to $11,600 in 2023. AI automation cuts those costs dramatically. Rate, one of the largest mortgage lenders, reports that its AI platform delivers savings of $900 to $1,200 per loan through reduced processing time and fewer errors.

Chestnut's technology takes this further by combining cost-cutting automation with rate monitoring to help borrowers lock at optimal timing.

Aurora's Competitive Rate Landscape

Aurora borrowers benefit from understanding how AI-powered offers compare to prevailing averages:

Rate Type | National Average | AI Lender Typical Rate | Difference |

|---|---|---|---|

30-Year Fixed | ~5.73% | 0.50 pp | |

30-Year Fixed (Chestnut) | ~5.69% | 0.50 pp |

The national 30-year fixed-rate mortgage averaged 6.23% as of late November 2025, down from 6.81% a year prior. Chestnut's AI technology consistently delivers approximately 0.50 percentage points below the national average by analyzing real-time data across its lender network.

For Aurora buyers, this means access to rates that would otherwise require perfect credit or significant rate shopping on their own.

Key takeaway: AI rate-comparison algorithms create savings by scanning more options, optimizing total costs, and monitoring markets continuously.

How Does AI Underwriting Cut Approval Times from 45 Days to 8 Minutes?

Traditional mortgage underwriting involves weeks of document collection, manual verification, and back-and-forth communication. AI fundamentally changes this timeline.

AI-based underwriting reduces the mortgage application processing time from an average of 30-45 days to just eight minutes. Here's how the process works:

Document submission: Upload W2s, pay stubs, bank statements, and tax returns through a secure portal.

Automated extraction: AI reads and extracts data from your documents, verifying income and assets against Fannie Mae and Freddie Mac guidelines.

Instant analysis: Real-time underwriting checks run automatically, eliminating process bottlenecks that historically took weeks.

Pre-approval generation: Chestnut delivers fully documented pre-approval letters in under 2 minutes through its proprietary system.

The platform's 94% first-attempt approval rate means fewer delays and stronger negotiating positions when making offers on Aurora homes.

To start the pre-approval process, visit the Chestnut home purchase page.

Keeping Humans in the Loop

Despite AI's speed advantages, consumer trust remains a concern. A recent survey found that 83.37% of respondents would not trust an AI mortgage broker to accurately assess their mortgage needs. Similarly, almost 36% of banking customers don't want their bank to use AI at all.

Responsible AI lenders address these concerns through hybrid models. Chestnut's human-in-the-loop approach pairs AI-driven document processing with experienced mortgage experts who review edge cases and answer complex questions. This ensures that automation handles routine tasks while humans manage the decisions that require judgment and context.

What Does Colorado's New AI Act Mean for Mortgage Borrowers?

Colorado's AI Act is the first comprehensive law regulating AI in the United States, and it directly affects mortgage lending.

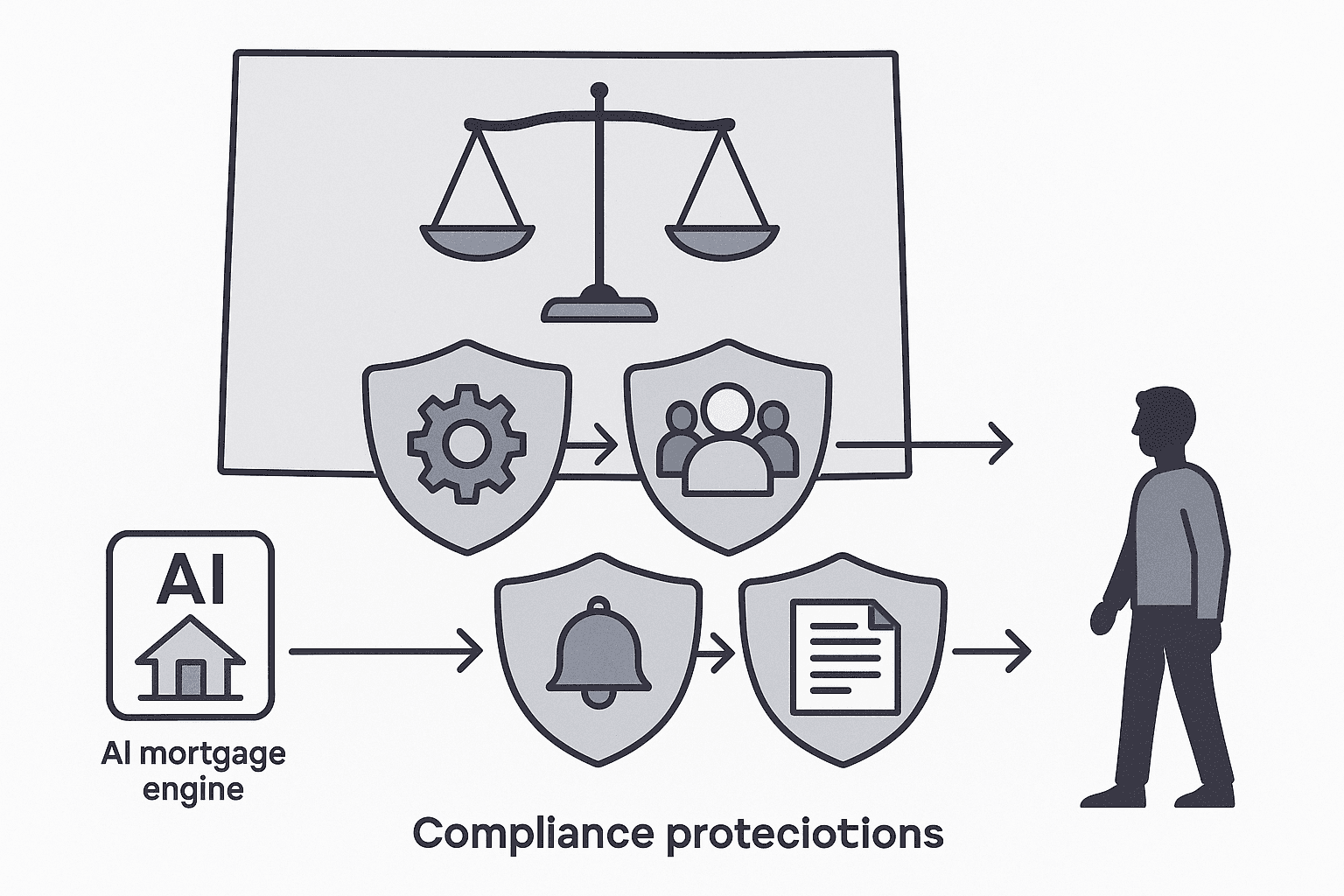

The law, officially known as S.B. 24-205, classifies credit decisions as "high-risk" AI applications. This triggers specific compliance requirements for any lender using AI to make or substantially influence mortgage approvals.

Key borrower protections under the law include:

Risk management programs: Deployers must implement a documented AI risk management program tailored to the size and complexity of their business.

Impact assessments: Lenders must evaluate their AI systems for potential algorithmic discrimination before deployment.

Consumer notification: Borrowers must be informed when AI plays a significant role in consequential decisions about their applications.

Transparency requirements: Lenders must provide information about how their AI systems work and the factors they consider.

The law takes effect June 30, 2026, giving lenders time to prepare. Reputable AI mortgage providers are already establishing governance committees and conducting vendor audits to meet these requirements ahead of the deadline.

For Aurora borrowers, this regulatory framework means additional protections when working with AI lenders. It also means that companies cutting corners on compliance may face enforcement actions from the Colorado Attorney General.

Learn more about how AI technology can work in your favor in our guide on how Chestnut AI can cut your rate in a rising-rate market.

Beyond the Rate: Total Cost Savings & Equity Options

The 0.5 percentage point rate reduction is just the starting point. AI lenders deliver additional value through streamlined refinancing and home equity access.

Lifetime Savings on a $400,000 Loan

On a $400,000 mortgage, a 0.5% rate reduction saves more than $20,000 over the loan term. This calculation accounts for both reduced monthly payments and the compound effect of lower interest charges.

Refinancing Opportunities

AI platforms continuously monitor rate movements. When conditions favor refinancing, borrowers receive alerts. Chestnut supports refinancing and HELOCs, monitoring live offers so you can access equity efficiently and lock at an opportune time.

HELOC Access

For homeowners who've built equity, AI lenders can streamline home equity line of credit applications. Chestnut offers HELOC options starting from $25,000, with the same automated comparison and approval process used for purchase mortgages.

Research on automated title underwriting programs shows that AI-driven approaches can generate estimated annual savings of $96 million across the market, with projected lifetime savings between $1.38 billion and $2.19 billion. These benefits extend to underserved populations, including low-income, rural, and minority consumers.

For refinancing strategies, see our guide on how refinancing can save you money.

How Do Modern Models Address Fair Lending and Bias?

AI in mortgage lending has faced legitimate scrutiny over potential bias. Research has documented concerning patterns that the industry is working to address.

A study published in early 2025 found that large language models systematically recommend more denials and higher interest rates for Black applicants than otherwise-identical white applicants when used without safeguards. These disparities appeared across multiple generations of LLMs from three leading firms.

However, the same research identified an effective solution. As one researcher noted, "It didn't partly reduce the bias, or overcorrect. It almost exactly undid it" (Lehigh University). When the LLMs were instructed to ignore race in decision-making, the racial bias virtually disappeared.

Mitigation strategies employed by responsible AI lenders include:

Bias auditing: Regular testing of AI systems against demographic groups to identify and correct disparities.

Explicit fairness instructions: Programming models to make decisions based solely on creditworthiness factors.

Human oversight: Maintaining expert review for applications that fall outside standard parameters.

Regulatory compliance: Following Colorado AI Act requirements for impact assessments and discrimination prevention.

The key insight is that AI bias is not inevitable. Simply instructing the model to make unbiased decisions eliminates the racial approval gap and significantly reduces interest rate disparities. Borrowers should ask prospective lenders about their bias testing and mitigation practices.

How to Pick the Right AI Lender in Aurora

Not all AI mortgage platforms are created equal. Use this checklist when evaluating options:

Rate transparency

Does the lender show how their rates compare to national averages?

Can you see offers from multiple lenders, not just the platform's preferred partners?

Human support

Is there access to licensed mortgage professionals for complex questions?

What is the average response time for support requests?

Compliance posture

Is the lender preparing for Colorado's AI Act requirements?

Do they conduct bias testing and impact assessments?

Track record

How many loans has the platform processed?

What do customer reviews say about the experience?

As STRATMOR Group principal Kris van Beever notes, "The mortgage industry stands at a critical juncture where AI adoption is no longer optional but essential for maintaining competitiveness" (STRATMOR Group). For borrowers, this means more options and better rates from lenders investing in technology.

Research shows that nearly 70% of consumers will choose a different company after a bad customer service experience, regardless of product quality. When selecting an AI lender, prioritize platforms that combine technological efficiency with responsive support.

Chestnut is licensed in Colorado and combines AI-powered rate comparison with experienced mortgage professionals. To see current rates and start your application, visit the Chestnut home purchase page.

Key Takeaways for Aurora Borrowers

AI mortgage lenders offer Aurora homebuyers three core advantages:

Rate savings: Consistent reductions of approximately 0.5 percentage points compared to traditional lenders, translating to over $20,000 in savings on a typical loan.

Speed: Pre-approval in minutes rather than weeks, with high first-attempt approval rates that strengthen your offer.

Compliance: Platforms operating under Colorado's new AI regulations provide additional consumer protections against algorithmic discrimination.

Chestnut has powered over $85 billion in loan volume and maintains a 5.0 Google rating. The platform's combination of AI efficiency and human expertise makes it well-suited for Aurora buyers seeking competitive rates without sacrificing personalized service.

Ready to see what rate you qualify for? Get your instant quote from Chestnut.

Frequently Asked Questions

How do AI mortgage lenders save borrowers money?

AI mortgage lenders save borrowers money by using advanced algorithms to compare offers from over 100 lenders, identifying the lowest available rates and fees. This process typically results in a rate reduction of approximately 0.5 percentage points, translating to significant savings over the life of a loan.

What are the benefits of using AI in mortgage lending?

AI in mortgage lending offers several benefits, including faster approval times, reduced operational costs, and personalized service. By automating tasks traditionally performed by human loan officers, AI platforms can process applications more efficiently and pass cost savings on to borrowers.

How does AI underwriting speed up the mortgage approval process?

AI underwriting speeds up the mortgage approval process by automating document verification and analysis, reducing the time from application to approval from weeks to minutes. This efficiency allows borrowers to receive pre-approval letters quickly, enhancing their negotiating position when purchasing a home.

What protections does Colorado's AI Act provide for mortgage borrowers?

Colorado's AI Act provides several protections for mortgage borrowers, including requirements for AI risk management programs, impact assessments to prevent algorithmic discrimination, and transparency about how AI systems influence credit decisions. These measures ensure that borrowers are informed and protected when AI is used in mortgage lending.

How does Chestnut ensure fair lending practices with AI technology?

Chestnut ensures fair lending practices by conducting regular bias audits, programming AI models to make decisions based solely on creditworthiness, and maintaining human oversight for complex cases. These strategies help eliminate potential biases and ensure equitable treatment for all borrowers.

Sources

https://chestnutmortgage.com/resources/how-chestnut-ai-can-cut-your-rate-in-a-rising-rate-market

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://hiretop.com/blog4/ai-mortgage-lender-chestnut-overview

https://news.lehigh.edu/ai-exhibits-racial-bias-in-mortgage-underwriting-decisions

https://www.emarketer.com/content/nonbank-lenders-pulling-ahead-on-ai-innovation-mortgages

https://chestnutmortgage.com/resources/how-mortgage-rates-work-(and-how-to-get-the-best-one

https://www.rate.com/news/rate-launches-rate-intelligence-to-transform-the-mortgage-experience

https://www.housingwire.com/articles/mortgage-lenders-ai-compliance-foundations-ai-summit-2025/

https://www.jdsupra.com/legalnews/colorado-artificial-intelligence-act-7629115/

https://chestnutmortgage.com/resources/how-refinancing-can-save-you-money

https://www.stratmorgroup.com/press_releases/stratmor-releases-ai-roadmap-for-mortgage-lenders/

https://chestnutmortgage.com/resources/what-to-know-before-buying-your-first-home