Fort Collins home loans: Local credit union vs Chestnut AI (2025)

When shopping for Fort Collins home loans, credit unions typically offer rates around 6.52%, while Chestnut AI's platform comparing 100+ lenders delivers approximately 0.50 percentage points in savings. Research shows half of borrowers only consider one lender, potentially overpaying by 55 basis points compared to those who shop broadly.

At a Glance

• Fort Collins mortgage rates average 6.52% for 30-year fixed loans, slightly below the 6.76% national average

• Credit unions offer 5 to 30-year fixed mortgages with closing costs around $4,706, well below the $8,356 market average

• Borrowers using Chestnut AI save approximately 0.50 percentage points by comparing real-time rates from over 100 lenders

• AI-powered pre-approvals take under 2 minutes with a 94% first-attempt approval rate, versus several days at traditional lenders

• Limited rate shopping costs borrowers up to 55 basis points or $6,250 in extra interest on a $250,000 loan

• First-time buyers now represent 58% of agency purchase loans, benefiting most from automated rate comparison

Fort Collins home loans have never been more competitive, and 2025 borrowers want to know whether a neighborhood credit union or Chestnut's AI engine really saves more. With rates averaging 6.52% locally and AI platforms promising half a percentage point in savings, the choice you make could mean thousands of dollars over the life of your loan.

Why Fort Collins borrowers are rethinking where they shop for a mortgage

The mortgage landscape has shifted dramatically. Colorado homebuyers face a challenging environment in late 2025, with rates averaging 6.52% as of September. That reality has borrowers questioning long-held assumptions about where to find the best deal.

Credit unions have traditionally marketed themselves as the borrower-friendly alternative to big banks. As not-for-profit organizations, they reinvest profits into members through reduced rates and fees. But there's a catch: their product menus and lender networks remain limited by design.

Meanwhile, AI-driven platforms are revolutionizing rate shopping. Borrowers using Chestnut AI typically see rate savings of 0.5% or more compared to traditional shopping methods. That gap exists because AI can simultaneously analyze offers from over 100 lenders in real time, a feat no single credit union can match.

The question isn't whether credit unions serve their members well. It's whether limiting your search to one institution costs you money you didn't need to spend.

2025 Fort Collins mortgage market snapshot

Before comparing lenders, you need context on what Fort Collins borrowers are actually paying.

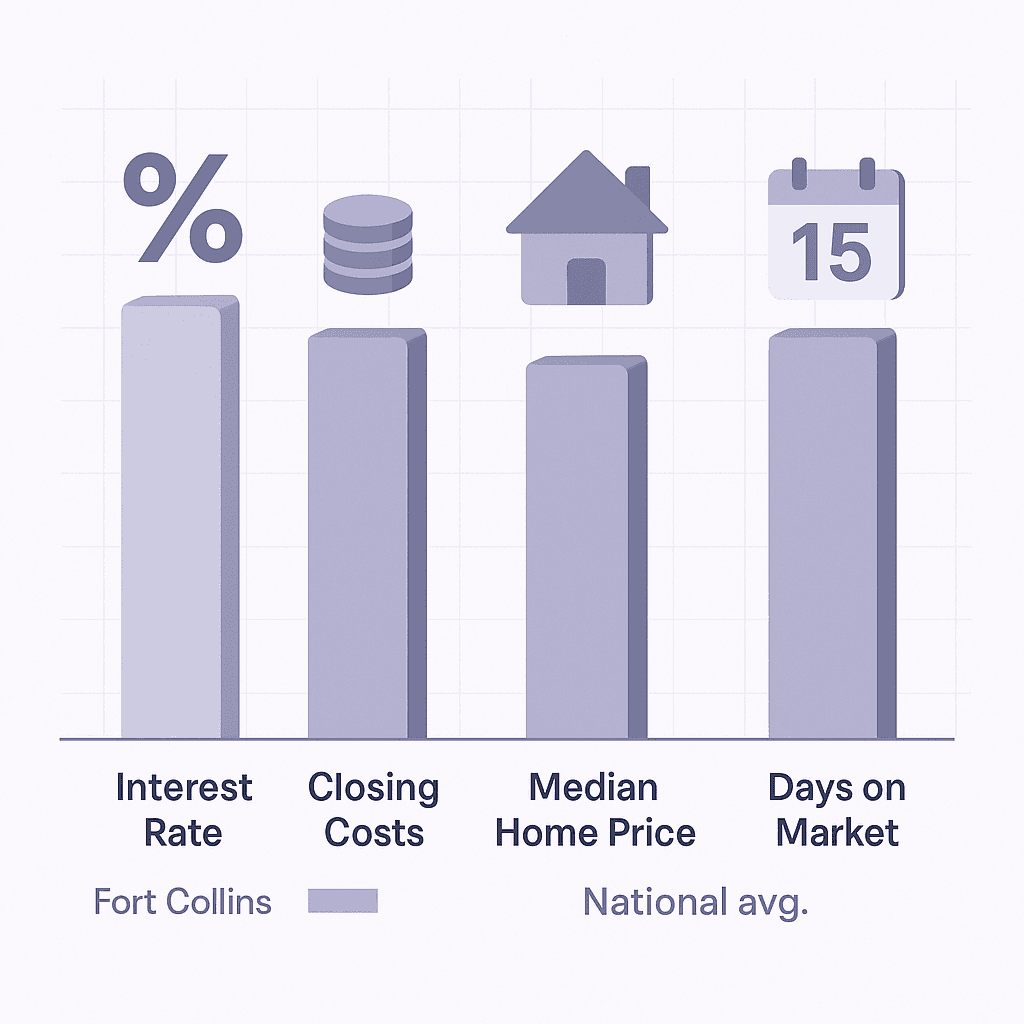

Metric | Fort Collins | National Average |

|---|---|---|

30-Year Fixed Rate | 6.52% | 6.76% |

Refinance Rate | 6.98% | — |

Average Closing Costs | $5,180 | $8,356 |

Median Home Price | $600,000 | — |

Days on Market | 37 | — |

Data from Origination Data for the week of May 8, 2025

Fort Collins enjoys rates slightly below the national average, and annual home price growth has cooled to 2.4% as of March. That's good news for buyers who felt priced out during the pandemic surge.

The lowest-fee local lenders include HomeAmerican Mortgage Corporation at $1,577 and Canvas Credit Union at $3,552. Meanwhile, the lowest-rate lenders with significant volume include Eagle Home Mortgage at 5.00% and Ent Credit Union at 5.99%.

Key takeaway: Fort Collins rates run competitive, but a 0.5 percentage point difference between lenders still translates to meaningful savings over 30 years.

What Fort Collins credit unions really offer (and where they fall short)

Credit unions bring genuine advantages to the table. They're member-owned, locally focused, and often charge lower fees than national banks. But their limitations matter too.

What credit unions do well:

Offer 5-year to 30-year fixed-rate mortgages and FHA products

Provide programs like Ent Credit Union's 90-day Lock & Shop that lets borrowers secure rates while house hunting

Maintain lower average fees than many competitors

Guarantee closing timelines, with some offering $500 penalties if they miss deadlines

Where credit unions fall short:

Membership restrictions based on geography or profession limit who can apply

Product ranges are narrower than larger banks

Rate shopping is constrained to their own products rather than a broader marketplace

Canvas Credit Union, one of Fort Collins' active lenders, illustrates the trade-offs. Their average 30-year fixed rate was 6.72% in 2024, slightly above the market average of 6.55%. They're a low-fee lender with total closing costs around $4,706, well below the $8,356 market average. But they also have a low "pick rate," meaning borrowers who get approved often don't close, possibly due to finding better terms elsewhere.

HELOC terms & fees you should know

For homeowners tapping equity, credit unions offer competitive HELOC products, but terms vary significantly.

Feature | Typical Credit Union Terms |

|---|---|

Draw Period | 10 years |

Repayment Period | 10 years |

Rate Type | Variable (some fixed options) |

Maximum LTV | 75-85% |

Annual Fee | Often $0 |

Closing Costs | Often $0 (no closing cost options) |

Ent Credit Union offers Variable-Rate HELOCs at 7.50% to 9.75% and Standard-Rate options at 8.24% to 10.74%. Bellco's ChoiceLine lets borrowers lock in up to three fixed-rate advances during the draw period, combining flexibility with payment predictability.

A key consideration: with HELOCs, you pay interest only on the money you draw, not the full credit line. That flexibility makes them attractive for ongoing projects or emergency reserves.

The hidden cost of sticking with one lender

Here's where the math gets uncomfortable for borrowers who don't shop around.

Research from the Philadelphia Fed found that "half of the borrowers taking out a mortgage in the US only seriously considered one lender, and just 3 percent considered more than three lenders." That limited shopping has real consequences.

The same study documented that the difference between the 90th and 10th percentile interest rate for otherwise identical borrowers is 55 basis points. For a typical $250,000 loan, that spread corresponds to roughly $6,250 in additional interest.

Traditional mortgage shopping creates friction that discourages comparison:

Multiple credit inquiries when applying to different lenders

Time-intensive processes requiring separate applications

Limited comparison data available to consumers

Rate volatility that makes timing difficult

Supply constraints compound the problem. An FDIC study found that during the 2020-2021 refinance boom, 12 percent of "marginal" borrowers failed to refinance due to lender capacity limits. Borrowers with lower loan balances, incomes, or credit scores faced particular challenges, as lenders rationed credit during high-demand periods.

Key takeaway: The borrowers who pay most are often those who assume all lenders offer similar rates or who find the comparison process too burdensome to complete.

How Chestnut AI compares 100+ lenders and cuts rates by ~0.50 pp

Chestnut's approach differs fundamentally from traditional mortgage shopping. Rather than asking borrowers to contact lenders one by one, the platform analyzes options across more than 100 lenders in real-time.

The technology works through several integrated systems:

Real-time rate aggregation pulls current pricing from banks, credit unions, and specialty mortgage companies simultaneously

Profile matching analyzes credit profiles, income patterns, debt-to-income ratios, and property characteristics to identify optimal lender matches

Dynamic pricing analysis maps rate variations across loan products, credit scores, and loan-to-value ratios

Continuous monitoring tracks daily rate movements to identify optimal timing for rate locks

The results are measurable. Chestnut's proprietary AI technology consistently delivers approximately 0.50 percentage points below the national average 30-year fixed rate. That's not marketing language; it's the result of technology that identifies lender matches most borrowers would never discover on their own.

"Chestnut's network of more than 100 lenders creates opportunities that simply don't exist when working with individual banks or credit unions," according to Chestnut's rate comparison documentation.

The AI's ability to identify specialty programs and lender incentives often uncovers opportunities that wouldn't be apparent through conventional shopping.

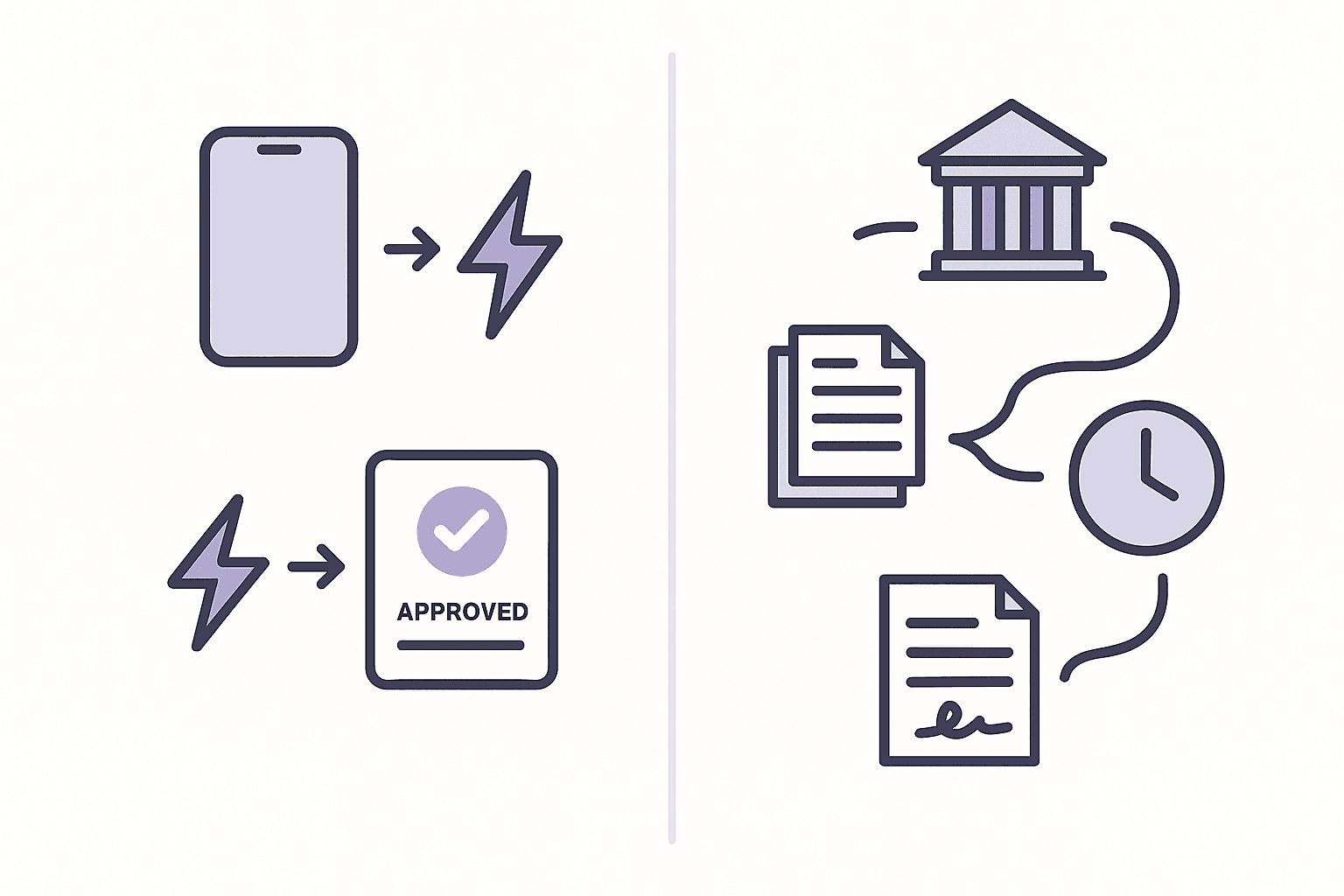

Two-minute pre-approvals vs. the credit-union paper chase

Speed matters in competitive housing markets. Fort Collins homes spend a median 37 days on market, which sounds reasonable until you're competing against multiple offers and need financing documentation immediately.

Process Step | Chestnut AI | Typical Credit Union |

|---|---|---|

Initial Quote | Under 2 minutes | Same day to several days |

Pre-Approval Letter | Under 2 minutes | 1-7 days |

Credit Impact | Soft pull (no score impact) | Often hard pull |

Lenders Compared | 100+ simultaneously | 1 |

Average Closing | 28 days | 28 days |

Chestnut delivers fully documented pre-approval letters through proprietary AI-powered underwriting. The process begins with an instantaneous soft-pull tri-merge credit report aggregating data from all three major bureaus without impacting the borrower's score.

Q3 2025 performance data shows Chestnut achieving:

Average processing time: 1 minute 47 seconds

First-attempt approval rate: 94%

Rate advantage: 0.50-point average savings vs. traditional lenders

Document accuracy: 99.2% automated extraction accuracy

Credit unions aren't necessarily slow. Andrews Federal Credit Union, for example, achieves an average time to close of 28 days, faster than the national average. But the initial pre-approval process often takes days rather than minutes, which can cost you a home in a competitive market.

Can AI stay fair? Regulations and safeguards you should know

Any discussion of AI in lending must address fairness. The technology is powerful, but it operates within a regulatory framework designed to prevent discrimination.

The foundational rule is clear: "There is no 'advanced technology' exception to Federal consumer financial laws." The Equal Credit Opportunity Act prohibits discrimination based on race, color, religion, national origin, sex, marital status, or age, and that applies whether decisions come from humans or algorithms.

Research on AI in mortgage underwriting has found both risks and solutions. A 2025 study documented that large language models can produce disparate outcomes, but also found that "simply instructing the LLM to make unbiased decisions eliminates the racial approval gap and significantly reduces interest rate disparities."

The Urban Institute's analysis of AI in mortgage finance noted that "artificial intelligence is poised to transform the mortgage industry. The potential efficiency gains are significant, as is the promise of AI to overcome human biases and the challenges of evaluating nontraditional financial profiles." However, the same report cautioned that AI could amplify existing racial disparities if not carefully designed.

The CFPB has responded by launching a Technologist Program that integrates data scientists, design experts, and software engineers into consumer protection work. Examiners now direct institutions to increase testing rigor and search for less discriminatory alternative credit models.

For borrowers, this regulatory attention means AI lending platforms face serious compliance requirements. The technology isn't a black box operating outside the law.

When Chestnut AI shines: first-time buyers, refis, and HELOC shoppers

Different borrowers see different benefits from AI-powered rate comparison. Here's where the technology delivers the most value:

First-time homebuyers face particular challenges navigating mortgage options. They made up a record 58% of agency purchase loans in Q1 2025, and many lack experience comparing lenders. AI platforms eliminate the learning curve by surfacing optimal matches automatically. Gen Z buyers, now accounting for roughly 15% of mortgaged home purchases, particularly benefit from digital-first processes.

Refinance candidates benefit from AI's ability to time rate locks. With refinance applications hitting a 3.5-year high in September 2025, competition for processing capacity has increased. The FDIC study found that "refinancing a mortgage when it is optimal to do so can result in thousands of dollars in savings on interest expenses over the life of the loan." AI helps borrowers identify that optimal moment.

HELOC shoppers can access rates from 100+ lenders rather than settling for whatever their current bank offers. With U.S. mortgage holders sitting on $17.0 trillion in equity, including $11.0 trillion in tappable equity, the home equity market represents significant opportunity.

Borrowers with non-traditional profiles may find AI platforms more receptive. The technology can evaluate complex financial situations that might trip up traditional underwriting, though regulatory guardrails ensure this doesn't come at the cost of fair lending compliance.

Choosing your 2025 mortgage partner in Fort Collins

The choice between a local credit union and AI-powered rate shopping comes down to priorities.

Credit unions offer relationship banking, community presence, and often competitive fees. If you value walking into a branch, knowing your loan officer by name, and supporting a local institution, those benefits have real worth.

But if your priority is finding the lowest possible rate across the broadest possible market, AI-powered comparison provides capabilities no single institution can match. Chestnut's platform compares offers from over 100 lenders in the time it takes to fill out a single application, with documented savings of approximately 0.5 percentage points.

For a $600,000 home at Fort Collins' median price, that half-point difference translates to real money over 30 years. The Q3 2025 performance metrics bear this out: average processing time of 1 minute 47 seconds, 94% first-attempt approval success, and rate advantages that compound over the life of your loan.

Chestnut is based in California and licensed to serve Colorado borrowers. For Fort Collins residents ready to see what AI-powered rate shopping can deliver, the two-minute quote process offers a zero-commitment way to compare.

Frequently Asked Questions

Are credit union mortgage rates in Fort Collins lower than what Chestnut AI can find?

Not usually. Recent Fort Collins data show average 30-year fixed rates around 6.52% at local lenders, while Chestnut AI users save roughly 0.50 percentage points by comparing 100+ lenders in real time. Research by the Philadelphia Fed finds borrowers who consider only one or two lenders often overpay by up to 55 basis points, almost exactly the gap Chestnut closes.

How fast can Chestnut AI secure a true mortgage pre-approval?

Chestnut's platform delivers a fully documented, lender-valid pre-approval in under two minutes. The AI stack runs a soft-pull tri-merge credit check, queries multiple automated underwriting systems, and ranks live pricing from 100+ lenders. Internal Q3 2025 data show an average processing time of 1 minute 47 seconds with a 94% first-attempt approval rate, weeks faster than the multi-day workflows still common at credit unions.

Frequently Asked Questions

Are credit union mortgage rates in Fort Collins lower than what Chestnut AI can find?

Not usually. Recent Fort Collins data show average 30-year fixed rates around 6.52% at local lenders, while Chestnut AI users save roughly 0.50 percentage points by comparing 100+ lenders in real time. Research by the Philadelphia Fed finds borrowers who consider only one or two lenders often overpay by up to 55 basis points, almost exactly the gap Chestnut closes.

How fast can Chestnut AI secure a true mortgage pre-approval?

Chestnut's platform delivers a fully documented, lender-valid pre-approval in under two minutes. The AI stack runs a soft-pull tri-merge credit check, queries multiple automated underwriting systems, and ranks live pricing from 100+ lenders. Internal Q3 2025 data show an average processing time of 1 minute 47 seconds with a 94% first-attempt approval rate, weeks faster than the multi-day workflows still common at credit unions.

What are the benefits of using a credit union for a mortgage in Fort Collins?

Credit unions offer member-owned, locally focused services with often lower fees than national banks. They provide fixed-rate mortgages and FHA products, and some offer programs like Ent Credit Union's 90-day Lock & Shop. However, their product ranges are narrower, and rate shopping is limited to their own offerings.

How does Chestnut AI's rate comparison work?

Chestnut AI analyzes options across more than 100 lenders in real-time, using systems like real-time rate aggregation, profile matching, and dynamic pricing analysis. This approach consistently delivers approximately 0.50 percentage points below the national average 30-year fixed rate, offering significant savings over traditional methods.

What are the typical terms for HELOCs offered by credit unions?

Credit unions typically offer HELOCs with a 10-year draw period, a 10-year repayment period, and variable rate types, though some fixed options are available. Maximum loan-to-value ratios range from 75-85%, with many offering no annual fees or closing costs.

Sources

https://www.philadelphiafed.org/-/media/frbp/assets/working-papers/2024/wp24-11.pdf

https://chestnutmortgage.com/resources/chestnut-ai-mortgage-pre-approval-under-2-minutes-2025

https://www.nerdwallet.com/mortgages/best/credit-union-mortgage-lenders

https://www.nerdwallet.com/best/mortgages/credit-union-mortgage-lenders

https://originationdata.com/institution/549300E3QJQLKVB40W93

https://www.ent.com/personal/loans/home-equity-lines-of-credit/

https://www.bellco.org/personal/consumer-lending/home-equity-choiceline/

https://www.fdic.gov/center-financial-research/supply-constraints-and-failure-refinance.pdf

https://chestnutmortgage.com/resources/chestnut-ai-delivers-0-50-point-rate-advantage-2025

https://eres.architexturez.net/system/files/eres202575paperP20250113195046_0558.pdf

https://mortgagetech.ice.com/publicdocs/mortgage/march-2025-mortgage-monitor-report.pdf