Cheapest Fort Collins home loan lenders: Chestnut vs 3 competitors (2025)

Fort Collins borrowers seeking the cheapest mortgage rates face a challenging market where identical borrowers receive offers varying by 54 basis points between lenders—roughly $6,500 in upfront costs. While local lenders like Guild, Cornerstone, and Excel offer single-rate shelves, Chestnut's AI technology compares 100+ lenders instantly, capturing the 50 basis point dispersion that translates to over $1,000 in annual savings.

At a Glance

• Fort Collins mortgage rates currently average 6.52%, down from 7.18% a year ago • Half of borrowers only consider one lender, missing potential savings of $6,000+ over five years • Average closing costs in Fort Collins total $5,180, with significant variation between lenders • Guild was founded in 1960 and operates through local loan officers with a single rate sheet • Chestnut's AI automates comparison across 100+ lenders in under two minutes, eliminating manual quote gathering

Borrowers hunting for the cheapest Fort Collins home loan lenders often discover that a single quote rarely tells the whole story. With mortgage rates fluctuating daily and significant price variations between lenders, finding the best deal requires more than a visit to your neighborhood bank. By contrast, Chestnut's AI scans 100+ lenders in seconds, revealing hidden rate gaps local banks simply cannot match.

Why is pinning down the cheapest lender so hard in Fort Collins?

Finding the lowest mortgage rate in Fort Collins is surprisingly difficult because identical borrowers receive wildly different offers from different lenders on the same day. Federal Reserve researchers found a 54 basis point gap between the 10th and 90th percentile mortgage rates for identical loans, translating to roughly $6,500 in upfront costs for the average borrower.

The problem compounds when you consider borrower behavior. Survey data shows that half of borrowers only consider one lender, and just three percent compare more than three options. This limited shopping leaves money on the table.

Here's why pinning down the cheapest lender is so challenging:

Rates change daily: What's competitive Monday may not be competitive Friday

Average closing costs vary: Fort Collins borrowers face average closing costs of $5,180, but individual lender fees swing dramatically

Local 30-year fixed rates: Currently averaging 6.52% compared to the national average of 6.76%

Search costs discourage comparison: Time spent gathering quotes from multiple lenders adds friction

Chestnut eliminates this friction by automatically comparing offers from 100+ lenders, capturing rate dispersion that manual shopping would miss. Learn more about how mortgage rates work.

What do 2025 Fort Collins mortgage stats reveal?

The Fort Collins housing market has shifted meaningfully in 2025, creating both challenges and opportunities for borrowers seeking the lowest rates.

Key Fort Collins mortgage and housing metrics:

Metric | Current Value | Year-Over-Year Change |

|---|---|---|

30-Year Fixed Rate | Down from 7.18% | |

Median Listing Price | Down 7.6% | |

Average Closing Costs | ||

Percent of List Price Received | Up from 98.12% |

The market reflects what the Colorado Association of REALTORS calls "true balance." Listings rose nearly 12% and sales climbed 13.5% year-over-year, yet homes are taking about 75 days to sell, keeping inventory above three months.

For borrowers, this balanced market means more negotiating leverage. When combined with lower rates than a year ago, the savings potential from finding the cheapest lender becomes even more significant.

Key takeaway: With rates down from 7.18% last year and home prices softening, Fort Collins borrowers have a rare window to lock in competitive financing if they shop strategically.

Chestnut vs. Guild, Cornerstone & Excel: who really lands the lowest quote?

When comparing Fort Collins mortgage lenders, the fundamental question is whether a local lender's single rate shelf can compete with AI-powered multi-lender comparison.

Comparing Loan Estimates helps you decide which lender offers the best deal on the loan amount and kind of loan you've selected. But gathering those estimates manually takes time. Chestnut automates this process, pulling quotes from 100+ lenders while local borrowers could save $600 to $1,200 annually by comparing multiple offers.

The comparison table below highlights key differences:

Lender | Rate Approach | Lender Network | Speed |

|---|---|---|---|

Chestnut | AI compares 100+ lenders | Nationwide wholesale access | Instant quotes |

Guild Mortgage | Single in-house rate | Traditional timeline | |

Cornerstone Home Lending | Fixed pricing model | Single lender | Traditional timeline |

Excel Financial | Refinance-focused | Limited network | Varies |

Guild Mortgage: personalized touch, but one-rate shelf

Guild was founded in 1960 in San Diego to provide financing for homes built by American Housing Guild. The company operates through local loan officers.

However, Guild's model means you're comparing options within one company's rate sheet rather than across the broader market. When rate dispersion runs 50 basis points or more, that single-lender approach may cost borrowers thousands.

Cornerstone Home Lending: experienced team, fixed pricing model

Cornerstone Home Lending has served customers for over 35 years with a team ready to help customers with every mortgage need.

Their longevity demonstrates reliability, but the fixed pricing model limits access to the competitive wholesale rates available through broader lender networks. Borrowers work with Cornerstone's offerings rather than the market as a whole.

Excel Financial: refinance niche, limited lender network

Excel Financial Mortgage Brokers specializes in mortgage refinancing, debt consolidation, home mortgages, and lending.

For refinance-focused borrowers, this specialization has appeal. However, the limited lender network means Excel may not surface the lowest available rate for purchase transactions or borrowers whose profiles would benefit from broader market access.

Explore Chestnut's home purchase options to see how AI-powered comparison delivers more competitive quotes.

The hidden cost of skipping mortgage shopping

The financial impact of accepting the first mortgage offer you receive is substantial and often invisible to borrowers.

Federal Reserve research confirms that "price dispersion for mortgages is often around 50 basis points" of the annual percentage rate. The CFPB quantifies this: "A 50 basis point difference amounts to over $1,000 a year for a typical mortgage."

Freddie Mac's research drives the point home even further. "Borrowers who received as many as five rate quotes during the second half of 2022 could have potentially saved more than $6,000 over the life of the loan, assuming the loan remains active for at least five years."

Why do borrowers leave this money on the table?

Time constraints: Gathering multiple quotes requires effort

Complexity: Understanding which offers are truly comparable takes expertise

Perception: Many assume rates are similar across lenders

Relationship bias: Borrowers often start with their existing bank

Chestnut eliminates these barriers by automating the comparison process, ensuring borrowers capture the savings that come from genuine multi-lender competition.

How does AI squeeze out cheaper mortgage rates?

AI is transforming how borrowers access competitive mortgage pricing, eliminating the manual effort traditionally required to compare multiple lenders.

The mortgage industry is being transformed by artificial intelligence, turning a slow, paper-laden mortgage process into a fast, borrower-friendly experience. At the core, AI systems automate three critical functions:

Document processing: AI achieves a 95%+ improvement in manual document review labor, dramatically accelerating underwriting

Pattern recognition: Machine learning identifies optimal loan programs for each borrower profile

Rate comparison: Automated systems query multiple lenders simultaneously

The speed advantage is measurable. Rocket Mortgage's AI framework increased efficiency by 20% in answering client questions without additional follow-up.

Chestnut's AI approach delivers these benefits directly to borrowers. Rather than accepting a single lender's rate sheet, the technology compares rates across 100+ lenders in under two minutes, surfacing the competitive options that manual shopping would miss.

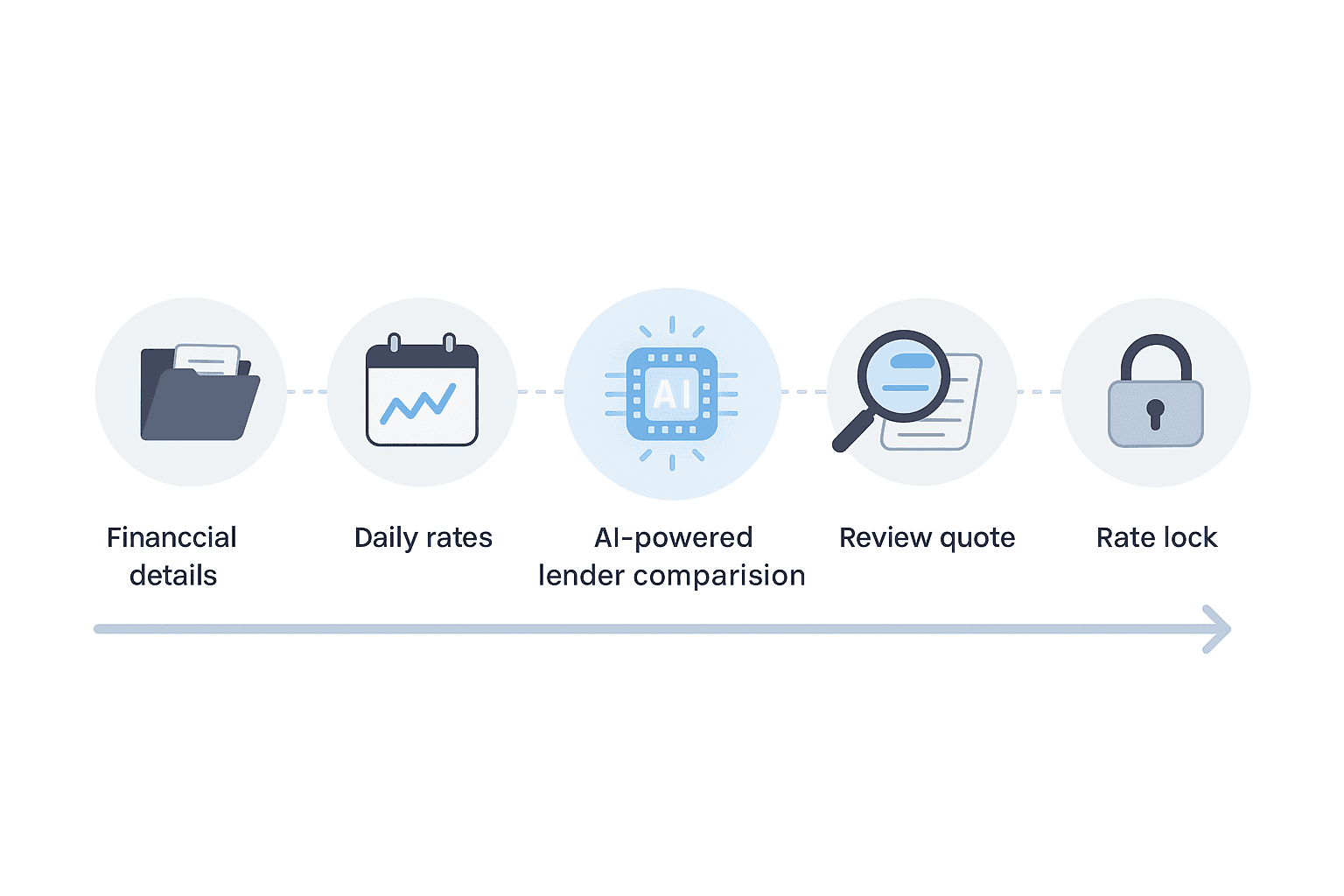

5 steps to lock the lowest Colorado rate with Chestnut

Securing the cheapest mortgage rate requires strategic action. Here's how to maximize your savings:

Step 1: Gather your financial details

Use advanced options to add details like income and debts for an even more accurate rate quote. Having your information ready accelerates the process.

Step 2: Understand rate variability

Mortgage rates change on a daily basis and can vary depending on your unique situation. Timing matters, so be prepared to act when you see favorable pricing.

Step 3: Request Chestnut's AI-powered comparison

Rather than manually contacting multiple lenders, let the technology query 100+ lenders on your behalf. This captures the 50 basis point dispersion that exists in the market.

Step 4: Review your personalized options

Compare the quotes surfaced, paying attention to both rate and closing costs. A slightly lower rate with higher fees may not be the best overall deal.

Step 5: Lock your rate

Once you've identified the best offer, lock your rate to protect against market fluctuations while your loan processes.

Whether you're looking to buy a home, refinance, or explore a HELOC, Chestnut's AI ensures you're seeing the most competitive options available.

Conclusion: lowest price without the trade-offs

Fort Collins borrowers face a clear choice: accept whatever rate a single local lender offers, or leverage AI to access pricing from 100+ lenders simultaneously.

The data is unambiguous. Rate dispersion of 50 basis points translates to over $1,000 annually in savings. Over a typical five-year loan tenure, that's more than $6,000. Local lenders like Guild, Cornerstone, and Excel offer service, but their single-rate-shelf approach cannot capture this market-wide dispersion.

Chestnut combines the speed of AI with access to wholesale rates from a nationwide lender network. The result is a mortgage experience that delivers lower rates without sacrificing the guidance borrowers need.

Ready to see what rate Chestnut can find for you? Get your personalized quote at Chestnut Mortgage in under two minutes.

Frequently Asked Questions

Why is it difficult to find the cheapest mortgage lender in Fort Collins?

Finding the lowest mortgage rate in Fort Collins is challenging due to daily rate fluctuations and significant price variations between lenders. Many borrowers only consider one lender, missing out on potential savings from comparing multiple offers.

How does Chestnut's AI technology benefit borrowers?

Chestnut's AI technology scans over 100 lenders to find the most competitive rates, revealing hidden rate gaps that local banks can't match. This automated process saves borrowers time and money by capturing rate dispersion that manual shopping would miss.

What are the current mortgage trends in Fort Collins for 2025?

In 2025, Fort Collins has seen a decrease in 30-year fixed rates to 6.52% and a drop in median listing prices. The market is balanced, offering borrowers more negotiating leverage and opportunities to secure competitive financing.

How does Chestnut compare to local lenders like Guild, Cornerstone, and Excel?

Chestnut uses AI to compare rates from over 100 lenders, offering instant quotes and access to competitive wholesale rates. In contrast, local lenders like Guild, Cornerstone, and Excel have a single-rate-shelf approach, which may not capture market-wide rate dispersion.

What are the hidden costs of not shopping around for a mortgage?

Accepting the first mortgage offer can lead to significant financial losses. Research shows that price dispersion for mortgages can be around 50 basis points, potentially costing borrowers over $1,000 annually if they don't compare multiple offers.

Sources

https://www.federalreserve.gov/econres/feds/files/2020062pap.pdf

https://chestnutmortgage.com/resources/how-mortgage-rates-work-(and-how-to-get-the-best-one

https://coloradorealtors.com/wp-content/uploads/2025/01/CARInfoFB_Dec2024.pdf

https://coloradorealtors.com/2025/10/13/buyers-hold-the-cards-in-colorado-housing-markets/

https://www.consumerfinance.gov/owning-a-home/compare-loan-offers/

https://threebestrated.com/mortgage-companies-in-fort-collins-co