Best Mortgage Rates in Thornton CO

Current mortgage rates in Thornton, Colorado average around 6.15% for 30-year fixed loans, with AI-powered platforms like Chestnut helping borrowers secure rates approximately 0.5 percentage points lower than traditional lenders by comparing over 100 lenders simultaneously. This technology-driven approach delivers fully documented pre-approvals in under two minutes, crucial for Thornton's fast-moving market where homes sell in about 16 days.

At a Glance

• Current 30-year fixed mortgage rates average 6.15% nationally, down from 6.91% a year ago • 15-year fixed rates stand at 5.44% on average, compared to 6.13% last year

• Thornton's median home price reached $535,550 in April 2025, with homes receiving two offers on average

• Colorado offers multiple first-time buyer programs including CHFA loans with down payment assistance up to $25,000

• Refinancing typically makes sense when you can reduce your rate by 0.50% to 0.75%

• Colorado has unusually low closing costs at 0.7% of sale price, well below the national 2-5% range

Securing the best mortgage rates in Thornton CO can save you tens of thousands of dollars over the life of your loan. With national 30-year fixed rates 6.15% average, savvy borrowers are discovering that AI-powered platforms can trim approximately 0.5 percentage points off prevailing offers. This guide walks you through current rate trends, first-time buyer programs, refinance and HELOC strategies, and how to lock your rate online in under two minutes.

Why Finding the Best Mortgage Rates in Thornton CO Matters in 2026

Thornton remains a seller's market where prices tend to be higher and homes sell faster. The median home sold price hit $535,550 in April 2025, up 2% year over year. In a market where competition is fierce and affordability is already stretched, even a small rate reduction translates into meaningful monthly savings.

Fannie Mae's March 2025 forecast projects mortgage rates to end 2025 at approximately 6.3%, with further declines expected in 2026. That outlook signals growing confidence in economic stabilization, but rates can still swing week to week. The difference between a 6.5% rate and a 6.0% rate on a $535,000 loan amounts to roughly $175 per month, or more than $60,000 over 30 years.

Key takeaway: Locking a competitive rate today protects you against volatility and keeps monthly payments manageable in Thornton's high-demand environment.

What Are the 2026 Mortgage Rate Trends & Housing Metrics in Thornton?

National benchmarks set the stage for local pricing. According to Freddie Mac's Primary Mortgage Market Survey, the 30-year fixed rate averaged 6.21% on December 18, 2025, while the 15-year fixed came in at 5.47%.

Metric | Thornton (Apr 2025) | Colorado Statewide |

|---|---|---|

Median Sale Price | $550,000 | |

Homes for Sale | 695 (+14.3% MoM) | 30,803 |

Avg. Days on Market | 16 | 68 |

Price Per Sq Ft | $240 (+3% YoY) | Varies |

Thornton homes receive two offers on average and sell in around 16 days. Statewide, inventory climbed for the 25th consecutive month, yet the median sale price of $550,000 has held firm year over year. Buyers closing today are negotiating roughly 5.7% below original list prices on average, giving well-prepared borrowers additional leverage.

Key takeaway: Thornton's fast-moving market rewards buyers who arrive with pre-approval in hand and competitive financing.

How Chestnut's AI Secures Lower Rates Than Traditional Colorado Lenders

Traditional mortgage shopping means calling multiple banks, waiting days for quotes, and hoping you didn't miss a better deal. Chestnut flips that model by comparing offers from more than 100 lenders in real time.

"Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods," according to Chestnut's own performance data.

The platform can identify rate spreads of 86 basis points between lenders for the same borrower profile. On a $500,000 loan, that spread could mean saving more than $25,000 in interest over the loan's life.

AI-based underwriting also cuts processing time to eight minutes, removing the bottlenecks that frustrate buyers in competitive markets.

Speed & Certainty of Approval

Chestnut delivers fully documented pre-approvals in under two minutes. Compare that to traditional banks, which can take 6-10 days. In Thornton, where hot homes go pending in around five days, speed matters.

Lenders using Freddie Mac's Loan Product Advisor digital capabilities save roughly $1,700 per loan and shorten production timelines by five days. Those efficiencies translate into faster closings and fewer last-minute surprises for borrowers.

Which Loan Options and First-Time Buyer Programs Exist in Colorado?

Colorado first-time buyers have access to low-interest mortgages, grants, and down-payment assistance through the Colorado Housing and Finance Authority (CHFA) and other programs.

CHFA Preferred: 30-year fixed conventional loans with optional down-payment assistance.

CHFA SmartStep: FHA, VA, and USDA loans for eligible borrowers.

CHFA FirstStep: FHA loans offering the lowest interest rates among CHFA programs.

Eligibility typically requires a minimum credit score of 620, a debt-to-income ratio of 50-55%, and completion of a CHFA-approved homebuyer education course. Income and purchase price limits vary by county, with a maximum loan amount of $806,500.

Down-Payment Assistance (CHFA & metroDPA)

Coming up with a down payment is one of the biggest hurdles for first-time buyers. CHFA and metroDPA help bridge the gap:

Program | Assistance Amount | Repayment |

|---|---|---|

CHFA DPA Grant | None | |

CHFA Second Mortgage | Deferred, 0% interest | |

metroDPA | Percentage of purchase price | Zero-interest second mortgage |

These programs can be combined with Chestnut's AI-driven rate shopping to maximize savings on both the interest rate and upfront costs.

Refinance & HELOC Strategies for Thornton Homeowners

If you already own a home in Thornton, falling rates may unlock refinance or home-equity opportunities.

As of December 16, 2025, the average 30-year fixed rate sat at 6.12%, nearly a full point below this year's January peak. Dr. Timothy Savage of NYU's Schack Institute of Real Estate advises, "Locking now protects against further increases and provides certainty, while trying to time the market can expose borrowers to unexpected and potentially costly rate movements."

A general rule: refinancing makes sense when you can reduce your rate by 0.50% to 0.75%. On a $350,000 loan dropping from 7.25% to 6.25%, monthly savings approach $230.

For homeowners wanting to tap equity without disturbing a low-rate first mortgage, a HELOC offers flexibility. The national average HELOC rate is 7.63% as of late December 2025. HELOC rates became more affordable in 2025, reaching their lowest level in about two years after the Federal Reserve's three quarter-point cuts.

The difference in total interest on a $100,000 HELOC at 6% versus 7% is about $14,000 over 20 years. Shopping multiple lenders, or using an AI platform that aggregates offers, can help you land on the lower end of that spectrum.

What Colorado Closing Costs Look Like in 2026

Closing costs catch many buyers off guard. Nationally, these fees range from 2% to 5% of the loan amount. On a $535,000 Thornton purchase, that's $10,700 to $26,750.

Colorado, however, has an unusually low closing-cost rate of 0.7% of a home's sale price, according to CoreLogic's ClosingCorp. Based on Rocket Mortgage data, average Colorado closing costs for a purchase loan are $13,034, while refinance costs average $8,333.

Fee Type | Typical Range |

|---|---|

Origination Fee | ~1% of loan |

Appraisal | $400-$600 |

Title Insurance | Varies |

Documentary Fee | $0.02 per $100 of sale price |

Most closing costs are negotiable. Strategies to reduce them include:

Comparing lender estimates side by side.

Asking the seller for concessions.

Using lender credits in exchange for a slightly higher rate.

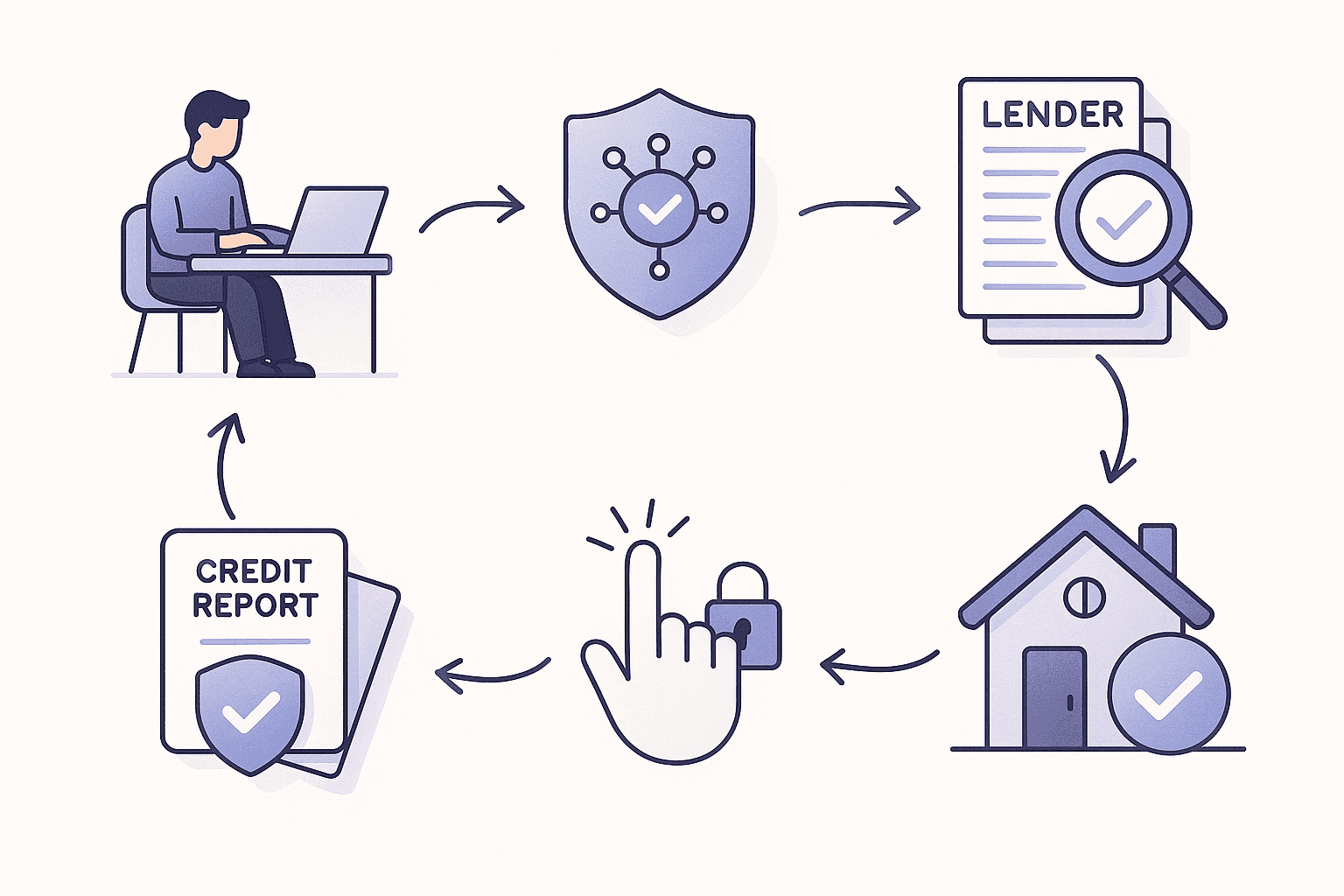

Step-By-Step: Lock Your Rate Online With Chestnut in Under 2 Minutes

Chestnut's platform turns rate shopping from a multi-day chore into a two-minute task.

Enter basic info. Property type, purchase price, down payment, and estimated credit score.

Soft-pull credit check. Chestnut runs a tri-merge credit report without impacting your score.

AI scans 100+ lenders. The system delivers personalized rate comparisons in under 60 seconds.

Review and lock. Once you see a quote you like, one click triggers a rate lock.

Upload documents. Chestnut's AI extracts and verifies data, flagging any discrepancies.

Receive pre-approval letter. Average processing time is 1 minute 47 seconds.

Traditional lenders may charge 0.125% of the loan amount for every 5-10 days a rate lock needs to be extended. Chestnut's speed reduces the risk of costly extensions.

For a deeper dive into how mortgage rates work, visit Chestnut's guide on how to get the best rate.

Chestnut Makes Thornton Mortgages Simple, and Affordable

Thornton's competitive housing market rewards buyers who move quickly with solid financing. Chestnut's AI compares more than 100 lenders, typically delivering rate savings of 0.5% or more and fully documented pre-approvals in under two minutes.

Whether you're purchasing your first home, refinancing an existing loan, or exploring a HELOC, the combination of speed, transparency, and competitive pricing makes Chestnut a compelling choice for Colorado borrowers.

Ready to see your personalized rate? Start your quote at Chestnut or explore refinance options today.

Frequently Asked Questions

What are the current mortgage rate trends in Thornton, CO?

As of late 2025, the 30-year fixed mortgage rate averaged 6.21%, while the 15-year fixed rate was 5.47%. Thornton's market remains competitive, with homes selling quickly and often receiving multiple offers.

How does Chestnut's AI platform help secure lower mortgage rates?

Chestnut's AI compares offers from over 100 lenders in real-time, typically saving borrowers 0.5% or more on rates compared to traditional methods. This can result in significant savings over the life of a loan.

What first-time homebuyer programs are available in Colorado?

Colorado offers several programs through the CHFA, including CHFA Preferred, SmartStep, and FirstStep, which provide low-interest loans and down-payment assistance for eligible buyers.

What are the benefits of refinancing a mortgage in Thornton?

Refinancing can lower your interest rate, potentially saving you hundreds of dollars monthly. It's advisable when you can reduce your rate by 0.50% to 0.75%.

How can I lock a mortgage rate online with Chestnut?

Chestnut's platform allows you to lock a rate in under two minutes by entering basic information, running a soft credit check, and reviewing AI-generated rate comparisons from over 100 lenders.

Sources

https://chestnutmortgage.com/resources/chestnut-ai-mortgage-pre-approval-under-2-minutes-2025

https://www.redfin.com/city/30790/CO/Thornton/housing-market

https://coloradorealtors.com/market-trends/regional-and-statewide-statistics/

https://chestnutmortgage.com/resources/how-chestnut-ai-can-cut-your-rate-in-a-rising-rate-market

https://sf.freddiemac.com/articles/insights/2025-updates-to-the-cost-to-originate-study

https://www.lendingtree.com/home/mortgage/colorado-first-time-homebuyer-programs/

https://www.refiguide.org/colorado-first-time-home-buyer-loan-programs/

https://www.bankrate.com/mortgages/colorado-first-time-homebuyer-assistance-programs/

https://www.cbsnews.com/news/what-to-consider-about-mortgage-rate-locks-now-according-to-experts/

https://www.bankrate.com/real-estate/closing-costs-in-colorado/

https://chestnutmortgage.com/resources/how-mortgage-rates-work-(and-how-to-get-the-best-one