Best Mortgage Rates in Superior CO

Current mortgage rates in Superior, Colorado average 6.09% APR for 30-year fixed loans, tracking slightly below the national 6.15% average. Borrowers using Chestnut's AI platform typically save 0.5% or more compared to traditional shopping methods, translating to approximately $52,200 in lifetime savings on the area's $580,000 median home price. The platform compares over 100 lenders instantly, delivering comprehensive rate comparisons in under two minutes.

Key Facts

• Colorado's 30-year fixed mortgage rates average 6.09% APR, with 15-year rates at 5.44% APR

• Superior's median single-family home price reached $580,000 in October 2025, with homes averaging 68 days on market

• Chestnut identifies rate spreads up to 86 basis points between lenders for identical borrower profiles

• CHFA assistance programs offer up to $25,000 for down payments without impacting debt-to-income ratios

• Approximately 4.1 million mortgage holders nationwide could save at least 75 basis points through refinancing

• Rate locks typically range from 30 to 120 days, with extensions costing about 0.125% per 5-10 days

Homebuyers searching for the best mortgage rates in Superior CO face a landscape shaped by national economic forces, regional demand in Boulder County, and the lender they choose. Even a fraction of a percentage point can translate into tens of thousands of dollars over a 30-year loan. This guide breaks down current rate benchmarks, explains what drives them, details how Chestnut's AI platform consistently undercuts averages, and walks you through assistance programs and timing strategies that can stack additional savings.

What Are Today's Mortgage Rates in Superior, CO?

Colorado buyers benefit from rates that track slightly below national benchmarks. Here is a snapshot of where things stand:

Metric | Value | Source |

|---|---|---|

National 30-year fixed average | 6.15% (Dec 31, 2025) | |

Colorado 30-year fixed average | 6.09% APR | |

Colorado 15-year fixed average | 5.44% APR | |

Year-over-year change (30-yr) | Down 54 basis points |

Why do small differences matter? On a typical Superior home, the median single-family sale price reached $580,000 in October 2025. A half-point rate reduction on that amount saves roughly $100 per month, compounding to meaningful lifetime savings.

Market conditions favor buyers who move strategically. Homes in the Boulder County area now average 68 days on market, up 12% from last year, and many closings land about 5.7% below original list price. That extra negotiating room pairs well with rate shopping to maximize affordability.

What Moves Rates in Boulder County – And How Does It Hit Superior Buyers?

Mortgage rates do not exist in a vacuum. Three macro-level forces shape what Superior buyers see on a rate sheet:

10-Year Treasury yield. The yield currently hovers around 4.1% and acts as the mortgage market's pricing benchmark. When Treasury yields climb, mortgage rates follow.

Federal Reserve policy. "Longer-term interest rates have risen in recent months even as the Fed continued to cut the short-term rate at its December meeting," Fannie Mae noted. The disconnect means Fed cuts do not guarantee lower mortgage rates.

Regional demand and inventory. Boulder County has defied the usual fall slowdown; new listings rose 9% year over year while prices held steady. Tight supply keeps competition alive even as rates ease.

Fannie Mae projects the 30-year fixed to end 2025 near 6.3% and drift toward 5.9% by late 2026. For Superior buyers, the window of opportunity lies in locking a competitive rate now while positioning for a potential refinance later.

Key takeaway: Macro trends set the floor; lender selection determines whether you pay above or below it.

How Does Chestnut Beat Average Colorado Rates by 0.50 Percentage Points?

Traditional rate shopping means contacting lenders one by one, comparing PDFs, and hoping you timed it right. Chestnut flips that model.

"Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods." — Chestnut

Here is how the platform delivers that edge:

Capability | Benefit |

|---|---|

Real-time comparison across 100+ lenders | Surfaces rate spreads of up to 86 basis points for the same borrower profile |

Instant quotes in under two minutes | Eliminates days of back-and-forth emails |

AI-driven profile matching | Analyzes credit, LTV, and loan purpose to pinpoint best-fit lenders |

Post-closing rate monitoring | Alerts you to refinance opportunities as markets shift |

Speed matters in a competitive market. AI-based underwriting has reduced processing from 30-45 days to eight minutes for some lenders. Chestnut pairs that efficiency with breadth, scanning wholesale and retail channels simultaneously.

What 0.50 pts Means on a Typical Superior Home

Numbers make the advantage concrete. Consider a $580,000 purchase with 20% down, leaving a $464,000 loan amount.

Scenario | Rate | Estimated Monthly P&I | 30-Year Interest Cost |

|---|---|---|---|

Colorado average | 6.09% | ~$2,805 | ~$545,800 |

Chestnut advantage | ~5.59% | ~$2,660 | ~$493,600 |

Savings | 0.50 pts | ~$145/month | ~$52,200 lifetime |

Estimates assume a 30-year fixed loan; actual figures depend on credit profile and market conditions.

A Houston case study showed Chestnut's half-point edge translated to nearly $46,000 in lifetime savings. Superior buyers purchasing at median prices can expect comparable or larger benefits given Colorado's higher price points.

Which Down-Payment Assistance Programs Pair with Low Rates?

Colorado's first-time and first-generation buyers can layer Chestnut's competitive rates with programs from the Colorado Housing and Finance Authority (CHFA). These programs do not increase your debt-to-income ratio, making qualification easier.

CHFA DPA Grant

Up to the lesser of $25,000 or 3% of the first mortgage

Use for down payment, closing costs, or prepaids

Does not impact DTI

CHFA DPA Second Mortgage Loan

Up to $25,000 or 4% of the first mortgage

First-generation homebuyers can access the full $25,000 regardless of loan size

No monthly payments; repayment due upon sale or refinance

Eligibility highlights:

Maximum DTI of 50% for FICO 620-659; 55% for 660+

Maximum LTV 97%; CLTV 105%

Minimum financial contribution of $1,000 (may be gifted)

Homebuyer education course required

CHFA allows borrowers with no credit scores, broadening access for buyers with thin files. Pairing a CHFA grant with Chestnut's rate advantage can shave thousands off both upfront and long-term costs.

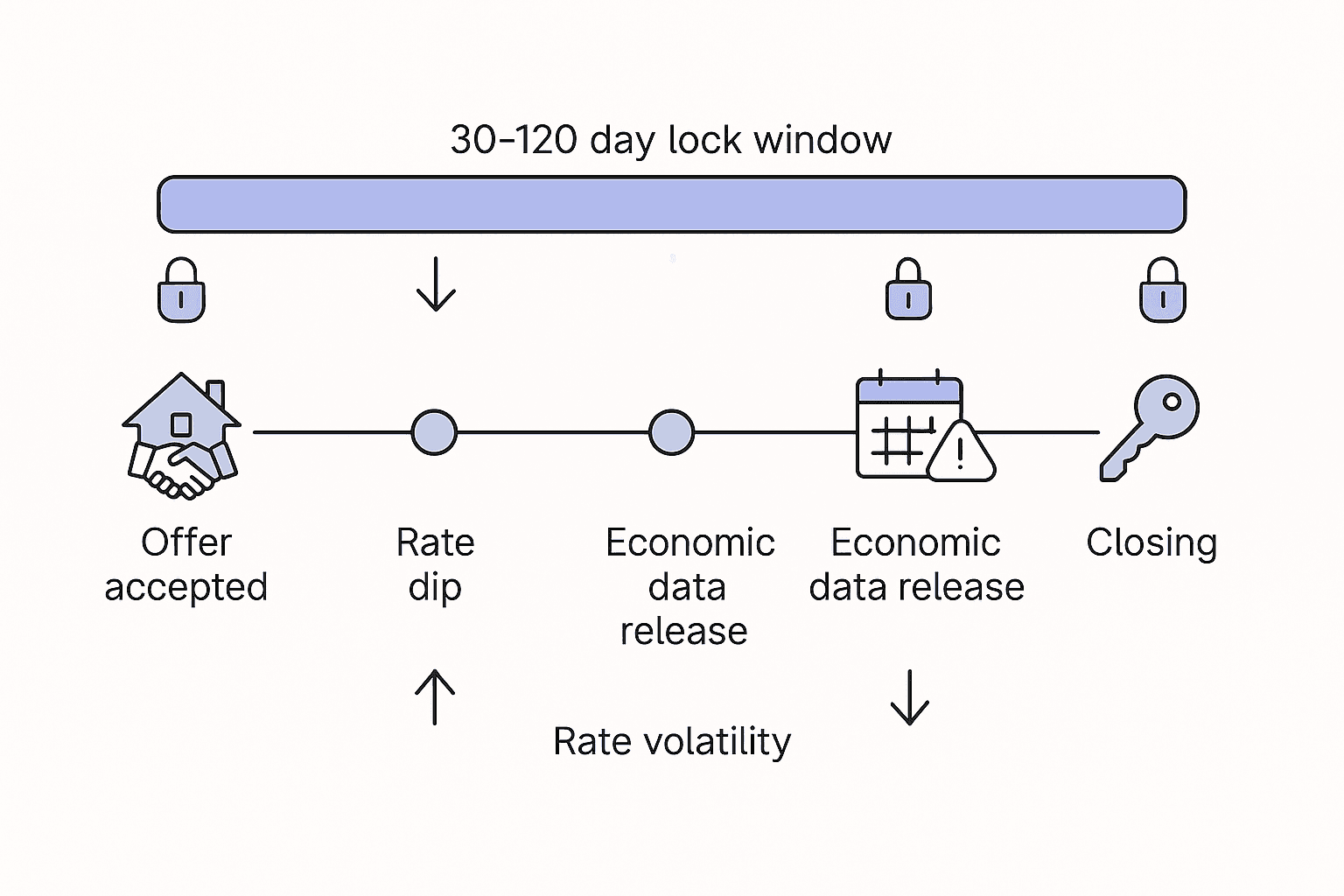

When Should You Lock a Mortgage Rate in 2026?

Rate locks protect you from increases between approval and closing. In a volatile environment, timing that lock is critical.

"A rate lock is one of the strongest forms of protection a borrower has in a volatile interest-rate environment." — Marc Halpern, CEO of Foundation Mortgage (CBS News)

How rate locks work:

Duration typically ranges from 30 to 120 days depending on lender and loan type

Many lenders offer free locks; extensions usually cost 0.125% per 5-10 days

Float-down options let you benefit if rates drop after locking, often for an additional fee

When to lock:

Once you have an accepted offer. Locking before contract exposes you to extension fees if closing slips.

When rates dip below your target. AI platforms track daily movements and alert you when conditions favor locking.

Before major economic announcements. Fed meetings, jobs reports, and inflation data can swing rates overnight.

Chestnut's system tracks daily rate movements and identifies optimal timing, removing guesswork from the decision.

Refinance & HELOC Paths When Superior Rates Dip

Even after closing, homeowners can capture future rate declines or tap equity for renovations and debt consolidation.

Refinance landscape:

Refinance retention hit a 3.5-year high (28%) in Q3 2025

Rate-and-term refinances accounted for 62% of activity in October, the highest share in nearly five years

Approximately 4.1 million mortgage holders are currently positioned to save at least 75 basis points through a refi

HELOC snapshot:

HELOC rates reached their lowest level in about two years after the Fed's three quarter-point cuts in 2025. Chestnut's platform monitors live HELOC offers, helping homeowners lock at opportune moments and access equity efficiently.

Key takeaway: If you secure a rate today that feels high, Chestnut's post-closing monitoring can alert you when refinancing makes financial sense.

Getting Superior's Best Rate Starts with Chestnut

Superior buyers operate in a market where small edges compound into large savings. Chestnut's AI engine delivers those edges through:

Instant comparison across 100+ lenders

Quotes in under two minutes

A documented track record of $85 billion+ in mortgages powered and a 5.0 Google rating

Whether you are buying your first home, layering CHFA assistance, or positioning for a future refinance, Chestnut's combination of speed, breadth, and AI-driven precision puts you ahead of borrowers still shopping the old-fashioned way. Start your quote today and see what 0.50 percentage points can do for your budget.

Frequently Asked Questions

What are the current mortgage rates in Superior, CO?

As of December 2025, the national 30-year fixed average is 6.15%, while Colorado's average is slightly lower at 6.09% APR. Chestnut's AI platform often secures rates 0.5% below these averages.

How does Chestnut offer better mortgage rates?

Chestnut uses AI to compare offers from over 100 lenders, providing real-time quotes and matching borrower profiles to the best-fit lenders, often saving borrowers 0.5% or more on rates.

What factors influence mortgage rates in Boulder County?

Mortgage rates in Boulder County are influenced by the 10-Year Treasury yield, Federal Reserve policies, and regional demand and inventory levels. These factors collectively impact the rates available to Superior buyers.

What down-payment assistance programs are available in Colorado?

The Colorado Housing and Finance Authority (CHFA) offers programs like the DPA Grant and DPA Second Mortgage Loan, which provide financial assistance without increasing debt-to-income ratios, making homeownership more accessible.

When is the best time to lock a mortgage rate?

It's advisable to lock a mortgage rate once you have an accepted offer, when rates dip below your target, or before major economic announcements. Chestnut's AI tracks daily rate movements to help identify optimal locking times.

Sources

https://www.nerdwallet.com/mortgages/mortgage-rates/colorado

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://www.fanniemae.com/research-and-insights/forecast/economic-developments-january-2025

https://www.fanniemae.com/data-and-insights/forecast/economic-developments-october-2025

https://chestnutmortgage.com/resources/chestnut-ai-delivers-0-50-point-rate-advantage-2025

https://www.cbsnews.com/news/what-to-consider-about-mortgage-rate-locks-now-according-to-experts/

https://www.bankrate.com/mortgages/what-is-mortgage-rate-lock/

https://mortgagetech.ice.com/resources/data-reports/december-2025-mortgage-monitor

https://mortgagetech.ice.com/resources/data-reports/november-2025-mortgage-monitor