Best Mortgage Rates in Southlake TX

Current mortgage rates in Southlake TX average around 6.26% for 30-year fixed loans, with Texas rates typically running 0.14% below national averages. AI-powered platforms like Chestnut help buyers secure rates approximately 0.5 percentage points lower by comparing over 100 lenders simultaneously, potentially saving $150,000+ over a 30-year loan on Southlake's median-priced homes.

At a Glance

• Current 30-year fixed mortgage rates hover around 6.26% nationally, with Texas averaging 6.12% • 15-year fixed rates average 5.67% nationally, offering lower rates for shorter terms

• Southlake's median home price of $1.4 million means even small rate differences translate to tens of thousands in savings

• Borrowers comparing 4+ lenders save an average of $1,200 annually on their mortgage payments

• Jumbo loans (exceeding $806,500) are common in Southlake and require higher credit scores and down payments

• Digital mortgage platforms reduce origination costs by approximately 14%, passing savings to borrowers

Locking in the best mortgage rates in Southlake TX could be the difference between a comfortable monthly payment and one that stretches your budget thin. With median home prices in this sought-after Dallas-Fort Worth suburb now exceeding $1.4 million, even a small rate difference translates into tens of thousands of dollars over the life of your loan.

The good news? Current borrowing costs sit at their lowest point in over a year, and AI-powered platforms like Chestnut are helping Southlake buyers secure rates approximately 0.5 percentage points below what traditional shopping methods yield.

This comprehensive guide walks you through everything you need to know about finding the best mortgage rates in Southlake, from current market benchmarks to the specific factors that influence your offer.

Why Finding the Best Mortgage Rates in Southlake, TX Matters in 2026

Southlake's housing market continues to command premium prices. The median home list price reached $1,399,892 in March 2025, representing a 5.9% increase from the previous year. At these price points, the difference between a 6.5% and a 6.0% mortgage rate isn't trivial -- it's a significant monthly expense that compounds over decades.

Consider the math: on a $1 million loan, a half-point rate reduction saves roughly $300 per month. Over a 30-year term, that's more than $100,000 in interest payments you keep in your pocket rather than sending to a lender.

The Southlake market also presents unique dynamics. According to Redfin data, the median sale price of homes was $565,000 in some Southlake neighborhoods, with prices up 6.6% year-over-year. Homes are selling after an average of 31 days on the market, giving buyers slightly more negotiating room than during the pandemic frenzy.

Bankrate's December 2025 survey shows national averages hovering around 6.26% for 30-year fixed mortgages. However, the rate you actually receive depends heavily on your financial profile and how effectively you shop. Buyers who leverage AI-driven comparison tools consistently outperform those who accept the first offer presented.

How Do Current Mortgage Rates in Southlake Compare to Texas and National Averages?

Understanding where rates stand helps you evaluate whether an offer is competitive. Here's how current benchmarks stack up:

Loan Type | National Average | Texas Average |

|---|---|---|

30-Year Fixed | ||

15-Year Fixed | 5.67% | 5.16% |

5/1 ARM | 5.60% | Varies by lender |

Texas borrowers often see slightly lower rates than the national average. According to NerdWallet, the national average 30-year fixed mortgage APR is 6.631%, which accounts for both the interest rate and fees.

Southlake-area lenders typically price within this range, but significant variation exists between institutions. The Mortgage Bankers Association expects rates to remain between 6% and 6.5% in 2026, even with anticipated Federal Reserve rate cuts, primarily due to concerns about inflation and growing budget deficits.

Key takeaway: While you can't control macroeconomic factors, you can control how many lenders you compare. Chestnut's AI platform analyzes offers from over 100 lenders simultaneously, routinely delivering rates approximately 0.5 percentage points below what manual shopping produces.

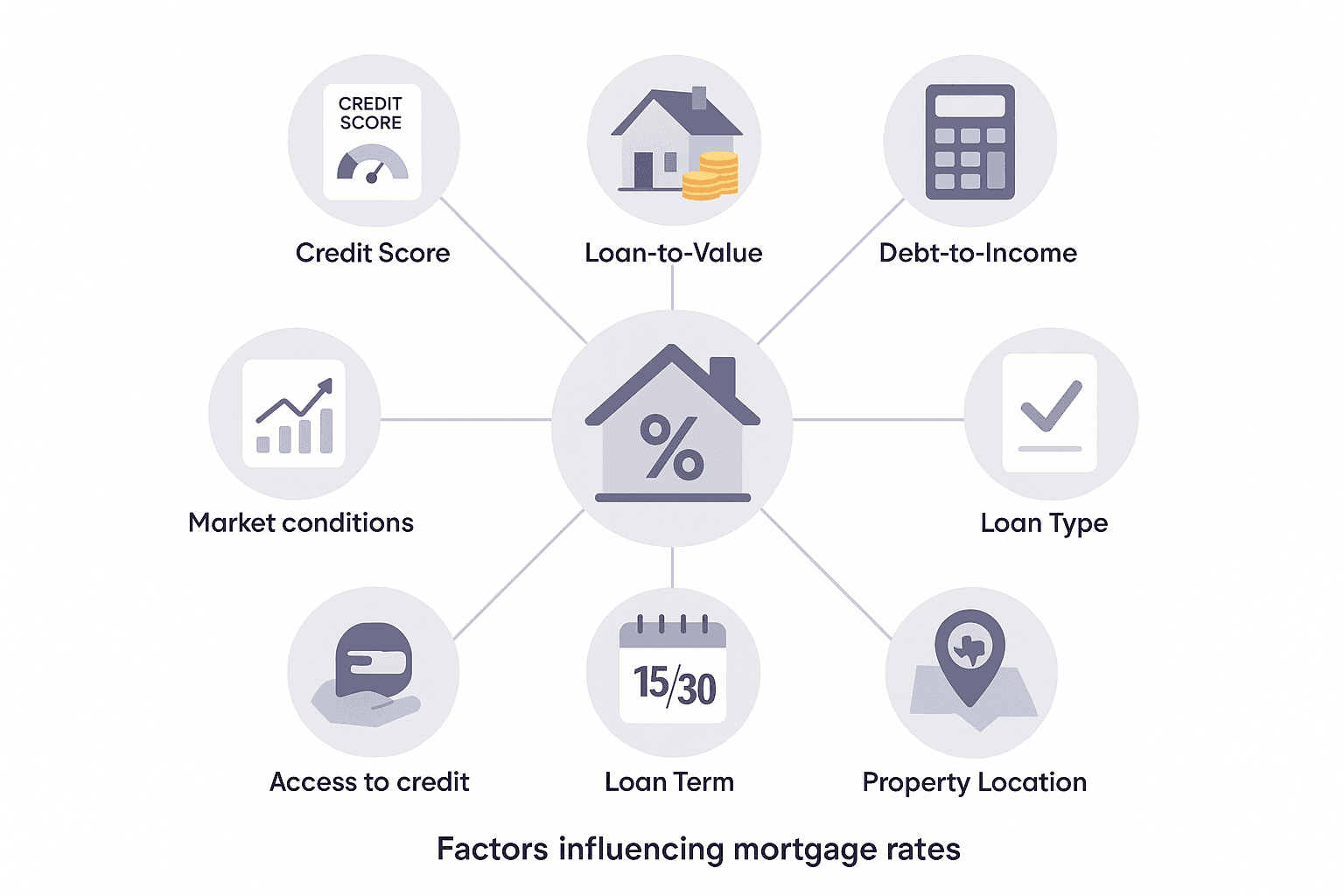

Eight Factors That Drive Mortgage Rates in Southlake

Your mortgage rate isn't pulled from thin air. As Zillow explains, "Lenders will determine your loan interest rate based on several factors -- some of which you can influence and others you can't." Understanding these variables helps you optimize your profile before applying.

Credit Score

A score of 720 is the historical cutoff where you can expect better rates without negative adjustments. Borrowers above 760 typically secure the most competitive offers.Loan-to-Value Ratio (LTV)

The more equity you bring, the lower your rate. For conventional loans, borrowers who want to avoid private mortgage insurance generally need a 20% down payment.Debt-to-Income Ratio (DTI)

Lenders typically want this number no higher than 36% -- the lower, the better.Loan Type

FHA and VA rates often come in below conventional rates. According to LendingTree, VA refinance rates tend to come in below conventional and FHA rates.Loan Term

Shorter terms command lower rates. 15-year loans typically run about 0.5% lower than 30-year options.Property Location

Some locations carry higher risk for lenders due to local default rates, early repayment likelihood, and state foreclosure laws.Market Conditions

Mortgage rates typically track the 10-year Treasury yield, which fluctuates based on economic sentiment.Texas-Specific Programs

Programs like Home Sweet Texas from the Texas State Affordable Housing Corporation offer fixed-rate mortgages and down payment assistance that can effectively lower your borrowing costs.

How Chestnut's AI Engine Finds Rates 0.5 % Below Market

Traditional mortgage shopping requires contacting multiple lenders individually, comparing disparate offers on spreadsheets, and hoping you haven't missed a better deal. Chestnut's AI engine fundamentally changes this process.

Here's how the technology works:

Real-Time Lender Analysis

Chestnut AI™ analyzes options across more than 100 lenders simultaneously, identifying competitive offers that wouldn't surface through manual searches.Profile-Based Matching

The system analyzes individual borrower profiles -- credit score, income, debt-to-income ratio, down payment, and loan specifics -- to identify lenders most likely to offer competitive terms for that particular situation.Instant Quote Generation

The system provides instant quotes in under two minutes, allowing borrowers to see comprehensive rate comparisons immediately rather than waiting days for callbacks.Continuous Rate Monitoring

Markets move constantly. Chestnut's continuous monitoring ensures you lock at optimal moments rather than missing windows.

This AI-driven approach aligns with broader industry trends. According to eMarketer, "When used in the lending process, AI can speed up approvals and communications while personalizing service." The five largest U.S. nonbank mortgage lenders now use AI throughout their application and approval processes.

A Freddie Mac study found that buyers who got quotes from at least four lenders saved up to $1,200 annually. Chestnut's platform effectively queries over 100 lenders, exponentially increasing your odds of finding the best available rate.

Conventional, FHA/VA, Jumbo & HELOC: Which Loan Fits Southlake Buyers?

Southlake's high home values mean many buyers encounter jumbo loan territory. Understanding your options helps you select the most cost-effective path.

Loan Type | Best For | Rate Considerations | Key Requirements |

|---|---|---|---|

Conventional | Buyers with strong credit, 20%+ down | Baseline rates | 620+ credit score |

FHA | First-time buyers, lower down payments | 580+ credit score, 3.5% down | |

VA | Veterans and active military | Certificate of Eligibility | |

Jumbo | Loans exceeding $806,500 | Slightly higher, more variation | 680+ credit, 10-15% down |

HELOC | Accessing existing home equity | Variable, currently around 7.63% | 15-20% equity minimum |

Jumbo Loan Considerations for Southlake

Given Southlake's median prices, many buyers will need jumbo financing. For 2025, the conforming loan limit in most areas is $806,500, or up to $1,209,750 in high-cost areas. Loans exceeding these thresholds require jumbo products.

Jumbo qualification requirements are stricter:

Credit score of 680 or higher

Debt-to-income ratio of 45% or lower

Down payment of 10% to 15%

Cash reserves of six to 12 months' worth of mortgage payments

The good news? While jumbo loans once carried higher rates, they now often track closely with conforming loans.

Refinancing in Southlake

If you purchased during the rate spike of 2023-2024, refinancing may soon make sense. A refinance replaces your current mortgage with a new one at a lower rate or better terms to save you money. Chestnut's tech-driven approach analyzes your situation to secure the best possible deal in less time than traditional processes.

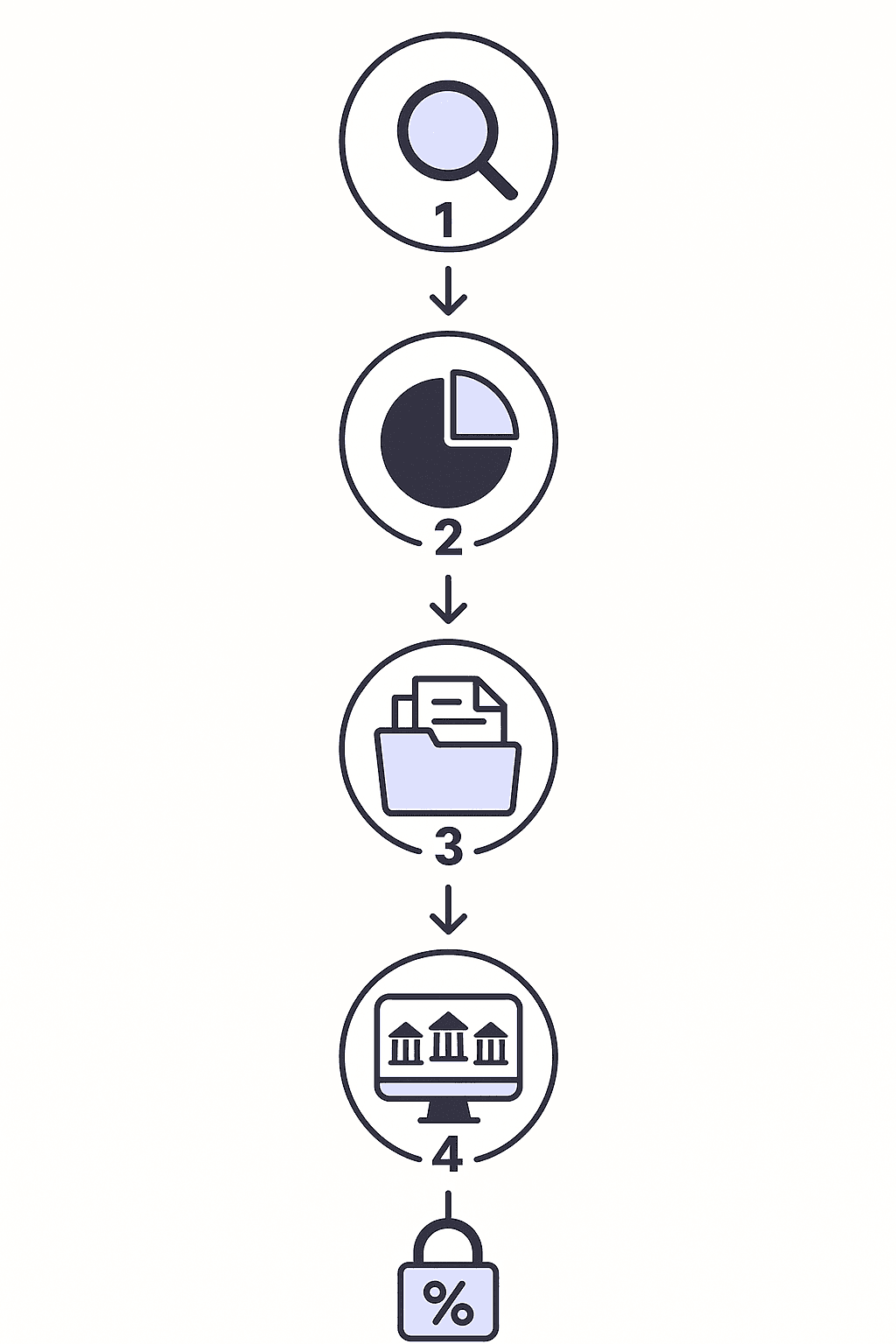

Five Steps to Lock the Best Rate in Southlake Today

Securing optimal mortgage rates requires preparation and strategy. Follow this action plan:

Step 1: Check Your Credit Profile

The best rates go to borrowers with scores above 740. FICO scores in the 740-850 range are considered "very good" to "exceptional," while scores in the 670-739 range are "good." If you're below 740, consider waiting a few months to improve your score before applying.

Step 2: Calculate Your Debt-to-Income Ratio

Add up your monthly debt payments and divide by your gross monthly income. If you're above 36%, pay down balances before applying. Lower DTI translates directly to better rate offers.

Step 3: Gather Documentation

Prepare tax returns, pay stubs, bank statements, and asset documentation. Having these ready accelerates the process and demonstrates financial organization to lenders.

Step 4: Compare Multiple Lenders

As NerdWallet notes, "Mortgage rates are likely to rise in November, as a December cut from the Federal Reserve has started to seem uncertain." Timing matters, but so does breadth of comparison.

Rather than manually contacting lenders one by one, use Chestnut's instant quote tool to see comprehensive rate comparisons in under two minutes. The platform's 94% first-attempt approval rate means fewer delays and stronger negotiating positions.

Step 5: Lock at the Right Moment

Once you've found a competitive rate, lock it. Rate locks typically last 30-60 days. If you're still house hunting, discuss float-down options with your lender.

Key takeaway: The average cost to originate a mortgage has risen from $5,100 in 2012 to $11,600 in 2023. Lenders using digital tools pass savings to borrowers -- Freddie Mac research shows digitally-optimized lenders originate loans that are $1,500, or 14%, less costly.

Chestnut Puts Southlake Homebuyers in the Driver's Seat

Refinancing your mortgage can help you save money, either right away or over time -- and the same principle applies to purchase mortgages. The key is finding the best available rate for your specific situation.

Chestnut delivers this through:

AI-Powered Rate Comparison across 100+ lenders

Instant Quotes in under two minutes

Continuous Monitoring to identify optimal lock timing

Rate Savings averaging 0.5 percentage points below traditional methods

For Southlake buyers navigating a market with $1.4 million median prices, that half-point savings translates to real money -- potentially $150,000 or more over a 30-year loan term.

Ready to see what rate you qualify for? Get your instant quote from Chestnut and discover why AI-powered mortgage shopping is becoming the preferred approach for Texas homebuyers who refuse to overpay.

Frequently Asked Questions

What are the current mortgage rates in Southlake, TX?

As of December 2025, the national average for a 30-year fixed mortgage is around 6.26%, with Texas averages slightly lower at 6.12%. Rates in Southlake typically align with these figures, but using AI-driven tools like Chestnut can help secure rates approximately 0.5% lower.

How does Chestnut's AI platform help in finding better mortgage rates?

Chestnut's AI platform analyzes offers from over 100 lenders simultaneously, providing instant quotes and continuous rate monitoring. This approach often results in rates 0.5% lower than traditional methods, saving borrowers significant amounts over the life of their loans.

What factors influence mortgage rates in Southlake, TX?

Mortgage rates in Southlake are influenced by factors such as credit score, loan-to-value ratio, debt-to-income ratio, loan type, and market conditions. Local programs and property location also play a role in determining rates.

Why is it important to compare multiple lenders when shopping for a mortgage?

Comparing multiple lenders is crucial because it increases the chances of finding the most competitive rate. Chestnut's platform simplifies this process by providing comprehensive rate comparisons from over 100 lenders, ensuring you don't miss out on better offers.

What are the benefits of using Chestnut for mortgage shopping in Southlake?

Chestnut offers AI-powered rate comparisons, instant quotes, and continuous monitoring, which help secure lower rates and optimal lock timing. This results in significant savings, especially in high-value markets like Southlake.

Sources

https://www.bankrate.com/mortgages/todays-rates/mortgage-rates-for-wednesday-september-24-2025/

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://www.redfin.com/neighborhood/765026/TX/Pearland/Southlake/housing-market

https://www.zillow.com/learn/what-factors-determine-interest-rates/

https://www.nerdwallet.com/article/mortgages/how-to-get-the-best-mortgage-rate

https://www.wsj.com/buyside/personal-finance/mortgage/mortgage-rates-by-credit-score

https://www.emarketer.com/content/nonbank-lenders-pulling-ahead-on-ai-innovation-mortgages

https://www.bankrate.com/home-equity/helocs-approach-three-year-lows/

https://sf.freddiemac.com/docs/pdf/cost-to-originate-full-study-2024.pdf