Best Mortgage Rates in Richardson TX

Current mortgage rates in Richardson, TX range from 6.2% to 6.3% for 30-year fixed loans and 5.5% to 5.6% for 15-year mortgages. The most effective way to secure competitive rates is comparing multiple lenders through platforms like Chestnut, which analyzes 100+ lenders in real time and typically delivers rate savings of 0.5% or more compared to traditional shopping methods.

Key Facts

• Richardson mortgage rates currently average 6.2% to 6.3% APR for 30-year loans and 5.5% to 5.6% for 15-year terms

• Even a 0.25% rate difference saves tens of thousands over a 30-year loan term on a typical Richardson home

• Credit scores of 760+ unlock the best rates, while scores below 620 limit lender options significantly

• Texas offers multiple assistance programs including Home Sweet Texas with up to 5% down payment assistance

• Richardson's Home Improvement Incentive Program provides cash rebates worth 10x the tax increase after qualifying renovations

• Mortgage rates are forecast to end 2025 at 6.4% and fall to 5.9% by late 2026

Finding the best mortgage rates in Richardson TX can save you tens of thousands of dollars over the life of your loan. Even a difference of 0.25% on a 30-year mortgage translates into significant monthly and lifetime savings. This comprehensive guide walks you through Richardson's current housing market, the key factors that shape your quoted rate, how to compare lenders effectively, state and local assistance programs, rate-lock timing strategies, loan-term trade-offs, and how to fast-track your pre-approval. By the end, you will have a clear action plan for securing a competitive mortgage.

What Does Richardson's 2025 Housing Market Look Like—and Why Do Mortgage Rates Matter?

Richardson sits inside the Dallas-Fort Worth metroplex, a region that continues to outpace most of the country in job growth and population gains. According to the Dallas Fed, the DFW economy expanded in August 2025 with strong employment growth, while home sales fell 3.3% and inventory tightened to 4.2 months of supply.

Housing inventory across North Texas has climbed to its highest level since 2003, giving buyers more options and negotiating power. Homes in the region now average 57 days on the market, an 18.8% increase year-over-year. Meanwhile, current 30-year mortgage rates in Texas hover around 6.2% to 6.3% APR, with 15-year loans near 5.5% to 5.6%.

Why does a fraction of a percent matter? On a $400,000 loan, dropping your rate from 6.5% to 6.0% can reduce your monthly payment by roughly $130 and your total interest by more than $45,000 over 30 years. In a market where prices have softened slightly and inventory is rising, locking in a competitive rate amplifies your purchasing power.

Key takeaway: Richardson's balanced inventory and steady regional job growth create favorable conditions for buyers who shop strategically for the lowest rate.

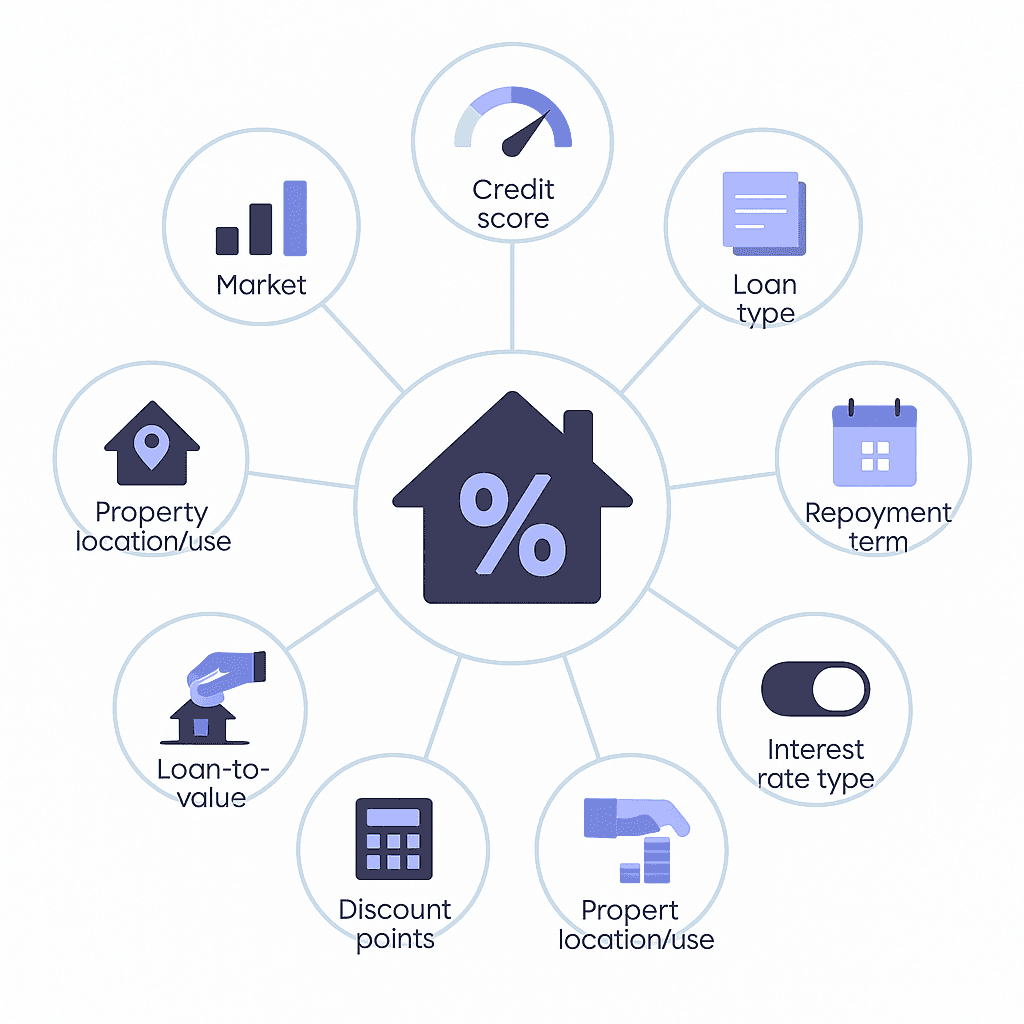

Eight Factors That Drive Richardson Mortgage Rates

Understanding what influences your quoted rate helps you take control of the variables you can change. According to Experian, lenders weigh 11 primary factors, but eight carry the most weight for Richardson borrowers:

Market conditions – Broader economic trends, inflation, and Federal Reserve policy set the baseline.

Credit score – A score of 760 or higher typically unlocks the best rates; scores below 620 may disqualify you from many lenders.

Loan type – Conventional, FHA, VA, and USDA loans each carry different risk profiles and rate bands.

Repayment term – Shorter terms such as 15 years usually command lower rates.

Interest-rate type – Fixed rates provide payment certainty; adjustable-rate mortgages (ARMs) may start lower but carry future risk.

Loan-to-value ratio (LTV) – A larger down payment lowers LTV and often reduces your rate.

Property location and use – Investment properties and vacation homes attract higher rates than primary residences.

Discount points – Paying upfront points can buy down your rate, shifting costs from monthly payments to closing.

Fannie Mae's September 2025 Economic Outlook projects mortgage rates to end 2025 at 6.4% and fall to 5.9% by late 2026. Understanding how these factors interact positions you to time your purchase and optimize your financial profile before applying.

Key takeaway: Improve controllable factors like credit score, down payment, and loan structure to earn a rate on the lower end of the market range.

Chestnut vs. Rocket Mortgage: Who Really Offers Lower Rates?

When comparing lenders, Richardson buyers often weigh large national platforms against AI-powered services. Rocket Mortgage is a household name, but how does it stack up against Chestnut?

Feature | Chestnut | Rocket Mortgage |

|---|---|---|

Lender network | Single lender | |

Typical rate advantage | 0.5%+ savings vs. traditional shopping | 0.73 percentage points above APOR on average |

Quote speed | Instant quotes in under two minutes | Fast online application |

Origination fees | Competitive | Higher than average per federal data |

HELOCs | Available | Not offered |

Chestnut's AI engine analyzes your credit score, income, debt-to-income ratio, and down payment to match you with lenders most likely to offer competitive terms for your specific situation. "Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods," according to Chestnut's own research.

Rocket Mortgage is a pioneer in digital mortgages and consistently ranks high for customer satisfaction. However, its rates tend to run above industry averages, and the lender does not offer HELOCs for borrowers seeking flexible equity access.

For Richardson buyers focused purely on rate, Chestnut's broad lender network and AI-driven comparison engine provide a structural advantage. You can get an instant quote in under two minutes to see how your personalized rate compares.

Which Texas and Richardson Programs Can Reduce Your Mortgage Cost?

Texas offers several state-sponsored programs, and Richardson has its own local incentive. Layering these programs can meaningfully reduce your upfront and ongoing costs.

Program | Benefit | Eligibility Highlights |

|---|---|---|

Fixed-rate mortgage + down payment assistance grant up to 5% | Run by TSAHC; income and purchase price limits apply | |

Up to 5% of loan amount as a 30-year, interest-free second mortgage | First-time buyers; income limits | |

One-time cash rebate equal to 10× the increase in city taxes after improvements of $20,000+ | Homeowners in single-family zones; project completed within 24 months | |

Forgivable loans up to $10,000 | City of Frisco or Frisco ISD employees; income ≤ $144,567; max purchase price $563,500 |

These programs can be combined with conventional, FHA, or VA financing. For example, a first-time buyer using My First Texas Home alongside an FHA loan could secure down payment assistance while benefiting from FHA's lower credit-score requirements.

Key takeaway: Explore state and local assistance before finalizing your loan to capture grants and forgivable loans that lower your out-of-pocket costs.

When and How Should You Lock Your Mortgage Rate in 2026's Volatile Market?

"A rate lock is one of the strongest forms of protection a borrower has in a volatile interest-rate environment," says Marc Halpern, CEO of Foundation Mortgage, as quoted by CBS News.

A mortgage rate lock keeps your interest rate from changing for a set period, typically 30 to 120 days. Here is a practical timeline:

Get pre-approved – Complete documentation and credit verification.

Sign a purchase contract – Most buyers lock once they have an accepted offer.

Choose a lock period – A 30- to 60-day lock covers most closings; extensions cost roughly 0.125% of the loan for every 5 to 10 additional days.

Consider a float-down option – For a small fee, this lets you capture a lower rate if the market drops after you lock.

Fannie Mae forecasts mortgage rates to end 2025 at 6.4% and 2026 at 5.9%. If you are buying in early 2026, locking once you have a signed contract protects you from short-term spikes while still allowing refinancing if rates decline further.

Key takeaway: Lock your rate once you have a purchase agreement in hand, and ask your lender about float-down provisions to hedge against potential drops.

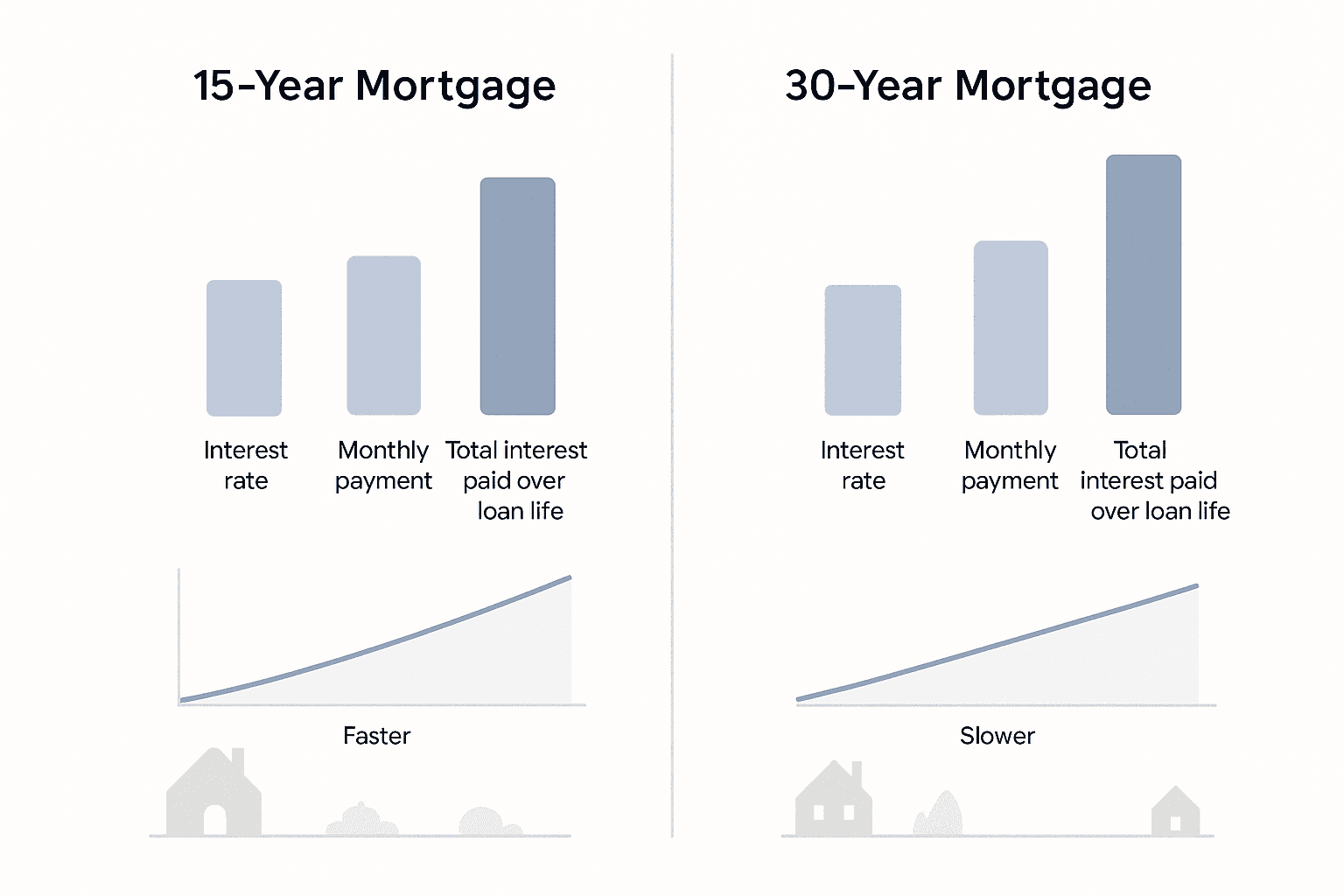

15- vs 30-Year Loans: Which Term Saves More in Richardson?

Choosing between a 15-year and 30-year mortgage depends on your cash-flow priorities and long-term savings goals.

Metric | 15-Year Fixed | 30-Year Fixed |

|---|---|---|

Typical rate (Dec 2025) | ||

Monthly payment difference | 30–60% higher | Lower, more flexible |

Lifetime interest saved | Less savings; more interest paid | |

Best for | Buyers with stable, higher income | Buyers seeking budget flexibility |

"A 15-year mortgage means larger monthly payments, but a lower interest rate," notes Bankrate. "Over time, a 30-year mortgage is substantially more expensive."

Consider a $400,000 loan in Richardson. At current average rates, a 15-year term would carry monthly payments roughly $700 higher, but you would save well over $150,000 in interest and own your home outright in half the time. A 30-year term keeps payments manageable and frees cash for other investments or emergencies.

Key takeaway: If you can comfortably afford the higher payment, a 15-year loan builds equity faster and costs far less in interest; otherwise, a 30-year term preserves monthly flexibility.

How Can You Fast-Track Mortgage Pre-Approval in Richardson?

"A mortgage pre-approval isn't just an estimate—it's a conditional commitment based on verified financial information," explains Redfin. Obtaining pre-approval early strengthens your offer and clarifies your budget.

Typical pre-approval timelines run around 10 days, though lenders with advanced automation can shorten that window significantly. Chestnut's AI engine compresses the process further, providing instant quotes in under two minutes and streamlining document verification.

Documents to gather:

Two years of W-2s or tax returns

Recent pay stubs covering 30 days

Bank statements for the past two months

Photo ID and Social Security number

Details on debts (student loans, auto loans, credit cards)

Pre-approval letters typically remain valid for 60 to 90 days. If your home search extends beyond that window, ask your lender for an extension or requalification.

Key takeaway: Gather documents early, choose a lender with fast turnaround, and get pre-approved before you start touring homes to make competitive offers with confidence.

Key Takeaways: Lock in a Smarter Richardson Mortgage Today

Securing the best mortgage rates in Richardson TX requires a combination of market awareness, personal financial optimization, and smart lender selection.

Understand local conditions – Inventory is rising and prices have stabilized, giving buyers leverage.

Improve controllable factors – Boost your credit score, lower your DTI, and save for a larger down payment.

Compare multiple lenders – Platforms that aggregate offers from 100+ lenders, like Chestnut, can surface rates 0.5% or more below traditional shopping.

Layer assistance programs – Texas state programs and Richardson's local incentives reduce upfront costs.

Lock strategically – Secure your rate once you have a signed contract and consider a float-down option.

Choose the right term – A 15-year mortgage saves significant interest; a 30-year mortgage preserves monthly flexibility.

Get pre-approved early – Documentation and verification take time; starting early keeps you competitive.

Chestnut's service extends beyond the initial loan closing. The AI continues monitoring market conditions and can alert you to refinancing opportunities as they arise, according to Chestnut's resources. Ready to see your personalized rate? Get an instant quote in under two minutes and take the first step toward a smarter Richardson mortgage.

Frequently Asked Questions

What are the best mortgage rates in Richardson, TX right now?

Daily trackers such as Zillow and Bankrate show 30-year fixed rates for Texas hovering between 6.2% and 6.3% APR as of late December 2025, with 15-year loans near 5.5%–5.6% APR. Individual quotes vary by credit score, down payment, and loan type, so shoppers should compare personalized offers from several lenders.

How can I lock a competitive rate before they rise again?

Most Richardson buyers lock once a purchase contract is signed. Experts recommend a 30–60 day lock; extensions typically cost 0.125% of the loan every extra 5–10 days. A float-down option lets you capture later drops for a small fee. Improving credit, boosting your down payment, and comparing at least three lenders before locking can shave thousands over the loan term.

Frequently Asked Questions

What are the best mortgage rates in Richardson, TX right now?

Daily trackers such as Zillow and Bankrate show 30-year fixed rates for Texas hovering between 6.2% and 6.3% APR as of late December 2025, with 15-year loans near 5.5%–5.6% APR. Individual quotes vary by credit score, down payment, and loan type, so shoppers should compare personalized offers from several lenders.

How can I lock a competitive rate before they rise again?

Most Richardson buyers lock once a purchase contract is signed. Experts recommend a 30–60 day lock; extensions typically cost 0.125% of the loan every extra 5–10 days. A float-down option lets you capture later drops for a small fee. Improving credit, boosting your down payment, and comparing at least three lenders before locking can shave thousands over the loan term.

What factors influence mortgage rates in Richardson?

Key factors include market conditions, credit score, loan type, repayment term, interest-rate type, loan-to-value ratio, property location, and discount points. Improving controllable factors like credit score and down payment can help secure a lower rate.

How does Chestnut compare to Rocket Mortgage for Richardson buyers?

Chestnut offers a broad lender network and AI-driven comparison engine, providing rate savings of 0.5% or more compared to traditional shopping methods. Rocket Mortgage, while a pioneer in digital mortgages, tends to have rates above industry averages and does not offer HELOCs.

What local programs can help reduce mortgage costs in Richardson?

Programs like Home Sweet Texas, My First Texas Home, and the Richardson Home Improvement Incentive offer benefits such as down payment assistance and cash rebates. These can be combined with conventional, FHA, or VA financing to lower upfront and ongoing costs.

Sources

https://www.dallasfed.org/research/indicators/dfw/2025/dfw2509

https://www.mdregroup.com/dallas-fort-worth-housing-market-update-mid-2025-analysis/

https://experian.com/blogs/ask-experian/how-are-mortgage-rates-determined

https://experian.com/blogs/ask-experian/average-mortgage-rates-by-credit-score

https://www.friscotexas.gov/680/Down-Payment-Assistance-Program

https://www.cbsnews.com/news/what-to-consider-about-mortgage-rate-locks-now-according-to-experts/

https://www.bankrate.com/mortgages/what-is-mortgage-rate-lock/

https://www.bankrate.com/mortgages/todays-rates/mortgage-rates-for-monday-december-15-2025/

https://www.redfin.com/blog/documents-needed-for-mortgage-pre-approval/

https://sofi.com/learn/content/how-long-does-a-preapproval-for-mortgage-take