Best Mortgage Rates in McKinney TX

Current mortgage rates in McKinney TX average around 6.58% for 30-year fixed mortgages, slightly below the national average of 6.83%. With the 30-year fixed-rate mortgage down from 6.85% a year ago, McKinney buyers who shop strategically can secure even better rates through AI-powered platforms like Chestnut that compare 100+ lenders simultaneously.

At a Glance

McKinney mortgage rates currently average 6.58% for 30-year fixed loans, below the national average

Rates have dropped 0.67 percentage points from 6.85% one year ago

50% of McKinney homes sold below asking price last month, creating additional negotiating leverage

Local assistance programs through McKinney Housing Finance Corporation offer down payment help for buyers earning up to $118,565

Chestnut's AI platform analyzes 100+ lenders to find rates typically 0.5% below traditional shopping methods

Pre-approval letters available in under 2 minutes versus 6-10 days at traditional banks

Homebuyers searching for the best mortgage rates in McKinney TX need to understand how fast-moving rate shifts can add or subtract tens of thousands of dollars over the life of a loan. This guide shows where McKinney sits today, what drives pricing, and how Chestnut's AI can shave roughly half a percentage point off published offers.

Why Do Mortgage Rates Matter in McKinney's 2026 Housing Market?

In McKinney's current real estate landscape, even a fraction of a percentage point on your mortgage rate translates into significant long-term savings or costs. The average McKinney home value is $505,763, and at that price point, a half-point rate difference could mean tens of thousands of dollars over a 30-year loan.

The local market presents unique opportunities for buyers. According to Rocket Homes, 50% of homes sold below asking price last month, creating negotiating room that savvy buyers can leverage alongside competitive financing.

As of December 24, 2025, Freddie Mac reports that "the 30-year fixed-rate mortgage averaged 6.18%, down from last week when it averaged 6.21%. A year ago at this time, the 30-year FRM averaged 6.85%." That year-over-year decline of 0.67 percentage points represents meaningful monthly payment reductions for McKinney homebuyers.

Key takeaway: In a market where half of homes sell below list price, combining negotiating power with an optimized mortgage rate creates compounding savings that benefit buyers for decades.

How Do McKinney Mortgage-Rate Trends Compare With the National Average?

McKinney sits within the broader Dallas-Fort Worth metro, where local rates closely track national benchmarks but can vary by lender.

Metric | Rate | Change |

|---|---|---|

National 30-Year Fixed | 6.18% | Down from 6.85% YoY |

Collin County 30-Year Fixed | 6.58% | Down 0.05% week-over-week |

Plano Area 30-Year Fixed | 6.83% | 47 bps lower than last year |

The Collin County average currently sits at 6.58% for 30-year fixed-rate mortgages, while nearby Plano shows rates around 6.83% for a 30-year fixed.

These figures reveal meaningful variation even within the same metro area. Freddie Mac's weekly survey shows rates are well below the year-to-date average of 6.62%, providing "some sense of balance to the housing market," according to Sam Khater, Freddie Mac's Chief Economist.

For context, NerdWallet reports that the national average 30-year fixed mortgage APR is 6.83%, meaning Collin County buyers are actually positioned slightly better than the broader U.S. average.

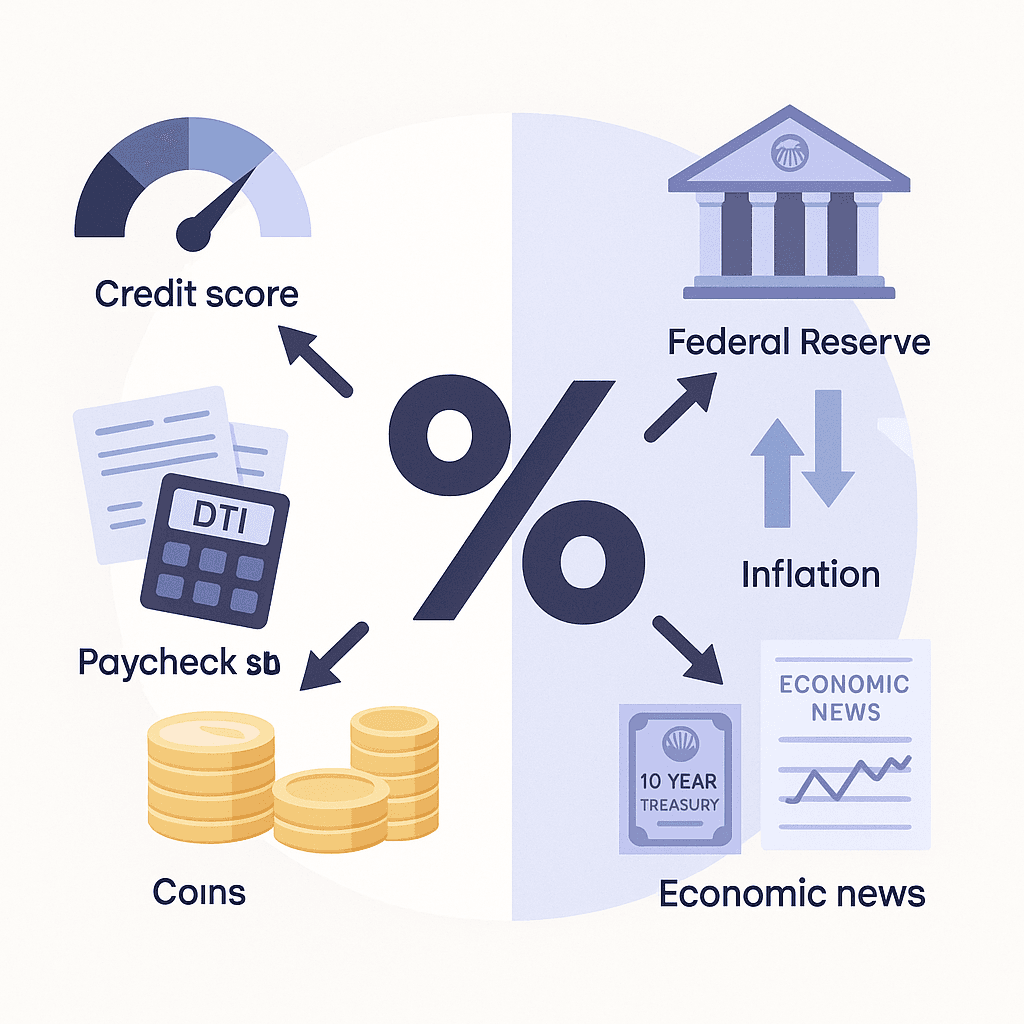

What Drives Your Rate? Credit, Fed Policy, and More

Understanding what influences your personal rate helps you optimize your application before shopping.

Lenders evaluate two major categories when setting your mortgage rate:

Your likelihood of repayment - credit score, income stability, debt-to-income ratio

Broader economic conditions - inflation, Federal Reserve policy, employment trends

As LendingTree explains, "Lenders consider two major factors when determining your mortgage rate: How likely you are to repay the loan and what's going on in financial markets and the larger economy."

Your credit score carries particular weight. The Consumer Financial Protection Bureau notes that "your credit score and the information on your credit report determine whether you'll be able to get a mortgage, and the rate you'll pay."

Importantly, many lenders do not accept borrowers with credit scores below 620, making score improvement a priority for some buyers.

Federal Reserve & Treasury Yields

Mortgage rates don't move in isolation. They respond to macroeconomic signals, particularly Federal Reserve policy and Treasury yields.

Fannie Mae's economic forecast projects the federal funds rate at 3.6% for 2025, with gradual decreases expected through 2027. This trajectory suggests continued, though modest, rate relief ahead.

The relationship between Treasury yields and mortgage rates is direct. The 10-year Treasury bond currently yields around 4.1%, and as Chestnut's market analysis notes, "these yields directly influence mortgage pricing."

When Treasury yields rise, mortgage rates typically follow. When they fall, borrowers benefit from lower financing costs.

Which McKinney Assistance Programs Can Lower Your Effective Rate?

McKinney offers several assistance programs that can reduce your upfront costs or improve your effective rate.

The McKinney Housing Finance Corporation partners with TDHCA to offer the Texas Homebuyers Program, which includes:

My First Texas Home - Available to veterans and first-time homebuyers

Bonus Gift Dollars - Available to those who qualify

Texas Mortgage Credit Certificate Program - For veterans, first-time buyers, or those who haven't owned in three years

Income limits for these programs are generous. For McKinney residents, the caps are:

Up to $103,100 for one or two persons (100% area median income)

Up to $118,565 for three or more persons (115% area median income)

Purchase price limits extend to $541,594 for single-family homes.

The Housing Services Division also provides down payment and closing cost assistance through HOME grant funds and Community Development Block Grants. These programs can effectively lower your total borrowing costs even if they don't directly reduce your interest rate.

Chestnut vs. Traditional Lenders: Saving 0.50% With AI

Traditional mortgage shopping requires contacting multiple lenders individually, comparing disparate offers, and hoping you've found the best available rate. This process is time-consuming and often incomplete.

Chestnut's approach fundamentally differs. The platform's AI engine analyzes options across more than 100 lenders in real-time, identifying optimal matches based on your specific financial profile.

The results speak clearly: "Borrowers using Chestnut AI typically see rate savings of 0.5% or more compared to traditional shopping methods."

On a median McKinney home, that half-point advantage translates to substantial long-term savings.

Feature | Traditional Lenders | Chestnut |

|---|---|---|

Lenders Compared | 1-3 typically | 100+ |

Quote Time | Days to weeks | Under 2 minutes |

Rate Advantage | Market average | ~0.50% below average |

Ongoing Monitoring | Rarely offered | Continuous |

The technology goes beyond simple rate comparison. Chestnut's AI analyzes individual borrower profiles, including credit score, income, debt-to-income ratio, and loan specifics, to identify lenders most likely to offer competitive terms for each unique situation.

Speed & Approval Rates

Speed matters in competitive markets. Traditional bank pre-approvals can take 6-10 days. Chestnut's AI delivers fully documented pre-approval letters in under 2 minutes.

The platform's performance metrics are compelling. Based on Q3 2025 data, Chestnut consistently delivers an average processing time of 1 minute 47 seconds.

Faster approvals mean stronger offers. When competing against other buyers, a verified pre-approval letter gives you credibility that verbal assurances cannot match.

Refinancing in 2026: When Does a Lower Rate Still Make Sense?

Refinancing replaces your existing mortgage with a new one, typically to secure better terms or access home equity. As Empower explains, "refinancing replaces your existing mortgage with a new one, usually to secure better terms, and sometimes to access home equity."

The break-even calculation is straightforward: closing costs typically run 2% to 6% of the loan amount. Divide those costs by your monthly savings to determine how long until the refinance pays for itself.

A common guideline suggests that refinancing makes sense if the new rate is at least one to two points lower than your current rate. However, even smaller gaps can justify refinancing if you plan to stay long-term.

Chestnut's tech-driven approach makes refinancing streamlined, analyzing your situation to secure the best possible deal while trimming weeks off the typical timeline. The platform continues monitoring market conditions after closing, alerting you to refinancing opportunities as they arise.

Key refinancing considerations:

Break-even timeline - How many months until savings exceed closing costs?

Time in home - Will you stay long enough to realize the savings?

Rate differential - Is the gap significant enough to justify costs?

Loan term - Shorter terms build equity faster but increase monthly payments

Need a Jumbo Loan in McKinney? Rate Rules & AI Tips

Jumbo loans finance amounts exceeding conforming loan limits. In 2025, these limits range from $806,000 to $1,209,750 depending on the county.

For McKinney buyers eyeing higher-priced properties, understanding jumbo requirements is essential.

Jumbo loans carry stricter qualification standards:

Credit scores of 680-740 minimum

Debt-to-income ratios of 45% or lower

Down payments of 10-15% or more

Cash reserves covering 6-12 months of payments

As Bankrate reports, the national average 30-year fixed jumbo rate is 6.41%, which is actually competitive with conforming loan rates in many cases.

A key insight from industry expert Melissa Cohn: "Rates with jumbo mortgages can vary broadly from bank to bank," because lenders have more flexibility in setting terms for these non-conforming products.

This variation creates opportunity. Jumbo rates are typically higher due to increased lender risk, but shopping across multiple sources can uncover significant differences. Chestnut's 100+ lender network is particularly valuable for jumbo borrowers seeking competitive pricing.

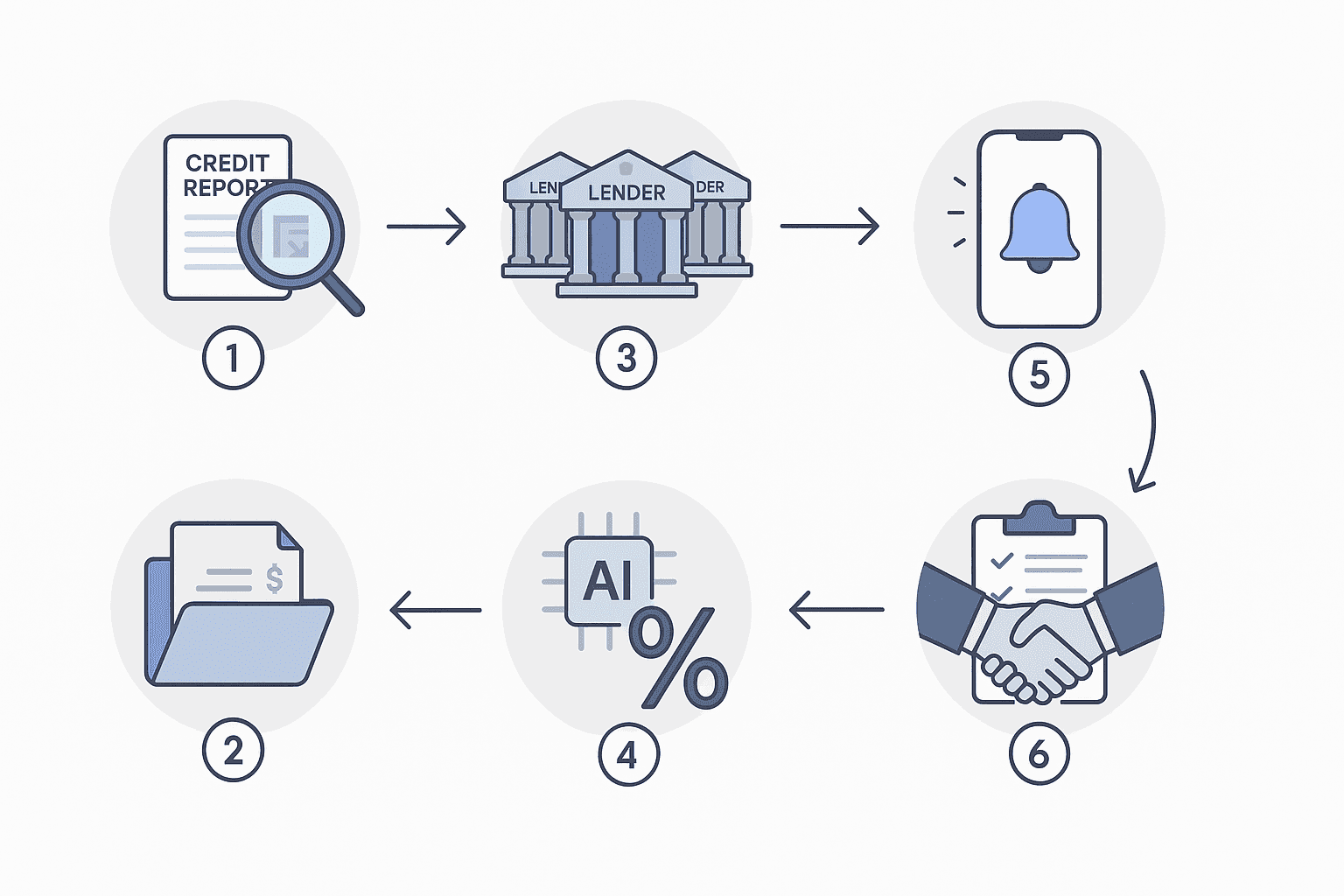

6 Steps to Lock the Best Mortgage Rate With Chestnut

Check your credit report first - Review for errors that could lower your score. Higher scores unlock better rates.

Gather financial documentation - Income verification, tax returns, and asset statements speed the process.

Get quotes from multiple sources - Buyers who got quotes from at least four lenders saved up to $1,200 annually, according to Freddie Mac research.

Use Chestnut's instant quote tool - The platform provides instant quotes in under two minutes, comparing 100+ lenders simultaneously.

Time your rate lock strategically - Rates change daily. Chestnut's system can alert borrowers to favorable rate movements during the loan process.

Review before closing - Ensure all terms match your expectations and that no last-minute changes have occurred.

Remember that it pays to shop around for mortgage rates. The variation between lenders can be substantial, and AI-powered comparison tools eliminate the friction that traditionally limited borrowers to checking only a few options.

McKinney Buyers: Act Now, Save for Decades

McKinney's housing market offers genuine opportunity. Half of homes sell below asking price, rates sit near their lowest levels in over a year, and assistance programs can further reduce your costs.

The difference between an average rate and an optimized one compounds over 30 years. For McKinney buyers serious about maximizing their purchasing power, Chestnut offers a clear advantage.

With over $85 billion in mortgages processed and a 5.0 Google rating, Chestnut has established itself as a leader in delivering lower rates through AI-driven solutions. The platform is licensed in Texas and designed specifically to help buyers like you secure the best possible financing.

Get your instant quote in under two minutes and see how much you could save on your McKinney home purchase.

Frequently Asked Questions

What factors influence mortgage rates in McKinney, TX?

Mortgage rates in McKinney, TX, are influenced by personal factors like credit score and income stability, as well as broader economic conditions such as Federal Reserve policy and Treasury yields.

How does Chestnut help in finding the best mortgage rates?

Chestnut uses AI to analyze options from over 100 lenders, providing real-time, optimized mortgage rate matches based on your financial profile, often saving borrowers 0.5% or more compared to traditional methods.

What are the current mortgage rate trends in McKinney, TX?

As of late 2025, McKinney's mortgage rates are slightly below the national average, with the 30-year fixed rate around 6.58%, offering a favorable environment for buyers.

What assistance programs are available for homebuyers in McKinney?

McKinney offers programs like My First Texas Home and the Texas Mortgage Credit Certificate Program, which provide financial assistance and tax benefits to eligible homebuyers.

How does refinancing work with Chestnut?

Chestnut streamlines the refinancing process using AI to secure the best possible terms, continuously monitoring market conditions to alert you of refinancing opportunities.

What are the benefits of using Chestnut over traditional lenders?

Chestnut offers faster pre-approvals, compares over 100 lenders for the best rates, and provides ongoing monitoring, often resulting in a 0.5% rate advantage over traditional lenders.

Sources

https://www.nerdwallet.com/mortgages/mortgage-rates/texas/plano

https://chestnutmortgage.com/resources/chestnut-ai-mortgage-pre-approval-under-2-minutes-2025

https://www.lendingtree.com/home/mortgage/rates/how-are-mortgage-rates-determined/

https://www.consumerfinance.gov/owning-a-home/explore-rates/

https://www.fanniemae.com/media/document/pdf/economic-forecast-112025

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://www.empower.com/the-currency/money/how-does-refinancing-a-mortgage-work-sense-check-news

https://experian.com/blogs/ask-experian/jumbo-mortgage-rates

https://money.usnews.com/loans/rates/mortgages/jumbo-mortgage