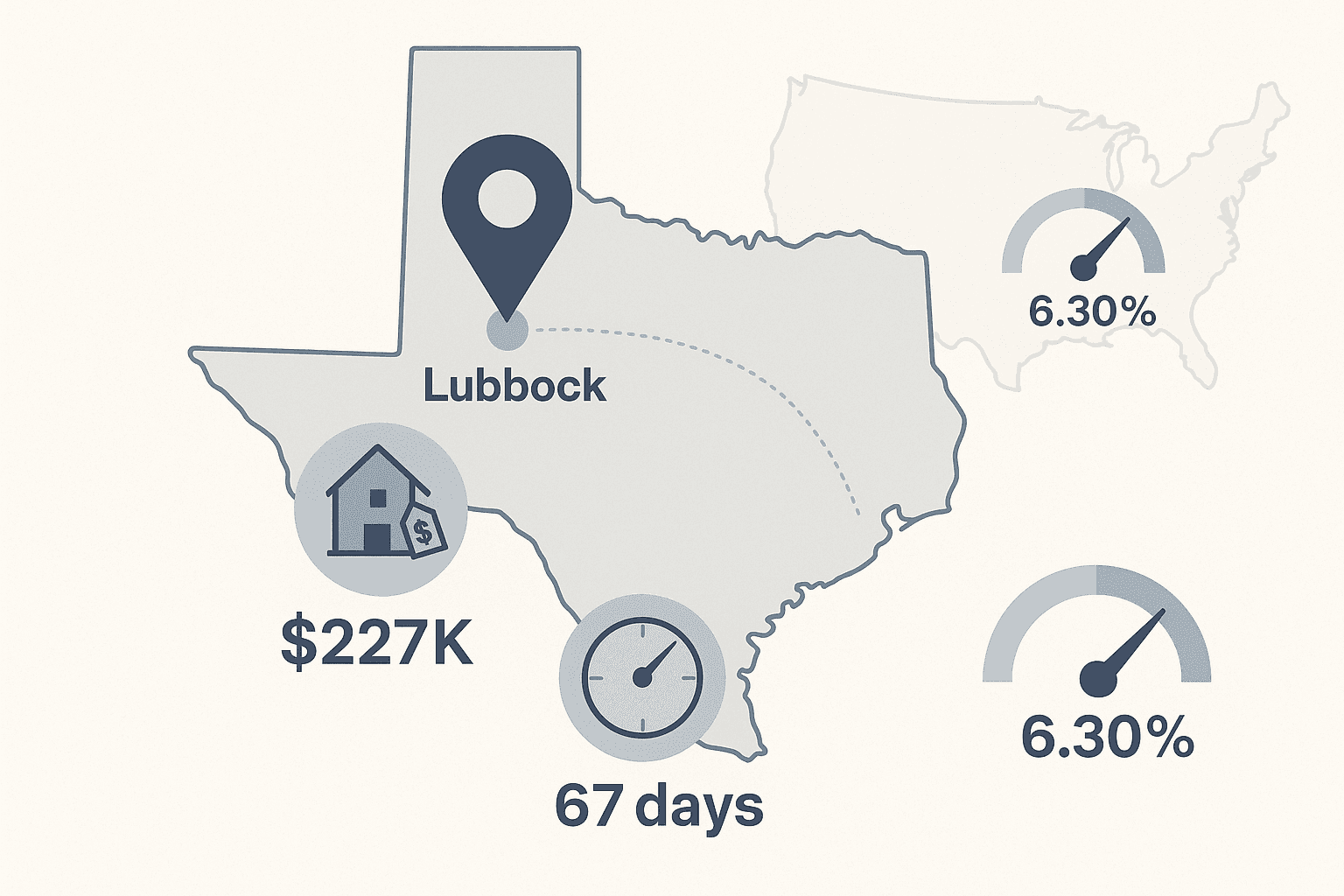

Best Mortgage Rates in Lubbock TX

Current mortgage rates in Lubbock, TX average 6.945% for a 30-year fixed loan, higher than the national average of 6.30%. Borrowers using Chestnut's AI technology typically save 0.5% by comparing over 100 lenders simultaneously, with pre-approval in under 2 minutes.

Key Facts

• Lubbock's median home price is $227,000, down 2% year-over-year with homes averaging 67 days on market

• Texas first-time buyer programs offer 2-5% down payment assistance with 0% interest second liens

• Traditional lenders take 30-45 days to process applications versus AI-based underwriting in 8 minutes

• Half of Lubbock homes sell below asking price, creating negotiation opportunities for prepared buyers

• The Texas Mortgage Credit Certificate provides a 20% federal tax credit on annual mortgage interest paid

• National mortgage satisfaction scores rank near bottom of measured industries at 75/100

In this 2026 guide to finding the best mortgage rates in Lubbock TX, we explain why local borrowers pay very different prices for the same loan and how Chestnut's AI helps you beat the market in minutes.

Why Do Lubbock Homebuyers Care About Getting the Best Rate?

"A mortgage rate is the interest rate you pay on the money you borrow to buy your house," according to Freddie Mac. That simple definition masks enormous financial stakes: a lower rate reduces your borrowing costs, increases your purchasing power, and can save you tens of thousands of dollars over the life of your loan.

Today's mortgage rates in Lubbock, TX are 6.945% for a 30-year fixed, 6.047% for a 15-year fixed, and 7.457% for a 5-year adjustable-rate mortgage. Meanwhile, Bankrate's January 6, 2026 survey shows the national average 30-year fixed APR at 6.30%. That gap matters because even small rate differences compound dramatically.

Consider a basis point: one one-hundredth of one percent. A difference of just 50 basis points on a $227,000 home (Lubbock's current median price) translates to thousands in savings over 30 years. Lenders set rates based on personal factors like credit score and current market conditions, so actively shopping and comparing offers is essential for Lubbock buyers who want to minimize their lifetime borrowing costs.

What Is the 2025-2026 Lubbock Housing & Rate Outlook?

Lubbock's housing market continues to offer relative affordability compared to major Texas metros. In October 2025, home prices were down 2.0% compared to last year, selling for a median price of $227K.

Homes are taking longer to sell, averaging 67 days on the market compared to 57 days last year, giving buyers more negotiating room. The Lubbock real estate market had 1,136 homes for sale in March 2025, a 9.2% decrease compared to February.

Half of homes sold below asking price, suggesting opportunities for patient buyers. As a regional hub for West Texas, Lubbock's housing market benefits from strong anchors in education, healthcare, and agriculture, with Texas Tech University and a growing medical district driving consistent population growth.

Metric | Lubbock (Oct 2025) | Year-Over-Year Change |

|---|---|---|

Median Sale Price | $227,000 | -2.0% |

Days on Market | 67 | +10 days |

Homes Sold | 324 | +24.1% |

Homes Selling Below Ask | 50% | — |

National vs. Local Forces That Move Rates

Mortgage rates became more affordable in 2025 after the Federal Reserve began cutting rates late in the year. Since August, average 30-year fixed mortgage rates have held below 6.5%, offering relief to borrowers.

However, local and national forces often diverge. "Longer-term interest rates have risen in recent months even as the Fed continued to cut the short-term rate at its December meeting," according to Fannie Mae's January 2025 analysis. The 10-year Treasury bond serves as the mortgage market's north star, currently yielding around 4.1%, and these yields directly influence mortgage pricing.

For Lubbock specifically, Texas home sales rose significantly in December to deliver a strong fourth-quarter finish, with total statewide home purchases up 10.7% from a year ago. Mortgage rates in Texas remain in the low 6% range, barely budging following December's 25 basis point rate cut.

Key takeaway: While national trends set the baseline, Lubbock's stable economy and balanced inventory create opportunities for savvy borrowers who compare multiple lenders.

How Chestnut Consistently Beats Average Lubbock Rates by 0.50%

"Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods," according to Chestnut's rate analysis. This advantage comes from proprietary AI technology that continuously analyzes pricing data from over 100 lenders in real-time.

Chestnut's AI platform operates differently from traditional mortgage shopping. Rather than requiring borrowers to manually contact multiple lenders, the system provides instant quotes in under two minutes, allowing comprehensive rate comparisons immediately. The AI goes beyond simple rate comparison, analyzing individual borrower profiles—credit score, income, debt-to-income ratio, down payment, and loan specifics—to identify lenders most likely to offer competitive terms.

Perhaps most impressive: AI-based underwriting reduces processing time from an average of 30-45 days to just eight minutes. This speed advantage matters in competitive markets where delays can cost you a home.

Pre-Approval in Under 2 Minutes

Chestnut has emerged as the category speed leader, delivering fully documented pre-approval letters through proprietary AI-powered underwriting. Based on Q3 2025 performance data, Chestnut consistently delivers an average processing time of 1 minute 47 seconds.

The process begins with an instantaneous soft-pull tri-merge credit report that aggregates data from all three major bureaus without impacting your credit score. The AI system processes this credit data in under 15 seconds, identifying potential issues and automatically flagging opportunities for credit optimization.

The platform's 94% first-attempt approval rate means fewer delays and stronger negotiating positions. When you're competing for a Lubbock home, getting started takes just 2 minutes.

Traditional Lenders vs. Chestnut: Service, Speed, and Savings

The American Customer Satisfaction Index places mortgage lenders near the bottom of all measured industries, with a debut score of 75 on a scale of 0-100.

Overall customer satisfaction with mortgage lenders is 727 on a 1,000-point scale, down 3 points from a year ago. While some lenders post high ratings online, industry-wide surveys reveal that processing times remain significantly slower than AI-driven alternatives.

Key comparison factors:

Factor | Traditional Lenders | Chestnut |

|---|---|---|

Pre-Approval Time | Days to weeks | Under 2 minutes |

Lenders Compared | 1-3 typically | 100+ simultaneously |

Rate Advantage | Market average | ~0.50% below average |

Processing Time | 30-45 days | Minutes to days |

On average, 26% of customers report filing complaints with their lender. Mobile apps performed well in satisfaction surveys, scoring 82 for quality and 80 for reliability, while websites scored 81—making digital channels the most positive aspects of the customer experience. Chestnut combines this digital excellence with AI-powered rate optimization.

Which State & Local Programs Can Lower Your Lubbock Mortgage Cost?

Texas offers several programs that stack with competitive rates to reduce your total homebuying costs.

My First Texas Home Program

This TDHCA program provides assistance ranging from 2%-5% of the total mortgage loan for down payment and closing costs. Key requirements:

First-time homebuyer (no primary residence ownership in past 3 years)

Minimum credit score of 620

Texas residency attestation

Occupy property within 60 days of closing

Complete pre-purchase homebuyer education course

The program offers 0% interest with no required monthly payments on the second lien, and no pre-payment penalties.

My Choice Texas Home

For non-first-time buyers, MCTH provides a 30-year deferred repayable second lien with down payment assistance up to 5% of the mortgage loan.

Texas Mortgage Credit Certificate (MCC)

The MCC is a non-refundable federal income tax credit allowing homeowners to claim a portion of annual mortgage interest paid. The TDHCA MCC is issued at a 20% credit rate, providing ongoing tax savings throughout homeownership.

The TDHCA Homebuyer Program offers flexible down payment assistance and low-interest mortgages with live support from experienced mortgage and real estate professionals. These programs can be combined with Chestnut's competitive rates for maximum savings.

Step-by-Step: Lock Your Best Rate in 5 Minutes or Less

Whether you're buying a new home or refinancing in Lubbock, follow these steps to secure your lowest possible rate:

Step 1: Check Your Rate (2 Minutes)

Visit Chestnut's platform to get started. Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods. The system provides instant quotes in under two minutes.

Step 2: Complete Pre-Approval

Chestnut's AI performs a soft-pull credit check that doesn't impact your score, then matches your profile against 100+ lenders. You'll receive a fully documented pre-approval letter that strengthens your offer.

Step 3: Lock Your Rate

Once you find a home, lock your rate to protect against market fluctuations. All loans are subject to credit approval.

For Refinancing:

When you refinance, you are applying for a new mortgage to replace your current one, which will result in a new rate, term and monthly payment. Consider refinancing if mortgage rates are lower than when you closed, or if your financial situation has improved.

The total cost to refinance will be determined by your lender, credit score, and location, but expect to spend 3%-6% of your loan principal. Chestnut's rate advantage can help offset these costs faster.

Key Takeaways: Secure Your Lowest Lubbock Rate Today

Finding the best mortgage rates in Lubbock TX requires understanding local market conditions, comparing multiple lenders, and leveraging technology to your advantage.

By leveraging proprietary AI technology, Chestnut compares offers from over 100 lenders to secure the most competitive rates, often reducing borrower rates by approximately 0.5%. With over $85 billion in mortgages processed and a 5.0 Google rating, Chestnut has established itself as a leader in the mortgage industry.

Your action plan:

Check current Lubbock rates against the national average

Get a pre-approval in under 2 minutes through Chestnut

Explore TDHCA programs for additional down payment assistance

Lock your rate when you find the right home

Chestnut is licensed in Texas and combines AI-driven efficiency with human expertise to ensure accuracy on every file. Whether you're a first-time buyer using TDHCA assistance or refinancing to tap equity, start with a free quote to see how much you could save on your Lubbock mortgage.

Frequently Asked Questions

What are the current mortgage rates in Lubbock, TX?

As of January 2026, mortgage rates in Lubbock, TX are approximately 6.945% for a 30-year fixed, 6.047% for a 15-year fixed, and 7.457% for a 5-year adjustable-rate mortgage.

How does Chestnut's AI technology help in securing better mortgage rates?

Chestnut's AI technology analyzes pricing data from over 100 lenders in real-time, providing instant quotes and typically saving borrowers 0.5% or more compared to traditional methods.

What is the advantage of using Chestnut for mortgage pre-approval?

Chestnut offers a fast pre-approval process, delivering fully documented letters in under 2 minutes, which strengthens your negotiating position when buying a home.

What local programs can help reduce mortgage costs in Lubbock?

Programs like the My First Texas Home and My Choice Texas Home offer down payment assistance, while the Texas Mortgage Credit Certificate provides tax credits, all of which can be combined with Chestnut's competitive rates for maximum savings.

How does the Lubbock housing market compare to other Texas metros?

Lubbock's housing market remains relatively affordable, with a median sale price of $227,000 as of October 2025, and benefits from strong local economic anchors like Texas Tech University.

Sources

https://chestnutmortgage.com/resources/chestnut-ai-mortgage-pre-approval-under-2-minutes-2025

https://chestnutmortgage.com/resources/how-chestnut-ai-can-cut-your-rate-in-a-rising-rate-market

https://www.nerdwallet.com/mortgages/mortgage-rates/texas/lubbock

https://www.bankrate.com/mortgages/todays-rates/mortgage-rates-for-tuesday-december-30-2025/

https://www.fanniemae.com/research-and-insights/forecast/economic-developments-january-2025

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://trerc.tamu.edu/article/texas-housing-insight-december-2024

https://chestnutmortgage.com/resources/chestnut-ai-delivers-0-50-point-rate-advantage-2025

https://welcomehome.tdhca.texas.gov/uploads/My-First-Texas-Home-Program-Matrix-TMS.pdf?v=1738018341

https://thetexashomebuyerprogram.com/uploads/Lender-Guide.pdf

https://myhome.freddiemac.com/blog/refinancing/when-right-time-refinance