Best Mortgage Rates in Littleton CO

Littleton homebuyers can access mortgage rates averaging 6.09% APR for 30-year fixed loans in Colorado, below the national average of 6.18%. Comparing multiple lenders saves buyers up to $1,200 annually, while AI-powered platforms like Chestnut typically deliver rates 0.5% lower than traditional shopping methods through automated comparison of 100+ lenders.

At a Glance

• Current Colorado 30-year fixed rates average 6.09% APR, down from 6.85% last year • Littleton homes average $655,967 with properties going pending in 11 days • Shopping 4+ lenders saves borrowers approximately $1,200 annually on average • Chestnut's AI technology analyzes 100+ lenders simultaneously, reducing rates by 0.5% compared to traditional methods

• Local down payment assistance programs offer up to 5% help through zero-interest second mortgages

• Rates forecast to reach 5.9% by 2026 according to Fannie Mae projections

Littleton homebuyers have reason to celebrate heading into 2025. Colorado's average 30-year fixed mortgage rate currently sits at 6.09% APR, while the national average tracked by Freddie Mac shows 6.18% as of late December. For context, that's 54 basis points lower than this time last year. With the average Littleton home valued at $655,967, even a small rate reduction can translate into thousands saved over the life of your loan.

This guide breaks down everything you need to know about securing the best mortgage rates in Littleton, CO, including what drives local rates, how to compare lenders efficiently, and why AI-powered tools like Chestnut can help you secure materially lower rates.

What are today's Littleton mortgage rates and why do they matter?

Understanding current rates is the first step toward making an informed decision. Here's a snapshot of where Colorado mortgage rates stand:

Loan Type | Colorado Average APR | Weekly Change |

|---|---|---|

30-Year Fixed | -0.02% | |

15-Year Fixed | 5.44% | -0.08% |

5-Year ARM | 6.51% | -0.15% |

According Freddie Mac's Primary Mortgage Market Survey, "The 30-year fixed-rate mortgage averaged 6.18% as of December 24, 2025, down from last week when it averaged 6.21%. A year ago at this time, the 30-year FRM averaged 6.85%."

Why does this matter for Littleton buyers? With homes going pending in around 11 days on average, the local market moves quickly. Buyers who secure preapproval at competitive rates gain a significant edge when submitting offers. A quarter-point difference on a $650,000 mortgage can mean over $100 per month in savings.

Key takeaway: Rates are at their lowest point in over a year, making now an opportune time to explore your options.

What drives mortgage rates in Littleton? 4 forces to watch

Mortgage rates don't exist in a vacuum. Several interconnected factors determine what lenders offer Littleton borrowers.

Federal Reserve & Treasury yields

The relationship between Federal Reserve policy and mortgage rates is indirect but powerful. The 10-year Treasury bond serves as the mortgage market's north star, currently yielding around 4.1%. When Treasury yields rise, mortgage rates typically follow.

Fed Chair Jerome Powell recently noted that "a further reduction in the policy rate at the December meeting is not a foregone conclusion," signaling continued uncertainty in rate direction.

Credit score & loan type

Mortgage lenders use credit score as a stand-in for risk. Higher scores are generally rewarded with lower interest rate offers. The spread between rates offered to excellent-credit borrowers versus fair-credit borrowers can exceed a full percentage point.

Other borrower-specific factors include:

Down payment size

Debt-to-income ratio

Loan amount and property type

Employment history

Fannie Mae forecasts mortgage rates to end 2025 at 6.3% and decline to 5.9% by 2026. Economic conditions, inflation data, and employment figures will all influence whether rates follow this trajectory.

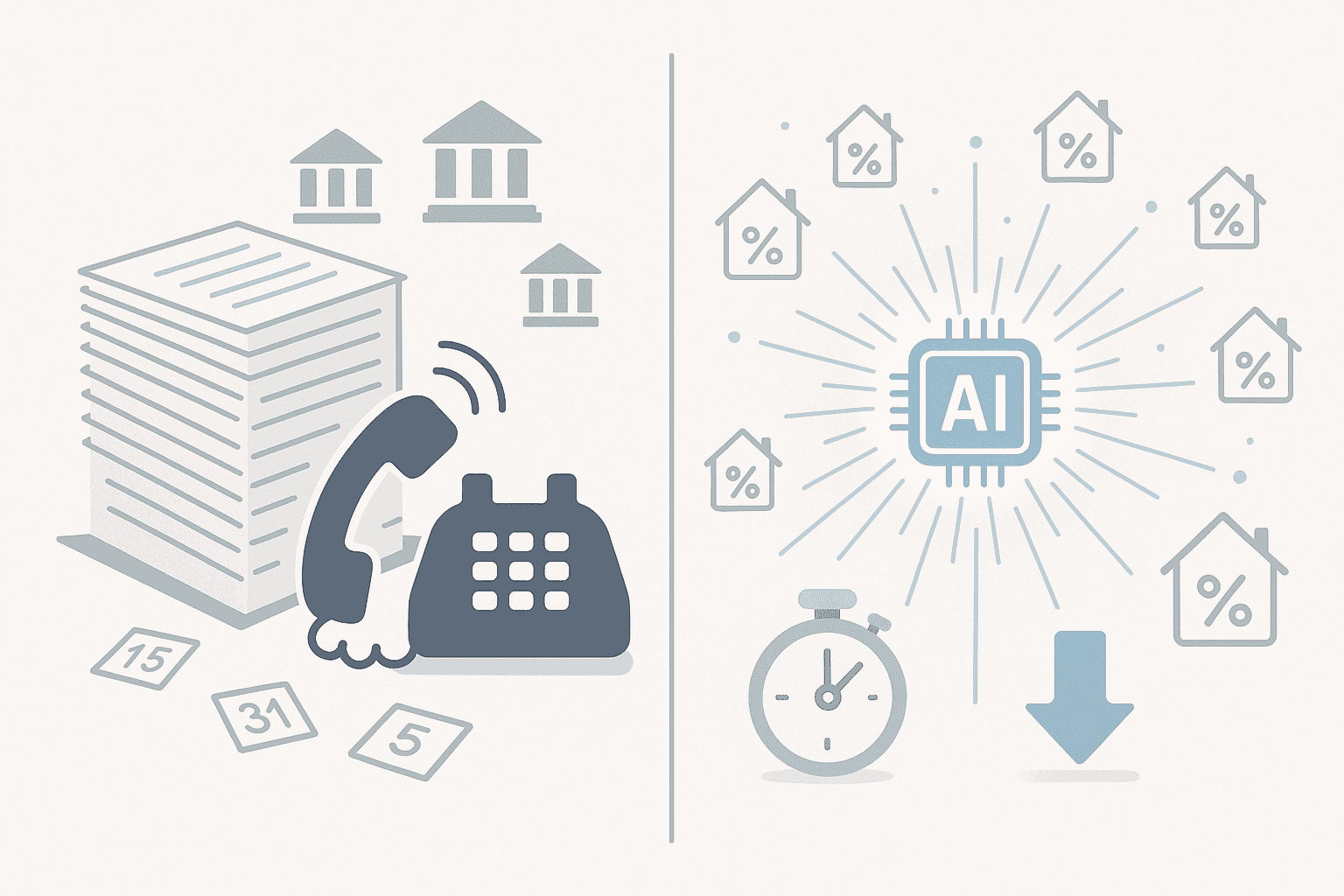

Why comparing lenders can save $1,200 a year—and how AI makes it effortless

The difference between the first rate you're quoted and the best rate available can be substantial. A Freddie Mac study found buyers who got quotes from at least four lenders saved up to $1,200 annually.

Traditional rate shopping involves:

Contacting multiple lenders individually

Submitting repetitive paperwork

Comparing quotes with different fee structures

Timing applications within a 14-day window to minimize credit impact

AI-driven mortgage platforms address these challenges by analyzing real-time market data from hundreds of lenders simultaneously. These systems track daily rate movements and can identify optimal timing for rate locks, potentially saving additional basis points through strategic timing.

AI systems also identify optimal locking windows, alerting borrowers when conditions favor securing a rate. This eliminates the guesswork that frustrates many homebuyers.

How Chestnut gives Littleton borrowers up to a 0.50-point edge

Chestnut's approach represents a departure from traditional mortgage shopping. While conventional methods require manually contacting lenders one by one, Chestnut's AI engine analyzes options across more than 100 lenders in real time.

The results speak for themselves: "Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods."

How does this work in practice?

Traditional Shopping | Chestnut's AI Approach |

|---|---|

Days of phone calls | Instant quotes under 2 minutes |

3-5 lender quotes | 100+ lender comparisons |

Manual rate tracking | Automated monitoring alerts |

Higher origination costs |

The average cost to originate a mortgage has risen from $5,100 in 2012 to $11,600 in 2023. Chestnut's automation helps reduce these overhead costs, passing savings directly to borrowers.

How can you lock the best Littleton rate with Chestnut in under 10 minutes?

Securing a competitive rate doesn't require weeks of effort. Here's a streamlined approach:

1. Get a 60-second, no-credit-pull quote

The soft-pull alternative used by advanced AI platforms provides accurate rate estimates without affecting credit scores. This enables broader comparison shopping before committing to a formal application. With Chestnut, you can get started in 2 minutes and receive personalized rate comparisons immediately.

2. Use rate-monitoring alerts to time your lock

Chestnut's rate-monitoring alerts notify borrowers immediately when market conditions favor locking in better rates. Rather than obsessively checking rates yourself, the system does the monitoring for you. Chestnut's platform generates instant quotes in less than 2 minutes, providing real-time rate comparisons across its lender network. The AI analyzes your credit profile, income, and loan specifics to match you with optimal offers. Once you've identified your preferred rate, Chestnut's automated system streamlines document collection. The platform's 94% first-attempt approval rate means fewer delays and back-and-forth requests. Chestnut delivers fully documented pre-approval letters in under 2 minutes, giving you the documentation needed to make competitive offers in Littleton's fast-moving market.

Refinance or stay put? Reading the 2025-2026 forecast

Refinancing involves replacing your current mortgage with a new one, typically to secure a lower rate or adjust loan terms. For current Littleton homeowners, the question is timing.

Fannie Mae projects mortgage rates to reach 5.9% by 2026. If you're currently locked into a rate above 7%, waiting for sub-6% rates could make sense. However, if your rate is only marginally higher than current offerings, the costs of refinancing may outweigh the benefits.

Consider refinancing when:

Your current rate exceeds market rates by 0.75% or more

You plan to stay in your home long enough to recoup closing costs

Your credit score has improved significantly since your original loan

You want to switch from an ARM to a fixed-rate mortgage

Refinance rates may be slightly lower than purchase rates in some market conditions, making it worth checking current offerings.

Littleton mortgage FAQ

What is a basis point?

A basis point is one hundredth of a percent, or 0.01%. When rates drop by 25 basis points, they've declined by 0.25 percentage points.

Are there down payment assistance programs in Littleton?

Yes. In 2019, the Littleton City Council approved participation in the Metro Down Payment Assistance program, which helps potential homebuyers with down payment assistance. Homebuyers receive help with down payment and closing costs of up to 5 percent of the loan as a zero-interest, forgivable second mortgage.

What's the difference between rate and APR?

A basis point represents one one-hundredth of one percent. The APR includes both the interest rate and lender fees, providing a more complete cost picture.

How do mortgage rates in Colorado compare to national averages?

Colorado rates generally track close to national figures. As noted by Freddie Mac's Chief Economist Sam Khater, "Mortgage rates decreased for the fourth consecutive week. The last few months have brought lower rates and homebuyers are increasingly entering the market."

How quickly can I get preapproved?

Chestnut's instant approval process saves weeks compared to traditional lenders, providing documented preapproval letters in minutes rather than days.

Key takeaways for Littleton homebuyers

The current rate environment presents genuine opportunity for Littleton buyers and refinancers alike. Here's what to remember:

Colorado's 30-year fixed rates average around 6.09% APR, down significantly from last year

Comparing multiple lenders can save you over $1,000 annually

AI-powered platforms like Chestnut deliver rates approximately 0.5% lower than traditional methods

Local assistance programs like MetroDPA can help with down payment and closing costs

With over $85 billion in mortgages processed and a 5.0 Google rating, Chestnut has established itself as a trusted option for Colorado borrowers seeking competitive rates without the hassle of traditional shopping.

Ready to see what rate you qualify for? Chestnut's automated system provides instant quotes in under two minutes, letting you explore your options without commitment or credit impact.

Frequently Asked Questions

What factors influence mortgage rates in Littleton, CO?

Mortgage rates in Littleton are influenced by several factors including Federal Reserve policies, Treasury yields, credit scores, loan types, and economic conditions. These elements collectively determine the rates lenders offer to borrowers.

How can Chestnut help me secure a better mortgage rate?

Chestnut uses AI technology to compare offers from over 100 lenders, providing real-time rate comparisons and potentially saving borrowers up to 0.5% on their mortgage rates compared to traditional methods.

What is the difference between interest rate and APR?

The interest rate is the cost of borrowing the principal loan amount, while the APR includes both the interest rate and additional lender fees, offering a more comprehensive view of the loan's total cost.

Are there any down payment assistance programs available in Littleton?

Yes, Littleton participates in the Metro Down Payment Assistance program, which offers up to 5% of the loan amount as a zero-interest, forgivable second mortgage to help with down payment and closing costs.

How quickly can I get preapproved for a mortgage with Chestnut?

Chestnut's automated system provides instant preapproval letters in under two minutes, significantly faster than traditional lenders, allowing you to make competitive offers quickly.

Sources

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://www.fanniemae.com/data-and-insights/forecast/economic-developments-october-2025

https://www.nerdwallet.com/mortgages/mortgage-rates/colorado

https://www.nerdwallet.com/article/mortgages/mortgage-rates-today-friday-september-19-2025

https://chestnutmortgage.com/resources/chestnut-ai-delivers-0-50-point-rate-advantage-2025

https://www.nerdwallet.com/mortgages/mortgage-rates/colorado/denver

https://www.nerdwallet.com/mortgages/mortgage-rates/colorado/loveland