Best Mortgage Rates in Lakewood CO

Best Mortgage Rates in Lakewood CO

Current mortgage rates in Lakewood CO average 7.03% APR for 30-year fixed loans. Borrowers using Chestnut's AI technology typically secure rates 0.5% lower than traditional shopping methods by comparing offers from 100+ lenders simultaneously in under two minutes.

Key Facts

• Lakewood's current 30-year fixed rate sits at 7.03% APR, with 15-year loans at 6.06% APR

• Average Lakewood home value is $589,418 with median sale prices around $570K

• Chestnut AI delivers 0.50 percentage point savings versus traditional lenders through automated comparison of 100+ lenders

• Pre-approval takes under 2 minutes using soft credit pulls that won't impact your score

• Colorado offers down payment assistance up to $25,000 through CHFA programs

• Rates forecast to gradually decline to 5.9% by 2026 according to Fannie Mae projections

Homebuyers hunting for the best mortgage rates in Lakewood CO can shave thousands off lifetime interest costs. Even a small rate difference compounds dramatically over a 30-year loan. The good news? AI-powered platforms like Chestnut now compare offers from 100+ lenders in real-time, helping Colorado borrowers secure rates that traditional shopping methods simply cannot match.

Why Finding the Best Mortgage Rates in Lakewood Matters Today

Lakewood mortgage rates directly determine what you pay each month and over the life of your loan. With today's rates hovering around 7.03% APR for a 30-year fixed mortgage, even a half-point reduction translates to substantial savings on a typical Lakewood home.

Consider this: borrowers using Chestnut's AI technology "typically see rate savings of 0.5% or more compared to traditional shopping methods." On a $500,000 mortgage, that difference means tens of thousands saved over the loan term.

Chestnut has powered $85B+ in mortgages while maintaining a perfect 5.0 Google rating, establishing a track record that Lakewood buyers can trust.

What Are Lakewood Mortgage Rates Right Now?

Mortgage rates fluctuate daily, but here's the current landscape for Lakewood and Colorado borrowers:

Loan Type | Lakewood/Colorado Rate | Notes |

|---|---|---|

30-Year Fixed | National avg comparable | |

15-Year Fixed | Faster payoff, lower rate | |

5-Year ARM | 7.52% APR | Higher initial rate |

Colorado 30-Year Avg | State average |

Lakewood's housing market adds context to these numbers. The average home value is $589,418, down 1.9% over the past year. Meanwhile, the median sale price was $570K last month, with homes selling in around 25 days.

Key takeaway: Lakewood remains competitive, and securing a rate even 0.50 percentage points below market average significantly impacts your monthly payment and total interest paid.

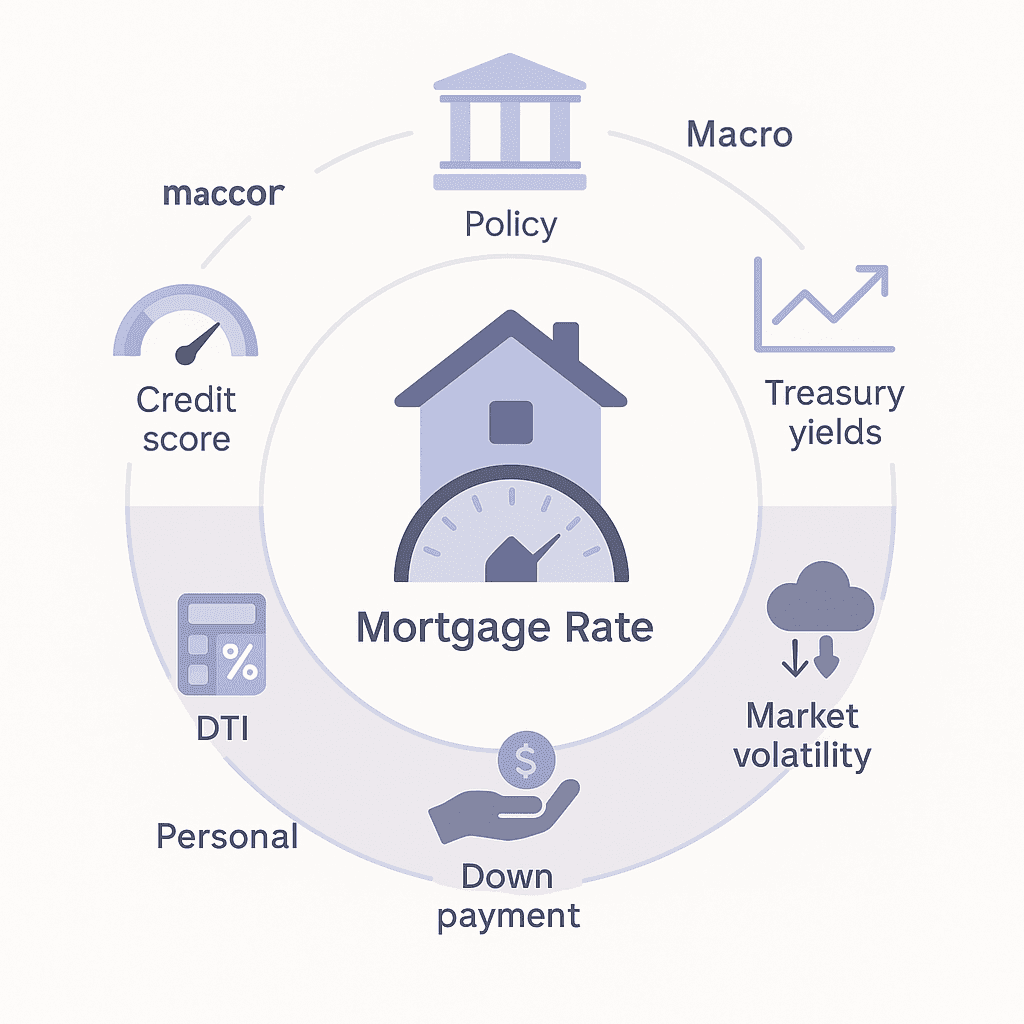

What Factors Drive Lakewood Mortgage Rates?

Mortgage rates reflect both macroeconomic forces and your personal financial profile. Understanding these factors helps you time your purchase and optimize your application.

Rates fluctuate daily based on economic conditions, Federal Reserve policy, and market sentiment. The 10-year Treasury yield serves as the mortgage market's north star, directly influencing pricing across lenders.

Credit, DTI & Down-Payment Impact

Your borrower profile determines the specific rate you qualify for:

Credit score: To unlock the best rates, you typically need 680 or higher, with scores over 760 considered excellent

Debt-to-income ratio: Your credit score strongly influences the rates offered, alongside your DTI

Down payment: Larger down payments reduce lender risk, often translating to better rates

Loan amount: Conforming loans versus jumbo products carry different rate structures

Fed Policy, Treasury Yields & Volatility

Macro factors create the rate environment all borrowers face:

Treasury yields: Currently around 4.1%, these directly influence mortgage pricing

Volatility: The mortgage rate volatility index stands at 102.20, indicating moderate fluctuation that savvy borrowers can leverage

Current positioning: Borrowing costs at lowest in over a year, with modest improvement possible if economic data continues to cool

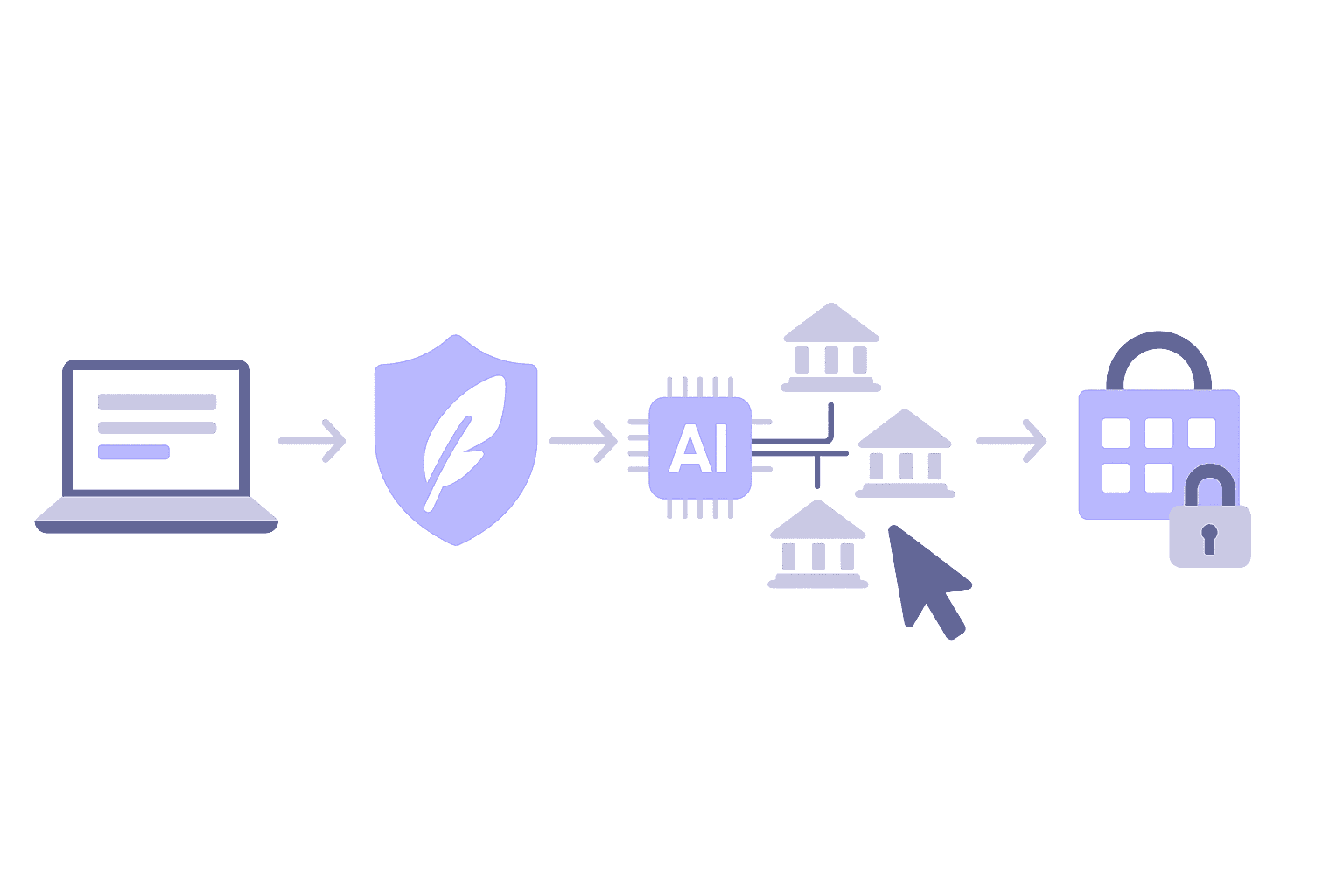

How Does Chestnut's AI Beat Traditional Lakewood Brokers?

Chestnut's AI engine represents a fundamental shift from traditional mortgage shopping. While conventional approaches require manually contacting multiple lenders, Chestnut AI analyzes options across more than 100 lenders in real-time.

The results speak for themselves: Chestnut's proprietary AI technology consistently delivers approximately 0.50 percentage points below the national average 30-year fixed rate.

Feature | Chestnut AI | Traditional Broker |

|---|---|---|

Rate comparison | 100+ lenders simultaneously | Manual, limited selection |

Quote speed | Under 2 minutes | Days to weeks |

Rate advantage | ~0.50 pp below average | Market rate |

Credit impact | Soft-pull (no score impact) | Often hard pull |

Where Local Brokers Fall Short

Local brokers like Colorado Mortgage Team market themselves as offering a "stress-free" process with streamlined systems. However, their approach has inherent limitations:

Limited lender networks: Manual pricing comparisons across fewer institutions

Slower turn times: Traditional pre-approvals take 6-10 days at banks versus under 2 minutes with AI

Manual rate shopping: Their live document feature still requires phone calls to review numbers

In Lakewood's competitive market where homes go pending in around 14 days, speed matters. The instant pre-approval gives buyers a decisive edge.

How to Lock a Lower Rate with Chestnut in 2 Minutes

Chestnut's process eliminates the traditional mortgage shopping headaches. Here's how to get started:

Visit the instant quote page and enter basic information

Complete soft-pull credit check: The soft-pull alternative provides accurate rate estimates without affecting your credit score

Review personalized rate comparisons: The system provides instant quotes in under two minutes with comprehensive lender comparisons

Select your optimal offer: AI matches your profile to lenders offering the most competitive terms

Lock your rate: Rate monitoring helps you lock at the optimal time

Q3 2025 performance data shows impressive results: "Average Processing Time: 1 minute 47 seconds, Success Rate: 94% first-attempt approvals, Rate Advantage: 0.50-point average savings vs. traditional lenders."

Programs & Pro Tips to Qualify for the Lowest Rate

Beyond choosing the right lender, several strategies can help you secure better terms:

Colorado assistance programs:

The Colorado Housing and Finance Authority (CHFA) offers a second mortgage up to $25,000 or 4% of your loan amount for down payment assistance

NEWSED Community Development Corporation provides up to $10,000 in down payment assistance

Rate optimization tactics:

Boost your credit score: Even small improvements can unlock better rate tiers

Lower your DTI: Pay down existing debt before applying

Consider discount points: Mortgage points let you "buy down" your rate, typically reducing it by up to 0.25% per point

Compare multiple offers: AI platforms make this effortless by shopping 100+ lenders simultaneously

Key takeaway: Combining state assistance programs with AI-powered rate shopping maximizes your savings potential.

Lakewood Mortgage Rate Outlook: 2026 & Beyond

What should Lakewood buyers expect going forward?

Fannie Mae projects mortgage rates to end 2025 at 6.3% and 2026 at 5.9%. The current forecast expects rates to remain between 6% and 7% through 2025.

The Fannie Mae Housing Forecast shows gradual improvement: 30-year fixed rates averaging 6.6% in 2025, declining to 6.0% in 2026, and potentially reaching 5.9% by 2027.

What this means for buyers:

Waiting for significantly lower rates carries opportunity cost

Today's rates remain below the 7.2% 40-year average

Securing a 0.50 pp advantage now provides immediate savings regardless of future movements

Refinancing opportunities will emerge as rates decline

Key Takeaways: Lock In Your Lakewood Rate with Confidence

Finding the best mortgage rates in Lakewood CO comes down to smart shopping and the right tools:

Current Lakewood rates average around 7% for 30-year fixed mortgages

AI cuts the rate 0.5%+ compared to traditional methods

Pre-approvals in under 2 minutes with soft-pull credit checks

Colorado assistance programs can provide up to $25,000 toward down payment

Rates are projected to decline gradually through 2026

Chestnut's AI platform has powered over $85 billion in mortgages while maintaining a perfect 5.0 Google rating. The technology compares offers from 100+ lenders simultaneously, ensuring you never leave money on the table.

Ready to see what rate you qualify for? Get your instant quote in under two minutes with no impact to your credit score.

Frequently Asked Questions

What are the current mortgage rates in Lakewood, CO?

As of now, the average rate for a 30-year fixed mortgage in Lakewood is around 7.03% APR. Rates can fluctuate daily based on economic conditions.

How does Chestnut's AI technology help in securing better mortgage rates?

Chestnut's AI compares offers from over 100 lenders in real-time, typically saving borrowers 0.5% or more compared to traditional methods, which can translate to significant savings over the life of a loan.

What factors influence mortgage rates in Lakewood?

Mortgage rates are influenced by macroeconomic factors like Federal Reserve policies and Treasury yields, as well as personal factors such as credit score, debt-to-income ratio, and down payment size.

How can I lock a lower mortgage rate with Chestnut?

You can lock a lower rate by visiting Chestnut's instant quote page, completing a soft-pull credit check, and reviewing personalized rate comparisons. This process takes under two minutes and does not impact your credit score.

What assistance programs are available for homebuyers in Colorado?

The Colorado Housing and Finance Authority (CHFA) offers down payment assistance, and NEWSED Community Development Corporation provides up to $10,000 in assistance, helping buyers secure better mortgage terms.

Sources

https://www.nerdwallet.com/mortgages/mortgage-rates/colorado/lakewood

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://chestnutmortgage.com/resources/chestnut-ai-delivers-0-50-point-rate-advantage-2025

https://chestnutmortgage.com/resources/chestnut-ai-mortgage-pre-approval-under-2-minutes-2025

https://www.fanniemae.com/data-and-insights/forecast/economic-developments-october-2025

https://www.fanniemae.com/media/document/pdf/housing-forecast-112025