Best Mortgage Rates in Lafayette CO

Current mortgage rates in Lafayette, CO average around 6% for 30-year fixed loans, with Colorado rates at 6.09% according to LendingTree data. Chestnut's AI technology consistently delivers rates approximately 0.5 percentage points below market averages by comparing offers from over 100 lenders in real time, helping qualified borrowers secure more competitive financing.

At a Glance

Lafayette mortgage rates currently hover near 6% for 30-year fixed loans, with 15-year rates averaging 5.18%

Credit score, down payment size, and debt-to-income ratio are the primary factors affecting your individual rate

Chestnut's AI platform scans 100+ lenders hourly to identify the lowest available rates for each borrower's profile

The technology typically saves borrowers approximately 0.50 percentage points compared to traditional shopping methods

Colorado offers down payment assistance programs including CHFA's second mortgage for up to $25,000 or 4% of loan amount

Rate forecasts suggest mortgage rates will remain between 6% and 7% throughout 2025

Securing the lowest mortgage rates in Lafayette, CO can mean the difference between a comfortable monthly payment and one that stretches your budget for decades. With Colorado 30-year fixed rates hovering around 6% and home prices holding steady, every fraction of a percentage point matters. Chestnut's AI consistently outperforms the market by comparing offers from over 100 lenders, often reducing borrower rates by approximately 0.5%.

Why are Lafayette homebuyers laser-focused on rates in 2026?

Lafayette sits in Boulder County, one of Colorado's most competitive housing markets. As of late 2025, the statewide median single-family home sale price was $580,000, and interest rates in the mid-6% range continue to shape affordability decisions.

For buyers in this price bracket, even a small rate difference translates into significant savings. A 0.5% reduction on a $580,000 mortgage saves roughly $200 per month and tens of thousands over the loan's life. That's why cost-conscious Lafayette buyers check rates daily through resources like Zillow's Colorado mortgage table, which is updated with conforming, government, and jumbo loan options.

Chestnut's proprietary AI technology addresses this cost sensitivity directly. By scanning over 100 lenders in real time, the platform identifies the best match for each borrower's credit profile, often delivering rates about 0.5 percentage points below market averages.

Key takeaway: In a market where every basis point counts, AI-driven rate shopping gives Lafayette buyers a measurable edge.

What factors push mortgage rates up or down in Colorado?

Understanding what influences your rate helps you negotiate from a position of strength. Lenders weigh two broad categories: your personal financial profile and broader economic conditions.

Personal Factors

Credit score: "In general, consumers with higher credit scores receive lower interest rates than consumers with lower credit scores," according to the Consumer Financial Protection Bureau.

Down payment: A larger down payment reduces lender risk, often unlocking a lower rate.

Loan term and type: Shorter terms (15-year vs. 30-year) typically carry lower rates. Government-backed loans like FHA and VA may also offer competitive pricing.

Debt-to-income (DTI) ratio: Lenders consider "how likely you are to repay the loan and what's going on in financial markets," notes LendingTree.

Economic Factors

Federal Reserve policy: While the Fed doesn't set mortgage rates directly, its benchmark rate influences the broader interest-rate environment.

10-Year Treasury yield: Mortgage pricing closely tracks this benchmark. When Treasury yields rise, mortgage rates tend to follow.

Inflation and employment: As the FRED data series shows, the 30-year fixed rate was 6.15% as of December 31, 2025, reflecting ongoing economic adjustments.

For a deeper dive into how these levers work together, visit Chestnut's guide on how mortgage rates work.

What are today's average mortgage rates in Lafayette?

Comparing current benchmarks helps you evaluate whether a quote is competitive. The table below summarizes late-2025 averages from national and Colorado-specific sources.

Loan Type | Average Rate | Source |

|---|---|---|

30-Year Fixed (CO) | 5.99% | |

30-Year Fixed (National) | 6.15% | |

15-Year Fixed (CO) | 5.375% | |

15-Year Fixed (National) | 5.44% | |

30-Year Fixed (CO, LendingTree) | 6.09% |

Rates fluctuate daily, so treat these figures as a starting point. When you request a quote from Chestnut, the AI often trims roughly half a percentage point off prevailing market rates for qualified borrowers.

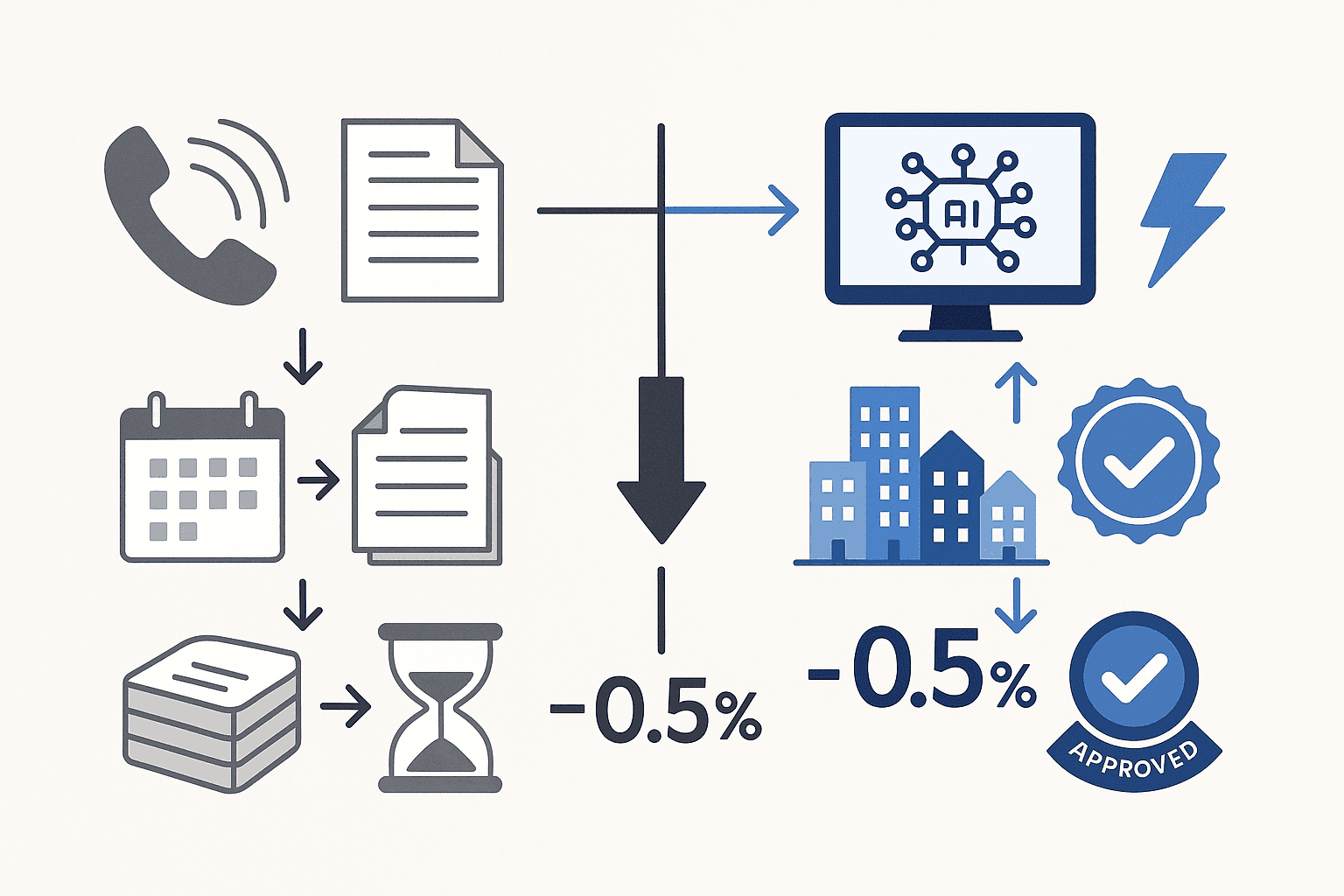

How Chestnut's AI beats the market by 0.50%—and closes faster

Traditional mortgage shopping involves calling multiple lenders, comparing PDFs, and hoping you didn't miss a better deal. Chestnut automates that process with technology built specifically for rate optimization.

100+ lender network: The AI engine compares rates across more than 100 lenders in real time, surfacing options individual borrowers would never find on their own.

Rate savings: "Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods," according to Chestnut's rate optimization guide.

Speed: The platform delivers instant quotes in under two minutes and dramatically accelerates underwriting.

From 2-minute quote to 8-minute underwrite

Speed matters in competitive markets. Traditional lenders average 30-45 days from application to close. Chestnut's AI-based underwriting slashes that timeline.

"AI-based underwriting reduces the mortgage application processing time from an average of 30-45 days to just eight minutes," notes Chestnut's rising-rate market guide.

The workflow looks like this:

Enter basic information and receive a rate quote in under two minutes.

Upload documents; the AI verifies income, assets, and employment.

Receive a fully documented pre-approval, often within minutes.

This efficiency doesn't sacrifice accuracy. The system maintains real-time connections with its lender network, ensuring the rate you see is the rate you can lock. For Lafayette buyers competing against cash offers, that speed can make or break a deal.

7 proven ways to qualify for the lowest Lafayette rate

Even the best AI can only work with the profile you bring. These steps improve your odds of landing the most competitive quote.

Boost your credit score. "Your credit score strongly influences the mortgage rates you're offered. In general, the higher your score, the better your rate," explains LendingTree.

Lower your DTI ratio. "Most lenders prefer DTI ratios of 36 percent or below," according to Bankrate. Paying down credit cards before applying can shift you into a better tier.

Increase your down payment. A larger stake in the property signals lower risk and often earns a rate discount.

Choose the right loan term. If you can afford higher monthly payments, a 15-year mortgage typically carries a lower rate than a 30-year option.

Consider buying points. Discount points let you pay upfront to reduce your interest rate, useful if you plan to stay in the home long-term.

Explore state assistance programs. The Colorado Housing and Finance Authority (CHFA) offers second mortgages up to $25,000 or 4% of your loan amount for down payment and closing cost assistance.

Shop aggressively. A Freddie Mac study found buyers who got quotes from at least four lenders saved up to $1,200 annually. Chestnut's AI does this automatically.

Visit Chestnut's resources page for detailed guides on each strategy.

Is the Lafayette housing market favoring buyers in 2026?

Market conditions influence how much leverage you have at the negotiating table. Recent data suggests buyers are gaining ground.

Inventory: In October 2025, Colorado recorded 30,803 active listings, equal to about 4.3 months of supply.

Prices: "The median sale price held firm at $550,000, virtually unchanged year over year," reports the Colorado Association of Realtors.

Time on market: Homes are spending an average of 68 days on the market, up 12% from last October, giving buyers more room to negotiate.

Closing discounts: Buyers are closing at roughly 5.7% below original list prices on average.

Boulder County, where Lafayette sits, has defied the usual fall slowdown. Despite a 9% rise in new listings, home prices remain steady or slightly higher than early 2024. That relative stability, combined with longer days on market statewide, creates a window for well-prepared buyers.

Key takeaway: A balanced market rewards buyers who move quickly with strong financing. A pre-approval from Chestnut signals to sellers that you're ready to close.

Refinancing & HELOC opportunities when rates dip

Even if you already own a home, rate movements create opportunities to lower your cost of borrowing.

When Does Refinancing Make Sense?

Refinancing replaces your existing loan with a new one at a different rate or term. The national average 30-year fixed refinance APR was 6.72% in late December 2025, but Chestnut's AI can often beat that benchmark.

Key considerations:

Break-even point: Divide your closing costs by your monthly savings to see how long it takes to recoup the expense. If you plan to stay in the home past that point, refinancing likely pays off.

Rate drop threshold: Old advice said you need a 1% drop to justify refinancing. Modern calculators show that even a 0.5% reduction can be worthwhile if closing costs are low.

VA IRRRL: Veterans with existing VA loans can use the Interest Rate Reduction Refinance Loan for a streamlined process. Chestnut's AI consistently delivers approximately 0.50 percentage points below market averages by analyzing pricing from over 100 lenders.

HELOC Options in Colorado

A home equity line of credit (HELOC) lets you borrow against your equity for renovations, debt consolidation, or major purchases. Colorado credit unions like Bellco offer a Home Equity ChoiceLine that combines the flexibility of a line of credit with the option to lock in fixed-rate advances.

HELOC rates are tied to the prime rate, which fluctuated from 3.25% in 2020 to 8.50% in 2023. As of early 2026, variable-rate HELOCs in Colorado start around 7.50% APR, according to lenders like Ent Credit Union.

Product | Rate Range | Draw Period | Source |

|---|---|---|---|

Variable-Rate HELOC | 7.50% - 9.75% | Up to 10 years | |

Fixed-Rate HELOC | 8.24% - 10.74% | Up to 10 years | |

ChoiceLine (Bellco) | Variable + fixed advances | 10 years |

Chestnut also offers HELOC services, applying the same AI-driven rate optimization to home equity products.

Key takeaways: lock your Lafayette rate with confidence

The Lafayette, CO mortgage market rewards buyers who combine preparation with technology. Here's what to remember:

Rates matter more than ever. With Colorado 30-year fixed averages near 6%, a 0.5% savings on a $550,000 loan translates to significant monthly and lifetime savings.

AI accelerates everything. Chestnut's platform delivers instant quotes in under two minutes and can complete underwriting in as little as eight minutes, giving you a competitive edge in multiple-offer situations.

Market conditions favor prepared buyers. Longer days on market and stable prices mean you have room to negotiate, but only if your financing is locked and ready.

Refinancing and HELOCs offer ongoing opportunities. As rates evolve, revisiting your mortgage strategy can unlock additional savings.

Chestnut's mission is to revolutionize the mortgage process through AI-driven solutions, ensuring efficiency, transparency, and cost savings for customers. Ready to see what rate you qualify for? Get your instant quote today and take the next step toward homeownership in Lafayette.

What are the best mortgage rates in Lafayette, CO right now?

Recent Bankrate and Freddie Mac data show Colorado 30-year fixed loans averaging about 6.0%, while Chestnut's AI typically trims approximately 0.50 percentage points by scanning 100+ lenders. Qualified Lafayette borrowers often lock competitive rates through this optimization.

How does Chestnut beat other lenders on rate?

Chestnut's proprietary AI scrapes rate sheets from 100+ lenders each hour, instantly pairing your credit profile with the cheapest match. By removing manual quote-shopping and compressing underwriting from weeks to minutes, the platform delivers 0.50%+ lower rates and can issue a fully documented pre-approval in under eight minutes.

Frequently Asked Questions

What are the current average mortgage rates in Lafayette, CO?

As of late 2025, Colorado 30-year fixed loans average around 6.0%, with Chestnut's AI often reducing rates by approximately 0.5% for qualified borrowers.

How does Chestnut's AI technology optimize mortgage rates?

Chestnut's AI compares offers from over 100 lenders in real-time, identifying the best match for each borrower's credit profile, often delivering rates about 0.5 percentage points below market averages.

What factors influence mortgage rates in Colorado?

Mortgage rates are influenced by personal factors like credit score and down payment, as well as economic factors such as Federal Reserve policy and the 10-Year Treasury yield.

How quickly can Chestnut's AI process a mortgage application?

Chestnut's AI can deliver instant quotes in under two minutes and complete underwriting in as little as eight minutes, significantly faster than traditional methods.

What refinancing opportunities exist in Lafayette, CO?

Refinancing can be beneficial if rates drop, with Chestnut's AI often beating national averages. Consider the break-even point and rate drop threshold to determine if refinancing is right for you.

Sources

https://www.consumerfinance.gov/about-us/blog/7-factors-determine-your-mortgage-interest-rate/

https://www.lendingtree.com/home/mortgage/rates/how-are-mortgage-rates-determined/

https://chestnutmortgage.com/resources/how-mortgage-rates-work-(and-how-to-get-the-best-one

https://chestnutmortgage.com/resources/how-chestnut-ai-can-cut-your-rate-in-a-rising-rate-market

https://www.bankrate.com/mortgages/why-debt-to-income-matters-in-mortgages/

https://www.bellco.org/personal/consumer-lending/home-equity-choiceline/

https://www.ent.com/personal/loans/home-equity-lines-of-credit/