Best Mortgage Rates in Killeen TX

The best mortgage rates in Killeen TX currently average around 6.28% for 30-year fixed loans, but Chestnut's AI platform delivers approximately 0.5% below market averages by comparing over 100 lenders simultaneously. This advantage can save Killeen buyers $25,000+ over their loan term, particularly valuable with local median home prices at $222,671.

Key Facts

• Current Texas mortgage rates average 6.28% for 30-year fixed and 5.75% for 15-year fixed loans

• Killeen's median home value of $222,671 sits well below Texas's $315,815 average, making homeownership more accessible

• Chestnut borrowers typically save 0.5% or more compared to traditional shopping methods

• The 2026 conforming loan limit increased to $832,750, ensuring most Killeen buyers avoid jumbo loan pricing

• Rate spreads can reach 86 basis points between lenders for identical borrower profiles

• Processing time drops from 30-45 days to just 8 minutes with AI-powered underwriting

Buying in Killeen? Securing the best mortgage rates in Killeen TX can trim tens of thousands off lifetime interest, and Chestnut's AI-powered platform makes that advantage real.

Why Finding the Best Mortgage Rates in Killeen Matters in 2026

Every fraction of a percentage point on your mortgage rate translates to real dollars over a 30-year loan. For Killeen buyers, the stakes are significant: shaving half a point off your rate on a typical home purchase can mean keeping tens of thousands of dollars in your pocket rather than sending them to a lender.

Chestnut's approach to mortgage lending changes the game for local buyers. As Chestnut's own research notes, "Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods." That half-point advantage compounds dramatically over three decades.

The platform's scale reinforces these savings. With $85 billion in mortgages powered and a perfect 5.0 Google rating, the platform has refined its AI engine to consistently identify the lowest available rates across its massive lender network. For Killeen mortgage lenders, that kind of competition-driven pricing simply isn't standard practice.

Key takeaway: A 0.5% rate reduction on a $250,000 loan can save you roughly $25,000 over 30 years.

What Factors Shape Mortgage Rates in Killeen?

Mortgage rates in Killeen don't exist in a vacuum. They respond to three distinct layers of influence: national economic forces, Texas-specific loan limits, and your individual borrower profile.

National and Federal Factors:

Federal Reserve policy and inflation expectations

10-year Treasury yields

Secondary mortgage market activity

Texas Conforming Loan Limits:

The 2026 conforming loan limit for one-unit properties is $832,750, an increase of $26,250 from 2025. This matters because loans within conforming limits typically qualify for better rates than jumbo loans.

For FHA borrowers, HUD's 2026 mortgage limits set the national low-cost area ceiling at $541,287 for a one-unit property. Killeen falls into standard limit territory, meaning most buyers can access conventional or FHA financing without jumbo loan pricing.

Borrower-Level Variables:

Factor | Impact on Rate |

|---|---|

Credit score | Higher scores unlock lower rates |

Down payment | Larger down payments reduce risk and rates |

Debt-to-income ratio | Lower DTI signals repayment ability |

Loan type | FHA, VA, and conventional each price differently |

Understanding that conforming loan limits are set annually under the HERA formula helps you anticipate how much home you can finance at conventional rates. Killeen's median prices sit well below these thresholds, giving most buyers access to competitive conforming loan pricing.

What Do 2026 Mortgage & Housing Numbers Say About Killeen vs. Texas?

Killeen's housing market tells a different story than the broader Texas landscape, and those differences create opportunity for prepared buyers.

Current Texas Mortgage Rates:

As of late December 2025, Texas mortgage rates average 6.28% for a 30-year fixed mortgage and 5.75% for a 15-year fixed mortgage.

Killeen Market Snapshot:

Metric | Killeen | Texas Statewide |

|---|---|---|

Median home value | $315,815 | |

Price trend (YoY) | Down 2.3% | Down 0.68% |

Days on market | 37 (to pending) | 74 |

Market type | Neutral | Balanced |

Killeen's median sale price reached $254K in recent months, up 2.1% year-over-year, though homes now average 73 days on market compared to 62 days last year.

The Rocket Homes data confirms Killeen operates as a neutral market, with 44.4% of homes selling below asking price.

This balanced market gives buyers negotiating leverage while still maintaining steady appreciation. Combined with home values significantly below the statewide median, Killeen offers entry points that keep monthly payments manageable.

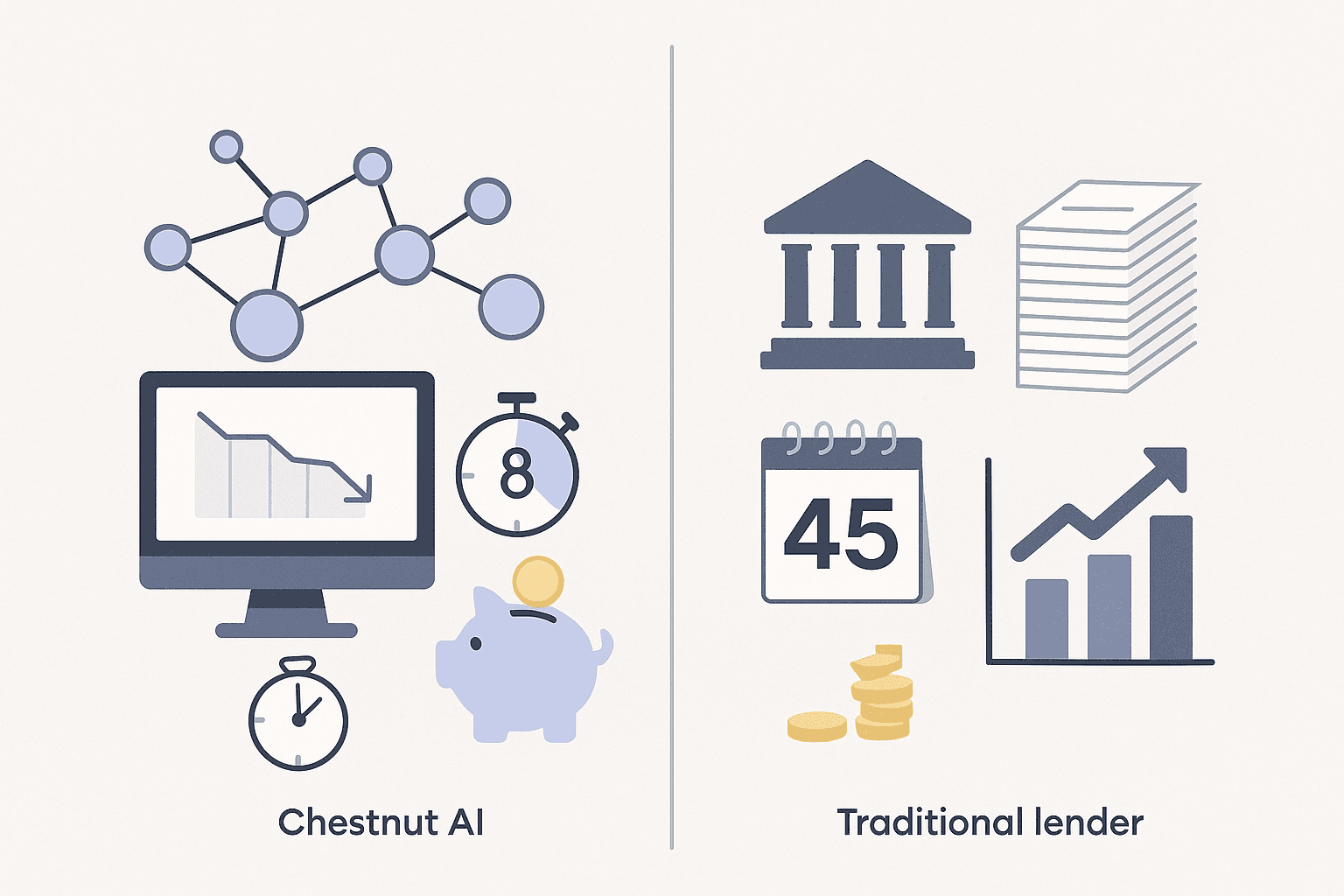

How Chestnut's AI Delivers Sub-6% Rates When Others Can't

Chestnut's technology advantage comes from three core capabilities that traditional lenders simply cannot match.

Real-Time Multi-Lender Comparison:

Chestnut's proprietary AI consistently delivers approximately 0.50 percentage points below the national average 30-year fixed rate. The system achieves this by continuously analyzing pricing data from over 100 lenders simultaneously.

Speed That Creates Opportunity:

"AI-based underwriting reduces the mortgage application processing time from an average of 30-45 days to just eight minutes," according to Chestnut's rate optimization research. This speed matters because mortgage rates fluctuate constantly. Locking quickly when rates dip can save thousands.

Industry-Wide Efficiency Focus:

A 2023 Fannie Mae study found that 73% of mortgage lenders who have adopted AI solutions cited improving operational efficiency as their primary motivator. Chestnut channels those efficiency gains directly into borrower savings rather than profit margins.

Get your personalized rate by visiting Chestnut's instant quote tool.

Where Big-Box & Online Lenders Fall Short

Traditional and big-box lenders face structural disadvantages that translate into higher rates for borrowers.

Origination Cost Burden:

According to Freddie Mac's 2024 Cost to Originate Study, "average origination costs have gone up 35% over the past three years." The average cost to originate a loan reached approximately $11,600 in Q3 2023. These costs get passed to borrowers through higher rates or fees.

Limited Rate Shopping:

Some major platforms advertise convenience but work with limited lender pools. For example, Redfin's Texas rate page shows partner Rocket Mortgage offering a 30-year fixed APR of 6.766% as of early January 2026. Compare that to Chestnut's typical half-point advantage.

Aggregator Trust Issues:

LendingTree's Trustpilot rating of 4.5 out of 5 sounds reasonable until you consider that comparison shopping through aggregators often means your information gets sold to multiple lenders, each adding their own margin.

The efficiency gap is stark: top-performing originators keep costs at roughly $6,900 per loan while average lenders hover near $11,600. Chestnut's AI automation captures those savings for borrowers.

Which Loan Programs Help Killeen Buyers Save?

Killeen buyers have access to multiple loan programs, each with distinct advantages depending on your situation.

Program | Best For | Key Benefit |

|---|---|---|

Conventional | Strong credit, 5%+ down | Lower PMI costs |

FHA | Lower credit scores, 3.5% down | Flexible qualification |

VA | Military/veterans | Zero down payment |

USDA | Rural areas | Zero down payment |

TDHCA | First-time buyers | Down payment assistance |

State-Level Support:

TSAHC provides fixed-rate mortgage loans, down payment assistance, and mortgage interest tax credits through programs like Homes for Texas Heroes and Home Sweet Texas.

The TDHCA Homebuyer Program offers flexible down payment assistance and low-interest mortgages backed by a network of experienced mortgage and real estate professionals.

State & City First-Time Homebuyer Aid

My First Texas Home Program:

This TDHCA program offers assistance ranging from 2% to 5% of the total mortgage loan amount. The assistance requires no monthly payments and is fully forgivable after a 36-month maturity date if you remain in the home and stay current on your mortgage.

Eligibility requirements include:

Texas residency

No primary residence ownership in the past three years (veterans exempt)

Minimum 620 credit score

Income and purchase price limits apply

Completion of a homebuyer education course

TSAHC Programs:

Bankrate notes that My First Texas Home, managed by TDHCA, offers mortgages designed with smaller monthly payments for qualifying buyers.

City of Killeen HAP Status:

Note that Killeen's First Time Homebuyer Assistance Program is currently on hold due to rising costs and HUD purchase price limits. However, the State of Texas programs remain available and can be combined with Chestnut's competitive rates.

When Should You Refinance or Tap a HELOC in Killeen?

Refinancing or accessing a HELOC makes sense under specific circumstances. The key is timing and math.

Refinance Timing Indicators:

Your current rate exceeds market rates by 0.5% or more

You've built substantial equity (20%+ reduces PMI costs)

Your credit score has improved significantly since purchase

You need to switch from an ARM to a fixed-rate loan

Current Refinance Benchmarks:

LendingTree reports Texas refinance rates averaging 6.42% for 30-year fixed and 5.93% for 15-year fixed loans. The current mortgage rates forecast suggests rates will remain around 6.0% in early 2026 following Federal Reserve rate cuts in late 2025.

Break-Even Calculation:

Divide your closing costs by your monthly savings to find your break-even point. If you plan to stay in the home longer than that period, refinancing makes financial sense.

HELOC Considerations:

Cognizant's market report notes that mortgage rates are expected to hover around 6% to 7% for a standard 30-year fixed loan in 2025. HELOCs often carry variable rates tied to prime, so timing matters.

Chestnut supports refinancing and HELOCs, monitoring live offers so you can access equity efficiently and lock at an opportune time. Visit the refinance page to explore your options.

5 Pro Tips to Lock a Chestnut-Optimized Rate in Under 2 Minutes

Check Your Credit First

Pull your credit reports from all three bureaus and dispute any errors before applying. Even small score improvements can unlock better rate tiers.

Gather Documentation Upfront

Have your pay stubs, W-2s, tax returns, and bank statements ready. Chestnut's system works fastest when you can verify income immediately.

Use the Instant Quote Tool

"The system provides instant quotes in under two minutes, allowing borrowers to see comprehensive rate comparisons immediately," according to Chestnut's AI research. Visit the instant quote page to get started.

Compare Across Loan Types

Chestnut AI™ can identify rate spreads of up to 86 basis points (0.86%) between different lenders for the same borrower profile. Let the system show you conventional, FHA, and VA options side by side.

Lock Strategically

Chestnut's human-in-the-loop model pairs AI-driven document processing with experienced mortgage experts who can advise on optimal lock timing based on market conditions.

Chestnut Makes Killeen Homeownership Affordable Without the Headaches

Killeen's balanced market, affordable home prices, and access to Texas assistance programs create a favorable environment for buyers. The missing piece for most is securing the best possible rate without spending weeks shopping lenders.

Chestnut solves that problem. By comparing offers from 100+ lenders in real time and delivering instant quotes, the platform consistently delivers rate advantages that translate to real savings. For Killeen buyers, that could mean keeping $25,000 to $45,000 more over the life of your loan.

Ready to see your personalized rate? Compare rates and discover what Chestnut's AI can find for your Killeen home purchase.

Frequently Asked Questions

How does Chestnut's AI platform help secure better mortgage rates?

Chestnut's AI platform analyzes offers from over 100 lenders in real-time, consistently delivering rates approximately 0.5% lower than the national average. This advantage can save borrowers tens of thousands over the life of a loan.

What factors influence mortgage rates in Killeen, TX?

Mortgage rates in Killeen are influenced by national economic factors, Texas-specific loan limits, and individual borrower profiles, including credit score, down payment, and debt-to-income ratio.

What are the current mortgage rates in Texas as of 2026?

As of late December 2025, Texas mortgage rates average 6.28% for a 30-year fixed mortgage and 5.75% for a 15-year fixed mortgage, with Killeen offering competitive rates due to its balanced market.

What loan programs are available for Killeen homebuyers?

Killeen homebuyers can access various loan programs, including conventional, FHA, VA, USDA, and TDHCA loans, each offering unique benefits like lower PMI costs, flexible qualifications, and down payment assistance.

How can I lock a mortgage rate quickly with Chestnut?

To lock a rate quickly with Chestnut, check your credit, gather necessary documentation, use Chestnut's instant quote tool, compare loan types, and strategically lock in rates with the help of Chestnut's AI and mortgage experts.

Sources

https://www.fhfa.gov/news/news-release/fhfa-announces-conforming-loan-limit-values-for-2026

https://www.hud.gov/sites/dfiles/hudclips/documents/2025-23hsgml.pdf

https://chestnutmortgage.com/resources/chestnut-ai-delivers-0-50-point-rate-advantage-2025

https://chestnutmortgage.com/resources/how-chestnut-ai-can-cut-your-rate-in-a-rising-rate-market

https://ocrolus.com/whitepapers/mortgage-underwriting-whitepaper

https://sf.freddiemac.com/docs/pdf/cost-to-originate-full-study-2024.pdf

https://welcomehome.tdhca.texas.gov/uploads/My-First-Texas-Home-Program-Matrix-TMS.pdf?v=1738018341

https://www.killeentexas.gov/296/Homebuyer-Assistance-Program-HAP