Best Mortgage Rates in Irving TX

Current mortgage rates in Irving, TX average 6.81% for a 30-year fixed loan, with rates falling 25 basis points over the past week. Borrowers using Chestnut's AI platform, which compares offers from 100+ lenders simultaneously, typically secure rates 0.5% below market averages through instant quote technology that identifies the most competitive terms for each buyer's specific financial profile.

At a Glance

Current 30-year fixed rates in Irving average 6.81% APR, down from 7.30% one year ago

A 0.5% rate reduction saves approximately $43,000 in interest on a $400,000 loan over 30 years

Irving offers zero-interest down payment assistance loans for qualified first-time buyers

Chestnut's AI technology delivers instant quotes in under 2 minutes across 100+ lenders

Texas home prices fell nearly 1% year-over-year while sales volume increased

Over 80% of existing homeowners have rates below 6%, reducing move-up buyer competition

Buying a home in Irving means finding the best mortgage rates in Irving TX before prices tick higher again. Even a 0.25-point difference can add thousands of dollars to lifetime interest, making rate shopping one of the most valuable steps in your homebuying journey. The good news? Technology has transformed how borrowers compare offers, and Chestnut's AI helps you capitalize on market opportunities that traditional lenders simply cannot match.

This guide walks you through everything Irving homebuyers need to know: current rate benchmarks, the factors that influence your personal rate, local assistance programs, and a step-by-step playbook for locking in the lowest rate possible.

Why Mortgage Rates Matter in Irving, TX

Mortgage rates directly determine both your monthly payment and the total interest you pay over the life of your loan. For Irving buyers, understanding current benchmarks provides essential context for evaluating offers.

As of April 29, 2025, the 30-year fixed mortgage APR is 6.81%. That rate is 25 basis points lower than one week ago and 49 basis points below where it sat one year earlier. A basis point equals one one-hundredth of one percent, so these movements may sound small but translate to meaningful monthly savings.

Here's what makes rate differences significant:

On a $400,000 loan, a 0.5% rate reduction saves approximately $120 per month

Over 30 years, that half-point difference compounds to nearly $43,000 in interest savings

Lower rates also increase your purchasing power, potentially qualifying you for a larger loan

Borrowers using Chestnut AI typically see rate savings of 0.5% or more compared to traditional shopping methods. That consistent advantage transforms what might seem like minor rate differences into substantial long-term savings.

Key takeaway: In Irving's competitive market, every basis point matters. A systematic approach to rate shopping can save tens of thousands over your loan term.

What Factors Drive Irving Mortgage Rates in 2025?

Your mortgage rate depends on a combination of macroeconomic conditions, regulatory factors, and your individual borrower profile. Understanding these inputs helps you position yourself for the best possible offer.

Macroeconomic Factors

Federal Reserve policy: The Fed's interest rate decisions ripple through mortgage markets

Inflation expectations: Higher inflation typically pushes rates upward

Bond market movements: Mortgage rates track the 10-year Treasury yield

Borrower-Level Inputs

Your personal financial profile significantly impacts the rate lenders offer:

Factor | Impact on Rate |

|---|---|

Credit score | Higher scores unlock lower rates |

Debt-to-income ratio | Lower ratios signal less risk |

Down payment size | Larger down payments reduce lender exposure |

Loan type | Conventional, FHA, VA each carry different pricing |

The national average FICO Score sits at 715, and lenders use credit scores as a primary risk indicator. FICO data reveals that both macro and segmented trends in credit scores, stratified by product and geography, influence how lenders price mortgages across different borrower segments.

External Cost Pressures

Texas homeowners face additional considerations beyond base rates. Research from the Federal Reserve Bank of Dallas shows that homeowners' insurance premiums are rising dramatically due to climate-related risks. These rising costs affect overall housing affordability and can influence mortgage qualification.

Key takeaway: Improving your credit score and reducing debt before applying positions you for the most competitive rates Irving lenders can offer.

Chestnut vs. Traditional Lenders: The AI Rate Edge

Traditional mortgage shopping requires contacting multiple lenders individually, comparing rate sheets manually, and hoping you time the market correctly. Chestnut's technology fundamentally changes this equation.

Chestnut AI analyzes options across more than 100 lenders in real-time. Rather than relying on a single bank's pricing or a broker's limited wholesale relationships, the AI scans live rate sheets continuously to identify the most competitive terms for your specific situation.

The platform delivers:

Instant quotes in under two minutes rather than days of back-and-forth

Personalized matching based on credit score, income, down payment, and loan specifics

Rate savings of approximately 0.5% below market averages

As one industry review noted, "The mortgage origination process is quick, efficient and user friendly" when platforms prioritize speed and automation.

Traditional mortgage CRM and point-of-sale systems rate around 4.2 out of 5 based on user reviews, reflecting the friction that conventional processes still carry. The AI-first approach eliminates much of that friction.

Where Other Online Lenders Fall Short

Not all digital lenders deliver equal value. Common limitations include:

Smaller lender panels: Many online platforms work with only a handful of wholesale lenders, limiting rate options

Slower turn times: Some digital tools still require manual intervention for underwriting

Higher overlays: Additional lender requirements can disqualify borrowers who would otherwise qualify

G2 comparison data shows that Encompass Digital Mortgage Solution scores 4.2 stars, while smaller platforms vary widely in user satisfaction. The difference often comes down to how many lenders a platform can access and how quickly it processes applications.

Chestnut's network of 100+ lenders creates opportunities that simply don't exist when working with individual banks or credit unions.

Which Down Payment and Closing-Cost Programs Can Irving Buyers Use?

Irving offers valuable assistance programs that pair with competitive rates to reduce your cash-to-close requirement. These HUD-funded programs can make homeownership accessible even with limited savings.

Irving Down Payment Assistance Program

The City of Irving's program provides financial assistance in the form of a zero percent interest, deferred forgivable loan. Key features include:

Funds apply to down payment and closing costs for homes purchased within Irving city limits

The loan is forgivable over time, meaning you may not need to repay it

Eligibility requirements:

Be approved for a home loan with a City of Irving approved lender

Not have owned a home within the last three years

Have household income at or below 80% of the Area Median Income per HUD guidelines

How to Apply

Complete the required orientation video

Submit an online application through the City of Irving housing portal

Work with an approved lender to coordinate loan closing

Combining these assistance programs with Chestnut's competitive rates can significantly reduce your upfront costs while securing favorable long-term terms.

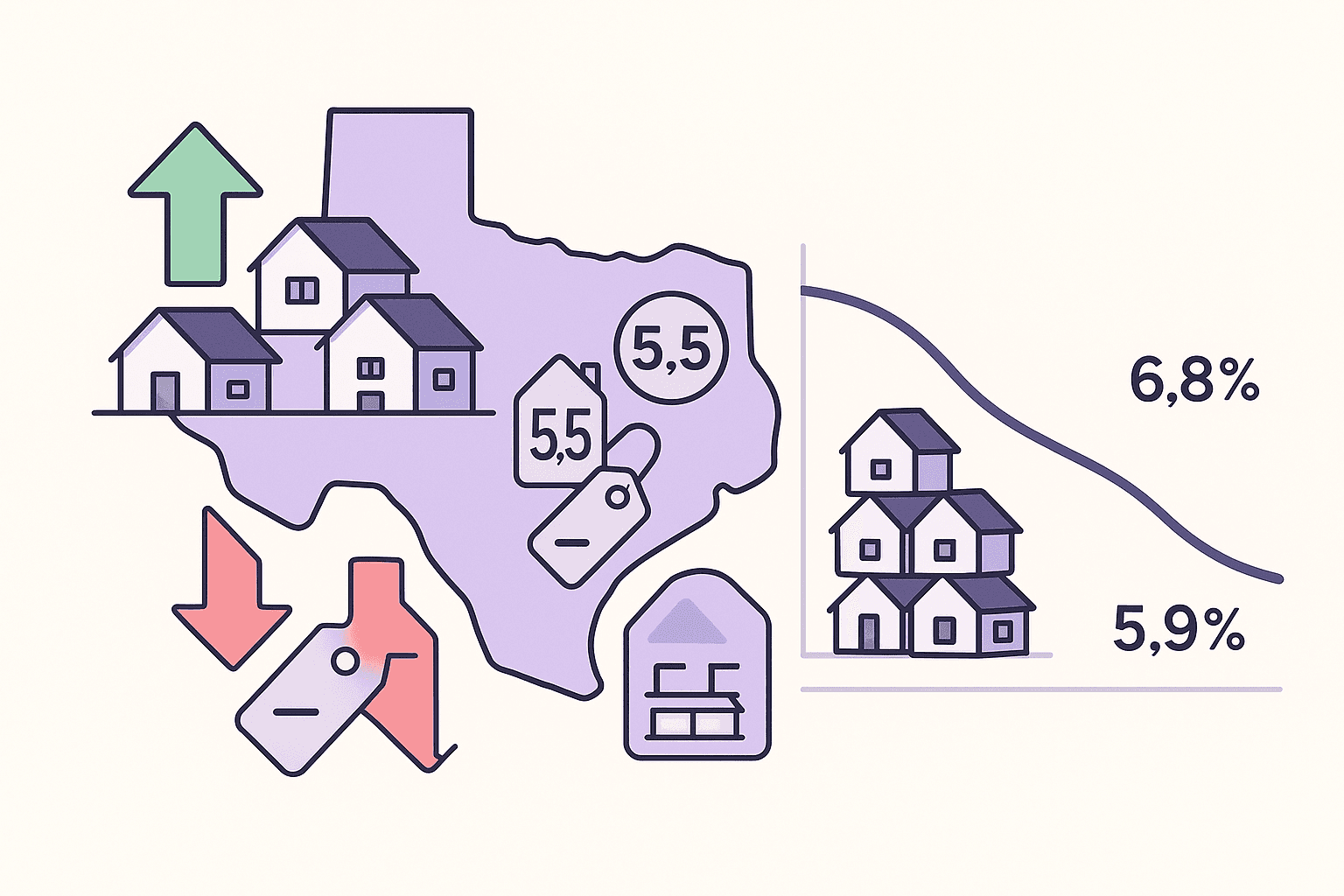

2025 Texas Housing Trends: What Do They Mean for Rates?

Understanding statewide market dynamics helps Irving buyers time their purchase and rate lock strategically.

Current Market Conditions

The Texas housing market shows unusual divergence from typical patterns. According to the Texas Real Estate Research Center, "Housing market cycles are typically marked by prices and sales volume moving in the same direction. That said, recent market indicators point to a divergence from the usual pattern in the Texas housing market."

Key September 2025 data points:

Metric | Current Status |

|---|---|

Sales growth | |

Home prices | |

Inventory | 5.5-month supply (buyer-friendly) |

Seller concessions | Median asking price reductions at $17,000 |

Rate Forecast

Fannie Mae projects 30-year fixed rates declining from 6.8% to 5.9% by 2027. This gradual decline suggests opportunities for refinancing in coming years, but current buyers shouldn't wait indefinitely.

The Lock-In Effect

The Texas Housing Insight report notes that "With over 80 percent of mortgaged homeowners locked into rates below 6 percent, discretionary demand from existing homeowners is likely to remain limited under the current interest rate environment."

This creates less competition from move-up buyers, potentially benefiting first-time purchasers.

Key takeaway: Irving's current buyer-friendly conditions, combined with seller concessions and falling prices, create favorable negotiating leverage.

How to Lock the Lowest Rate With Chestnut

Follow this step-by-step playbook to secure the best possible rate on your Irving home purchase.

Step 1: Get Your Instant Quote

Chestnut's platform generates instant quotes in less than 2 minutes, providing real-time rate comparisons across 100+ lenders. Start by entering basic information about your purchase:

Target home price and down payment

Estimated credit score range

Employment and income details

Step 2: Review Your Personalized Options

The AI system goes beyond simple rate comparison. It analyzes your complete borrower profile to identify lenders most likely to offer competitive terms for your specific situation. You'll see:

Multiple rate and fee combinations

Trade-offs between upfront costs and long-term savings

Specialty programs you might qualify for

Step 3: Complete Pre-Approval

The system provides instant quotes in under two minutes, but full pre-approval requires documentation verification. Gather:

Recent pay stubs and W-2s

Bank statements showing assets

Tax returns if self-employed

Photo ID

Step 4: Lock Your Rate Strategically

Timing matters. Chestnut's technology tracks current mortgage rates daily, ensuring you have access to the most current pricing. Consider:

Lock when you have an accepted offer

Monitor economic calendars for major announcements

Discuss float-down options with your loan officer

Step 5: Close Efficiently

AI-driven technology consistently delivers rates approximately 0.50 percentage points below market averages. That advantage carries through closing, where automated processes reduce delays and paperwork.

Putting It All Together: Secure Your Irving Home With Confidence

Finding the best mortgage rates in Irving TX requires understanding current market conditions, optimizing your borrower profile, and using technology that can scan the entire lender landscape efficiently.

Here's what to remember:

Current 30-year fixed rates average around 6.81%, with weekly fluctuations creating windows of opportunity

Your credit score, debt-to-income ratio, and down payment directly influence your personal rate

Irving's down payment assistance program can reduce cash-to-close for qualifying buyers

Texas market conditions favor buyers, with falling prices and generous seller concessions

Systematic rate shopping through AI comparison typically saves 0.5% or more

Chestnut's AI analyzes options across more than 100 lenders in real-time, delivering instant quotes that help Irving buyers secure rates below market averages. Whether you're purchasing your first home or refinancing an existing mortgage, starting with a comprehensive rate comparison positions you for the best possible outcome.

Ready to see what rates you qualify for? Get your personalized quote from Chestnut in under two minutes.

Frequently Asked Questions

What are the current mortgage rates in Irving, TX?

As of April 29, 2025, the 30-year fixed mortgage APR in Irving, TX is 6.81%, which is 25 basis points lower than the previous week and 49 basis points below the rate from a year ago.

How does Chestnut's AI technology help in finding mortgage rates?

Chestnut's AI technology analyzes options from over 100 lenders in real-time, providing instant quotes and personalized rate comparisons, typically saving borrowers 0.5% or more compared to traditional methods.

What factors influence mortgage rates in Irving, TX?

Mortgage rates in Irving are influenced by macroeconomic factors like Federal Reserve policies and inflation, as well as borrower-specific factors such as credit score, debt-to-income ratio, and down payment size.

What assistance programs are available for homebuyers in Irving, TX?

Irving offers a down payment assistance program providing zero percent interest, deferred forgivable loans for eligible buyers, which can be used for down payment and closing costs.

How can I lock in the best mortgage rate with Chestnut?

To lock in the best rate with Chestnut, start by getting an instant quote, review personalized options, complete pre-approval, and strategically lock your rate when you have an accepted offer.

Sources

https://www.nerdwallet.com/mortgages/mortgage-rates/texas/irving

https://www.fico.com/blogs/fico-score-credit-insights-report

https://www.dallasfed.org/~/media/documents/research/papers/2025/wp2505.pdf

https://www.g2.com/compare/encompass-digital-mortgage-solution-vs-turnkey-lender

https://www.g2.com/compare/encompass-digital-mortgage-solution-vs-lendingpad

https://trerc.tamu.edu/article/texas-housing-insight-september-2025/

https://www.fanniemae.com/media/document/pdf/housing-forecast-112025

https://chestnutmortgage.com/resources/chestnut-ai-delivers-0-50-point-rate-advantage-2025