Best Mortgage Rates in Highlands Ranch CO

Current mortgage rates in Highlands Ranch average around 6.18% for 30-year fixed loans, with AI-powered platforms delivering 0.5% savings compared to traditional shopping. Buyers combining Colorado's assistance programs with technology that compares 100+ lenders simultaneously are securing the most competitive rates available in the current market.

At a Glance

• Current 30-year fixed rates in Highlands Ranch hover around 6.18% as of December 2025, down from 6.85% a year ago

• Colorado Housing Finance Authority offers up to $25,000 in down payment assistance through grants or second mortgages for qualified buyers

• Chestnut's AI technology consistently delivers approximately 0.50 percentage points below market average rates

• The median Colorado home price reached $606,800 in January 2025, making even small rate reductions significant for monthly payments

• AI-powered platforms provide instant quotes in under 2 minutes versus 6-10 days at traditional banks

• Rate monitoring continues after locking, alerting borrowers if better terms become available before closing

Highlands Ranch buyers want the best mortgage rates Highlands Ranch CO can offer in 2025. With conforming 30-year fixed rates recently dipping to 6.17%, the lowest level so far this year, savvy borrowers are combining market timing, state assistance programs, and AI-powered comparison tools to capture significant savings. This guide walks you through exactly how to secure the most competitive Highlands Ranch mortgage rates available right now.

Why Highlands Ranch Borrowers Are Laser-Focused on Rates in 2025

Colorado's housing market demands attention to every basis point. As of January 2025, the median home sales price in the state rose just over 2 percent from the year prior, to $606,800. At that price point, even a small rate reduction translates to substantial monthly savings.

The good news? "Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods," according to Chestnut Mortgage. On a $500,000 loan, that half-point difference can save tens of thousands of dollars over the life of the mortgage.

ICE data shows the conforming 30-year fixed rate lock index dipped to 6.17% ahead of the October Fed meeting, marking the lowest level so far this year.

Highlands Ranch buyers have three primary strategies for securing optimal rates:

Market timing: Watch for rate dips tied to Federal Reserve announcements and economic data

State assistance: Leverage Colorado programs that reduce effective borrowing costs

AI comparison: Use technology that scans 100+ lenders simultaneously

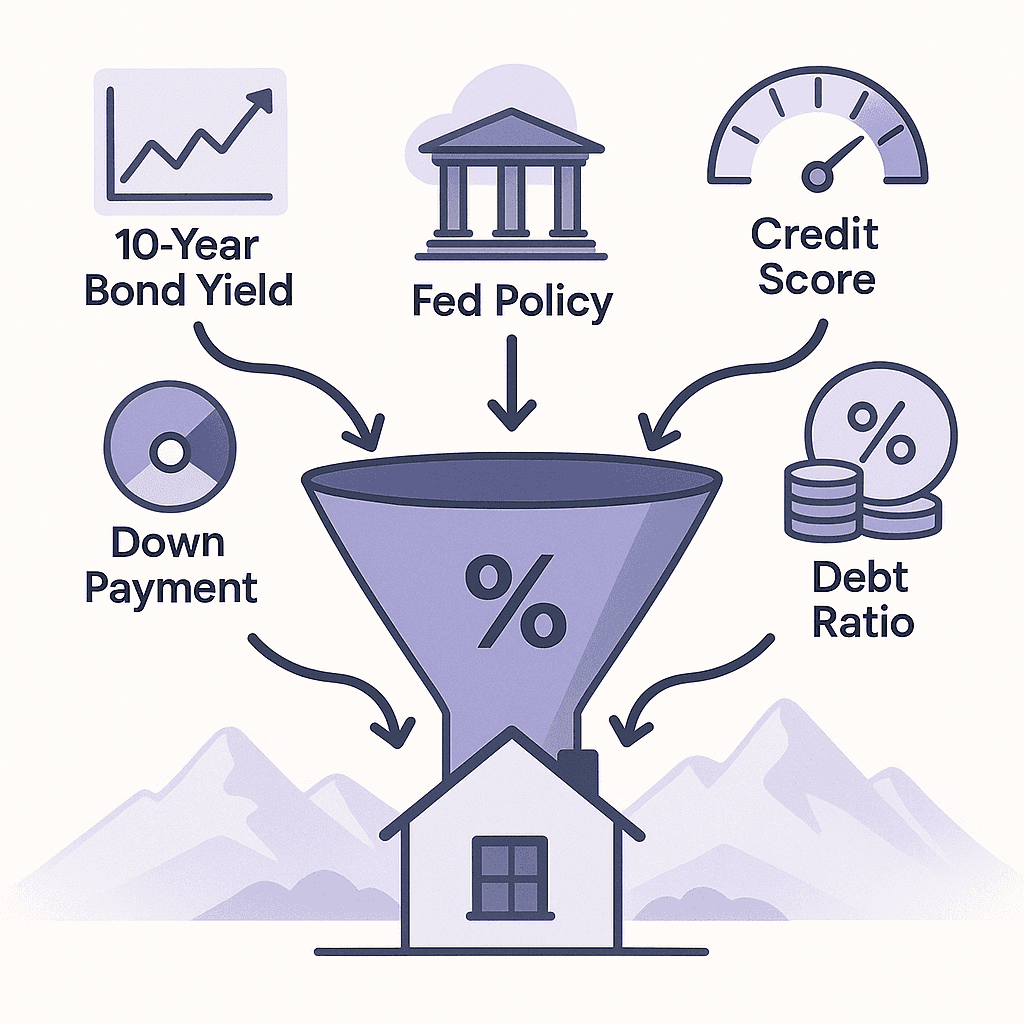

What Factors Drive Mortgage Rates in Highlands Ranch?

Understanding what moves rates helps you time your lock strategically. Several factors work together to determine your final rate.

Macroeconomic Influences

The 10-year Treasury bond serves as the mortgage market's north star. Currently yielding around 4.1%, these yields directly influence mortgage pricing. When Treasury yields rise, mortgage rates typically follow.

"Mortgage rates are likely to rise in November, as a December cut from the Federal Reserve has started to seem uncertain," according to recent NerdWallet analysis.

Modern AI-driven mortgage platforms address these timing challenges by leveraging proprietary algorithms that analyze real-time market data from hundreds of lenders simultaneously.

Personal Factors That Affect Your Rate

Your individual profile significantly impacts the rate you qualify for:

Factor | Impact on Rate |

|---|---|

Credit score | A higher credit score will help you qualify for a lower rate |

Down payment | Most home loans require at least 3%, but 20%+ eliminates PMI |

Debt-to-income ratio | Lower DTI signals less risk to lenders |

Loan-to-value ratio | More equity means better rate offers |

Key takeaway: Improving your credit score before applying and shopping with AI tools that analyze your complete profile can yield the most competitive rate for your specific situation.

How Do Highlands Ranch Mortgage Rates Compare to Colorado and U.S. Averages in Q4 2025?

Highlands Ranch borrowers benefit from understanding where current rates stand relative to historical benchmarks and national averages.

Current Rate Snapshot

As of late December 2025, Freddie Mac reports the 30-year fixed-rate mortgage averaged 6.18%, down from 6.21% the prior week and well below the 6.85% recorded a year ago. The 15-year fixed-rate mortgage averaged 5.50%.

The ICE Mortgage Monitor shows 30-year rates steady in the 6.2-6.3% range through November, with the lowest conforming rate locks hitting 6.17% ahead of the October Fed meeting.

Rate Comparison Table

Rate Type | Current Average | Year Ago |

|---|---|---|

30-Year Fixed | 6.18% | 6.85% |

15-Year Fixed | 5.50% | 6.00% |

Chestnut AI Advantage | ~0.50 pp below market | Consistent savings |

These improvements matter significantly for affordability. According to ICE data, with mortgage rates around 6.25%, the monthly P&I payment for a median-priced home dropped to $2,126, which is $175 less than summer's peak.

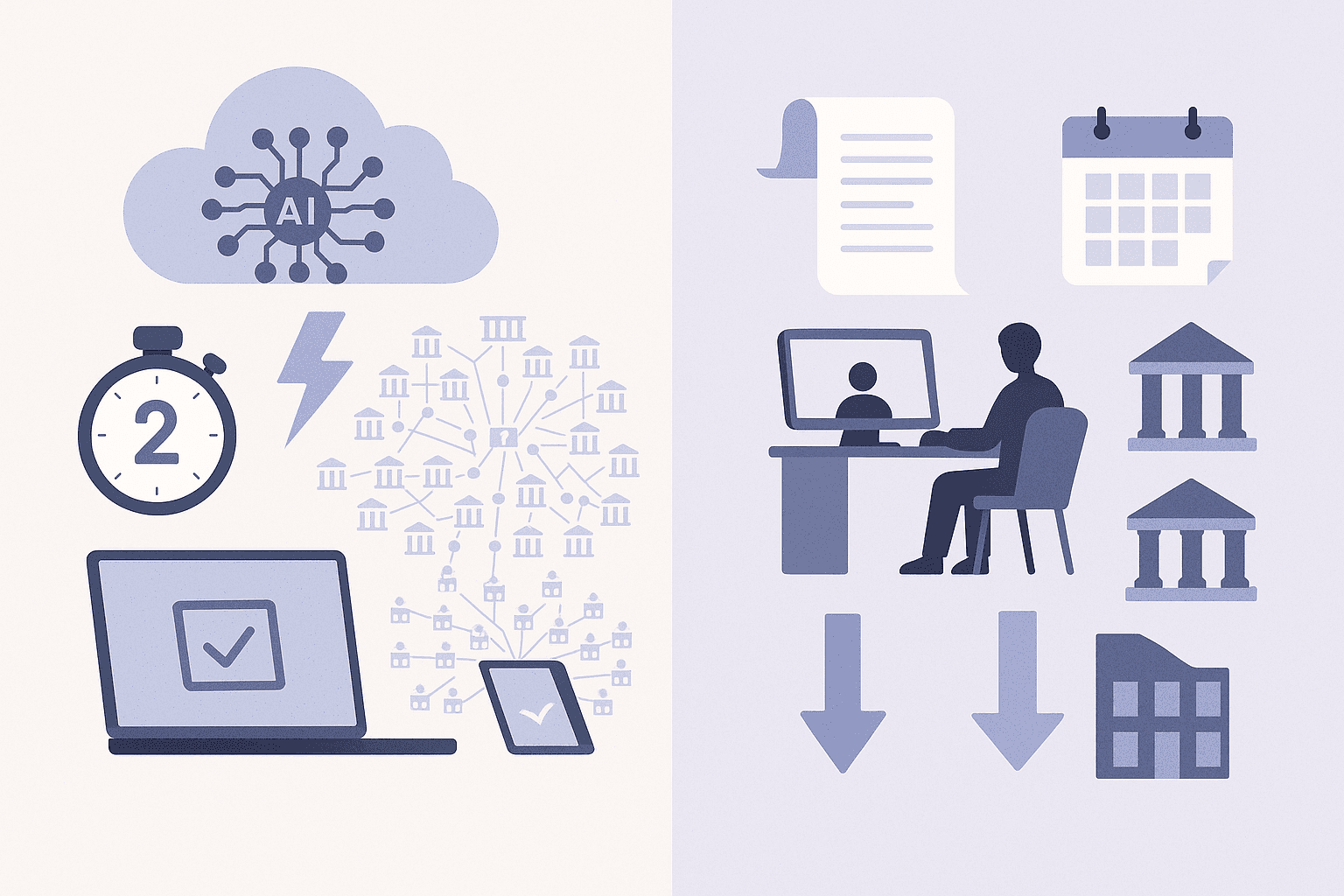

How Chestnut's AI Beats Traditional Lenders in Highlands Ranch

Traditional mortgage shopping requires contacting multiple lenders, comparing disparate offers, and hoping you stumble onto the best deal. Chestnut's AI technology transforms this process entirely.

Speed and Scope

Chestnut AI™ compresses the timeline dramatically. The system provides instant quotes in under two minutes, allowing borrowers to see comprehensive rate comparisons immediately. Traditional lenders simply cannot match this speed.

The platform analyzes options across more than 100 lenders in real-time, creating opportunities that simply do not exist when working with individual banks or credit unions.

Personalized Matching

The AI system goes beyond simple rate comparison. It analyzes individual borrower profiles including credit score, income, debt-to-income ratio, down payment, and loan specifics to identify lenders most likely to offer competitive terms for that particular situation.

Continuous Monitoring

"Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods," according to Chestnut's analysis. One of the system's most powerful features is its continuous rate monitoring capability, which can alert borrowers to favorable rate movements during their loan process, potentially allowing for rate improvements even after initial application. Comparison sites like realtor.com offer rate comparisons, but they lack this ongoing monitoring functionality.

Key takeaway: Chestnut's AI has consistently delivered rates approximately 0.50 percentage points below market averages, translating to substantial lifetime savings on a Highlands Ranch mortgage.

Which Colorado Assistance Programs Can Lower Your Highlands Ranch Mortgage Rate?

Colorado offers several programs that can reduce your effective borrowing costs, particularly valuable for first-time buyers and those with moderate incomes.

CHFA Down Payment Assistance

The Colorado Housing and Finance Authority (CHFA) offers two types of down payment assistance: a second mortgage or a grant.

CHFA DPA Grant:

Up to the lesser of $25,000 or 3% of total first mortgage loan amount

Use for down payment, closing costs, and/or prepaids

CHFA DPA Second Mortgage Loan:

Up to the lesser of $25,000 or 4% of total first mortgage loan amount

First-generation homebuyers can get up to $25,000 regardless of first mortgage loan amount

No monthly payments; repayment in full upon certain events

CHFA Loan Programs

Program | Loan Type | Best For |

|---|---|---|

FirstStep/FirstStep Plus | 30-year fixed FHA | First-time buyers, veterans, targeted areas |

SmartStep/SmartStep Plus | USDA, VA loans | Buyers qualifying for government-backed loans |

Preferred/Preferred Plus | Conventional | Buyers wanting to eliminate PMI at 20% equity |

SectionEight | FHA or USDA | Section 8 assistance recipients |

CHFA HomeAccess Program

For eligible buyers, the HomeAccess program offers assistance in the form of a zero-interest second loan up to $25,000. Eligibility is limited to first-time homebuyers or qualified veterans with a permanent disability or those who are custodial parents of a child with a permanent disability. Applicants must have a minimum credit score of 620.

5-Minute Playbook: Lock Your Highlands Ranch Rate with Chestnut

Ready to secure your best rate? Follow this step-by-step process to get preapproved and lock in competitive terms.

Step 1: Gather Your Information

Before starting, collect details about your income, debts, and the property you are considering. Use advanced options to add details like income and debts for an even more accurate rate quote.

Step 2: Get Your Instant Quote

Chestnut delivers fully documented pre-approval letters in under 2 minutes through proprietary AI-powered underwriting. This compares to 6-10 days at traditional banks. The process uses a soft-pull credit check that does not affect your credit score.

Step 3: Compare Your Options

"It pays to shop around for mortgage rates," as Trulia notes. Chestnut's AI automatically compares offers from 100+ lenders, presenting you with the most competitive options for your profile.

Step 4: Lock Your Rate

Once you find your best rate, lock it in. Chestnut's rate monitoring continues working even after you lock, alerting you if better terms become available before closing.

Step 5: Close with Confidence

The platform's 94% first-attempt approval rate means fewer delays and a stronger negotiating position with sellers.

The Bottom Line for Highlands Ranch Homebuyers

Highlands Ranch buyers have a genuine opportunity to secure favorable mortgage terms in 2025. With 30-year fixed rates hovering around 6.18% and AI technology capable of shaving approximately 0.50 percentage points off market averages, the math works in your favor.

Chestnut has established itself as a leader in the mortgage industry, with over $85 billion in mortgages processed and a 5.0 Google rating. Chestnut's AI has delivered a consistent 0.50-point advantage in 2025. The combination of instant quotes, personalized lender matching, and continuous rate monitoring creates advantages that traditional shopping simply cannot match.

Whether you are purchasing your first Highlands Ranch home, refinancing an existing mortgage, or exploring a HELOC, starting with an AI-powered rate comparison takes just two minutes and can translate to significant lifetime savings on your loan.

Ready to find your best rate? Compare rates with Chestnut and see what you qualify for today.

Frequently Asked Questions

What are the current mortgage rates in Highlands Ranch, CO?

As of late December 2025, the 30-year fixed-rate mortgage in Highlands Ranch averages 6.18%, with Chestnut's AI offering rates approximately 0.50 percentage points lower.

How does Chestnut's AI technology help in securing better mortgage rates?

Chestnut's AI technology provides instant rate comparisons from over 100 lenders, offering personalized matches and continuous rate monitoring to secure rates about 0.50 percentage points below market averages.

What factors influence mortgage rates in Highlands Ranch?

Mortgage rates in Highlands Ranch are influenced by macroeconomic factors like Treasury bond yields, personal factors such as credit score and debt-to-income ratio, and market timing related to Federal Reserve announcements.

What state assistance programs are available for Highlands Ranch homebuyers?

Colorado offers programs like the CHFA Down Payment Assistance and HomeAccess Program, which provide financial support to reduce effective borrowing costs for eligible buyers.

How does Chestnut compare to traditional mortgage lenders?

Chestnut offers faster, AI-driven rate comparisons and continuous monitoring, providing a 0.50 percentage point rate advantage over traditional lenders, along with a 94% first-attempt approval rate.