Best Mortgage Rates in Grapevine TX

Mortgage rates in Grapevine TX currently average around 6.2-6.3% for 30-year fixed loans, with rates forecast to drop to 5.9% by 2026. Using AI-powered comparison tools like Chestnut, which analyzes 100+ lenders simultaneously, typically yields rate savings of 0.5% or more compared to traditional shopping methods.

TLDR

Current Grapevine mortgage rates sit at 6.2-6.3% for 30-year fixed loans, down from 6.85% a year ago

Comparing at least four lenders saves borrowers up to $1,200 annually, or $36,000+ over the loan's lifetime

Chestnut's AI analyzes 100+ lenders in under two minutes, typically securing 0.5% better rates than conventional methods

Texas down payment assistance programs offer up to $25,000 in grants that never require repayment

Mortgage origination costs have risen to $11,600, making efficient comparison shopping essential for offsetting fees

Buying in Grapevine is not cheap, so grabbing the lowest mortgage rates in Grapevine TX can save you tens of thousands over the life of the loan. This guide shows 2026 borrowers exactly which data to track and how Chestnut's AI delivers below-market offers in seconds.

Why Finding Low Mortgage Rates Matters for Grapevine Buyers in 2026

Current borrowing costs sit at their lowest point in over a year, with modest improvement possible if economic data continues to cool. For Grapevine home loans, that timing creates a real opportunity.

A Freddie Mac study found buyers who got quotes from at least four lenders saved up to $1,200 annually. On a typical 30-year mortgage, that adds up to more than $36,000 in lifetime savings.

Chestnut makes getting those quotes effortless. You can get started in 2 minutes and see comprehensive rate comparisons immediately, rather than spending days calling individual lenders.

Key takeaway: Comparing multiple lenders is not optional. It is the single most effective way to reduce your borrowing costs when buying a Grapevine home.

Which Rate Forecasts & Market Metrics Should Grapevine Borrowers Watch in 2026?

Staying informed about mortgage rates in Grapevine TX means tracking the right benchmarks. Here are the key metrics that matter:

Metric | Current Status | 2026 Forecast |

|---|---|---|

30-Year Fixed Rate | ||

15-Year Fixed Rate | Trending lower | |

Mortgage Originations | Rising |

Fannie Mae forecasts mortgage rates to end 2025 at 6.4 percent and 2026 at 5.9 percent. That gradual decline creates opportunities for buyers who act strategically.

Recent Freddie Mac data shows the 30-year fixed-rate mortgage averaged 6.18% as of late December 2025, down from 6.85% a year ago. That is a meaningful improvement for Grapevine buyers.

Refinance activity has also surged, with prepayment activity hitting a 3.5-year high as borrowers lock in better terms.

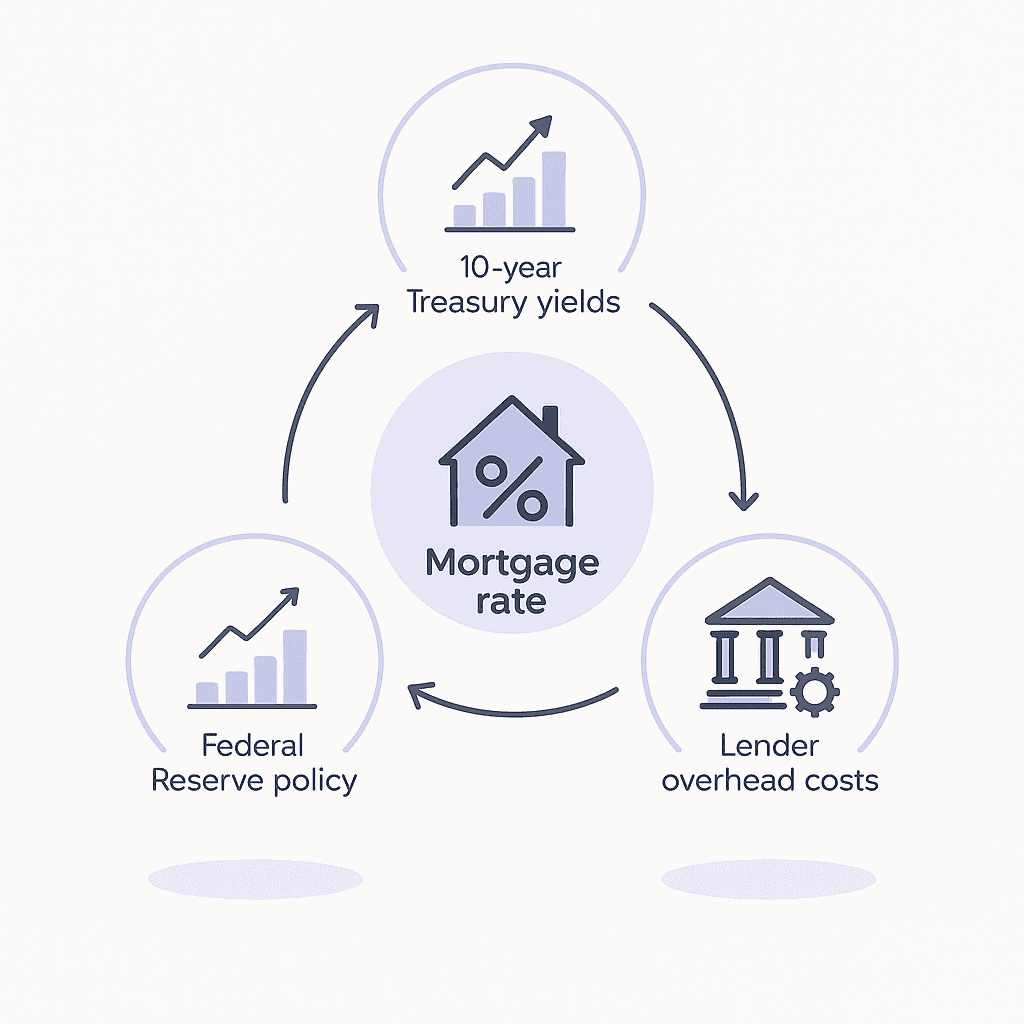

What Actually Moves Mortgage Rates in Grapevine?

Understanding what drives rates helps you time your purchase or refinance more effectively.

The 10-year Treasury bond serves as the mortgage market's north star. Currently yielding around 4.1%, these yields directly influence mortgage pricing. When Treasury yields drop, mortgage rates typically follow.

Federal Reserve policy sets the baseline. As recent NerdWallet analysis noted, "Mortgage rates are likely to rise in November, as a December cut from the Federal Reserve has started to seem uncertain." (Chestnut Resources)

Fed Chair Jerome Powell recently stated, "A further reduction in the policy rate at the December meeting is not a foregone conclusion." (Chestnut Resources)

Lender overhead also affects what you pay. The average cost to originate a mortgage has risen from $5,100 in 2012 to $11,600 in 2023. AI mortgage comparison tools like Chestnut help offset these costs by finding lenders with lower overhead.

Are Traditional Lenders Costing You More in Grapevine?

The traditional mortgage shopping experience has some significant drawbacks for Grapevine borrowers.

Hidden fees add up quickly. Some Texas-based lenders charge origination fees of up to 3 percent of the loan amount, plus underwriting and processing fees. On a $400,000 loan, that is $12,000 before you even factor in closing costs.

Price dispersion is real. CFPB data shows that price dispersion for mortgages is often around 50 basis points of the annual percentage rate. That difference amounts to over $1,000 a year for a typical mortgage.

Local options are limited. While Grapevine has several mortgage providers, including brokers like Fairway Independent Mortgage and full-service companies like Global Lending Solutions, most offer a narrow range of products from a handful of lenders.

An origination fee is what the lender charges the borrower for making the mortgage loan, covering processing, underwriting, and funding. These fees vary widely between lenders, which is why comparison shopping matters.

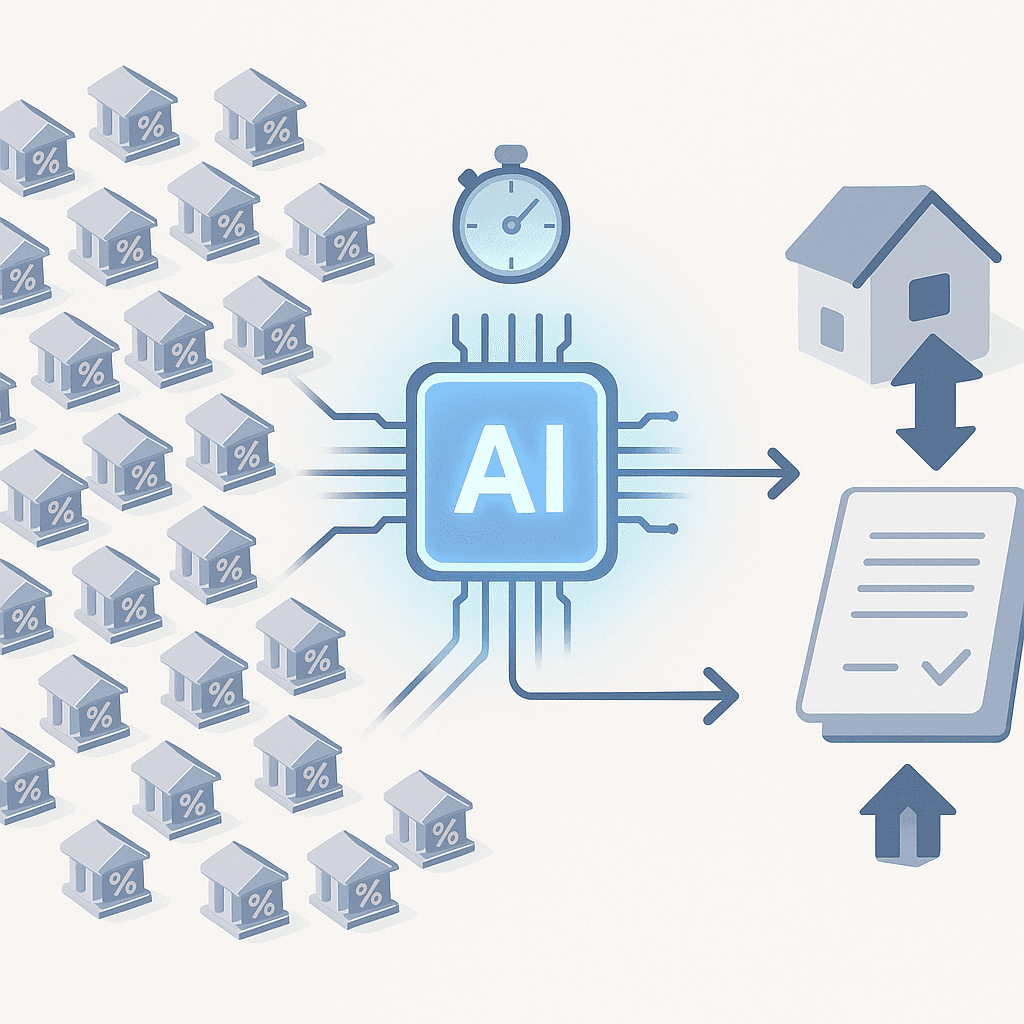

How Does Chestnut AI™ Find the Best Grapevine Rate in Seconds?

"Chestnut AI analyzes options across more than 100 lenders in real-time." (Chestnut Resources)

That scale creates opportunities that simply do not exist when working with individual banks or credit unions.

Rate savings are substantial. Borrowers using Chestnut AI typically see rate savings of 0.5% or more compared to traditional shopping methods. On a $400,000 mortgage, that translates to significant monthly and lifetime savings.

Speed matters in competitive markets. The system provides instant quotes in under two minutes, allowing borrowers to see comprehensive rate comparisons immediately. In Grapevine's competitive housing market, that speed can make the difference between winning and losing a deal.

Track record speaks volumes. With over $85 billion in mortgages processed and a 5.0 Google rating, Chestnut has established itself as a leader in the mortgage industry. The company is licensed in Texas and designed specifically for markets like Grapevine.

What Are the 4 Steps to Lock Your Grapevine Rate with Chestnut?

Whether you are purchasing or looking to refinance in Grapevine TX, here is how to secure your best rate:

Get your instant quote Start at Chestnut's instant quote tool. Enter basic information about your purchase or refinance, and receive rate comparisons from 100+ lenders in under two minutes.

Receive your AI-powered pre-approval Chestnut delivers fully documented pre-approval letters through proprietary AI-powered underwriting. The platform's 94% first-attempt approval rate means fewer delays and stronger negotiating positions with sellers.

Lock your rate Once you find the right property or decide to refinance, lock your rate to protect against market fluctuations. All loans are subject to credit approval.

Close with confidence Chestnut's streamlined process reduces the typical closing timeline. For purchases, visit the buy page. For refinancing, start at the refinance page.

Stacking Savings: Grants & Assistance Programs Around Grapevine

Grapevine buyers can combine competitive rates with Texas down payment assistance programs to maximize savings.

Program | Assistance Amount | Key Requirements |

|---|---|---|

Up to $25,000 | Income at/below 80% AMI; Fort Worth city limits | |

1-5% of loan amount | Credit score 620+; income limits apply | |

Based on need | 60% AMI minimum; Dallas city limits |

The Homeownership Across Texas (HAT) Program provides grants ranging from 1% to 5% of the mortgage loan amount, which can be applied toward down payment or closing costs. These grants never have to be repaid.

For Fort Worth buyers, an eligible homebuyer may qualify for assistance up to $25,000. Household income must be at or below 80% of HUD area median income.

Learn more about combining these programs with Chestnut's competitive rates at the Texas down payment assistance guide.

Key Takeaways for Grapevine Rate Shoppers

Finding the best mortgage rates in Grapevine TX comes down to three factors: timing, comparison shopping, and using the right tools.

Chestnut's mission is to revolutionize the mortgage process through AI-driven solutions, ensuring efficiency, transparency, and cost savings for customers. For Grapevine buyers, that means:

Real-time access to 100+ lenders rather than calling around to a handful of local options

Average rate savings of 0.5% compared to traditional shopping methods

Instant quotes in under two minutes so you can move quickly in competitive situations

With rates forecast to gradually decline through 2026, now is an excellent time to explore your options. Start your search with Chestnut's instant quote tool and see how much you could save on your Grapevine mortgage.

Frequently Asked Questions

Why is it important to find low mortgage rates in Grapevine, TX?

Finding low mortgage rates in Grapevine, TX is crucial as it can save you tens of thousands over the life of the loan. With current borrowing costs at their lowest in over a year, it's an opportune time to secure favorable rates.

How does Chestnut AI help in finding the best mortgage rates?

Chestnut AI analyzes options from over 100 lenders in real-time, providing instant quotes and comprehensive rate comparisons. This approach typically results in rate savings of 0.5% or more compared to traditional methods.

What factors influence mortgage rates in Grapevine?

Mortgage rates in Grapevine are influenced by the 10-year Treasury bond yields, Federal Reserve policies, and lender overhead costs. Monitoring these factors can help you time your purchase or refinance effectively.

What are the drawbacks of traditional mortgage lenders in Grapevine?

Traditional lenders often have hidden fees, limited local options, and significant price dispersion. These factors can lead to higher costs compared to using AI-driven tools like Chestnut for rate comparisons.

What assistance programs are available for Grapevine homebuyers?

Grapevine homebuyers can benefit from programs like the Fort Worth HAP, HAT Program, and Dallas DHAP, which offer grants and assistance for down payments and closing costs. These can be combined with competitive rates from Chestnut.

Sources

https://www.fanniemae.com/data-and-insights/forecast/economic-developments-september-2025

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://www.fanniemae.com/media/document/pdf/housing-forecast-112025

https://www.bankrate.com/mortgages/reviews/orchard-mortgage/

https://www.consumerfinance.gov/ask-cfpb/what-is-an-origination-fee-en-1957/