Best Mortgage Rates in Golden CO

Best Mortgage Rates in Golden CO

Golden's mortgage rates currently average 6.22% for 30-year fixed loans, matching Colorado's statewide average but sitting above the national rate of 6.18%. Chestnut Mortgage's AI platform compares over 100 lenders simultaneously, typically delivering rates 0.5 percentage points lower than traditional shopping methods—potentially saving Golden buyers over $100,000 on a typical $1 million home purchase.

At a Glance

• Golden's median home price reached $1 million with properties selling in just 4 days on average

• Colorado mortgage rates hover at 6.22% for 30-year and 5.75% for 15-year fixed loans

• Fannie Mae projects rates will end 2025 near 6.5% before easing slightly in 2026

• Rate shopping across multiple lenders can save borrowers over $6,000 over the loan term

• Colorado offers up to $25,000 in down payment assistance through CHFA programs for qualified buyers

• Digital mortgage tools reduce origination costs by approximately $1,500 per loan

Golden's housing market moves fast. Homes here receive an average of two offers and sell in roughly four days, leaving buyers almost no margin for error. Meanwhile, the median sale price climbed to $1.0 million last month, up 29.3% year over year. In a market this competitive, even a modest difference in your mortgage rate can translate into tens of thousands of dollars saved or lost over the life of your loan.

That is where smart rate shopping becomes essential. Chestnut Mortgage leverages proprietary AI to compare offers from over 100 lenders, often trimming borrower rates by approximately 0.5 percentage points. For Golden buyers racing against tight inventory and volatile pricing, that edge can mean the difference between stretching your budget and closing comfortably.

Why Mortgage Rates Matter More Than Ever in Golden's Red-Hot Market

Golden is one of the most competitive submarkets along Colorado's Front Range. Average homes sell at or near list price and go pending in around four days, while "hot homes" can command roughly 2% above list price and disappear in just two days. When bidding wars are common, every dollar of monthly payment capacity counts.

Consider the math: on a $1 million purchase, shaving half a percentage point off a 30-year fixed rate saves roughly $300 per month and well over $100,000 in lifetime interest. That savings cushion can help buyers compete on price without overextending, or free up cash for renovations once the keys are in hand.

Chestnut's AI engine addresses this challenge by scanning real-time pricing from more than 100 lenders and matching borrowers with offers tailored to their credit profile, income, and loan size. The result is a rate advantage that often reaches 0.5 percentage points below what traditional shopping methods produce.

Key takeaway: In Golden's sprint-paced market, locking a lower rate is not just about saving money; it is about gaining the buying power you need to win.

What Are the Latest Mortgage & Housing Metrics for Golden and Colorado?

Understanding current benchmarks helps you gauge whether any quoted rate qualifies as "best." The table below summarizes the most relevant figures as of late December 2025.

Metric | Value | Source |

|---|---|---|

Colorado 30-year fixed rate | 6.22% | |

Colorado 15-year fixed rate | 5.75% | |

National 30-year fixed rate | 6.18% | |

Golden median sale price | $1.0 million | |

Golden median days on market | 4 days | |

Hot homes premium | ~2% above list |

Colorado's statewide median single-family home price sat at $580,000 in October 2025, meaning Golden commands a significant premium. Buyers here face both elevated prices and the same mid-6% rate environment affecting the rest of the state. Securing a rate toward the lower end of that range, or below, becomes critical to affordability.

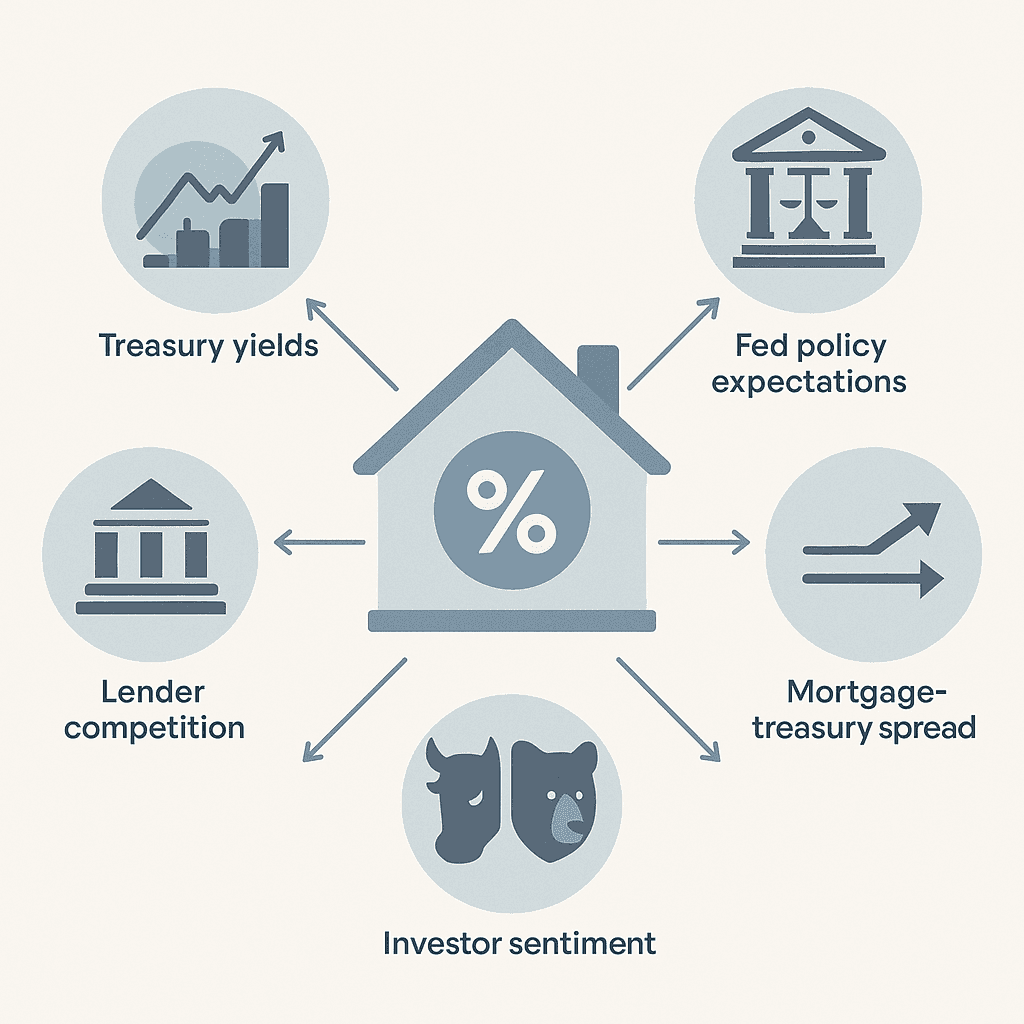

What Really Moves Mortgage Rates in Colorado?

Mortgage rates do not move in lockstep with Federal Reserve announcements. Understanding the underlying drivers can help you time your lock more strategically.

10-year Treasury yields. Mortgage rates closely track the 10-year Treasury bond, which currently yields around 4.1%. When investors demand higher yields, lenders follow suit.

Fed policy expectations. "Longer-term interest rates have risen in recent months even as the Fed continued to cut the short-term rate," Fannie Mae noted in its January 2025 outlook. Markets price in future rate moves, so a dovish Fed does not guarantee cheaper mortgages today.

Mortgage-Treasury spread. Historically, the spread averages around 1.7 to 1.8 percentage points, but it can widen during periods of volatility. In recent years, spreads above 2% have become more common, adding to borrower costs.

Investor sentiment and economic data. Mortgage rates move with investor sentiment and trends. Strong jobs reports or sticky inflation can push rates higher; softer data can ease them.

Lender competition. Rate dispersion across lenders can reach 50 basis points in volatile markets. Shopping multiple lenders, or using an AI platform that does it for you, is the most reliable way to capture savings.

How Chestnut's AI Engine Consistently Beats the Market by 0.5 Percentage Points

Traditional mortgage shopping is time-consuming. Borrowers call lenders one by one, compare PDFs, and hope they have not missed a better deal. Chestnut flips that model.

Chestnut AI analyzes options across more than 100 lenders in real time, evaluating each borrower's credit score, debt-to-income ratio, down payment, and loan specifics to identify the lenders most likely to offer competitive terms. The system delivers instant quotes in under two minutes, compressing weeks of legwork into seconds.

The payoff is measurable. Borrowers who received five rate quotes during volatile 2022 conditions could have saved more than $6,000 over the life of a loan, according to Freddie Mac research. Chestnut automates that multi-quote process, routinely delivering rate savings of 0.5% or more compared to traditional methods.

The technology also reduces origination friction. Lenders using digital tools within Freddie Mac's Loan Product Advisor originate loans that are $1,500, or 14%, less costly. Chestnut passes that efficiency on to borrowers through faster approvals and lower fees.

Step-by-Step: Lock an AI-Optimized Rate in Under 2 Minutes

Ready to act? Follow these steps to move from curious browser to rate-locked buyer.

Check your credit early. Most mortgage lenders use FICO scores, and 90% of top lenders rely on them. Review your reports for errors and pay down high-utilization balances before applying.

Gather key documents. Have recent pay stubs, tax returns, and bank statements on hand. Preapproval letters typically expire in 30 to 60 days, so timing matters.

Get preapproved. A preapproval letter shows sellers you can secure financing. Remember, getting preapproved is not the same as applying for a final loan, so you can still shop lenders afterward.

Run Chestnut's instant quote. Enter basic information, and the AI compares 100-plus lenders in real time. No hard credit pull is required for the initial quote.

Lock your rate. "Locking now protects against further increases and provides certainty," advises Dr. Timothy Savage of NYU Schack. If rates drop after you lock, ask about a float-down option.

Close and celebrate. With documents in order and rate secured, you are positioned to close on schedule and move into your new Golden home.

Pair Low Rates with Colorado Down-Payment Assistance

A great rate is only part of the affordability equation. Colorado offers several programs that can lower your upfront costs.

Program | Benefit | Key Details |

|---|---|---|

CHFA DPA Grant | Up to $25,000 | Non-repayable; does not impact DTI |

CHFA DPA Second Mortgage | Up to $25,000 or 4% of first mortgage | No monthly payments; repaid at sale or refinance |

CHAC Second Mortgage | Up to $12,000 | Rates from 0% to 5.5%; terms 12.5 to 30 years |

CHFA programs require borrowers to complete an approved homebuyer education course and meet income limits. The statewide income cap for the HomeAccess program, for example, is $174,440. First-generation homebuyers may qualify for the full $25,000 regardless of loan size.

Stacking a Chestnut-optimized rate with CHFA assistance can dramatically improve your purchasing power. Lower monthly payments plus reduced upfront cash equals a more comfortable path to homeownership.

Chestnut vs. Other Online Mortgage Lenders: An Unbiased Look

Online lenders have reshaped the mortgage landscape, but not all platforms deliver the same value. The comparison below highlights key differences.

| Lender | AI Rate Comparison | Quote Speed | Notable Limitation |

|--------|-------------------|-------------|--------------------||

| Chestnut | 100+ lenders in real time | Under 2 minutes | Licensed in select states (TX, CO) |

| Rocket Mortgage | Pathfinder AI for internal processing | Varies | Efficiency gains serve loan officers, not rate shopping |

| Better | Streamlined online process | Fast | Reviews note the experience can feel impersonal at times |

| Morty | Broker model with lender comparison | ~15 minutes | Smaller lender network |

| LoanSnap | AI-driven recommendations | Varies | Mixed reviews on follow-through |

Rocket Mortgage highlights internal processing improvements with its Pathfinder tool, which achieved a 69% increase in speed for internal queries. However, those efficiencies benefit loan officers rather than delivering lower rates for borrowers.

Better.com offers a straightforward digital application, but Trustpilot reviewers have described the process as "okay, just not exceptional," noting it can feel impersonal. For borrowers who value both competitive pricing and responsive service, Chestnut's combination of AI-driven rate discovery and human support stands out.

Golden Opportunity: Lock Your Lowest Rate with Chestnut

Golden's tight inventory and rising prices are not going away anytime soon. Waiting for rates to dip further is a gamble; acting with the best available rate today is a strategy.

Chestnut has processed over $85 billion in mortgages and maintains a 5.0 Google rating, reflecting a commitment to both competitive pricing and customer care. For Golden buyers ready to move, the platform offers a clear path: instant quotes, access to 100-plus lenders, and rate savings that can reach half a percentage point or more.

Start your quote at Chestnut and see what a smarter approach to mortgage shopping can do for your next home purchase.

Frequently Asked Questions

Why are mortgage rates important in Golden, CO?

In Golden's competitive housing market, even a small difference in mortgage rates can lead to significant savings over the life of a loan. With homes selling quickly and often above list price, securing a lower rate can enhance your buying power and affordability.

How does Chestnut Mortgage offer better rates?

Chestnut Mortgage uses proprietary AI to compare offers from over 100 lenders, often reducing borrower rates by approximately 0.5 percentage points. This technology provides a competitive edge in securing lower rates compared to traditional methods.

What factors influence mortgage rates in Colorado?

Mortgage rates in Colorado are influenced by 10-year Treasury yields, Federal Reserve policy expectations, the mortgage-Treasury spread, investor sentiment, and lender competition. Understanding these factors can help you time your rate lock strategically.

What are the current mortgage and housing metrics for Golden, CO?

As of late December 2025, the median sale price in Golden is $1.0 million, with homes typically selling in four days. The Colorado 30-year fixed rate is 6.22%, while the national rate is 6.18%.

How can Chestnut's AI engine save you money?

Chestnut's AI engine analyzes options from over 100 lenders in real time, providing instant quotes and often delivering rate savings of 0.5% or more compared to traditional shopping methods. This efficiency reduces origination costs and speeds up approvals.

Sources

https://www.fanniemae.com/research-and-insights/forecast/economic-developments-january-2025

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://www.bankrate.com/mortgages/how-to-get-the-best-mortgage-rate/

https://sf.freddiemac.com/docs/pdf/cost-to-originate-full-study-2024.pdf

https://www.myfico.com/loancenter/mortgage/step1/getthescores.aspx

https://www.consumerfinance.gov/owning-a-home/explore/get-a-preapproval-letter/

https://www.cbsnews.com/news/what-to-consider-about-mortgage-rate-locks-now-according-to-experts/