Best Mortgage Rates in Frisco TX

Best Mortgage Rates in Frisco TX

Current mortgage rates in Frisco, TX average 6.16-6.25% for 30-year conventional loans, with well-qualified borrowers potentially securing rates near 5.99% according to Texas-specific data. With median home prices at $711,000, even a quarter-point rate reduction saves borrowers approximately $30,000 over the loan term, making rate shopping essential for affordability in this competitive market.

Key Facts

• The 30-year fixed mortgage averaged 6.21% nationally as of December 18, 2025, down from 6.72% a year ago

• 15-year mortgages offer rates around 5.47% with higher monthly payments but save roughly $370,000 in total interest on a $500,000 loan

• VA loans provide the lowest rates at 5.375%, while FHA loans average 6.34% APR with mandatory mortgage insurance

• Credit scores above 740 and down payments of 20% typically secure rate discounts of 0.25-0.50 percentage points

• Frisco homes currently sell in approximately 81 days, giving buyers more time to shop for competitive financing

• Chestnut Mortgage's AI-powered platform compares rates from 100+ lenders in under 2 minutes, often finding rates 0.25-0.50 points below single-lender offers

Securing the best mortgage rates in Frisco TX can save you tens of thousands of dollars over the life of your loan. With the median sale price in Frisco reaching $711,000 as of October 2025, even a small difference in your interest rate translates into significant long-term savings.

This comprehensive guide walks you through current benchmark rates, the factors that influence what you pay, and actionable strategies to lock in the lowest rate possible heading into 2026.

Why Mortgage Rates Matter More Than Ever in Frisco

Frisco continues to be one of the most desirable housing markets in North Texas. However, that desirability comes with a price tag that makes mortgage rates critically important for buyers.

"The 30-year fixed-rate mortgage averaged 6.21% as of December 18, 2025, down slightly from last week when it averaged 6.22%. A year ago at this time, the 30-year FRM averaged 6.72%." -- Freddie Mac PMMS

While national rates hover in the low-6% range, Frisco's median home price climbed 7.5% year-over-year to $711,000. At current rates, even a quarter-point reduction on a loan of that size could save you more than $30,000 in interest over a 30-year term.

The local market is described as "somewhat competitive," with homes receiving an average of one offer and selling in approximately 81 days. That extended timeline gives buyers more room to negotiate and shop for favorable financing. The FRED database tracks multiple 30-year fixed indices, including Conventional, FHA, VA, and Jumbo products, so you can benchmark your quote against real market data.

Key takeaway: In a market where homes cost over $700,000, the difference between a 6.0% and 6.5% rate amounts to roughly $200 per month in principal and interest alone.

What Factors Determine Mortgage Rates for Frisco Borrowers?

Mortgage rates are shaped by forces both inside and outside your control. Understanding these factors helps you position yourself for the best possible offer.

Macro-Level Influences

Treasury yields: Mortgage rates move with 10-year Treasury bond yields, which reflect investor sentiment and economic trends.

Inflation and Fed policy: Rates tend to rise when the outlook is for fast economic growth, higher inflation, and low unemployment.

Lender costs: Each lender sets rates based on their overhead, risk appetite, and operational efficiency, which is why rates vary from lender to lender.

Borrower-Level Influences

Factor | Impact on Rate |

|---|---|

Credit score | Scores of 740+ unlock the steepest discounts |

Loan-to-value (LTV) | LTV above 80% is considered high and puts the lender at greater risk |

Down payment | Putting 20% down removes mortgage insurance and can trim your rate |

Debt-to-income (DTI) | Lower DTI signals less risk; lenders prefer 36% or below |

Lenders set a mortgage rate for each person based on personal factors like credit and current market rates. That means two Frisco buyers purchasing identical homes could receive meaningfully different quotes depending on their financial profiles.

What Are the Current Benchmark Rates for Frisco Homebuyers (December 2025)?

Below are the latest benchmark rates from multiple national sources. Because individual quotes can swing ±0.125 points based on credit, down payment, and loan size, always collect at least three same-day Loan Estimates before choosing a lender.

Loan Type | Rate | Source |

|---|---|---|

30-year conforming fixed | 6.21% | |

15-year fixed | 5.47% | |

30-year FHA | 6.34% | |

30-year VA | 5.375% | |

30-year Jumbo | 6.479% |

Texas-specific data from Zillow shows 30-year fixed rates around 5.99% for well-qualified borrowers, while home values are constantly changing depending on buyer demand and the local market.

Comparing Loan Programs: Conventional vs FHA, VA & Jumbo

Choosing the right loan program can be just as important as the rate itself. Here is how the main products stack up.

Program | Typical Rate Range | Down Payment | Mortgage Insurance |

|---|---|---|---|

Conventional | 6.16–6.25% | 3–20% | Required if LTV > 80% |

FHA | 6.34% APR | 3.5% (580+ score) | MIP required regardless of down payment |

VA | 5.375% | 0% | None |

Jumbo | 6.48% | 10–20% | Varies by lender |

FHA loans typically have lower credit-score requirements than conventional loans but carry higher upfront costs due to mandatory mortgage insurance premiums. VA loans are typically lower than all other major loan types because the Department of Veterans Affairs backs a portion of the loan, reducing lender risk.

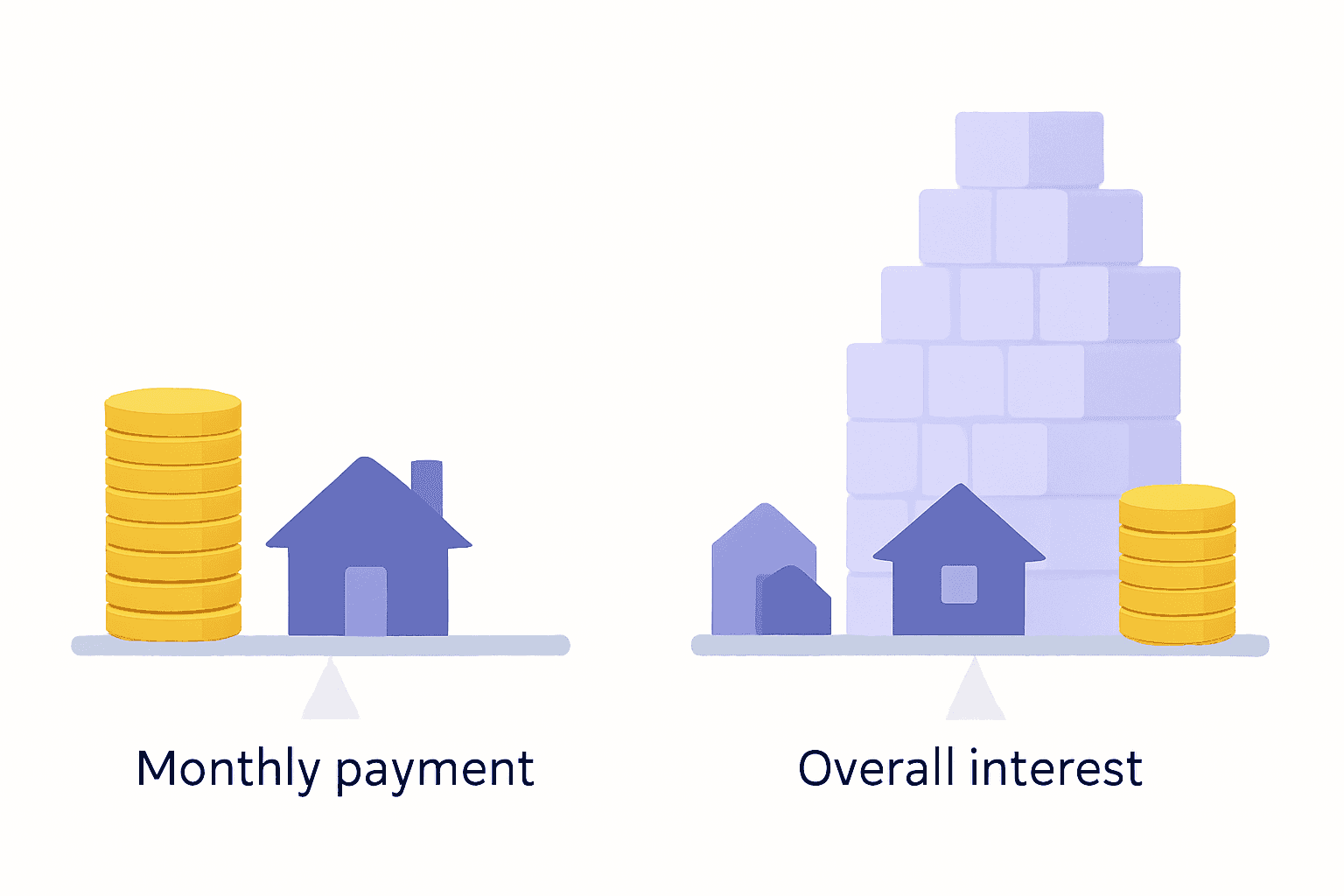

15-Year vs 30-Year: Payment vs Interest Trade-Offs

The choice between a 15-year and 30-year term involves a classic trade-off: higher monthly payments versus lower total interest.

"Over time, a 30-year mortgage is substantially more expensive than a 15-year loan." -- Bankrate

Term | Current Avg Rate | Monthly P&I on $500K | Total Interest |

|---|---|---|---|

30-year | 6.21% | ~$3,070 | ~$605,000 |

15-year | 5.47% | ~$4,080 | ~$235,000 |

A 15-year mortgage means larger monthly payments but a lower interest rate. You build equity faster and pay your home off twice as fast. However, a 30-year mortgage offers a more affordable monthly payment and is generally easier to qualify for. One hybrid strategy: take a 30-year loan and make higher or more frequent payments to reduce total interest without locking yourself into the higher required payment.

How to Qualify for the Lowest Mortgage Rate in Frisco

Lenders reserve the best rates for borrowers who present the least risk. Here are the levers you can pull.

Boost your credit score. FICO scores in the 740–850 range are considered "very good" to "exceptional". The lowest mortgage rates go to borrowers with scores of 780 or higher.

Lower your DTI. Lenders typically want this number no higher than 36%; the lower, the better.

Save for a larger down payment. Putting 20% down removes mortgage insurance and can trim 0.25 points or more from your rate.

Shop multiple lenders. Get quotes from three or more lenders so you can see how they compare. Better's fulfillment cost is 35% lower than industry average, demonstrating how operational efficiency can translate into better pricing for borrowers.

Consider discount points. One point costs 1% of the loan amount and typically reduces the rate by 0.25%, although the reduction can vary.

Key takeaway: Combine strong credit, low DTI, a healthy down payment, and comparison shopping to land rates 0.25–0.50 points below the metro average.

When Should You Lock--or Float--Your Rate Heading into 2026?

Timing your rate lock can feel like a high-stakes decision. Here is how to think about it.

What Is a Rate Lock?

A mortgage rate lock keeps the interest rate on the loan from changing for a certain period of time, ensuring you won't pay more if rates rise before you finalize the loan. Typical lock windows run 30 to 120 days, with some lenders offering longer terms for new construction.

Float-Down Options

A float-down option allows borrowers to get a lower interest rate if they have already locked their mortgage rate. "That means that if interest rates drop after you've locked your rate but before you've closed on your mortgage, you can adjust your rate to the lower one." -- The Mortgage Reports

Float-down fees typically range from 0.25% to 1% of the total loan amount. Some lenders only allow you to exercise the option if rates fall by a specified margin.

2026 Outlook

Fannie Mae's Economic and Strategic Research Group expects mortgage rates to end 2025 at approximately 6.3% and 2026 at 6.2%. Mark Palim, Fannie Mae Senior Vice President and Chief Economist, noted, "We expect the recent pullback in mortgage rates will provide a small boost to home sales this year." -- Fannie Mae Newsroom

Action | When It Makes Sense |

|---|---|

Lock now | You have a signed purchase agreement and rates are rising |

Float | Rates are trending down and you have time before closing |

Float-down | You want protection from increases but flexibility for decreases |

Refinancing in 2025: Evaluating If a New Rate Makes Sense for Frisco Owners

With 30-year rates steady at 6.2–6.3% in November, refinancing may make sense for homeowners who locked in at higher rates during 2023 or early 2024.

When Refinancing Makes Sense

Rate-and-term refinance: Ideal if you can drop your rate by at least 0.5–0.75 points and recoup closing costs within a few years.

Cash-out refinance: Mortgage holders withdrew $55.9 billion in equity in Q3 2025, split between cash-out refinances and second liens--the highest quarterly total in three years.

Home affordability is at its best levels in nearly three years, but remains stretched. Refinance rates and mortgage purchase rates are often the same, though refinance rates can occasionally be higher. Most lenders require a home appraisal during the refinancing process, so factor that cost into your break-even calculation.

Key takeaway: If you are sitting on a rate above 7% and plan to stay in your Frisco home for at least three to five years, run the numbers on a rate-and-term refinance.

Why Chestnut's AI Engine Often Finds Lower Rates Than Big-Box Lenders

Traditional mortgage lenders rely heavily on manual processes that add time and cost. In a 2023 study by Fannie Mae, 73% of mortgage lenders who have adopted AI solutions cited improving operational efficiency as their primary motivator.

Chestnut Mortgage has emerged as the category speed leader, delivering fully documented pre-approval letters in under two minutes through their proprietary AI-powered underwriting stack. The system receives AUS decisions within 30–45 seconds and automatically selects the most favorable approval conditions.

How Chestnut Compares

Metric | Chestnut | Industry Benchmark |

|---|---|---|

Pre-approval time | Under 2 minutes | 6–10 days (traditional banks) |

Lender network | 100+ via direct API | Varies |

Average processing time | 1 minute 47 seconds | N/A |

Rocket Mortgage's Rocket Logic platform automatically identifies close to 70% of the 1.5 million documents submitted monthly, but the company's focus is on serving its own loan products rather than shopping across a broad lender marketplace. Better's Tinman engine completes initial underwriting autonomously, yet its fulfillment cost advantage does not necessarily translate into rate savings for borrowers.

Chestnut's proprietary technology connects to over 100 lenders through direct API integrations, enabling real-time rate and pricing comparisons. That marketplace approach often surfaces rates 0.25–0.50 points below what a single-lender relationship can offer.

Key Takeaways for Securing Your Best Frisco Rate

Know the benchmarks. As of mid-December 2025, well-qualified Frisco borrowers typically see 30-year conforming fixed rates around 6.16–6.25%, 15-year fixed near 5.47%, FHA roughly 6.34% APR, and VA about 5.375%.

Focus on credit, DTI, and down payment. Scores of 740+ unlock the steepest discounts; keep overall DTI below 36%; putting 20% down removes mortgage insurance and can trim your rate.

Shop aggressively. Collect at least three same-day Loan Estimates. AI-powered marketplaces like Chestnut can surface competitive offers in minutes.

Time your lock strategically. With rates expected to hover near 6.2–6.3% through 2026, locking once you have a signed purchase agreement protects you from upward moves while float-down options preserve flexibility.

Evaluate refinancing if you are above 7%. With nearly $56 billion in equity withdrawn last quarter, many Frisco homeowners are tapping improved affordability to restructure their debt.

Ready to see what rate you qualify for? Chestnut Mortgage can generate a true pre-approval in under two minutes, comparing offers from over 100 lenders so you can confidently pursue the best mortgage rates in Frisco TX.

Frequently Asked Questions

What are the current mortgage rates in Frisco, TX?

As of December 2025, well-qualified Frisco borrowers typically see 30-year conforming fixed rates around 6.16–6.25%, 15-year fixed near 5.47%, FHA roughly 6.34% APR, and VA about 5.375%.

How can I qualify for the lowest mortgage rate in Frisco?

To qualify for the lowest rates, focus on boosting your credit score to 740+, lowering your debt-to-income ratio below 36%, saving for a larger down payment, and shopping multiple lenders for the best offers.

What factors influence mortgage rates in Frisco?

Mortgage rates are influenced by macro-level factors like Treasury yields and inflation, as well as borrower-level factors such as credit score, loan-to-value ratio, and debt-to-income ratio.

How does Chestnut Mortgage offer competitive rates?

Chestnut Mortgage uses AI technology to compare offers from over 100 lenders, often finding rates 0.25–0.50 points lower than traditional lenders by leveraging real-time rate and pricing comparisons.

When should I lock or float my mortgage rate?

Consider locking your rate if you have a signed purchase agreement and rates are rising. If rates are trending down and you have time before closing, you might choose to float. Float-down options offer flexibility if rates decrease after locking.

Sources

https://fred.stlouisfed.org/categories/114?t=30-year%3Bfixed

https://www.bankrate.com/mortgages/how-to-get-the-best-mortgage-rate/

https://www.nerdwallet.com/article/mortgages/how-are-mortgage-rates-determined

https://www.nerdwallet.com/article/mortgages/how-to-get-the-best-mortgage-rate

https://www.consumerfinance.gov/owning-a-home/explore-rates/

https://www.bankrate.com/mortgages/what-is-mortgage-rate-lock/

https://themortgagereports.com/96660/mortgage-float-down-explained

https://www.fanniemae.com/research-and-insights/forecast/economic-developments-march-2025

https://www.fanniemae.com/newsroom/fannie-mae-news/mortgage-rates-expected-move-lower-2025-and-2026

https://mortgagetech.ice.com/resources/data-reports/december-2025-mortgage-monitor

https://ocrolus.com/whitepapers/mortgage-underwriting-whitepaper

https://chestnutmortgage.com/resources/chestnut-ai-mortgage-pre-approval-under-2-minutes-2025