Best Mortgage Rates in Fort Collins CO

Fort Collins mortgage rates currently average 6.52% for 30-year fixed loans, below the national average of 6.76%, with Freddie Mac reporting rates at 6.21% as of December 18, 2025. Borrowers who compare offers from at least four lenders can save up to $1,200 annually, particularly when optimizing credit scores and understanding loan limits.

Key Facts

• Current 30-year fixed rates in Fort Collins average 6.52%, outperforming the national average by 24 basis points

• Mortgage rates have dropped 0.5% from last year, with purchase applications up 10% compared to December 2024

• The conforming loan limit for Larimer County is $806,500 for single-family properties in 2025

• Fort Collins median home price sits at $580,000 with homes typically pending in 19 days, giving buyers negotiating leverage

• VA refinance rates average 6.12%, offering Colorado veterans potential lifetime savings of $93,000 when refinancing from 7% loans

Finding the best mortgage rates in Fort Collins can save you tens of thousands of dollars over the life of your loan. With the average 30-year fixed rate at 6.21% as of December 18, 2025, Fort Collins borrowers who shop strategically are positioned to secure deals that outperform national averages.

Why Mortgage Rates Matter More Than Ever in Fort Collins

The Fort Collins housing market presents a unique opportunity for rate-conscious buyers. The average home value sits at $572,132, down 0.9% over the past year, while homes typically go pending in around 19 days. This moderate market gives buyers more negotiating power than they had during the pandemic frenzy.

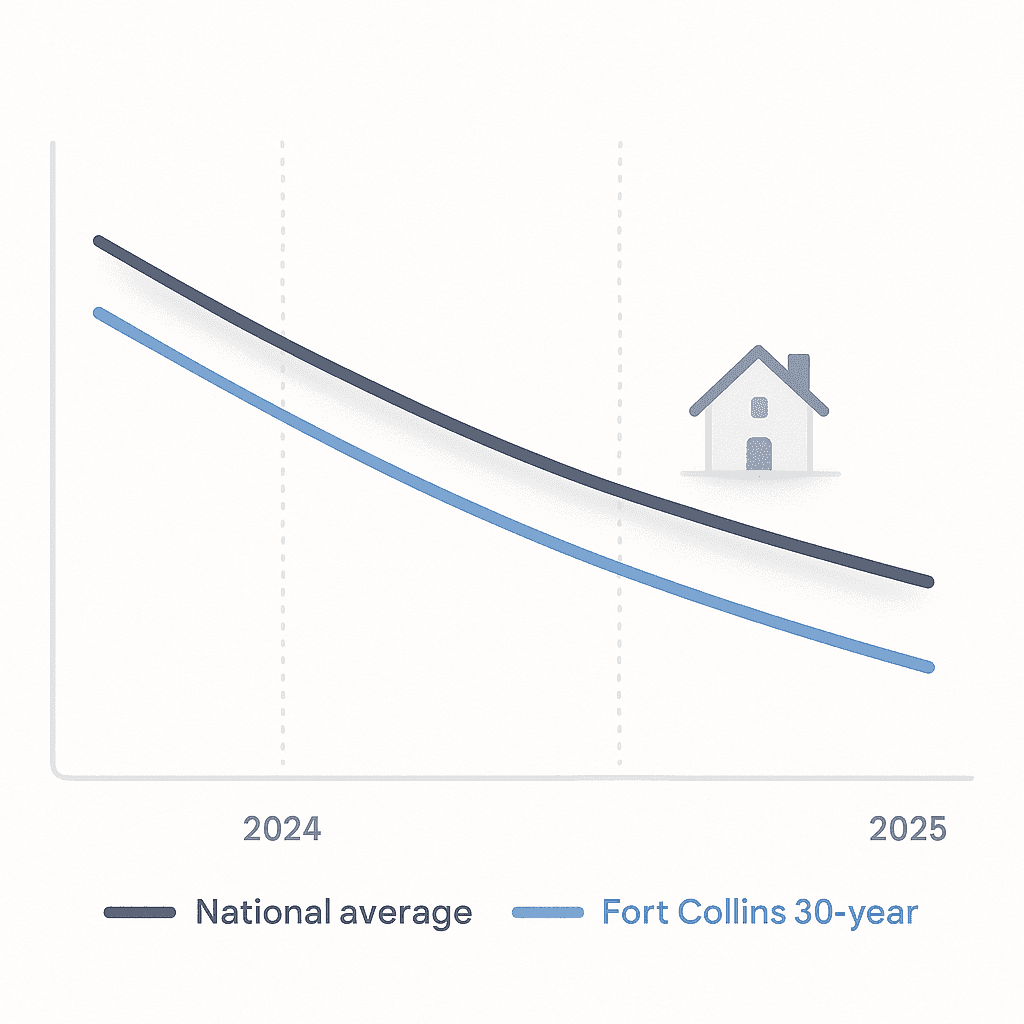

Local data reveals that Fort Collins borrowers are already beating national benchmarks. According to OriginationData, 30-year fixed rates in Fort Collins averaged 6.52% during a recent survey period, compared to the national average of 6.76%. That 24-basis-point difference translates to meaningful savings over a 30-year term.

Freddie Mac's latest survey confirms the broader trend: "The 30-year fixed-rate mortgage averaged 6.21% as of December 18, 2025, down slightly from last week when it averaged 6.22%. A year ago at this time, the 30-year FRM averaged 6.72%." (Freddie Mac PMMS)

Key takeaway: With rates down half a percent from last year and Fort Collins consistently outperforming national averages, now is an opportune time to lock in competitive financing.

2025--2026 Market & Rate Trends Shaping Larimer County

Mortgage rates have stabilized within a narrow band, creating predictability for borrowers. Freddie Mac reports that "the average 30-year fixed-rate mortgage has remained within a narrow 10-basis point range over the last two months. With rates down half a percent over last year, purchase applications are 10% above the same time one year ago." (Freddie Mac)

Nationally, housing inventory has climbed for 25 consecutive months, with 12.6% year-over-year growth. This expanding supply gives Fort Collins buyers more options and reduces bidding pressure.

Median Prices & Time-on-Market

Fort Collins pricing reflects a market finding its footing:

Metric | Value | Year-Over-Year Change |

|---|---|---|

Median Sale Price | +2.9% | |

Median Listing Price (July 2025) | Slight decrease from June | |

Days on Market | 37 days | +4 days from prior year |

The median listing price of $600,000 in April 2025 represented a 7.6% decrease from the prior year. Homes now sit on the market for approximately 37 days, giving buyers time to secure optimal financing before making offers.

Key Factors That Move Fort Collins Mortgage Rates

Your mortgage rate depends on forces you can't control and factors you can optimize. Understanding both helps you secure the best possible terms.

Economic factors: The Federal Reserve's monetary policy sets the baseline. The December 2025 FOMC projections show PCE inflation at 2.9% for 2025, with the federal funds rate projected at 3.6%. While the Fed doesn't directly set mortgage rates, its policies influence the 10-year Treasury yield, which serves as the mortgage market's benchmark.

Loan limits: Fannie Mae and Freddie Mac are restricted by law to purchasing mortgages below the conforming loan limit. For 2025, this baseline is $806,500 for single-family properties in most U.S. counties, including Larimer County.

Personal factors: Your credit score remains the single most controllable variable. The minimum score for a conventional loan is 620, though borrowers with higher scores secure significantly better rates.

Why 20 Points on Your FICO Can Save You Thousands

The gap between adequate and excellent credit is measured in dollars. According to myFICO, "the difference between a FICO® score of 620 and 760 can often be tens of thousands of dollars over the life of your loan."

Optimal Blue data shows the average credit score for purchase loan borrowers is 737. If you're below that threshold, consider these steps before applying:

Pay down revolving balances to lower credit utilization

Catch up on any past-due payments

Check credit reports for errors 60-90 days before applying

Avoid opening new credit accounts

Conforming vs. Jumbo in Larimer County

For 2025, Larimer County follows the national baseline. Loans up to $806,500 for single-family properties qualify as conforming mortgages, eligible for purchase by Fannie Mae and Freddie Mac.

Jumbo loans exceed these limits and carry different requirements:

Requirement | Conforming | Jumbo |

|---|---|---|

Credit Score | 620+ | |

Down Payment | 3-20% | 10-15%+ |

Cash Reserves | 2-3 months | 6-12 months |

DTI Ratio | Up to 50% | 45% or lower |

Notably, jumbo rates now often track closely with conforming loan rates, eliminating the historical premium borrowers once paid for larger mortgages.

How to Shop, Compare & Lock Better Rates

Rate shopping is the highest-ROI activity in the mortgage process. The Consumer Financial Protection Bureau found that homebuyers can save $600 to $1,200 per year by comparing offers from multiple lenders.

Step 1: Request multiple Loan Estimates. Lenders must provide a Loan Estimate within three business days of receiving your application. The CFPB advises to "make it your goal to compare at least three loan offers from different lenders."

Step 2: Use the 45-day window. Multiple credit inquiries within a 45-day period count as a single inquiry on your credit report. This rule exists specifically to encourage rate shopping.

Step 3: Negotiate. As the CFPB notes, "Negotiating can save you money. Your best bargaining chip is usually having Loan Estimates from other lenders in hand." (CFPB)

Step 4: Lock strategically. A Freddie Mac study found buyers who got quotes from at least four lenders saved up to $1,200 annually.

Decode the Loan Estimate in 5 Minutes

The Loan Estimate standardizes comparison shopping, but knowing where to look matters.

Focus on these sections:

Interest rate: Compare rates issued on the same day, since rates change daily

Origination charges: These are upfront fees charged by your lender

Lender credits: Rebates that offset closing costs but may mean a higher rate

Five-year cost: On average, borrowers keep a mortgage about five years before moving or refinancing

Watch for red flags: Be cautious of "no closing cost" loans. The CFPB warns that "loans with 'no closing costs' aren't free. Some lenders advertise loans with 'no closing costs,' but the catch is the loan has higher monthly payments." (CFPB)

Which Loan Type Cuts Costs in Colorado--Conventional, VA or HELOC?

Different loan products serve different borrower profiles. Choosing the right structure can reduce your total cost substantially.

Conventional loans: The standard option for borrowers with solid credit and stable income. Require a minimum 620 credit score and offer competitive rates for those who can put 20% down.

VA loans: Veterans and active-duty service members have access to some of the lowest rates available. Current 30-year VA loans average 6.12% for refinances, with no down payment required in most cases.

HELOCs: A Home Equity Line of Credit lets you borrow against your home's equity, providing flexible access to cash for renovations, debt consolidation, or anything else. HELOCs preserve your existing mortgage rate while accessing equity.

Jumbo loans: For properties exceeding the $806,500 conforming limit. While jumbo loans once carried premium rates, they now often track closely with conforming loans.

When a Colorado HELOC Beats a Cash-Out Refi

Homeowners sitting on substantial equity face a choice: cash-out refinance or HELOC. The math often favors HELOCs in today's environment.

Speed: Digital HELOCs can provide cash in less than two weeks, significantly faster than traditional refinance timelines.

Rate preservation: HELOCs allow you to access equity without refinancing your existing low-rate mortgage. If you locked in a rate below 5% during 2020-2021, a HELOC preserves that advantage.

Current HELOC rates in Colorado: Ent Credit Union reports variable-rate HELOCs from 7.50% to 9.75% and standard-rate HELOCs from 8.24% to 10.74%. While higher than first mortgages, these rates apply only to the amount borrowed, not your entire loan balance.

Key consideration: HELOCs tend to have low interest rates, usually close to those of mortgage loans, but the trade-off is variable rate risk during the draw period.

When Should You Refinance Your Fort Collins Home?

Refinancing makes sense when the numbers work and the timing aligns with your goals. A refinance replaces your current mortgage with a new one at a lower rate or better terms to save you money.

The traditional rule: Consider refinancing when you can reduce your rate by 1 to 2 percentage points, depending on your remaining loan term and how long you plan to stay.

Current opportunity: Freddie Mac's Chief Economist notes that "the average 30-year fixed-rate mortgage has remained within a narrow 10-basis point range over the last two months." (Freddie Mac)

VA refinance example: For Colorado veterans with 7% loans, the math is compelling. Current VA refinance rates around 6.12% mean substantial savings. According to Chestnut's analysis, "at 7%, you'll pay approximately $627,000 in interest over 30 years. At 6.12%, that drops to about $534,000: a lifetime savings of $93,000."

Break-even calculation: Divide your closing costs by your monthly savings to find your break-even point. If you plan to stay beyond that date, refinancing likely makes sense.

Rate Forecast: What Experts See for 2026 and Beyond

Predicting mortgage rates remains imprecise, but major forecasters provide directional guidance.

Current snapshot: The 30-year fixed averaged 6.21% as of December 18, 2025, down from 6.72% a year earlier. This half-percent decline has already stimulated buyer activity.

2026 projections:

Source | 2025 Year-End | 2026 Projection |

|---|---|---|

6.4% | 5.9% | |

Major agency average | -- |

Fannie Mae economists expect mortgage rates to dip below 6% by the end of 2026. However, forecasters acknowledge uncertainty. As one industry expert notes, "Everyone expected upper-5% to low-6% rates this year, and that's not how things ended up." (The Mortgage Reports)

The Fed's role: FOMC projections show the federal funds rate declining from 3.6% in 2025 to 3.1% by 2027. While mortgage rates don't move in lockstep with the Fed, this trajectory suggests continued downward pressure.

Key takeaway: Waiting for significantly lower rates carries risk. Rates may decline modestly, but the timing and magnitude remain uncertain.

Key Takeaways for Securing Fort Collins' Best Deal

The path to the best mortgage rate in Fort Collins combines preparation, comparison, and timing:

Optimize your credit score. The spread between a 620 and 760 FICO score can mean tens of thousands in lifetime interest costs.

Shop aggressively. Request Loan Estimates from at least four lenders within a 45-day window. Borrowers who do save up to $1,200 annually.

Understand your loan limits. Larimer County follows the $806,500 conforming limit for 2025. Staying below this threshold opens access to the most competitive conventional rates.

Consider all loan types. VA loans, HELOCs, and conventional mortgages each serve different needs. The right structure can save more than rate alone.

Don't wait for perfection. Rates sit near multi-year lows. Trying to time the absolute bottom often costs more than it saves.

For Fort Collins buyers ready to act, Chestnut's AI-powered platform offers a streamlined path to competitive rates. The technology analyzes offers from over 100 lenders, with borrowers typically seeing rate savings of 0.5% or more compared to traditional shopping methods. Combined with instant quotes in under two minutes and $85 billion in mortgages powered, Chestnut delivers the efficiency and savings that today's Fort Collins market demands.

Frequently Asked Questions

What are the current average mortgage rates in Fort Collins, CO?

As of December 18, 2025, the average 30-year fixed mortgage rate in Fort Collins is 6.52%, which is lower than the national average of 6.76%.

How can I improve my chances of getting a better mortgage rate?

Improving your credit score is crucial. Pay down revolving balances, catch up on past-due payments, and check your credit report for errors before applying.

What is the conforming loan limit for Larimer County in 2025?

For 2025, the conforming loan limit for single-family properties in Larimer County is $806,500, aligning with the national baseline.

How does Chestnut Mortgage help in securing better rates?

Chestnut Mortgage uses AI technology to compare offers from over 100 lenders, often reducing borrower rates by approximately 0.5% compared to traditional methods.

What are the benefits of using a HELOC in Colorado?

A HELOC allows you to access your home's equity without refinancing your existing mortgage, preserving your current low rate while providing flexible cash access.

Sources

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://www.fhfa.gov/news/news-release/fhfa-announces-conforming-loan-limit-values-for-2025

https://www.redfin.com/city/7006/CO/Fort-Collins/housing-market

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20251210.pdf

https://www.bankrate.com/mortgages/improve-credit-before-mortgage/

https://www.myfico.com/loancenter/mortgage/step1/getthescores.aspx

https://www.consumerfinance.gov/owning-a-home/compare/request-and-review-multiple-loan-estimates/

https://files.consumerfinance.gov/f/documents/cfpbshoppingforamortgage.pdf

https://www.consumerfinance.gov/owning-a-home/compare/compare-loan-estimates/

https://www.ent.com/personal/loans/home-equity-lines-of-credit/

https://freddiemac.gcs-web.com/news-releases/news-release-details/mortgage-rates-drop-slightly-1