Best Mortgage Rates in Erie CO

Erie CO mortgage rates currently average 6.09% for 30-year fixed loans, slightly below the national 6.15% rate. Chestnut's AI platform helps local buyers save 0.5% or more by comparing offers from over 100 lenders in real time, delivering quotes in under two minutes versus days with traditional banks.

At a Glance

• Current 30-year fixed rates in Colorado average 6.09%, down from 6.91% a year ago according to Freddie Mac data

• Chestnut's AI technology compares 100+ lenders simultaneously, identifying rate spreads up to 0.86% between lenders for identical borrower profiles

• Erie buyers can stack competitive rates with Colorado's CHFA assistance programs and the town's affordable housing initiatives for families earning under $146,000

• Federal Reserve policy and Colorado housing legislation like HB24-1304 are creating more favorable conditions for 2026 homebuyers

• Traditional lenders quote only from their own portfolios while AI-powered platforms scan the entire market in seconds

• Rate forecasts project mortgage rates to remain between 6.0-6.5% through 2026, making rate comparison critical for maximizing savings

Homebuyers scanning for the best mortgage rates in Erie CO need fresh data and smart tech. Local rates often diverge from statewide Colorado averages based on property values, loan types, and lender competition. Chestnut's AI platform consistently undercuts typical market rates by comparing offers from over 100 lenders in real time, helping Erie buyers secure financing that traditional shopping methods simply cannot match.

Why Do Mortgage Rates Matter More Than Ever in Erie, Colorado?

Even a fraction of a percentage point can translate into thousands of dollars over the life of a home loan. For Erie buyers, understanding how local rates compare to broader benchmarks is the first step toward smarter financing.

As of late December 2025, Freddie Mac's Primary Mortgage Market Survey reports the national 30-year fixed-rate mortgage averaging 6.15%, with the 15-year fixed at 5.44%. These figures are down meaningfully from the 6.91% and 6.13% recorded a year earlier, offering a welcome reprieve for prospective homeowners.

Colorado-specific data from Freddie Mac research echoes this trend, with statewide averages hovering near the national benchmarks. However, individual quotes in Erie can land above or below these yardsticks depending on credit profile, down payment, and loan product.

Key takeaway: Rates have improved year over year, but locking in the best deal still requires comparing multiple lenders.

What Are the 2026 Colorado and National Mortgage Rates?

Before requesting quotes, buyers benefit from knowing where the market stands. The table below summarizes current averages and near-term projections.

Metric | Current Average | Year-Ago Average | 2026 Forecast |

|---|---|---|---|

30-Year Fixed (National) | 6.15% | 6.91% | ~6.2% |

15-Year Fixed (National) | 5.44% | 6.13% | ~5.4% |

30-Year Fixed (Colorado) | 6.09% | -- | 6.0–6.5% |

15-Year Fixed (Colorado) | 5.18% | -- | -- |

Sources: Freddie Mac PMMS, LendingTree Colorado rates, Fannie Mae Economic Developments

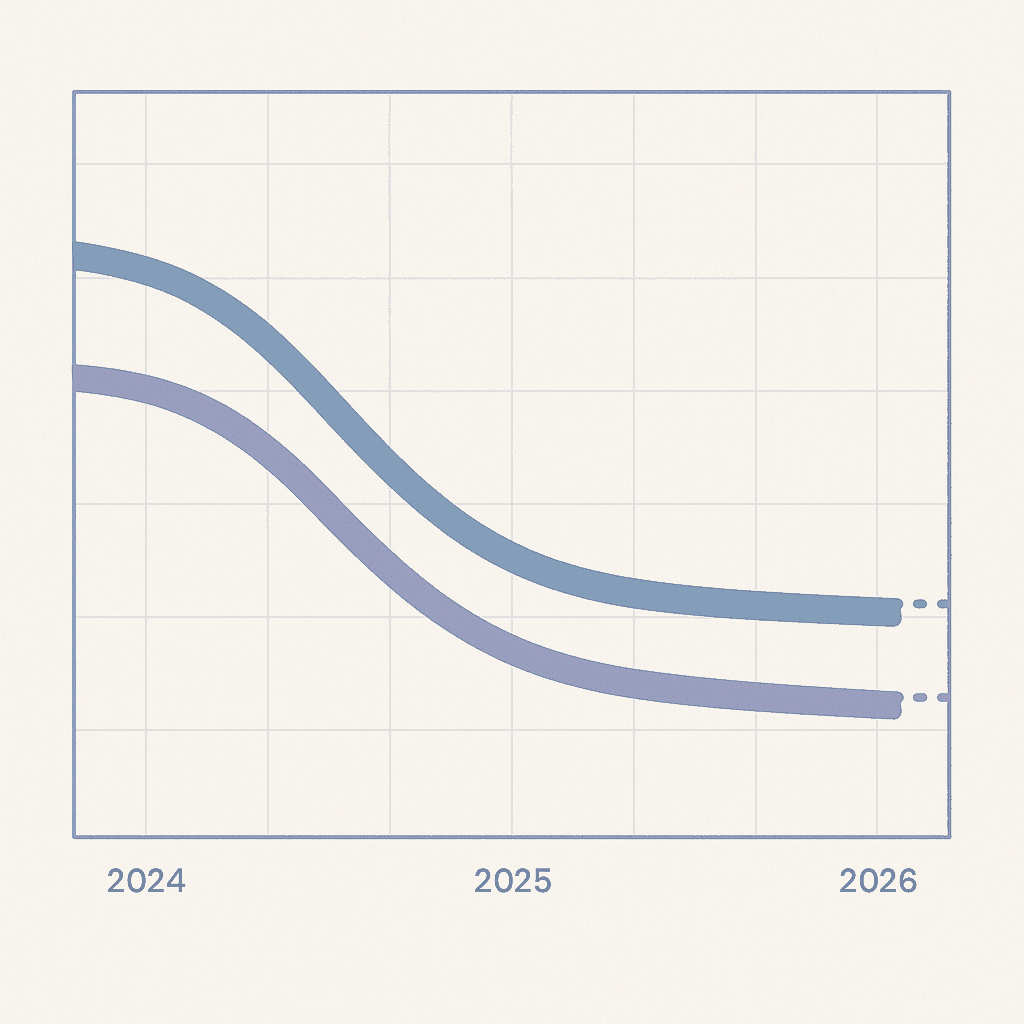

Fannie Mae projects mortgage rates to end 2025 and 2026 at approximately 6.3% and 6.2%, respectively, each a downward revision from earlier forecasts. Meanwhile, the Mortgage Bankers Association expects rates to remain between 6% and 6.5% through 2028.

Freddie Mac weekly trend lines

Week-to-week movements illustrate the market's volatility. According to Freddie Mac's archive:

December 18, 2025: 30-Year FRM 6.21% (down 0.01%), 15-Year FRM 5.47% (down 0.07%)

December 11, 2025: 30-Year FRM 6.22% (up 0.03%), 15-Year FRM 5.54% (up 0.10%)

December 4, 2025: 30-Year FRM 6.19% (down 0.04%), 15-Year FRM 5.44% (down 0.07%)

These small swings underscore why real-time rate monitoring matters when timing a lock.

What Forces Are Driving Erie Mortgage Rates in 2026?

Several macro and local levers shape what Erie borrowers ultimately pay.

Federal Reserve policy -- The Fed's benchmark rate influences short-term borrowing costs, which ripple into mortgage pricing.

Inflation expectations -- Persistent inflation keeps long-term Treasury yields elevated, pressuring mortgage rates.

Housing supply constraints -- Limited inventory in Erie and the broader Denver-Boulder corridor sustains home prices.

FinTech competition -- Technology-driven lenders process applications about 20% faster than traditional counterparts, increasing pricing pressure across the industry.

State housing legislation -- Recent Colorado laws aim to expand housing options and reduce costs.

Federal Reserve & inflation outlook

"It's a reminder that mortgage rates don't follow Fed cuts directly, and they respond to broader expectations around inflation, employment and long-term economic strength," notes Samir Dedhia, CEO of One Real Mortgage, in a Bankrate analysis.

The MBA forecasts U.S. economic growth to slow to 1.6% in 2025 with a 35% recession probability. These crosscurrents mean rates may stay range-bound rather than falling sharply.

Colorado housing legislation impact

Effective July 1, 2025, HB24-1304 eliminates unnecessary parking requirements that historically inflated construction costs. Additionally, HB24-1152 grants Coloradans the freedom to build accessory dwelling units, potentially boosting supply and easing price pressure over time.

Chestnut vs. Other Erie Lenders: A Data-Backed Look

How do local options stack up? The table below contrasts key features.

Lender Type | Rate Comparison Scope | Quote Speed | Special Programs |

|---|---|---|---|

Chestnut | 100+ lenders | Under 2 minutes | AI-optimized matching, rate monitoring |

Erie Bank | In-house portfolio only | Standard (days) | First-time buyer, First Responders |

Local Credit Unions | Limited network | Varies | Member discounts, low fees |

Sources: Chestnut, Erie Bank Mortgages, LendingTree

The platform's AI engine compares rates across more than 100 lenders in real time, creating opportunities that simply don't exist when working with a single bank or credit union.

Where Erie Bank stands

Erie Bank offers conventional mortgages with both fixed-rate and adjustable-rate options. Niche programs include a First Responders Mortgage for firefighters, EMTs, paramedics, and police officers, as well as a First Time Home Buyer program featuring low down payments, waived processing fees, and no PMI requirement.

However, Erie Bank quotes only from its own balance sheet. Borrowers miss the broader market scan that reveals where pricing truly stands.

Local credit-union offers

Credit unions sometimes market fee reductions and member discounts. LendingTree advises gathering loan estimates from three to five lenders to ensure competitive pricing. However, their limited lender networks may leave money on the table compared to AI-powered aggregators.

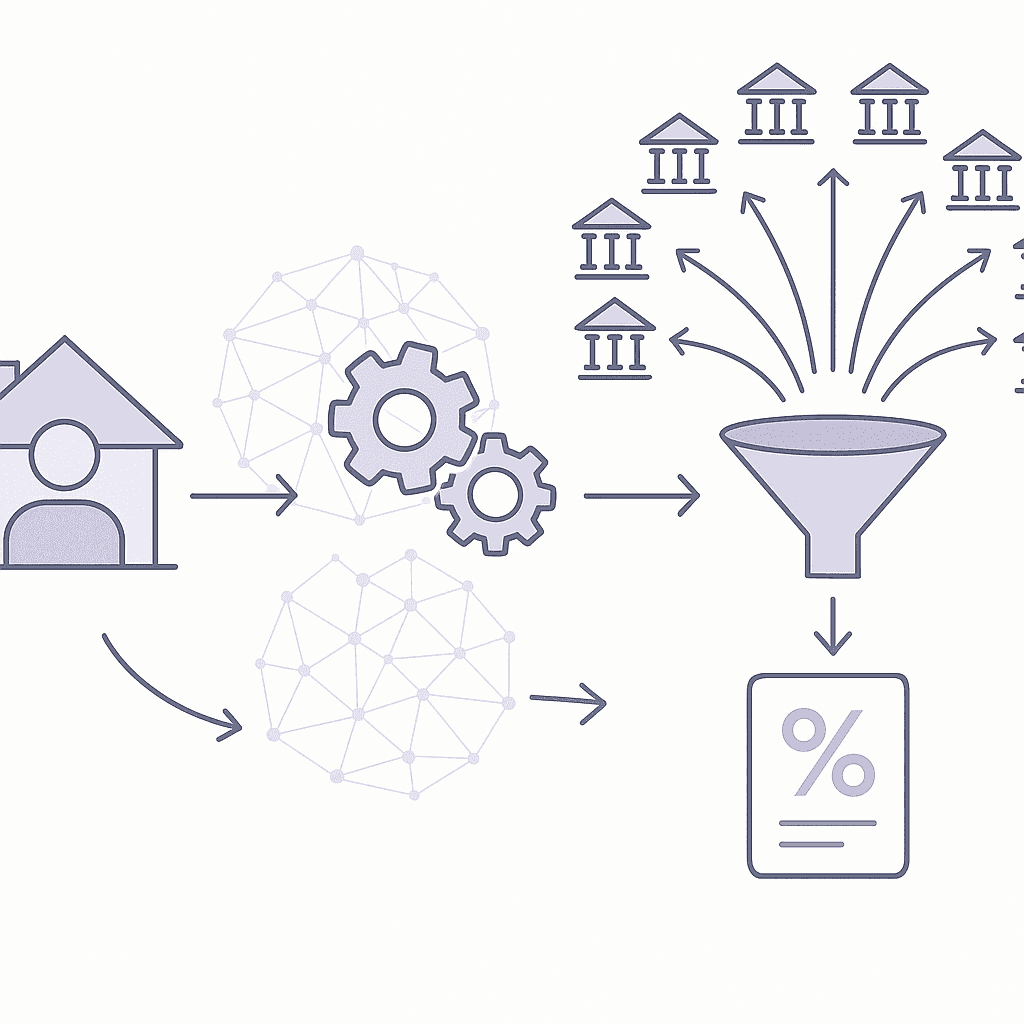

How Chestnut Locks Erie's Lowest Rates—Powered by AI

The platform's proprietary technology transforms how Erie buyers shop for mortgages.

Broad lender network: Real-time API connections with over 100 lenders surface offers traditional brokers miss.

Speed: Instant quotes arrive in under two minutes, compared to days with conventional lenders.

Savings: "Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods." -- Chestnut

Research from the National Bureau of Economic Research confirms that FinTech lenders process applications about 20% faster than traditional lenders, without increasing default rates. That efficiency translates into lower overhead and better pricing for borrowers.

Key takeaway: AI-driven comparison shopping delivers measurable rate advantages that manual methods cannot replicate.

How Do You Get Pre-Approved with Chestnut in Under 2 Minutes?

Securing a pre-approval through the platform is straightforward. Follow this checklist:

Visit the Chestnut platform -- Navigate to the home purchase page or HELOC section if tapping equity.

Enter basic information -- Provide details on income, credit profile, and desired loan amount.

Receive instant quotes -- The AI scans 100+ lenders and returns personalized offers in under two minutes.

Lock your rate -- Use the platform's rate monitoring to time your lock strategically.

Complete documentation -- Upload supporting documents; digital HELOCs can fund in less than two weeks.

Whether you're purchasing a new home, refinancing, or exploring a HELOC in Erie CO, the automation slashes both time and cost.

Which Assistance Programs Can Stack with Chestnut's Low Rate?

Colorado offers several down payment and affordability programs that pair well with competitive financing.

CHFA loans and grants -- The CHFA program connects first-time buyers to affordable loans plus down payment or closing cost assistance.

Town of Erie affordable housing -- The Cheesman Street Residences project provides 35 deed-restricted homes for families earning less than $146,000 (family of four).

Housing Hub Colorado -- A new statewide initiative aims to streamline applications for housing tax credits and public funds, with a common application targeted for 2026.

Layering these programs on top of AI-optimized rates can significantly reduce out-of-pocket costs.

The Bottom Line for Erie Homebuyers

Mortgage rates in Erie CO have improved from their 2024 highs, yet locking in the best deal still demands diligent comparison shopping. Traditional lenders quote only from their own portfolios, leaving borrowers without visibility into the broader market.

Chestnut changes that equation. By scanning 100+ lenders in real time and delivering quotes in under two minutes, the platform consistently helps buyers save approximately 0.5% compared to conventional methods. Pair that advantage with Colorado's down payment assistance programs, and Erie homeownership becomes more attainable than ever.

Ready to see your personalized rate? Get started with Chestnut today.

Frequently Asked Questions

How does Chestnut's AI platform help Erie homebuyers?

Chestnut's AI platform compares offers from over 100 lenders in real time, helping Erie buyers secure financing that traditional methods cannot match. This technology-driven approach often results in rate savings of approximately 0.5%.

What are the current mortgage rate trends in Erie, Colorado?

As of late December 2025, national 30-year fixed-rate mortgages average 6.15%, with Colorado-specific rates hovering near these benchmarks. Erie rates can vary based on credit profiles and loan products.

How do Erie Bank and local credit unions compare to Chestnut?

Erie Bank offers conventional mortgages with niche programs but only quotes from its own balance sheet. Local credit unions may offer fee reductions but have limited lender networks. Chestnut's AI scans over 100 lenders, providing broader market insights.

What factors influence mortgage rates in Erie, CO?

Mortgage rates in Erie are influenced by Federal Reserve policies, inflation expectations, housing supply constraints, and state housing legislation. These factors collectively shape the rates borrowers pay.

How can Erie homebuyers benefit from Colorado's assistance programs?

Colorado offers programs like CHFA loans and grants, which provide down payment and closing cost assistance. These can be combined with Chestnut's competitive rates to reduce out-of-pocket costs for Erie homebuyers.