Best Mortgage Rates in Denver CO

Denver mortgage rates currently average 6.09% APR for 30-year fixed loans, slightly below Colorado's 6.27% statewide average and the national 6.21% benchmark. With median home prices at $590,000, securing competitive rates through comparison shopping across multiple lenders can save buyers thousands over the loan term.

Key Facts

• Current Denver rates: 30-year fixed at 6.09% APR, 15-year fixed at 5.44% APR

• Rate trends: Down 54 basis points from one year ago when 30-year rates averaged 6.72%

• Market context: Rates remain below the 40-year historical average of 7.2%

• Savings potential: Comparison shopping saves up to $1,200 annually; Chestnut users typically see 0.5% rate reductions

• Closing costs: Expect 2-5% of loan amount, with Colorado averaging 0.7% of sale price

• Best practices: Compare at least three lenders within 45 days to minimize credit impact

Denver's red-hot housing scene means the hunt for the best mortgage rates in Denver can save or sink thousands. With median home prices hovering around $590,000 and rates in the mid-6% range, every basis point matters. This guide shows Mile-High buyers exactly where rates sit today, why they move, and the smartest ways to lock a low payment in 2025.

Why Should Denver Homebuyers Track Mortgage Rates Daily?

Mortgage rates shift constantly, and in Denver's recalibrating market, that volatility can translate into real money. A difference of just 0.25% on a $500,000 loan adds up to thousands over a 30-year term.

Here's why daily tracking pays off:

Rates move with national benchmarks. The 30-year fixed-rate mortgage averaged 6.21% as of December 18, 2025, down from 6.72% a year ago. That 0.5% drop puts significant savings within reach for prepared buyers.

Denver buyers have leverage. Homes are spending an average of 68 days on market, up 12% from last October, with buyers closing at roughly 5.7% below list. This negotiating power pairs well with rate-shopping discipline.

Colorado rates can vary from national averages. Statewide, the 30-year fixed sits at 6.27%, while Denver-specific trackers show 6.09% APR. Local lender competition and inventory levels influence these differences.

The takeaway: checking rates daily and comparing multiple lenders isn't optional in this market. It's the foundation of a smart purchase strategy.

What Are Today's Mortgage Rates in Denver Compared to Colorado and the U.S.?

Understanding where Denver fits within the broader rate landscape helps you benchmark any quote you receive.

Benchmark | 30-Year Fixed | 15-Year Fixed | Source |

|---|---|---|---|

U.S. National Average | 6.21% | 5.47% | |

Colorado Statewide | 6.27% | 5.67% | |

Denver Metro (APR) | 6.09% | 5.44% |

Denver's 30-year fixed APR of 6.09% runs two basis points lower than a week ago and 54 basis points lower than a year ago. That year-over-year improvement reflects both Federal Reserve policy shifts and competitive local lending.

For context, today's rates remain much lower than 7.2%, the 40-year historical average. While current levels may feel elevated compared to the pandemic-era lows, they represent a relatively favorable borrowing environment by long-term standards.

Key takeaway: Use these benchmarks when evaluating quotes. If a lender offers you 6.50% on a 30-year fixed in Denver, you know you're above market and should keep shopping.

Which 7 Factors Drive Your Mortgage Rate in Denver?

Lenders price risk. Understanding the variables they weigh helps you negotiate from strength.

Credit score. "In general, consumers with higher credit scores receive lower interest rates than consumers with lower credit scores," according to the Consumer Financial Protection Bureau. FICO scores of 740 or higher unlock the best pricing.

Down payment. "A larger down payment means a lower interest rate, because lenders see a lower level of risk when you have more stake in the property," the CFPB notes.

Debt-to-income ratio. Lenders typically prefer DTI below 36%, though conventional loans may approve up to 45%.

Loan term. Shorter terms carry lower rates. A 15-year mortgage at 5.47% costs less in interest than a 30-year at 6.21%, though monthly payments run higher.

Loan type. Conventional, FHA, VA, and jumbo products each carry different rate structures.

Home location. Many lenders offer slightly different rates by state, and even metro-level competition can influence pricing.

Discount points. Paying upfront fees to "buy down" your rate can make sense if you plan to stay long-term. One point typically costs 1% of the loan and reduces the rate by about 0.25%.

Key takeaway: "To get the best mortgage rate, boost your credit score, lower your debt and save up a sizable down payment," advises Bankrate.

30-Year vs. 15-Year vs. Adjustable-Rate: Which Mortgage Fits Denver Buyers?

Choosing the right loan structure is as important as finding the lowest rate. Here's how the main options stack up.

30-Year Fixed Mortgage

Current Denver-area rate: Approximately 6.09% APR

Pros: Lower monthly payments, easier qualification, budget flexibility

Cons: Higher total interest over the loan's life

"A 30-year mortgage may give you more breathing room in your monthly budget, and it's generally easier to qualify for," Bankrate explains.

15-Year Fixed Mortgage

Current Denver-area rate: Approximately 5.44% APR

Pros: Significant interest savings, faster equity build

Cons: Higher monthly payments (often 30-60% more than a 30-year)

"Lenders almost always charge a lower interest rate—and a lower APR—for 15-year loans than 30-year loans," according to Bankrate.

Adjustable-Rate Mortgage (ARM)

Current 5/1 ARM rate: Approximately 6.51% APR in Colorado

Pros: Lower introductory rate for the fixed period

Cons: Rate can increase significantly after adjustment

"With a fixed-rate mortgage, the rate literally remains fixed: It carries the same interest rate and monthly payment for the entire life of the loan," while an ARM resets at preset intervals.

ARMs have grown more popular as buyers seek payment relief. Applications rose from 3.1% in early 2022 to 9.3% by October 2025. They work best for buyers planning to sell or refinance before the fixed period ends.

FHA & CHFA Programs for Denver Borrowers

Government-backed and state-sponsored options expand access for buyers who don't fit conventional molds.

FHA Loans:

Require as little as 3.5% down payment with a 580+ credit score

Allow higher DTI ratios, often up to 43-50%

Available in 15- and 30-year terms

Require mortgage insurance for the life of the loan

CHFA Programs:

The Colorado Housing and Finance Authority offers programs specifically designed for first-time buyers:

Down payment assistance grants up to $25,000 or 3% of the loan amount (whichever is less)

Fixed-rate financing through FirstStep and SmartStep programs

Required homebuyer education courses

Income and purchase price limits apply

These programs can make Denver homeownership accessible even when conventional options fall short.

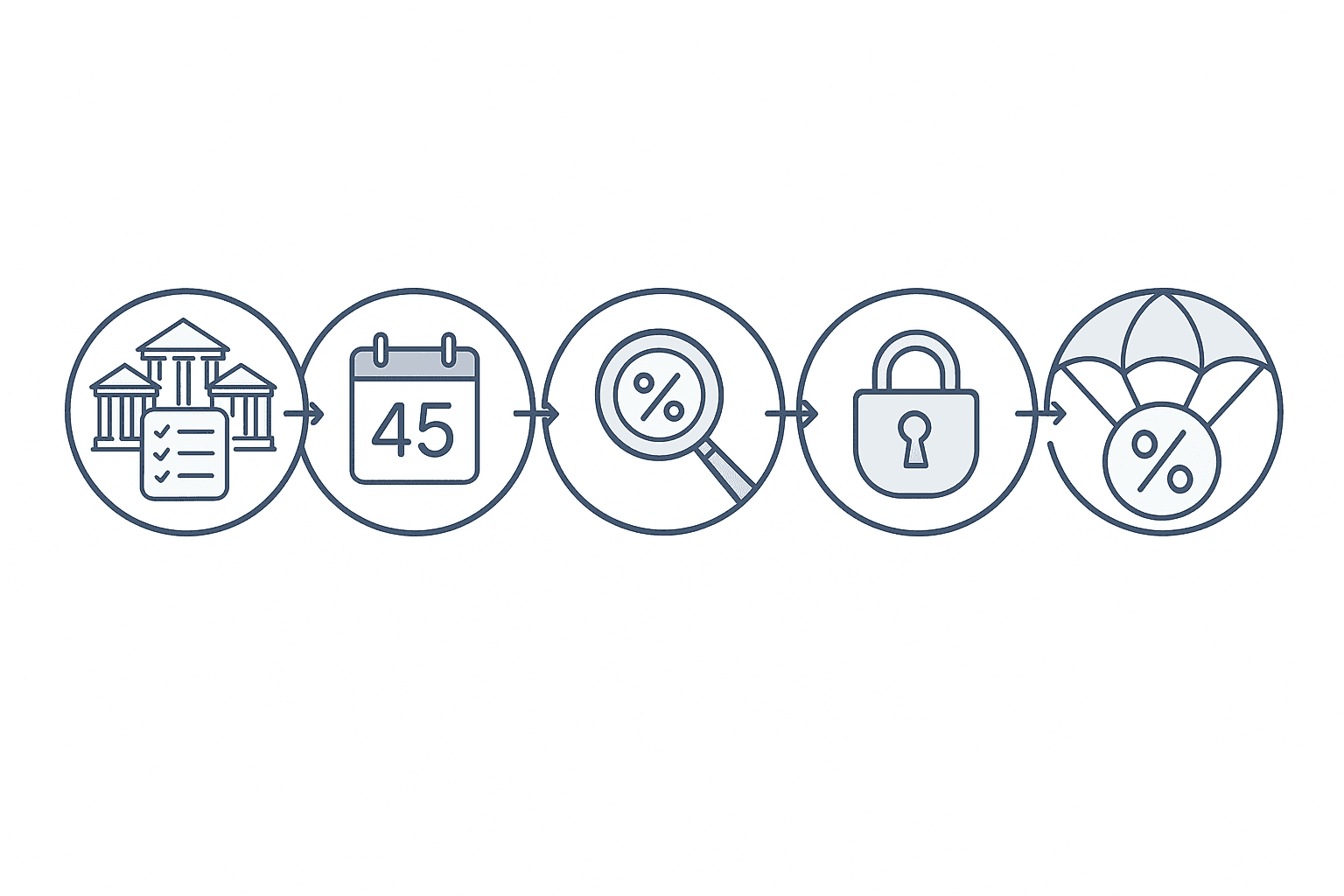

How Do You Shop Lenders and Lock the Right Rate?

Securing the best rate requires a systematic approach. Follow these steps:

Step 1: Get preapproved with multiple lenders.

"Time and again, research shows that comparison-shopping for a mortgage lender can help you obtain the best possible loan terms. Compare at least three offers," advises Bankrate. The CFPB recommends applying with at least three lenders.

Step 2: Keep applications within a 45-day window.

Multiple credit inquiries for mortgage shopping count as a single inquiry if completed within 45 days, minimizing credit score impact.

Step 3: Compare APRs, not just rates.

The annual percentage rate includes both the interest rate and lender fees, giving you a more realistic cost comparison.

Step 4: Lock your rate at the right time.

"A mortgage rate lock keeps the interest rate on the loan from changing for a certain period of time, ensuring you won't pay more if rates rise before you finalize the loan," explains Bankrate. Typical lock periods range from 30 to 120 days.

"Locking now protects against further increases and provides certainty, while trying to time the market can expose borrowers to unexpected and potentially costly rate movements," notes Dr. Timothy Savage of NYU, speaking to CBS News.

Step 5: Consider float-down options.

Some lenders offer float-down provisions that let you capture a lower rate if markets improve after locking. These typically carry fees and conditions.

The payoff for this effort is substantial. Research from Freddie Mac shows that applying with multiple lenders can save up to $1,200 annually.

Where Chestnut's AI Finds Extra 0.5% Savings

Traditional rate shopping is time-consuming. Calling multiple lenders, comparing quotes, and tracking daily fluctuations can stretch over weeks.

Chestnut approaches this differently. The platform's AI engine compares rates from over 100 lenders simultaneously, delivering personalized quotes in under two minutes. "Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods," according to Chestnut's research.

The system goes beyond simple rate comparison. It analyzes individual borrower profiles, including credit score, income, debt-to-income ratio, and loan specifics, to identify lenders most likely to offer competitive terms for each situation.

For Denver buyers navigating a market where every fraction of a percentage point counts, this automated approach offers both speed and savings. With over $85 billion in mortgage volume processed, the platform combines AI efficiency with proven lending expertise.

Estimating Closing Costs & Fees in Colorado

Your mortgage rate is only part of the total cost picture. Closing costs add a significant upfront expense.

Cost Category | Typical Range | Notes |

|---|---|---|

Total Closing Costs | 2% - 5% of loan amount | Varies by location and loan type |

Colorado Average | 0.7% of sale price | Lower than neighboring states |

National Average | For single-family home purchases |

For a Denver home at the median price of $590,000, expect closing costs between $11,800 and $29,500 depending on your loan structure and negotiated terms.

Common buyer-paid closing costs include:

Loan origination fees

Appraisal fees ($300-$500)

Home inspection fees ($300-$500)

Title insurance (lender's policy)

Prepaid property taxes and insurance

Discount points (if purchasing)

Closing costs can sometimes be negotiated. Sellers offering concessions have found the most success in today's market, and buyers should explore whether seller credits can offset these expenses.

Denver Housing Market Trends Shaping Rates in 2025

Understanding local market dynamics helps you time your purchase and negotiate effectively.

Current Denver Metro snapshot:

Median closed price: $590,000 (down 1% year-over-year)

Median days on market: 35 days (up 7 days from last year)

Closed listings: 3,448 in October (down 2%)

Pending listings: Up 3%, signaling buyer activity

The market shows typical seasonal cooling rather than systemic weakness. Inventory has stabilized at about 4 months of supply statewide, creating more balanced negotiation dynamics.

What this means for buyers:

Longer days on market give you time to shop rates carefully

Seller concessions are more common, potentially offsetting closing costs

Mid-6% rates combined with stabilizing prices create a workable affordability equation for prepared buyers

"With interest rates hovering in the mid-6% range and cost pressures still influencing affordability, value and pricing precision continue to drive buyer decisions," notes the Colorado Association of Realtors.

Key Takeaways for Denver-Area Rate Shoppers

Securing the best mortgage rate in Denver requires preparation, comparison, and timing. Here's your action plan:

Know the benchmarks. Denver's 30-year fixed APR sits around 6.09%, below both state and national averages.

Optimize your profile. Boost your credit score, lower your DTI, and save for the largest down payment you can manage.

Compare at least three lenders. This single step can save up to $1,200 annually.

Understand your loan options. 30-year fixed offers payment flexibility; 15-year saves on interest; ARMs provide short-term relief.

Lock strategically. Once you're under contract, locking protects against rate increases while you close.

Factor in total costs. Closing costs of 2-5% add significantly to your upfront expenses.

Chestnut simplifies this process by comparing offers across 100+ lenders instantly, helping Denver buyers find rates that outperform traditional shopping methods. With proprietary technology designed to cut through delays and uncover savings, the platform offers a modern approach to mortgage shopping in a market where every basis point matters.

Frequently Asked Questions

Why should Denver homebuyers track mortgage rates daily?

Tracking mortgage rates daily is crucial in Denver's volatile market, as even a 0.25% rate change on a $500,000 loan can save thousands over a 30-year term. Rates fluctuate with national benchmarks and local market conditions, making daily monitoring essential for securing the best deal.

How do Denver mortgage rates compare to Colorado and national averages?

Denver's 30-year fixed APR is approximately 6.09%, which is lower than both the Colorado statewide average of 6.27% and the U.S. national average of 6.21%. This makes Denver a competitive market for mortgage rates, offering potential savings for buyers.

What factors influence mortgage rates in Denver?

Key factors include credit score, down payment size, debt-to-income ratio, loan term, loan type, home location, and discount points. Improving these factors can help secure better rates, as lenders assess risk based on these criteria.

What are the benefits of using Chestnut's AI for mortgage rate shopping?

Chestnut's AI compares rates from over 100 lenders, providing personalized quotes in under two minutes. This approach often results in rate savings of 0.5% or more compared to traditional methods, offering both speed and cost efficiency for Denver buyers.

What are typical closing costs for a mortgage in Denver?

Closing costs in Denver typically range from 2% to 5% of the loan amount. For a median-priced home of $590,000, this translates to $11,800 to $29,500, depending on the loan structure and negotiated terms. Buyers should consider these costs when budgeting for a home purchase.

Sources

https://www.bankrate.com/mortgages/todays-rates/mortgage-rates-for-monday-december-8-2025/

https://www.bankrate.com/real-estate/closing-costs-in-colorado/

https://www.nerdwallet.com/mortgages/mortgage-rates/colorado/denver

https://www.nerdwallet.com/mortgages/mortgage-rates/colorado

https://www.consumerfinance.gov/about-us/blog/7-factors-determine-your-mortgage-interest-rate/

https://www.nerdwallet.com/mortgages/learn/how-to-get-the-best-mortgage-rate

https://www.bankrate.com/mortgages/how-to-get-the-best-mortgage-rate/

https://www.cohomesandloans.com/fha-pre-approval-requirements/

https://www.chfainfo.com/getattachment/75c6b7ac-958f-438e-b4e4-649391c92a49/CHFASellersGuide.pdf

https://www.bankrate.com/mortgages/what-is-mortgage-rate-lock/

https://www.cbsnews.com/news/what-to-consider-about-mortgage-rate-locks-now-according-to-experts/

https://chestnutmortgage.com/resources/how-mortgage-rates-work-(and-how-to-get-the-best-one