Best Mortgage Rates in Broomfield CO

Current mortgage rates in Broomfield average around 6.15-6.52%, but Chestnut's AI technology typically delivers 0.5% lower rates by comparing over 100 lenders simultaneously. Their platform provides instant quotes in under two minutes without impacting credit scores, often securing rates in the low-6% range for qualified borrowers.

Key Facts

• National 30-year rates averaged 6.15% at year-end 2025, down from 6.91% a year earlier

• Colorado rates reached 6.52% in September 2025, slightly above national averages

• Chestnut's AI compares 100+ lenders simultaneously, typically saving borrowers 0.5% on rates

• Fannie Mae forecasts rates will ease to 5.9% by late 2026

• Denver-area housing inventory jumped 21.81% month-over-month in April 2025, affecting local pricing dynamics

• Colorado homeowners withdrew $55.9 billion in equity via HELOCs in Q3 2025, the highest quarterly total in three years

Landing the best mortgage rates in Broomfield CO can shave tens of thousands of dollars off your lifetime interest costs. Whether you are buying your first home near the Flatirons Vista or refinancing an existing property, even a fraction of a percentage point translates into meaningful monthly savings. This guide walks through what drives local rates, how AI technology is reshaping the lending landscape, and why Chestnut consistently delivers pricing that outperforms traditional Broomfield mortgage lenders.

Why Are Broomfield Homebuyers Laser-Focused on Today's Mortgage Rates?

Mortgage rates directly determine how much house you can afford. A lower rate reduces your borrowing costs and increases your purchasing power, according to Freddie Mac.

As of late December 2025, the national 30-year fixed rate averaged 6.15%, down from 6.91% a year earlier. Colorado buyers faced slightly higher averages earlier in the fall, with state rates near 6.52% in September 2025. Even so, current borrowing costs sit at their lowest point in over a year.

Forecasters expect gradual relief ahead. Fannie Mae projects mortgage rates will end 2025 around 6.3% and ease to 5.9% by late 2026. For Broomfield buyers, that outlook underscores the value of locking a competitive rate now while remaining positioned to refinance if conditions improve.

Key takeaway: Even modest rate differences compound over a 30-year term, making aggressive rate shopping one of the highest-return activities in the homebuying process.

What Actually Moves Mortgage Rates in Broomfield?

Mortgage pricing reflects a blend of national economic forces and regional housing dynamics. Understanding these drivers helps you time your lock strategically.

Federal Reserve & Treasury Yields

Federal Reserve policy sets the baseline for borrowing costs. Fed Chair Jerome Powell recently cautioned that "A further reduction in the policy rate at the December meeting is not a foregone conclusion," signaling ongoing uncertainty (Chestnut Resources).

The 10-year Treasury bond serves as the mortgage market's north star. Currently yielding around 4.1%, Treasury movements ripple directly into mortgage pricing. When yields climb on inflation fears, rates follow; when economic data cools, rates often ease.

Front-Range Housing Supply

Local inventory also influences what lenders charge. Denver-Aurora-Lakewood active listings jumped 21.81% month-over-month in April 2025, a trend that spills into neighboring Broomfield. More supply can temper price appreciation, indirectly affecting loan-to-value calculations and the risk premiums lenders build into rates.

Realtor.com notes it has incorporated a new methodology for capturing housing inventory trends, so borrowers should watch for updated metrics when comparing year-over-year data.

How Does Chestnut Consistently Undercut Other Broomfield Mortgage Lenders?

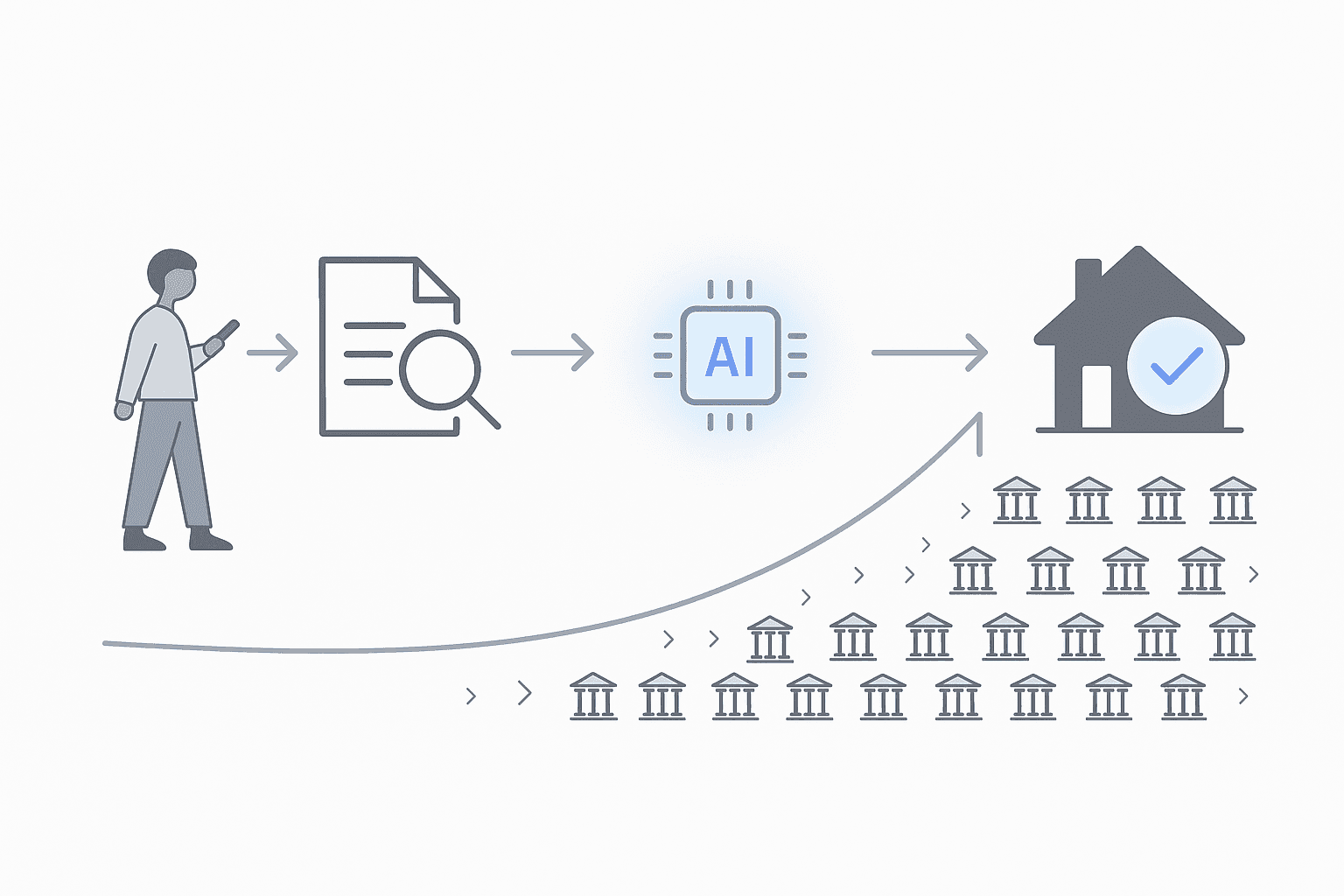

Chestnut's AI engine represents a fundamental shift from traditional mortgage shopping. While conventional approaches require borrowers to manually contact multiple lenders and compare disparate offers, Chestnut AI analyzes options across more than 100 lenders in real-time.

"Borrowers using Chestnut AI typically see rate savings of 0.5% or more compared to traditional shopping methods." (Chestnut Resources)

That half-point advantage can translate into substantial lifetime savings on a Broomfield purchase. The platform delivers instant quotes in under two minutes, letting you see comprehensive rate comparisons immediately without a hard credit pull.

Beyond speed, Chestnut's AI analyzes individual borrower profiles, including credit score, income, debt-to-income ratio, and down payment, to identify lenders most likely to offer competitive terms for your specific situation. The system also performs continuous rate monitoring, alerting you to favorable movements during your loan process.

Where Do Traditional Banks Fall Short?

Many national banks rely on legacy systems that limit how many lenders they can query and how quickly they can respond. Consider these observations from industry reviews:

One major online lender's rates averaged about 0.73 percentage points above the average prime offer rate in 2023, a gap that adds up over time.

Some banks require you to speak with a loan officer before receiving any quote, and post-closing servicing complaints are common.

Traditional platforms often lack the sophisticated AI-driven optimization found in more advanced systems, limiting their ability to surface specialty programs or lender incentives (Chestnut Resources).

Chestnut's network of more than 100 lenders creates opportunities that simply do not exist when working with a single bank or credit union.

Locking an AI-Optimized Rate in Under Two Minutes: Step-by-Step

Chestnut's soft-pull pre-approval process grabs your credit data in seconds, runs it through multiple automated underwriting engines, and compares pricing from 100+ lenders simultaneously. Here is how it works:

Enter basic information. No Social Security number required for the initial quote.

Receive a soft-pull credit analysis. The AI processes this data in under 15 seconds, identifying potential issues and flagging credit optimization opportunities.

Review real-time rate comparisons. Based on Q3 2025 performance data, Chestnut delivers results with an average processing time of 1 minute 47 seconds.

Select your preferred offer. The system provides instant quotes in under two minutes, allowing you to compare comprehensive options immediately.

E-sign and schedule a strategic rate lock. Chestnut's auto-refresh system includes intelligent rate lock recommendations based on market trend analysis.

For a deeper dive into how mortgage pricing works, visit Chestnut's guide on how mortgage rates work.

Can Refinancing or a HELOC Save Broomfield Homeowners Money in 2026?

Existing homeowners have options beyond purchase loans. Chestnut supports refinancing and HELOCs, monitoring live offers so you can access equity efficiently and lock at an opportune time.

Refinancing: A refinance replaces your current mortgage with a new one at a lower rate or better terms to save you money, according to Chestnut's refinance page. The platform's tech-driven approach trims weeks off the typical timeline by reducing paperwork and matching you with rates that traditional brokers might miss.

HELOC activity: Mortgage holders withdrew $55.9 billion of equity in Q3 2025, the highest quarterly total in three years. Colorado has seen some of the fastest growth in HELOC balances nationwide, with a 15% increase into Q1 2024.

Is a HELOC Right for You?

A HELOC is a revolving credit line, similar to a credit card, that leverages the equity you have built in your primary residence, explains SoFi. Common uses include renovations, debt consolidation, and education expenses.

Factor | Typical Range |

|---|---|

Draw period | 10 years |

Repayment period | 10 to 20 years |

Variable-rate HELOC (Ent Credit Union) | |

Standard-rate HELOC (Ent Credit Union) | |

Lowest starting rates in Colorado (2024) |

To qualify for favorable rates, prioritize building your credit score, maintain steady income, and keep your combined loan-to-value ratio at 85% or less. Chestnut offers clear terms and personalized options, unlike the one-size-fits-all approach of big banks, according to Chestnut's HELOC page.

Which Colorado Assistance Programs Can Lower Your Up-Front Costs?

Colorado Housing and Finance Authority (CHFA) offers several programs designed to reduce down payment and closing cost burdens:

Program | Assistance Amount | Key Requirements |

|---|---|---|

CHFA DPA Grant | Up to lesser of $25,000 or 3% of first mortgage | Does not impact DTI |

CHFA DPA Second Mortgage | Up to lesser of $25,000 or 4% of first mortgage | No monthly payments; repayment upon certain events |

First-generation homebuyer bonus | Up to $25,000 regardless of loan amount | Borrower and parents never owned a home |

Maximum debt-to-income limits are 50% with a mid-FICO of 620 to 659 and 55% with a mid-FICO of 660 or above. All borrowers must complete a CHFA-approved homebuyer education course.

Regulatory safeguards: Mortgage companies in Colorado must be registered on the Nationwide Multistate Licensing System. The Board of Mortgage Loan Originators can deny, suspend, or revoke registrations for companies that operate without proper licensing or engage in deceptive practices. Chestnut is fully licensed in Colorado, giving Broomfield buyers confidence in compliance and consumer protection.

Putting It All Together: Your Next Move in Broomfield

Broomfield buyers face a market where every basis point counts. National rates have retreated from 2024 highs, yet Colorado averages remain above the U.S. benchmark. The key to capturing savings lies in leveraging technology that compares offers at scale.

By leveraging proprietary AI technology, Chestnut compares offers from over 100 lenders to secure the most competitive rates, often reducing borrower rates by approximately 0.5%. With over $85 billion in mortgages processed and a 5.0 Google rating, Chestnut has established itself as a leader in delivering lower rates and exceptional service.

Ready to see what rate you qualify for? Get started with Chestnut and receive a personalized quote in under two minutes, with no impact to your credit score.

What are the best mortgage rates in Broomfield, CO right now?

Recent Freddie Mac data shows U.S. 30-year fixed rates averaged 6.15% at the close of 2025, while Colorado buyers faced roughly 6.52% in September 2025. Chestnut's AI platform typically trims about 0.50 percentage points by scanning 100+ lenders in real time, often producing quotes near the low-6 percent range for qualified Broomfield borrowers, all without a hard credit pull.

How do I lock the lowest mortgage rate in under two minutes?

Chestnut's soft-pull pre-approval grabs your credit data in seconds, runs it through multiple automated underwriting engines, and compares pricing from 100+ lenders simultaneously. The result: a fully documented, AI-optimized quote, often 0.5% below market, delivered in under two minutes without hurting your credit. From there, you can e-sign and schedule a strategic rate lock the moment markets dip.

Frequently Asked Questions

What are the current mortgage rates in Broomfield, CO?

As of late 2025, the national 30-year fixed rate averaged 6.15%, with Colorado rates slightly higher at 6.52%. Chestnut's AI platform often offers rates about 0.5% lower by comparing over 100 lenders.

How does Chestnut's AI technology help in securing better mortgage rates?

Chestnut's AI analyzes options from over 100 lenders in real-time, typically saving borrowers 0.5% compared to traditional methods. It provides instant quotes without a hard credit pull, optimizing rates based on individual borrower profiles.

What factors influence mortgage rates in Broomfield, CO?

Mortgage rates in Broomfield are influenced by national economic factors like Federal Reserve policies and Treasury yields, as well as local housing supply dynamics. Understanding these can help in timing your rate lock strategically.

How can I lock a mortgage rate quickly with Chestnut?

Chestnut offers a soft-pull pre-approval process that provides AI-optimized rate comparisons from over 100 lenders in under two minutes, allowing you to lock in a competitive rate without impacting your credit score.

What refinancing options does Chestnut offer for Broomfield homeowners?

Chestnut supports refinancing and HELOCs, offering tech-driven solutions that reduce paperwork and match homeowners with competitive rates, potentially saving money and accessing equity efficiently.

Sources

https://chestnutmortgage.com/resources/chestnut-ai-mortgage-pre-approval-under-2-minutes-2025

https://www.fanniemae.com/data-and-insights/forecast/economic-developments-october-2025

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://chestnutmortgage.com/resources/how-mortgage-rates-work-(and-how-to-get-the-best-one

https://chestnutmortgage.com/resources/how-chestnut-ai-can-cut-your-rate-in-a-rising-rate-market

https://www.ent.com/personal/loans/home-equity-lines-of-credit/