Best Mortgage Rates in Brighton CO

Brighton buyers can secure the best mortgage rates through Chestnut's AI technology, which compares over 100 lenders in real time to deliver rates approximately 0.5% lower than traditional shopping methods. With Brighton's median home price at $530,998 and homes selling in just 39 days, this rate advantage saves thousands over the loan term while providing quotes in under two minutes.

Key Takeaways

• Brighton's median home price reached $530,998 in April 2025, up 2.9% year-over-year with homes averaging 39 days on market

• Chestnut's AI technology identifies rate spreads up to 86 basis points between lenders for identical borrower profiles

• Colorado's CHFA program offers up to $25,000 in down payment assistance for qualifying buyers with credit scores above 620

• Fannie Mae forecasts mortgage rates dropping to 5.9% by end of 2026, down from current levels

• Brighton inventory dropped 5.5% from March to April 2025, intensifying buyer competition

• AI-powered underwriting reduces processing from 30-45 days to just eight minutes

Brighton's tight inventory means every basis point on a loan matters. This post shows readers hunting for the best mortgage rates in Brighton CO how Chestnut's AI routinely undercuts other offers while navigating local programs and market data.

Brighton's hot housing market makes every mortgage basis point count

Brighton is a seller's market, meaning more buyers are chasing fewer homes. That imbalance pushes prices higher and forces buyers to move fast.

The median home sold price in Brighton reached $530,998 in April 2025, up 2.9% from the previous year. Homes spend an average of just 39 days on the market before going under contract. In a market moving this quickly, even a small rate difference compounds into thousands of dollars over the life of a loan.

This is where Chestnut stands apart. "Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods," according to Chestnut's analysis. On a typical Brighton purchase, that half-point savings translates directly into lower monthly payments and long-term equity gains.

What are today's mortgage and housing numbers in Brighton?

The median sale price in Adams County was $505,000 last month, down a modest 0.54% year over year. Brighton itself trends slightly higher at $530,998.

Metric | Brighton | Adams County |

|---|---|---|

Median Sale Price | $530,998 | $510,169 |

Year-over-Year Change | +2.9% | +0.7% |

Homes for Sale | 398 | 3,144 |

Avg. Days on Market | 39 | 34 |

Brighton's inventory dropped 5.5% from March to April 2025, keeping competition fierce. Meanwhile, Adams County saw a 13.1% increase in listings, offering some relief for buyers willing to expand their search radius.

Key takeaway: Limited Brighton inventory and rising prices make rate optimization essential for any serious buyer.

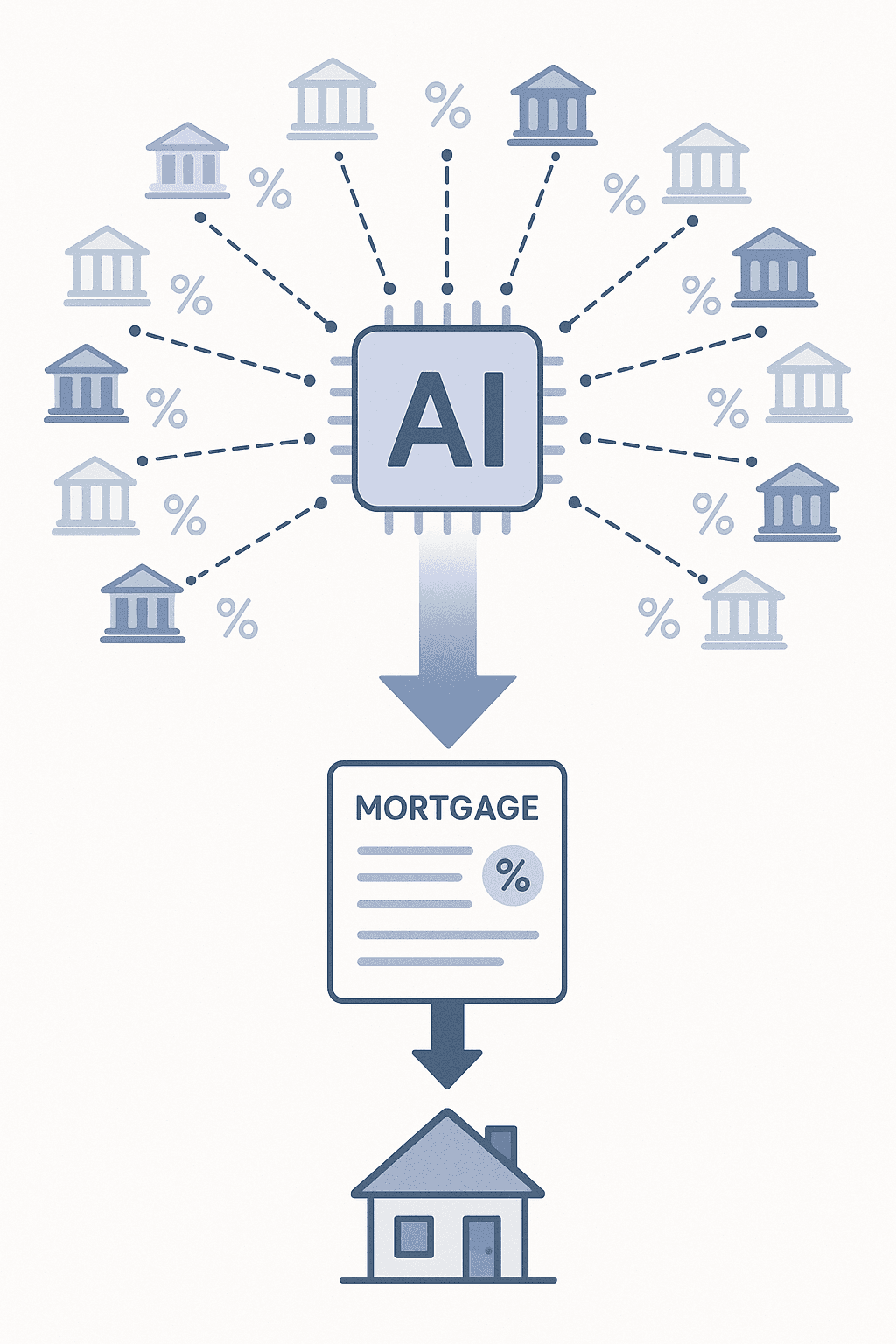

How Chestnut's AI finds lower rates other Brighton lenders miss

Chestnut's proprietary AI engine compares rates across more than 100 lenders in real time. Rather than relying on a single bank's pricing sheet, the platform surfaces the best available terms for each borrower's specific profile.

The technology identifies rate spreads of up to 86 basis points between lenders for the same borrower. That variance exists because different lenders price risk differently and offer varying incentives. Most buyers never see these spreads because they only shop two or three institutions.

A 2023 Fannie Mae study found that 73% of mortgage lenders who adopted AI solutions cited improving operational efficiency as their primary motivator. Chestnut channels that efficiency directly into rate savings rather than just internal cost cuts.

The platform delivers quotes in under two minutes, so buyers can compare rates before a property slips away. Learn more about how mortgage rates work on Chestnut's resource hub.

Human expertise keeps AI compliant in Colorado

Colorado became the first state to enact a statute governing AI tools in lending in May 2024. Federal regulators have also approved Quality Control Standards for Automated Valuation Models through the Consumer Financial Protection Bureau and Office of the Comptroller of the Currency.

Chestnut's human-in-the-loop model pairs AI-driven document processing with experienced mortgage experts. Every loan receives review from Colorado-licensed professionals who ensure compliance and catch edge cases the algorithm might flag.

This approach addresses a common concern: trusting a machine with one of life's largest financial decisions. The AI handles speed and comparison; humans handle judgment and accountability.

Chestnut vs. other online lenders serving Brighton

How does Chestnut stack up against other digital-first lenders available in Colorado?

Lender | Rate Advantage | Lender Fees | Speed | Customer Rating |

|---|---|---|---|---|

Chestnut | ~0.5% below comparable offers | Competitive | Quotes in under 2 min | 5.0 Google |

Tomo Mortgage | $0 | Fast | 4.9 Bankrate | |

Better.com | Claims lower rates | $0 origination | 4.4 out of 5 | |

Elevations Credit Union | N/A | Varies | Standard |

While Tomo Mortgage touts recognition, some customers have reported communication challenges, including delays in responses and difficulties obtaining clear information during the loan process.

Better.com has funded over $100 billion and offers a "One Day Mortgage" commitment letter. Some borrowers describe the experience as "fairly straightforward" but note it can feel impersonal.

Elevations Credit Union ranks as the top credit union residential mortgage lender by volume in Colorado. Credit unions often provide solid service but lack the lender network needed to surface the lowest rates across the market.

Garden State Home Loans has funded $5.6 billion since 2011 but operates primarily outside Colorado.

Key takeaway: Chestnut's combination of AI-powered rate comparison, human oversight, and a 5.0 Google rating positions it favorably against competitors.

What down-payment assistance programs can Brighton buyers use?

Colorado offers several programs that pair well with competitive mortgage rates.

The Colorado Housing and Finance Authority (CHFA) provides down payment and closing cost assistance to qualifying residents. Eligible first-time buyers can access up to $25,000 in assistance through non-repayable grants or deferred second mortgage loans.

Grant option: No repayment required

Second mortgage option: Deferred until sale, refinance, or title transfer

FirstGeneration program: Up to $25,000 for first-generation homebuyers

CHFA invested $76.8 million in down payment assistance and $1.9 billion in first mortgage loans in 2024, serving over 5,291 homeowners.

Key eligibility rules

To qualify for CHFA programs, borrowers must meet specific criteria:

Credit score: Minimum 620 or higher; borrowers with no credit score may be permitted

Income limit: Statewide cap of $174,440 regardless of county or household size

DTI ratios: Maximum 50% for scores 620-659; maximum 55% for scores 660 and above

Homebuyer education: All borrowers must complete a CHFA-approved course before closing

Minimum contribution: $500 for HomeAccess (can be a gift); $1,000 for SmartStep Plus

Eligible property types include single-family homes, PUDs, condominiums, and manufactured housing on a permanent foundation.

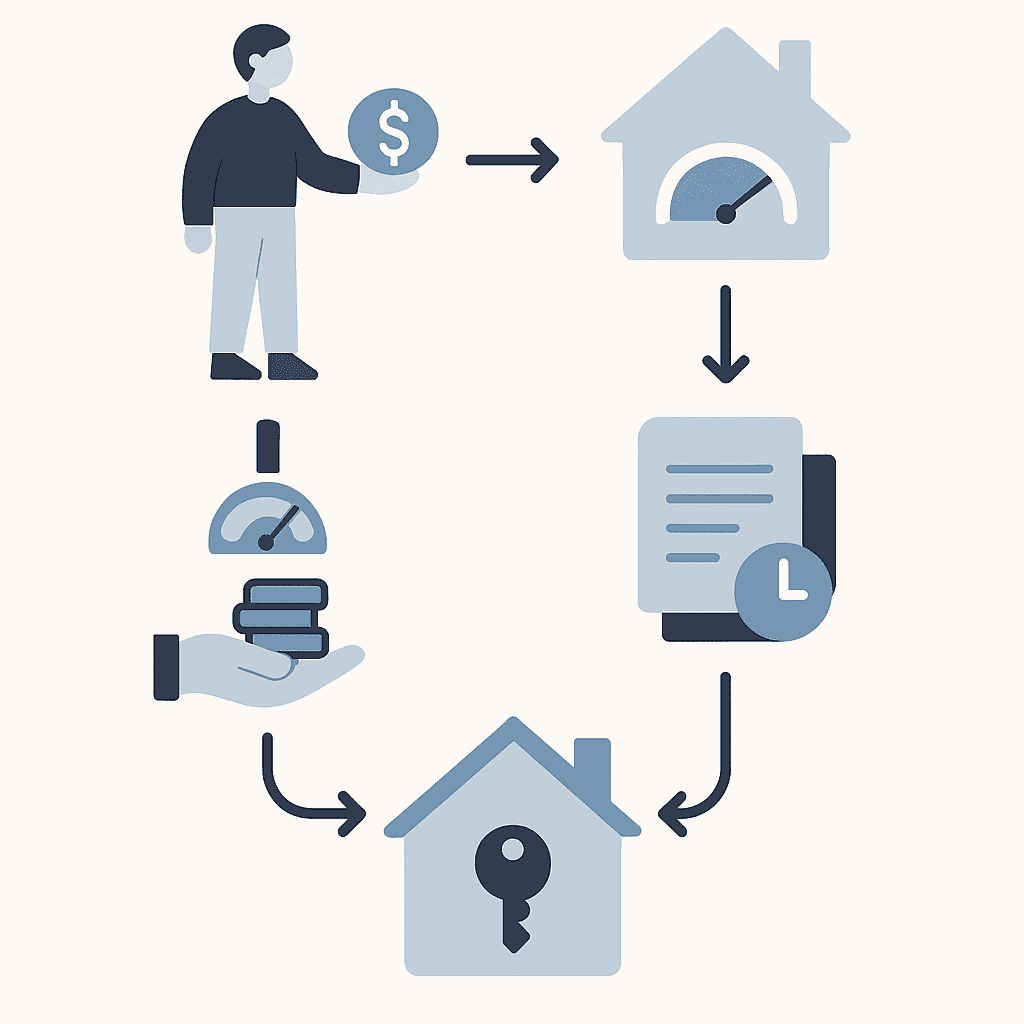

How can you lock the best Brighton rate in 2026?

Fannie Mae projects mortgage rates to end 2025 at 6.3% and 2026 at 5.9%. If those forecasts hold, waiting for lower rates could make sense. But Brighton's seller's market may not wait.

Here's a practical checklist:

Get preapproved quickly. Chestnut delivers quotes in under two minutes, giving you a competitive edge when making offers.

Compare across lenders. AI tools surface rate spreads invisible to single-lender shoppers.

Stack assistance programs. Combine CHFA grants with a low rate to maximize buying power.

Watch the calendar. Fannie Mae expects total home sales to reach 5.16 million in 2026, up from 4.74 million in 2025. More activity could tighten inventory further.

Lock when ready. A rate lock protects against short-term volatility while you close.

Explore your refinance options if you already own a Brighton home and want to capitalize on future rate drops.

Brighton buyers: act now while competition is high

Brighton's combination of rising prices, limited inventory, and strong demand makes rate optimization non-negotiable. Every basis point saved strengthens your offer and builds long-term equity.

Chestnut's AI compares rates across 100+ lenders in real time, delivering the kind of transparency that used to require days of phone calls. Colorado-licensed experts review every loan, ensuring compliance with the state's pioneering AI regulations.

Ready to see what rate you qualify for? Start your search at Chestnut's home buying page and get a personalized quote in under two minutes.

Frequently Asked Questions

What makes Brighton CO a competitive housing market?

Brighton is a seller's market with more buyers than available homes, leading to higher prices and quick sales. The median home price reached $530,998 in April 2025, with homes averaging just 39 days on the market.

How does Chestnut's AI help in finding better mortgage rates?

Chestnut's AI compares rates from over 100 lenders in real time, identifying rate spreads of up to 86 basis points. This technology ensures borrowers get the best terms tailored to their profiles, often saving 0.5% or more compared to traditional methods.

What are the benefits of using Chestnut over other lenders?

Chestnut offers a combination of AI-powered rate comparison, human oversight, and a 5.0 Google rating. It provides competitive rates, quick quotes, and compliance with Colorado's AI lending regulations, setting it apart from other digital-first lenders.

What down-payment assistance programs are available in Brighton CO?

The Colorado Housing and Finance Authority (CHFA) offers down payment and closing cost assistance through grants and deferred second mortgage loans. Eligible first-time buyers can access up to $25,000 in assistance.

How can buyers lock in the best mortgage rates in Brighton?

Buyers should get preapproved quickly, compare rates across multiple lenders, utilize assistance programs, and lock in rates when ready to protect against market volatility. Chestnut's AI can expedite this process with fast, competitive quotes.

Sources

https://www.ocrolus.com/whitepapers/mortgage-underwriting-whitepaper/

https://www.redfin.com/county/361/CO/Adams-County/housing-market

https://chestnutmortgage.com/resources/how-mortgage-rates-work-(and-how-to-get-the-best-one

https://chestnutmortgage.com/resources/how-chestnut-ai-can-cut-your-rate-in-a-rising-rate-market

https://www.fanniemae.com/data-and-insights/forecast/economic-developments-october-2025