Best Mortgage Rates in Austin TX

Austin mortgage rates currently average 6.28% for 30-year fixed loans and 5.62% for 15-year terms, staying below the 40-year historical average of 7.2%. Texas-specific rates track closely with national figures, with rates updated daily based on market conditions. Most Austin borrowers secure better rates through comparison shopping and improving credit scores above 740.

Key Facts

• Current 30-year fixed mortgage rates in Austin average 6.28%, with 15-year loans at 5.62%

• Adjustable-rate mortgages (5/1 ARMs) offer initial rates around 5.55%, below fixed options

• Refinance rates run slightly higher at 6.66% for 30-year fixed loans

• Rates remain below the 40-year historical average of 7.2%

• Credit scores above 740 and down payments over 20% unlock the best pricing tiers

• Texas assistance programs can reduce rates by 0.5-1% for qualifying buyers

Finding the best mortgage rates in Austin TX has become both easier and more complex in 2025. Inventory is climbing to levels not seen in over a year, giving buyers unprecedented leverage. Yet borrowing costs remain volatile, bouncing between the low and mid 6 percent range as markets digest Federal Reserve policy shifts and inflation data.

This guide unpacks the numbers that matter right now and walks through every lever you can pull to secure a competitive rate. Whether you are purchasing your first home, upgrading, or refinancing an existing loan, the sections ahead deliver actionable benchmarks and step-by-step tactics.

Austin's 2025 mortgage landscape at a glance

Austin's housing market has shifted decisively in favor of buyers. Inventory climbed to 6.3 months in November, the highest level in more than a year and above the six-month threshold that traditionally signals a balanced market. Pending sales rose 4.5 percent year over year, suggesting renewed buyer interest even as closed transactions declined.

Mortgage rates in Texas are updated daily and vary by loan type. The benchmark 30-year fixed mortgage averaged 6.28 percent in early December, while 15-year fixed loans sat near 5.62 percent and popular 5/1 ARMs hovered around 5.55 percent. These figures remain well below the 40-year historical average of 7.2 percent, offering meaningful savings for those who lock in today.

Median home prices in Austin have softened, slipping 1.1 percent year over year to $430,000 in November. Combined with elevated inventory, these conditions translate into negotiating power that was virtually nonexistent during the pandemic boom.

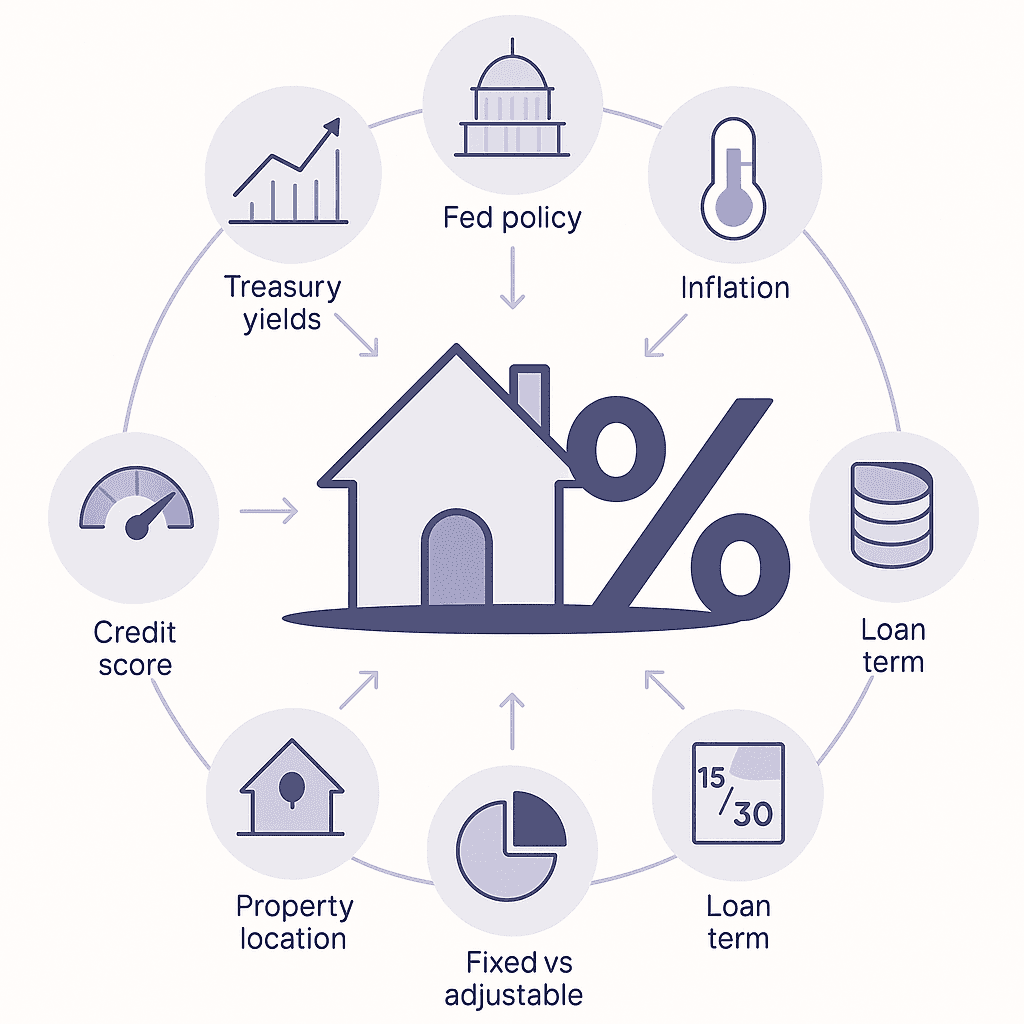

What really drives mortgage rates in Austin?

Mortgage rates are not plucked from thin air. They track 10-year Treasury rates, which fluctuate based on investor expectations about inflation and economic growth. When bond yields rise, lenders charge more for new loans; when yields fall, rates follow.

The Federal Open Market Committee's December 2025 projections peg the median federal funds rate at 3.6 percent for the year, with PCE inflation at 2.9 percent and unemployment at 4.5 percent. These macro signals suggest rates will stay elevated relative to the ultra-low pandemic era but remain historically moderate.

Seven borrower-level factors also shape your quoted rate, according to the Consumer Financial Protection Bureau:

Credit score

Home location

Home price and loan amount

Down payment size

Loan term

Interest rate type (fixed or adjustable)

Loan type (conventional, FHA, VA, USDA)

Higher credit scores and larger down payments signal lower risk, earning you better pricing. Shorter loan terms also carry lower rates, though monthly payments will be higher.

Credit scores & DTI: the biggest levers you control

Your debt-to-income ratio and credit profile are the two variables most directly under your control, and they pack serious punch. Most lenders prefer DTI ratios of 36 percent or below, though some will approve ratios up to 50 percent with compensating factors like substantial reserves.

For conventional loans backed by Fannie Mae, the maximum allowable DTI is 50 percent when underwritten through Desktop Underwriter. FHA loans cap at 43 percent without compensating factors, while VA and USDA loans recommend staying at or below 41 percent.

An excellent target is a front-end DTI below 28 percent and back-end DTI below 36 percent. The lower your ratios, the more pricing tiers open up.

Key takeaway: Before shopping for a home, calculate your DTI and identify debts you can pay down to improve your ratio.

What are today's average mortgage and refinance rates in Austin?

The table below summarizes current averages based on Bankrate data:

Loan Type | Average Rate |

|---|---|

30-year fixed | 6.28% |

15-year fixed | 5.62% |

5/1 ARM | 5.55% |

Jumbo | 6.51% |

30-year fixed refinance | 6.66% |

Texas-specific rates track closely with national figures. As of December 21, 2025, current interest rates in Texas stood at 6.28 percent for a 30-year fixed mortgage and 5.75 percent for a 15-year fixed mortgage.

Refinance rates tend to mirror purchase rates but can occasionally run slightly higher. Your personal quote will depend on credit score, loan-to-value ratio, and property location.

Fixed, adjustable, or 15- vs 30-year -- which loan term fits Austin buyers?

Choosing the right loan structure is as important as chasing the lowest rate. The biggest difference between fixed and adjustable options is variability: a fixed rate stays constant for the entire loan term, while an ARM changes over time.

Feature | 30-Year Fixed | 15-Year Fixed | 5/1 ARM |

|---|---|---|---|

Rate stability | Constant | Constant | Variable after 5 years |

Monthly payment | Lower | Higher | Lowest initially |

Total interest | Highest | Lowest | Depends on future rates |

Best for | Long-term owners | Fast equity builders | Short-term stays |

Lenders almost always charge a lower interest rate for 15-year loans because the shorter term reduces their risk. However, monthly payments are roughly 30 to 60 percent higher, so qualification standards tighten.

Are ARMs worth considering in 2025?

"Given still-high home prices and this rising rate environment, potential homebuyers are finding ways to reduce their monthly payments and view ARMs as more attractive given the widening spread between rates for ARM and fixed-rate loans," says Joel Kan, vice president and deputy chief economist at the Mortgage Bankers Association.

ARMs accounted for 4.7 percent of mortgage applications as of early January 2025, down from a peak of 9.3 percent in October 2025. The appeal lies in lower introductory rates, but the biggest disadvantage is the likelihood of your rate going up once the fixed period expires.

ARMs can be riskier because the interest rate and monthly payment can increase over time -- possibly to an unaffordable level. Consider an ARM only if you plan to sell or refinance before the adjustment period begins.

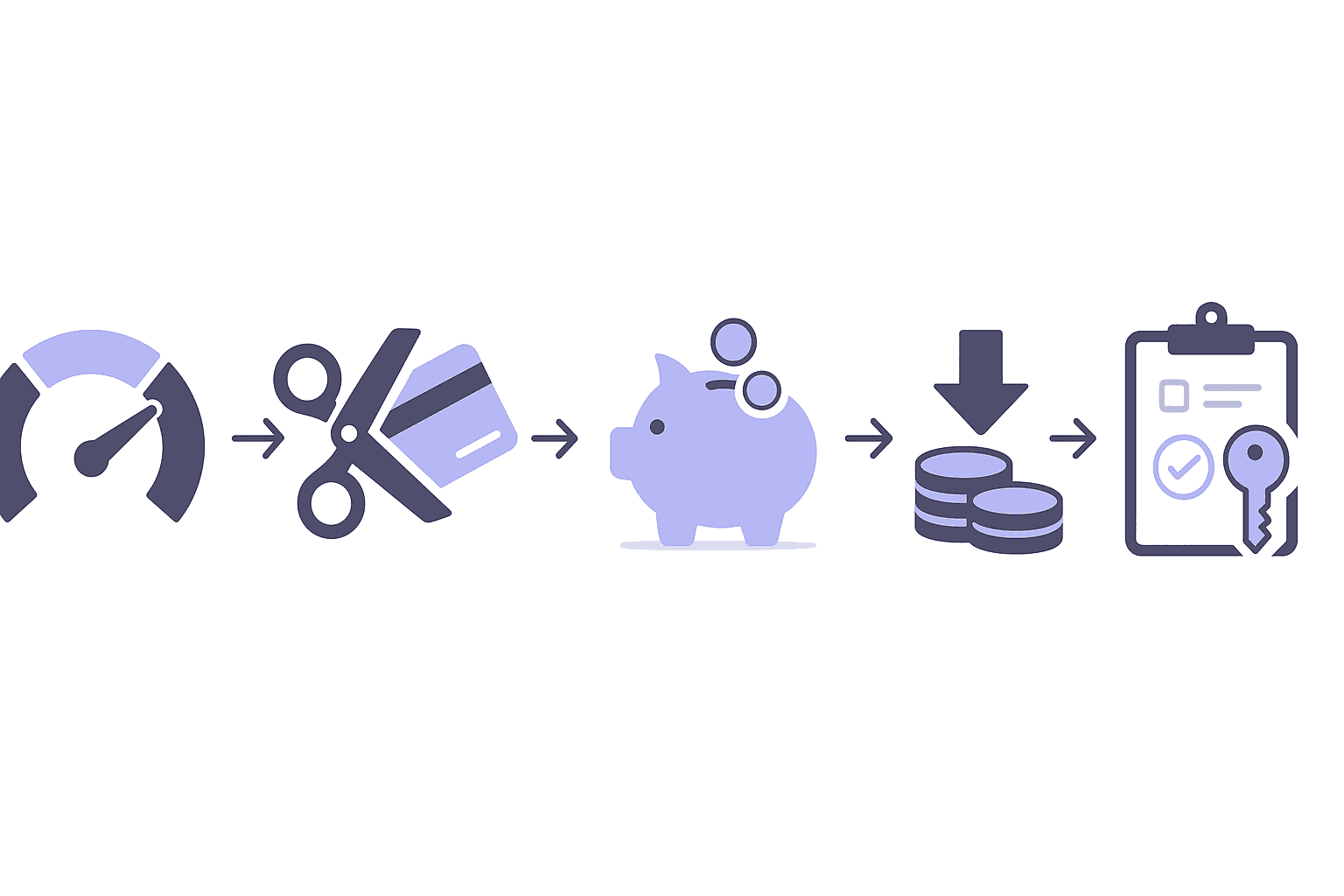

How to lock the lowest rate: credit, points & pre-approval

Securing the best mortgage rate requires preparation on multiple fronts. To get the best mortgage rate, boost your credit score, lower your debt and save up a sizable down payment. Then shop around with at least three lenders and compare quotes.

The average credit score for a borrower getting a purchase loan is 737, according to April 2025 data from Optimal Blue. Hitting 740 or above places you in the top pricing tier with most lenders. FICO scores in the 740-850 range are considered "very good" to "exceptional", while scores below 670 will push you into higher rate brackets.

Mortgage points offer another lever. Typically, one point costs 1 percent of the amount you borrow and reduces your interest rate by 0.25 percentage points. On a $400,000 loan, one point costs $4,000 and might lower your rate from 6.5 percent to 6.25 percent.

Points make sense when you plan to stay long enough to hit the break-even point. Divide the cost of the points by your monthly savings to find that horizon. If you will move or refinance before break-even, skip the points and put that cash toward your down payment instead.

Permanent rate buydowns have become common among builders. Around 64 percent of new home sales by the 21 largest builders use permanent buydowns, compared to just 13 percent among smaller builders. If you are considering new construction in Austin, ask about builder incentives.

Documents Austin lenders will ask for

Getting pre-approved accelerates your timeline and strengthens your offer. Most mortgage pre-approvals are valid for 60 to 90 days, so gather your paperwork before you start touring homes.

Lenders will typically request:

W-2 or 1099 forms for the past two years

Federal tax returns (all pages) for two years

Bank statements for checking, savings, and brokerage accounts (last two months)

Government-issued photo ID and Social Security number

Authorization for a credit check

A mortgage preapproval is written verification from a mortgage lender stating that you qualify to borrow a specific amount based on a review of your credit, income, and assets. It differs from prequalification, which is less rigorous and carries less weight with sellers.

Comparing mortgage lenders in Austin (and why Chestnut wins)

While Rocket Mortgage closed the most loans nationally in 2023, volume alone doesn't guarantee a better deal for Austin borrowers. NerdWallet's editorial team reviewed 50+ mortgage lenders using a star rating system assessing 120+ categories and 5,000+ data points.

When evaluating lenders, prioritize:

Compare Loan Estimates side by side

Read reviews from verified borrowers

Confirm the lender is licensed in Texas

Ask about rate locks, processing timelines, and communication protocols

Chestnut Mortgage stands apart by using AI to compare offers from over 100 lenders, often reducing borrower rates by approximately 0.5 percent. With over $85 billion in mortgages processed and a 5.0 Google rating, Chestnut delivers instant quotes in under two minutes and expedites approvals through automated underwriting. If you want to see how your rate compares, visit Chestnut's resources to explore personalized options.

Which Texas programs can lower your mortgage rate or down payment?

Texas offers several assistance programs that can shave points off your rate or cover part of your down payment.

My FIRST Texas Home is aimed at first-time homebuyers and considers the income of all persons signing the Deed of Trust. It pairs below-market bond-funded rates with down payment assistance options ranging from 5.625 percent to 6.875 percent depending on the loan type and assistance level.

My CHOICE Texas Home carries no first-time homebuyer requirement and offers forgivable loans not subject to recapture tax. This flexibility makes it attractive for repeat buyers who still meet income limits.

Additional programs include:

Homes Sweet Texas Home Loan: 30-year fixed mortgages with grants up to 5 percent of the loan

Homes for Texas Heroes: Discounts for teachers, police officers, veterans, and first responders

The Finance Commission of Texas recently adopted new rules clarifying licensing requirements and sponsorship conditions for mortgage originators, reinforcing consumer protections statewide.

Is now the time to refinance in Austin?

"If you can shave off half a point to three-quarters of a point off your current rate, it's worth looking into it," says Greg McBride, CFA, former chief financial analyst for Bankrate. "Grab the savings now while you can. There's no guarantee that rates will drop further."

Refinancing makes sense when you can lower your rate meaningfully and plan to stay long enough to recoup closing costs. Calculate the break-even point by dividing closing costs by your monthly savings. If you will sell or pay off the loan before that date, refinancing may not pencil out.

Refinance rates in Austin are personalized based on credit score, loan-to-value ratio, and property location. A higher credit score will help you qualify for a lower refinance rate, so consider improving your score before applying.

Refinancing at the right time can help you lower your mortgage payments, but it also requires you to pay fees and other closing costs. Weigh the total savings against upfront expenses before committing.

Key takeaways for Austin homebuyers in 2025

Austin's market has cooled enough to give buyers real leverage, but borrowing costs still demand strategic preparation. Here is your action checklist:

Check your credit score and aim for 740 or higher.

Calculate your DTI and pay down debt to stay below 36 percent.

Gather pre-approval documents before touring homes.

Compare quotes from at least three lenders.

Evaluate whether points make sense given your time horizon.

Explore TDHCA programs for rate discounts or down payment grants.

If refinancing, run a break-even calculation first.

For a personalized rate comparison that leverages AI across 100+ lenders, visit Chestnut Mortgage and get an instant quote in under two minutes. Understanding how mortgage rates work will help you negotiate from a position of strength and lock in savings that compound over decades.

Frequently Asked Questions

What are the current average mortgage rates in Austin, TX?

As of December 2025, the average mortgage rates in Austin are 6.28% for a 30-year fixed loan, 5.62% for a 15-year fixed loan, and 5.55% for a 5/1 ARM.

How can I secure the best mortgage rate in Austin?

To secure the best mortgage rate, improve your credit score, reduce your debt-to-income ratio, and shop around with multiple lenders for quotes. Consider using Chestnut Mortgage's AI technology to compare offers from over 100 lenders.

What factors influence mortgage rates in Austin?

Mortgage rates in Austin are influenced by 10-year Treasury rates, Federal Reserve policies, and borrower-specific factors like credit score, loan type, and down payment size.

Are adjustable-rate mortgages (ARMs) a good option in 2025?

ARMs can offer lower initial rates, making them attractive in a high-rate environment. However, they carry the risk of rate increases after the fixed period, so they are best for short-term stays or if you plan to refinance before the adjustment period.

What assistance programs are available for homebuyers in Texas?

Texas offers programs like My FIRST Texas Home and My CHOICE Texas Home, which provide down payment assistance and favorable rates for eligible buyers. These programs can help reduce upfront costs and make homeownership more accessible.

Sources

https://www.bankrate.com/mortgages/todays-rates/mortgage-rates-for-monday-december-8-2025/

https://www.bankrate.com/mortgages/todays-rates/mortgage-rates-for-friday-december-12-2025/

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20251210.pdf

https://www.consumerfinance.gov/about-us/blog/7-factors-determine-your-mortgage-interest-rate/

https://www.bankrate.com/mortgages/why-debt-to-income-matters-in-mortgages/

https://selling-guide.fanniemae.com/sel/b3-6-02/debt-income-ratios

https://www.nerdwallet.com/article/mortgages/debt-income-ratio-mortgage

https://www.bankrate.com/mortgages/is-an-adjustable-rate-mortgage-right-for-you/

https://www.bankrate.com/mortgages/how-to-get-the-best-mortgage-rate/

https://www.bankrate.com/mortgages/improve-credit-before-mortgage/

https://www.nerdwallet.com/article/mortgages/how-to-get-the-best-mortgage-rate

https://www.lendingtree.com/home/mortgage/what-are-mortgage-points/

https://www.aei.org/research-products/report/aei-housing-market-indicators-november-2025/

https://www.redfin.com/blog/documents-needed-for-mortgage-pre-approval/

https://thetexashomebuyerprogram.com/uploads/Rate-Notice.pdf?v=1755525684

https://www.bankrate.com/mortgages/should-you-refinance-this-year/

https://chestnutmortgage.com/resources/how-mortgage-rates-work-(and-how-to-get-the-best-one