Best Mortgage Rates in Amarillo TX

Best Mortgage Rates in Amarillo TX

Amarillo mortgage rates currently average 6.895% for 30-year fixed loans, slightly above the national rate. Chestnut's AI platform consistently delivers rates approximately 0.50 percentage points below market averages by comparing offers from over 100 lenders in real-time, potentially saving borrowers tens of thousands over their loan term.

TLDR

• Current Amarillo mortgage rates sit at 6.895% for 30-year fixed loans, tracking close to national averages

• Chestnut's AI technology compares rates across 100+ lenders simultaneously, delivering rates 0.5% below traditional shopping methods

• Local unemployment remains low at 3.0%, supporting strong housing demand despite median listing prices reaching $302,473

• Texas first-time buyer programs offer 2-5% down payment assistance and 20% mortgage interest tax credits

• AI-based underwriting cuts processing time from 30-45 days to just eight minutes

• Digital HELOCs through Chestnut provide cash access in under two weeks with competitive rates

Interest costs dominate the true price of a Panhandle home. On a typical 30-year loan, you will pay more in interest than the original purchase price. That reality makes finding the best mortgage rates in Amarillo TX the single most important step before signing on a new home. This guide walks through the 2026 rate landscape, explains the economic forces behind every basis point, and shows how Chestnut's AI platform fits into your search.

Why Amarillo Homebuyers Are Laser-Focused on Rates in 2026

Mortgage rates in Amarillo currently sit near 6.895% for a 30-year fixed, according to NerdWallet's April 2025 survey. Meanwhile, Freddie Mac reported the national 30-year fixed-rate mortgage averaged 6.15% as of December 31, 2025. That gap matters because even a quarter-point difference can translate to thousands of dollars over the life of a loan.

For Amarillo buyers, two realities collide:

Home prices have climbed. Median listing prices reached $302,473 in April 2025, and both average and median sales prices hit all-time highs in 2024.

Rate sensitivity is high. A half-point swing on a $250,000 loan changes your monthly payment by roughly $75 and your lifetime interest by more than $25,000.

Chestnut addresses this squeeze head-on. "Borrowers using Chestnut AI™ typically see rate savings of 0.5% or more compared to traditional shopping methods," the company notes on its resource page. That advantage comes from comparing offers across more than 100 lenders in real time, then surfacing the cheapest fit for your profile.

What Economic Forces Move Amarillo Mortgage Rates in 2026?

Rates do not appear out of thin air. Several national, state, and local drivers shape what you will pay.

National monetary policy

The Federal Reserve sets the tone. While the Fed may still cut its benchmark rate, mortgage rates have barely budged after recent moves. As Samir Dedhia, CEO of One Real Mortgage, explained: "It's a reminder that mortgage rates don't follow Fed cuts directly, and they respond to broader expectations around inflation, employment and long-term economic strength" (Bankrate).

Amarillo's local economy

Amarillo's job market remains solid. During the 12 months ending June 2024, nonfarm payrolls totaled 128,700 jobs, up 2.0% year over year. The unemployment rate averaged just 3.0%, well below state and national figures. Strong employment supports housing demand, which in turn influences lender appetite and pricing.

Housing supply and prices

Home prices in the Amarillo HMA dipped slightly, with the average price of homes sold decreasing by $1,250, or 1%, to $239,200 during the 12 months ending June 2024. Lower prices can improve affordability, but persistent inventory constraints keep competition alive.

Key takeaway: National inflation expectations and local employment trends matter more than any single Fed announcement. Watch both when timing your rate lock.

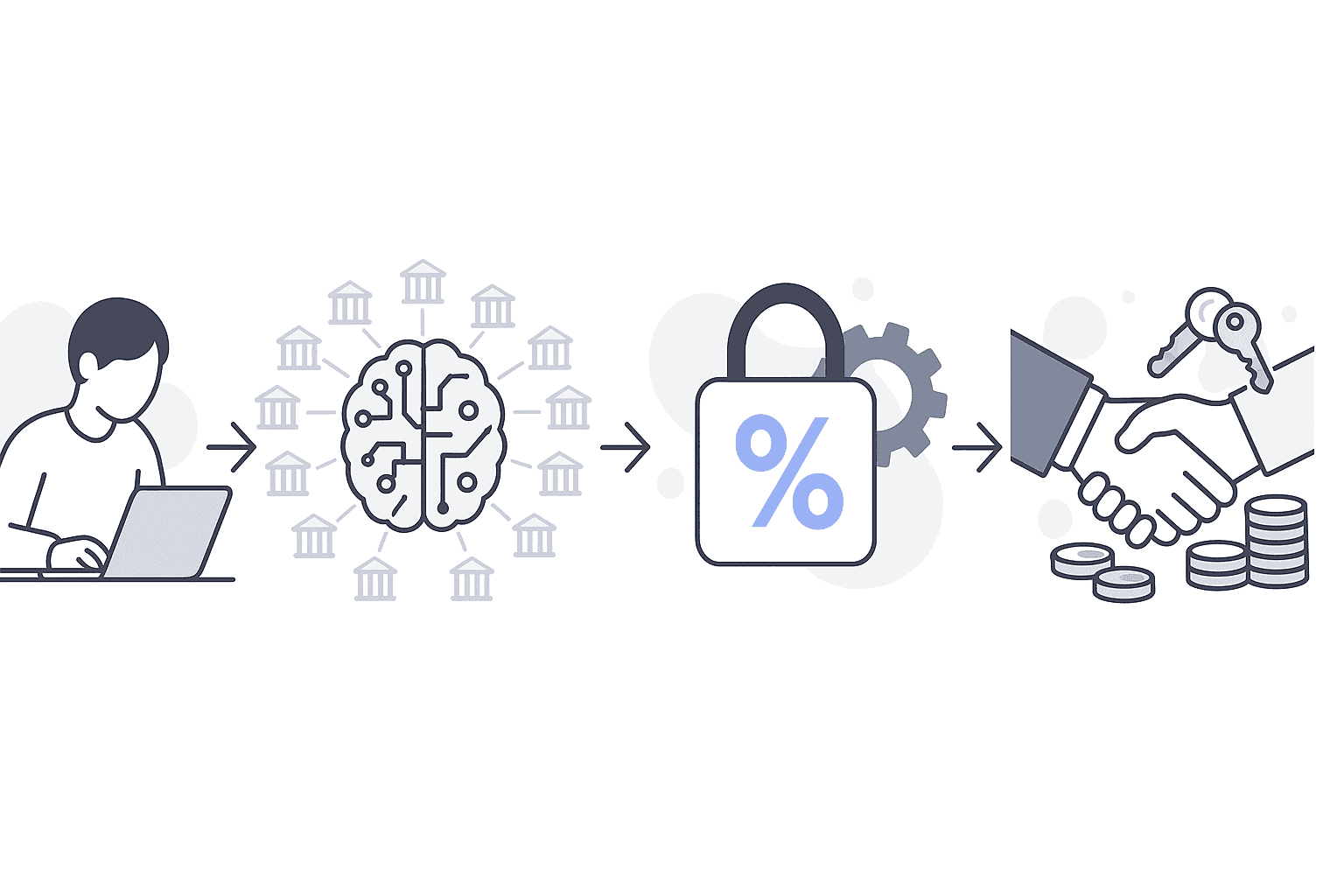

How Chestnut Consistently Beats the Market by ~0.50 Percentage Points

Chestnut Mortgage's proprietary AI technology consistently delivers approximately 0.50 percentage points below the national average 30-year fixed rate. How?

Real-time lender comparison. The platform pulls live pricing from more than 100 wholesale and retail lenders.

Risk-tier clustering. Machine learning groups borrowers by credit profile, then matches each tier to the lenders most likely to offer the lowest rate.

Speed. AI-based underwriting reduces the mortgage application processing time from an average of 30-45 days to just eight minutes.

Chestnut's AI engine compares rates across more than 100 lenders in real time, ensuring accuracy and completeness in rate comparisons. A single-bank offer simply cannot match that competitive pressure.

Chestnut vs. Amarillo National Bank & Credit Unions

Local lenders like Amarillo National Bank dominate the market by volume, with 424 loans originated in recent tracking periods. They advertise "competitive rates," "local processing," and "quick decisions" on products like home equity loans. However, a single institution can only offer its own pricing sheet.

Chestnut's advantage is structural:

Factor | Local Bank | Chestnut |

|---|---|---|

Lender network | 1 | 100+ |

Rate quote speed | Days | Under 2 minutes |

Fee reduction | Manual | |

Rate monitoring | Limited | Ongoing alerts |

Over 130 years of history and a strong balance sheet do not guarantee the lowest rate. Breadth of comparison does.

How Do 2026 Amarillo Mortgage Rates Compare to State and National Averages?

Metric | Amarillo | Texas | National |

|---|---|---|---|

30-year fixed (week of May 29, 2025) | ~6.11% (LendingTree avg) | ||

Average closing costs | Varies | Varies | |

Unemployment rate | 4.20% | 4.00% |

As of December 31, 2024, the conventional 30-year mortgage loan interest rate was 6.85% in Amarillo, up 0.24% from a year earlier. By late December 2025, Freddie Mac's national average had eased to 6.15%, signaling a modest downward trend heading into 2026.

Amarillo rates tend to track slightly below or at the national average, but local lender competition and borrower profiles create variation. Shopping multiple sources remains essential.

How to Lock Your Amarillo Rate in Under 2 Minutes with Chestnut

Chestnut's platform lets you get started in 2 minutes. Here is the step-by-step process:

Visit the instant quote page. Enter basic information about your purchase or refinance.

Review AI-generated offers. The system compares pricing from 100+ lenders and surfaces the best matches.

Select your rate. Lock in your preferred option directly through the platform.

Upload documents. Chestnut's human-in-the-loop model pairs AI-driven document processing with experienced mortgage experts.

Close faster. Automated workflows cut weeks off traditional timelines.

What Documents You'll Need

Preparing your paperwork in advance speeds approval. Gather:

Recent pay stubs (last 30 days)

W-2s from the past two years

Bank statements (last two months)

Government-issued ID

Tax returns (if self-employed)

As one industry executive noted, "The AI-powered automation has allowed underwriters to open a file and start underwriting immediately. Ocrolus handles the renaming and organization, so our team doesn't waste time getting the file ready" (Ocrolus).

Chestnut's automated income calculation converts these documents into auditable, guideline-ready outputs for FHA, VA, and conventional loans, reducing back-and-forth delays.

Which Texas First-Time Buyer Programs Cut Your Rate Further?

Texas offers several state-backed programs that can lower your effective rate or reduce out-of-pocket costs.

Program | Eligibility | Benefit |

|---|---|---|

My First Texas Home | First-time buyers, 620+ credit, income limits | Down payment assistance (2%-5%), 30-year fixed FHA/VA/USDA loans |

My Choice Texas Home | All buyers (no first-time requirement) | Forgivable second lien, 30-year fixed rates |

Texas Mortgage Credit Certificate (MCC) | First-time buyers in most areas | 20% tax credit on annual mortgage interest |

Key requirements for My First Texas Home include:

Minimum FICO of 620

Must complete a homebuyer education course

Occupy the home within 60 days of closing

Lenders may charge origination up to 0.50% of the total loan amount for TDHCA products. These programs pair well with Chestnut's rate-shopping engine, allowing you to stack state assistance on top of the lowest available market rate.

Should You Tap Equity? HELOC & Refi Rates in Amarillo Explained

If you already own a home, accessing equity can fund renovations, consolidate debt, or cover major expenses. Two primary paths exist: home equity lines of credit (HELOCs) and cash-out refinances.

HELOC basics

A HELOC is a revolving credit line secured by your home. Interest rates are influenced by the prime rate and economic conditions, along with your credit profile. Most lenders require at least 15% equity and a credit score of 640 or better.

Draw period: Typically 10 years, during which you can access funds as needed.

Repayment period: 10-20 years of principal and interest payments.

Rate type: Usually variable, tied to the prime rate.

Chestnut's HELOC offering leverages AI to cut borrower rates by approximately 0.5% through intelligent lender comparison, with digital HELOCs providing cash in less than two weeks.

Cash-out refinance

A cash-out refinance replaces your existing mortgage with a larger one, giving you the difference in cash. According to Freddie Mac, more than $200 billion in home equity has been taken out to consolidate second mortgages this decade alone.

Factor | HELOC | Cash-Out Refi |

|---|---|---|

Rate type | Variable | Fixed |

Closing costs | Lower | Higher |

Best for | Ongoing draws | Lump-sum needs |

If you locked a low rate during 2020-2021, a HELOC may preserve that first mortgage while still accessing equity. If your current rate is already above market, a cash-out refi could lower your overall cost.

Key Takeaways: Lock Low, Close Fast, Save Big

Finding the best mortgage rates in Amarillo TX comes down to three actions:

Compare broadly. A single lender cannot match the competitive pressure of 100+ options. Chestnut's AI surfaces the cheapest fit for your profile.

Move quickly. Rates shift weekly. Locking in under two minutes protects you from upward swings.

Stack advantages. Combine Chestnut's rate edge with Texas first-time buyer programs or MCC tax credits to maximize savings.

Chestnut has powered $85 billion in mortgages, maintains a 5.0 Google rating, and consistently delivers rates approximately 0.50 percentage points below market averages. For Amarillo buyers navigating 2026's rate environment, that edge can mean tens of thousands of dollars saved over the life of a loan.

Ready to see your personalized rate? Visit Chestnut's instant quote page and get started in under two minutes.

Frequently Asked Questions

What are the current mortgage rates in Amarillo, TX for 2026?

As of 2026, mortgage rates in Amarillo, TX are around 6.895% for a 30-year fixed loan, slightly above the national average of 6.15%.

How does Chestnut Mortgage offer better rates than local banks?

Chestnut Mortgage uses AI technology to compare offers from over 100 lenders, typically saving borrowers 0.5% or more compared to traditional methods.

What factors influence mortgage rates in Amarillo?

Mortgage rates in Amarillo are influenced by national monetary policy, local economic conditions, and housing supply and demand dynamics.

How can I lock in a mortgage rate quickly with Chestnut?

You can lock in a mortgage rate with Chestnut in under two minutes by visiting their instant quote page and following a simple step-by-step process.

What documents are needed for a mortgage application with Chestnut?

You'll need recent pay stubs, W-2s, bank statements, a government-issued ID, and tax returns if self-employed to apply for a mortgage with Chestnut.

Are there any first-time homebuyer programs available in Texas?

Yes, Texas offers programs like My First Texas Home and My Choice Texas Home, which provide down payment assistance and favorable loan terms for eligible buyers.

Sources

https://www.nerdwallet.com/mortgages/mortgage-rates/texas/amarillo

https://chestnutmortgage.com/resources/chestnut-ai-delivers-0-50-point-rate-advantage-2025

https://chestnutmortgage.com/resources/how-chestnut-ai-can-cut-your-rate-in-a-rising-rate-market

https://www.bankrate.com/mortgages/mortgage-interest-rates-forecast/

https://www.huduser.gov/portal/publications/pdf/AmarilloTX-CHMA-24.pdf

https://thetexashomebuyerprogram.com/uploads/Lender-Guide.pdf

https://welcomehome.tdhca.texas.gov/uploads/My-First-Texas-Home-Program-Matrix-TMS.pdf?v=1738018341

https://thetexashomebuyerprogram.com/uploads/Rate-Notice.pdf?v=1755525684

https://themortgagereports.com/41218/cash-out-refinance-to-pay-off-heloc-or-home-equity-loan