Best Mortgage Rates in Allen TX

Current mortgage rates in Allen, TX average around 6.18% for a 30-year fixed loan, with AI-powered platforms like Chestnut typically securing rates 0.5% lower by comparing 100+ lenders simultaneously. Allen's median home price of $568,626 makes rate shopping crucial—even a quarter-point reduction saves roughly $29,000 over the loan's lifetime.

At a Glance

• Allen's median home price reached $568,626 in March 2025, up 2.9% year-over-year, while inventory increased 26.4% month-over-month

• Current 30-year fixed rates sit at 6.18%, down from 6.85% a year earlier—a drop that saves hundreds monthly on typical Allen purchases

• Shopping multiple lenders can save $600 to $1,200 annually, with five quotes potentially saving $3,000 over the loan's life

• Chestnut's AI technology analyzes 100+ lenders in under 2 minutes, compared to days or weeks with traditional lenders

• Texas home sellers now offer median price reductions of $17,000 (roughly 5% off asking), creating additional buyer leverage

• The statewide housing supply sits at 5.5 months, well above the 3-4 month level indicating a balanced market

Allen buyers hunting for the best mortgage rates in Allen TX can save thousands when they know today's numbers and why Chestnut's AI routinely beats them. With median list prices hovering near $569,000 and national 30-year fixed rates sitting around 6.18%, every fraction of a percentage point matters. This guide breaks down current Allen market conditions, explains what drives rates, and shows you how to lock in the lowest possible rate.

Why Do Today's Allen Mortgage Rates Matter So Much?

A small rate difference compounds into big money over a 30-year loan. The 30-year fixed-rate mortgage averaged 6.18% as of December 24, 2025, down from 6.85% a year earlier. That 67-basis-point drop translates to hundreds of dollars less per month on a typical Allen purchase.

Allen's median home list price reached $568,626 in March 2025, up 2.9% year over year. On a loan that size, even a quarter-point rate reduction saves roughly $80 per month, or nearly $29,000 over the life of the mortgage.

Borrowers using Chestnut AI typically see rate savings of 0.5% or more compared to traditional shopping methods. On a $450,000 loan, that half-point edge could mean $135 per month back in your pocket.

Key takeaway: Today's rates remain well below last year's peaks, and Allen's rising prices make rate shopping more important than ever.

What Do 2026 Allen & North Texas Mortgage Numbers Look Like?

Allen's housing market is diverging from typical patterns. Prices are softening while sales activity stays resilient, creating buyer-friendly conditions.

Metric | Allen (Mar 2025) | Change |

|---|---|---|

Median list price | $568,626 | +2.9% YoY |

Homes for sale | 522 | +26.4% MoM |

Average days on market | 64 | -28.3% YoY |

Homes sold below asking | 33.3% | — |

Source: Rocket Homes

Statewide, average home prices fell for a third consecutive month with a nearly 1% year-over-year drop. Seller concessions hit unprecedented levels, with the median asking price reduction climbing to $17,000, roughly 5% off asking.

Inventory now sits at a 5.5-month supply statewide. In Texas, a three- to four-month supply is generally considered indicative of a more stable and balanced market, meaning buyers hold more leverage today than they have in years.

Key takeaway: Rising inventory and price cuts give Allen buyers negotiating power, but locking a low rate amplifies those savings.

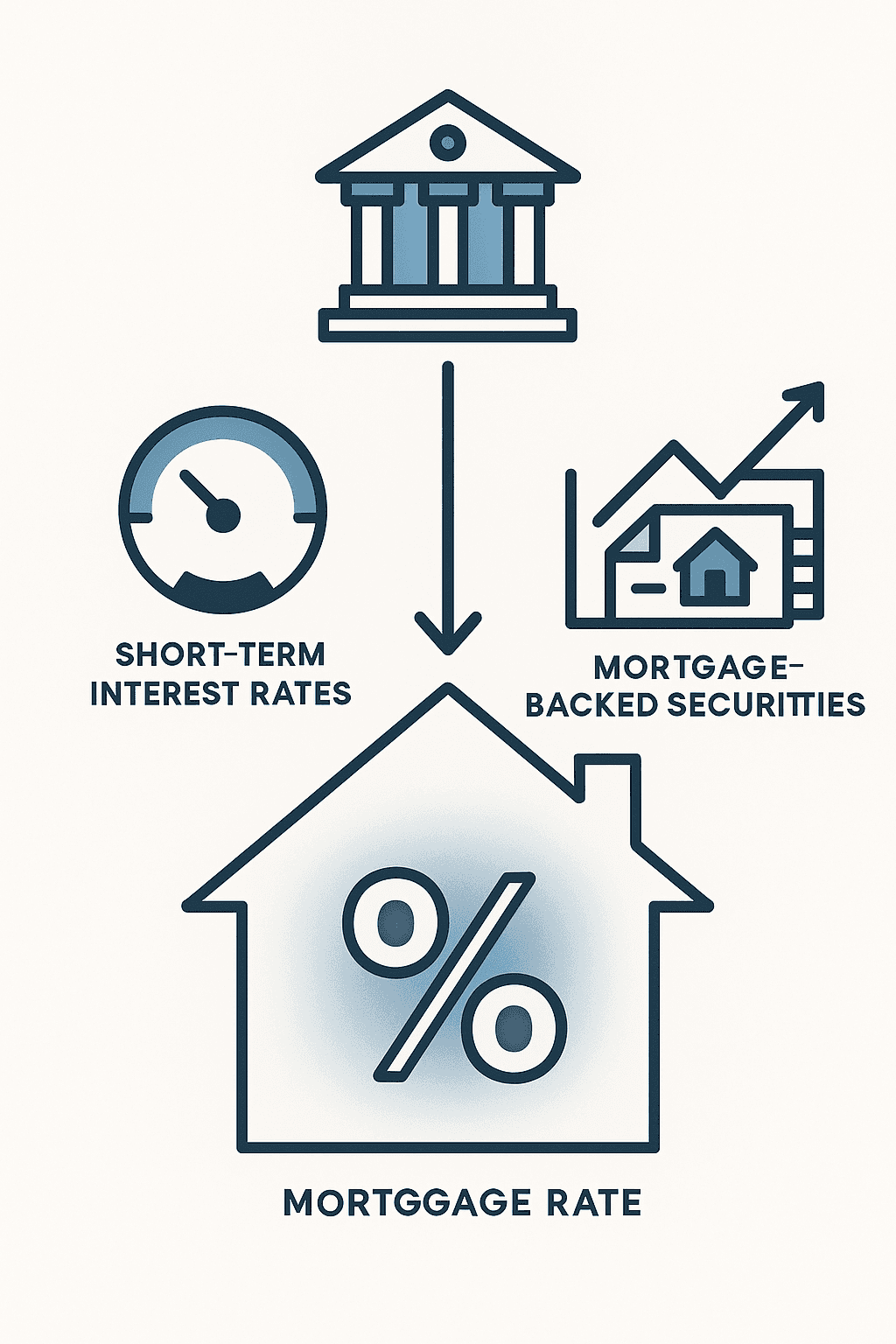

What Moves Mortgage Rates in Allen, from the Fed to the 10-Year Treasury?

Understanding rate drivers helps you time your lock.

Federal Reserve Policy

Fed Chair Jerome Powell recently stated, "A further reduction in the policy rate at the December meeting is not a foregone conclusion." The central bank's cautious stance means short-term rate cuts may not immediately lower mortgage rates.

The 10-Year Treasury

The 10-year Treasury bond serves as the mortgage market's north star. Currently yielding around 4.1%, these yields directly influence mortgage pricing. When Treasury yields rise, mortgage rates typically follow.

MBS Runoff

Future mortgage rate trends depend on the Fed's balance sheet policy. The Fed continued to allow roughly $17 billion of MBS to roll off its balance sheet each month, which exerts upward pressure on rates.

Freddie Mac Forecast

The 30-year fixed-rate mortgage averaged 6.18% as of December 24, 2025, down from 6.21% the prior week. Analysts project rates to hover in the low-6% range through mid-2026.

Key takeaway: Rates respond to Treasury movements and Fed policy more than headline news. Watch the 10-year yield for clues.

How to Compare Mortgage Lenders and Save Up to $1,200 a Year

Shopping around pays off. Here is a step-by-step playbook:

Request at least three Loan Estimates. Lenders must provide one within three business days after receiving your name, income, Social Security number, property address, estimated value, and loan amount. No written documentation is required.

Compare within 45 days. Multiple credit checks from mortgage lenders are recorded as a single inquiry during this window, minimizing score impact.

Focus on APR, not just rate. The APR reflects the total cost you pay for credit as a yearly rate, including lender fees.

Negotiate. Your best bargaining chip is having Loan Estimates from other lenders in hand.

Calculate five-year cost. On average, borrowers keep a mortgage for about five years before moving or refinancing, so compare total costs over that horizon.

As mortgage rates remain higher than in recent years, homebuyers can potentially save $600 to $1,200 annually by applying for mortgages from multiple lenders, according to Freddie Mac research.

Borrowers could save an average of $1,500 over the life of the loan by getting one additional rate quote and about $3,000 for five quotes. Chestnut streamlines this by comparing offers from 100-plus lenders in under two minutes.

Chestnut vs. Traditional Lenders: How Does AI Shave 0.5 Points?

The table below highlights key differences between Chestnut and conventional lenders.

Factor | Traditional Lender | Chestnut |

|---|---|---|

Lenders compared | 1-3 | 100+ |

Quote turnaround | Days to weeks | Under 2 minutes |

Avg. closing cycle | 40-50 days | Significantly faster |

Rate edge | Baseline | ~0.5% lower |

Track record | Varies | $85B+ mortgages powered, 5.0 Google rating |

Sources: Chestnut, Freddie Mac Benchmark Study

Top-performing companies in Q2 2020 processed loans up to 63% faster than their lower-performing counterparts. Chestnut's AI-driven automation mirrors that efficiency gap.

Mphasis research found that AI-driven solutions have enabled lenders to reduce loan processing times by up to 40%. Chestnut applies similar technology to rate shopping, comparing live offers and returning personalized quotes instantly.

Fixed-Rate, ARM, Refinance or HELOC: Picking the Right Allen Loan

Choosing the right product depends on your timeline and goals.

Fixed-Rate Mortgage

Your interest rate and monthly payment stay the same for the life of your loan. Best for buyers planning to stay long term.

Adjustable-Rate Mortgage (ARM)

Your interest rate typically is fixed for the first few years of the loan. Once the fixed period expires, the rate adjusts at regular intervals based on an index. Consider an ARM if you plan to move or refinance before the adjustment period.

Refinance

A refinance replaces your current mortgage with a new one at a lower rate or better terms to save you money. With prepayment activity hitting a 3.5-year high in October, many Texas homeowners are capitalizing on recent rate dips.

HELOC

A Home Equity Line of Credit lets you borrow against your home's equity, giving you flexible access to cash. The national average HELOC interest rate is 7.63% as of December 2025, according to Bankrate.

Home equity loans usually have a fixed interest rate while HELOCs usually have a low starting rate that increases after six months or a year. A HELOC is less costly and time-consuming compared to a cash-out refinance.

How Can Allen Buyers Get Pre-approved in 120 Seconds with Chestnut?

Chestnut AI compresses the traditional timeline dramatically. The system provides instant quotes in under two minutes, allowing borrowers to see comprehensive rate comparisons immediately.

Here is how it works:

Enter basic info. Provide your credit range, income, down payment, and desired loan amount.

AI analyzes 100+ lenders. Chestnut's engine matches your profile to lenders most likely to offer competitive terms.

Receive personalized quotes. You can get started in 2 minutes and review side-by-side offers.

Lock your rate. Chestnut's rate monitoring alerts you when conditions favor locking.

The mortgage closing cycle time is the number of days from application to funding. The industry average has decreased from 46 days in 2016 to 40 days in 2019, and Chestnut's automation pushes that timeline even lower.

Key Takeaways for Allen Borrowers

Rates are favorable. The 30-year fixed sits at 6.18%, down from 6.85% a year ago.

Allen inventory is rising. More homes for sale means more negotiating power.

Shopping saves money. Comparing multiple lenders can cut $600 to $1,200 per year off your costs.

AI accelerates the process. Chestnut compares 100-plus lenders and delivers quotes in under two minutes.

Chestnut is licensed in Texas. Founded by Spencer Brown, a seasoned entrepreneur with prior experience in mortgage technology, Chestnut is licensed in Texas and Colorado, with plans for further expansion.

If you are ready to lock in the best mortgage rate in Allen TX, start with Chestnut's instant quote tool. In the time it takes to finish your morning coffee, you could have a personalized rate that saves you thousands over the life of your loan.

Frequently Asked Questions

Why are current mortgage rates important for Allen TX buyers?

Current mortgage rates are crucial for Allen TX buyers because even a small rate difference can lead to significant savings over a 30-year loan. With Allen's median home prices rising, securing a lower rate can save thousands of dollars over the life of the mortgage.

How does Chestnut's AI technology benefit mortgage seekers?

Chestnut's AI technology benefits mortgage seekers by comparing offers from over 100 lenders, often reducing borrower rates by approximately 0.5%. This technology provides instant quotes and significantly expedites the approval process, making it easier for buyers to secure competitive rates quickly.

What factors influence mortgage rates in Allen TX?

Mortgage rates in Allen TX are influenced by several factors, including Federal Reserve policies, the 10-year Treasury yield, and the Fed's balance sheet activities. These elements affect the overall economic environment, which in turn impacts mortgage pricing.

How can Allen buyers save money when shopping for mortgages?

Allen buyers can save money by requesting multiple Loan Estimates from different lenders, comparing APRs, and negotiating terms. Shopping around can potentially save buyers $600 to $1,200 annually, according to Freddie Mac research.

What makes Chestnut different from traditional mortgage lenders?

Chestnut differs from traditional lenders by using AI to compare over 100 lenders, providing instant quotes, and offering a faster closing cycle. This approach often results in a rate edge of about 0.5% lower than conventional methods, saving borrowers money over the loan's duration.

Sources

https://trerc.tamu.edu/article/texas-housing-insight-september-2025/

https://chestnutmortgage.com/resources/how-to-find-the-best-mortgage-rates-this-month-november-2025

https://trerc.tamu.edu/blog/where-do-mortgage-rates-go-from-here/

https://www.consumerfinance.gov/owning-a-home/compare/request-and-review-multiple-loan-estimates/

https://www.freddiemac.com/fmac-resources/research/pdf/201804-Insight.pdf

https://sf.freddiemac.com/docs/pdf/fact-sheet/mortgage-cycle-time-benchmark-study.pdf

https://files.consumerfinance.gov/f/documents/cfpbshoppingforamortgage.pdf

https://www.freeandclear.com/interest-rates/home-equity-loan-rates