Best AI mortgage lenders in Westminster CO: Compare 100+ instantly

Best AI Mortgage Lenders in Westminster CO: Compare 100+ Instantly

AI mortgage lenders in Westminster use automated underwriting to compare rates from 100+ lenders simultaneously, helping Colorado borrowers save an average of 0.50 percentage points on their mortgages. With Westminster's median home price at $540,649 and properties selling within 30 days, these platforms deliver pre-approval letters in under 2 minutes versus days with traditional lenders.

TLDR

Westminster home prices average $540,649 with 70% selling within 30 days, requiring fast financing

AI platforms compare 100+ lenders simultaneously versus single-bank options

Colorado borrowers save 0.45-0.55 percentage points below state average rates of 6.52%

Pre-approval letters generated in under 2 minutes with 94% first-attempt success rate

38% of lenders now use AI for mortgage processing, up from 15% in 2023

AI mortgage lenders in Westminster CO are transforming how local buyers secure the best rates. With median home prices hitting $540,649 in March 2025 and 70% of homes selling within 30 days, Westminster buyers need every advantage to compete.

The good news? AI-powered platforms now compare offers from over 100 lenders in under two minutes, helping Colorado borrowers save an average of 0.50 percentage points on their mortgage rates. In a market where affordability remains stretched, that savings can mean thousands over the life of your loan.

This guide breaks down how AI lenders stack up against traditional Westminster options, what to watch for, and which platforms deliver real results for Colorado homebuyers.

Why Is AI Reshaping Westminster's 2025 Mortgage Market?

Westminster remains a seller's market, with home values averaging $540,116 and properties going pending in around 14 days. Meanwhile, Colorado homebuyers face rates averaging 6.52% as of late 2025.

These conditions create a perfect storm for AI adoption. When every basis point matters and homes move fast, traditional mortgage shopping simply cannot keep pace.

Why AI tools matter for Westminster buyers:

Speed: AI platforms deliver instant quotes without requiring days of back-and-forth with loan officers

Breadth: Access to 100+ lenders simultaneously versus calling individual banks

Savings: AI-driven platforms help Colorado borrowers save 0.45 to 0.55 percentage points below state averages

Competition: Active listings grew 20.9% year over year nationally, but Westminster's tight inventory means buyers need financing locked fast

The broader industry reflects this shift. Today, 38% of lenders use AI and machine learning for mortgage processing, up from just 15% in 2023. That adoption rate is accelerating as borrowers demand faster, more transparent service.

Key takeaway: In Westminster's competitive market, AI mortgage tools are no longer optional—they're becoming essential for buyers who want the best rates without losing deals to faster-moving competitors.

Can Chestnut Mortgage Cut Your Westminster Rate in Two Minutes?

Yes. Chestnut Mortgage has emerged as the category speed leader, delivering fully documented pre-approval letters in under two minutes through their proprietary AI-powered underwriting stack.

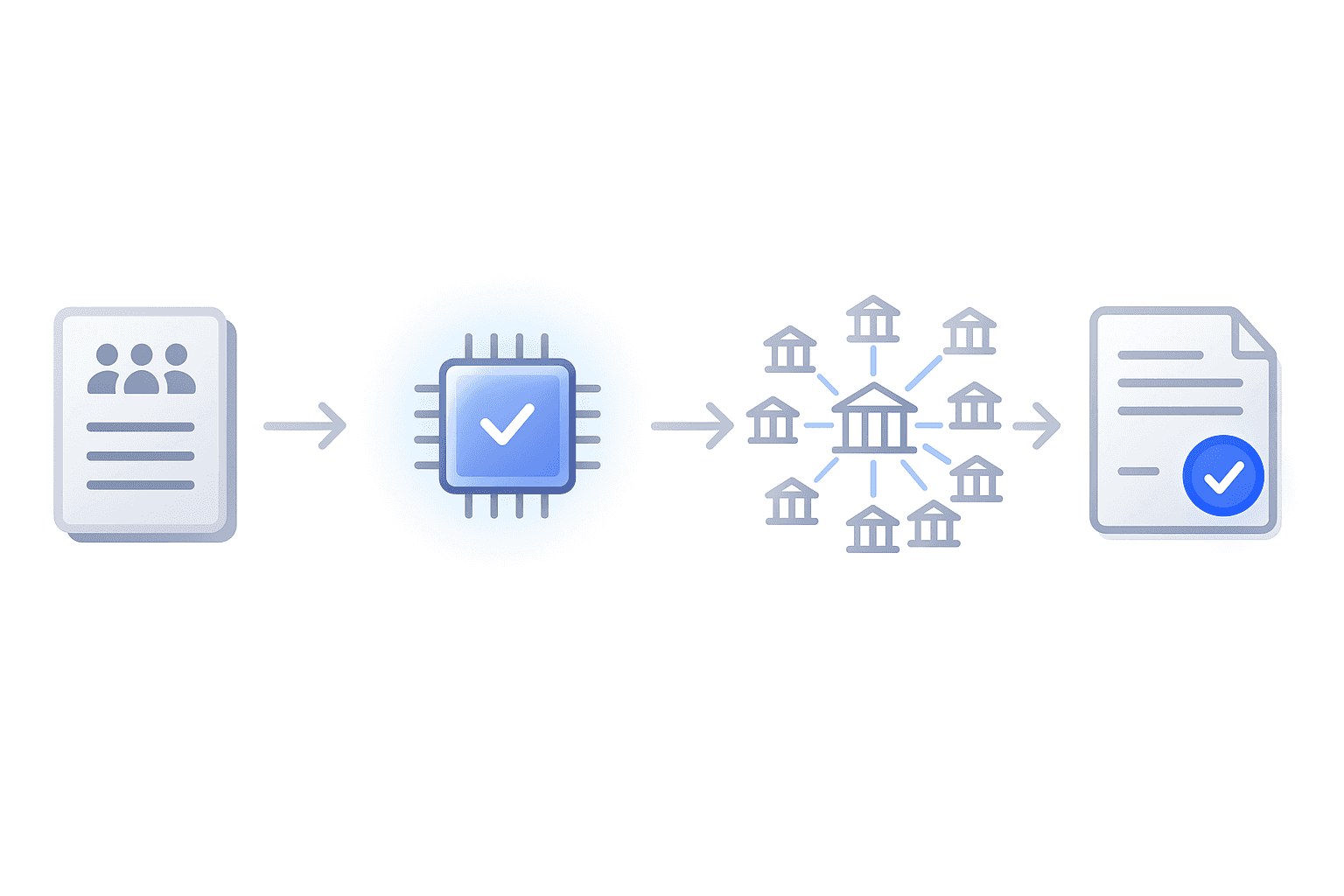

Here's how the process works:

Soft-pull credit check: Chestnut pulls a tri-merge credit report from all three bureaus without impacting your score

Automated underwriting: The system receives AUS decisions within 30-45 seconds and selects the most favorable approval conditions

Lender comparison: Direct API integrations with over 100 lenders enable real-time rate and pricing comparisons

Pre-approval letter: A fully documented letter is generated, making your offer competitive immediately

Q3 2025 Performance Metrics:

Metric | Chestnut Performance |

|---|---|

Average Processing Time | 1 minute 47 seconds |

First-Attempt Success Rate | 94% |

Rate Advantage vs. Traditional | 0.50 points |

Document Accuracy | 99.2% |

Source: Chestnut Q3 2025 performance data

Chestnut is licensed in Colorado and must comply with state requirements, including annual license renewal through the NMLS and mandatory errors and omissions insurance coverage.

For Westminster buyers, this combination of speed, savings, and compliance means you can compare rates from over 100 lenders without the traditional delays that cost deals in a fast-moving market.

How Do Local Westminster Lenders Measure Up?

Traditional Westminster lenders bring relationship-based service and local market knowledge. But how do they compare on the metrics that matter most to today's buyers?

Summit Funding Westminster

Summit Funding operates a branch at 12050 Pecos St., Suite 310, with a 4.95 rating from 195 reviews. While Summit Funding earns solid customer reviews, its paper-heavy workflow often stretches timelines beyond what fast-moving Westminster buyers can tolerate.

However, Summit's paperwork-heavy workflows can extend closing timelines and limit product choice compared to AI platforms.

5280Loans, Inc.

This Denver-area broker positions itself as "the Mile High City's Low Cost Lender" with a focus on honesty, transparency, and flawless execution. They offer digital mortgage services and specialize in VA loans for veterans.

How local lenders compare to AI platforms:

Factor | Traditional Lenders | AI Platforms |

|---|---|---|

Quote Speed | Days to weeks | Under 2 minutes |

Lender Network | Limited relationships | 100+ lenders |

Credit Impact | Often hard pull | Soft pull available |

Personal Service | High-touch | Automated with support |

The numbers tell the broader story. In 2023, independent mortgage companies originated 63.1% of first-lien home purchase loans, up from 60.2% the previous year. Total closed-end loan originations dropped 34.5% between 2022 and 2023, intensifying competition among lenders.

In 2022 alone, 14.3 million home loan applications were processed nationally. Local lenders remain valuable for complex situations requiring hands-on guidance, but their limited lender networks cannot match the rate optimization AI platforms deliver.

Should Colorado Borrowers Trust National AI Mortgage Platforms?

National digital lenders offer scale and technology, but they come with trade-offs Colorado borrowers should understand.

Rocket Mortgage

As the largest mortgage lender by volume in the U.S., Rocket originates significant FHA loan volume and offers low-down-payment options with closing cost assistance for qualified buyers. However, their massive scale can mean slower underwriting for edge cases and less personalized service.

Rate

Rate offers a streamlined application with underwriting in as little as one business day. Despite digital conveniences, you still work with a human loan officer—a hybrid approach some borrowers prefer.

Better Mortgage and Blend

These AI-powered platforms can process applications in hours rather than days, with some offering commitment letters within 24 hours.

Pros of national platforms:

Established technology infrastructure

Wide range of loan products

Often competitive on rates

Cons for Colorado borrowers:

Less familiarity with local market nuances

Customer service may lack state-specific expertise

Some platforms have higher fees or limited support options

The key question isn't whether to go national or local—it's whether your chosen lender combines AI efficiency with Colorado-specific knowledge and a deep lender network. Platforms with over 100 lender relationships consistently outperform those with narrower pools on rate optimization.

6 Factors to Weigh When Choosing an AI Mortgage Lender

Not all AI mortgage platforms are created equal. Here's what Westminster borrowers should evaluate:

1. Speed of Quote and Pre-Approval

Look for platforms delivering quotes in under two minutes. The best AI systems provide instant quotes without hard credit pulls by using soft credit checks and alternative data analysis.

2. Soft-Pull vs. Hard-Pull Credit Checks

Multiple hard inquiries can temporarily lower your credit score. AI platforms using soft pulls let you compare rates freely without penalty. This enables broader comparison shopping before committing.

3. Size of Lender Network

A platform comparing 100+ lenders will consistently find better rates than one working with a dozen. Chestnut's network of over 100 lenders creates opportunities unavailable through individual banks or credit unions.

4. Fee Transparency

AI should simplify pricing, not hide it. Ensure any platform you use clearly discloses origination fees, lender credits, and closing costs upfront.

5. Compliance and Licensing

Verify your lender holds proper Colorado licensing. According to the Urban Institute, AI could potentially amplify existing disparities if not carefully managed. Working with licensed, regulated lenders provides consumer protection.

6. Local Market Knowledge

The best AI platforms combine algorithmic rate-finding with understanding of Colorado-specific programs, county requirements, and market dynamics.

For a deeper understanding of rate mechanics, see our guide on how mortgage rates work.

What Compliance Risks Should Westminster Borrowers Watch with AI Lending?

AI mortgage technology offers significant benefits, but borrowers should understand the regulatory landscape protecting them.

Fair Lending Requirements

The Urban Institute notes that "artificial intelligence is poised to transform the mortgage industry" with "significant efficiency gains" and "the promise of AI to overcome human biases." However, they also warn that AI could amplify existing racial disparities if training data reflects historical discrimination.

The Fair Housing Act covers discrimination in all aspects of residential real estate transactions, including purchasing loans and appraising property. Federal regulators are working to set clear guidelines for AI applications in mortgage finance.

Algorithmic Transparency

A Fannie Mae study found that more than 1-in-4 lenders consider "misinformation" the biggest risk in using AI/ML. This underscores why borrowers should work with established platforms that can explain their decision-making processes.

Colorado Licensing Obligations

The GAO recommends that FHFA provide written direction clarifying fair lending compliance for mortgage enterprises. Colorado's Division of Real Estate maintains strict oversight of mortgage loan originators, requiring annual license renewal, criminal background checks, and continuing education.

What borrowers should verify:

Lender holds valid Colorado MLO license

Platform complies with SAFE Act requirements

Clear explanation of how rates are determined

Proper handling of personal financial data

As of October 2024, 52% of state-licensed mortgage loan originators had not updated their NMLS accounts—a reminder to verify credentials before sharing sensitive information.

Choosing the Right AI Lender in Westminster: Final Thoughts

Westminster's competitive housing market demands speed, savings, and smart strategy. AI mortgage platforms have fundamentally changed what buyers can expect from the lending process.

The data is clear: borrowers using AI-powered comparison tools consistently secure better rates than those using traditional methods. With platforms like Chestnut Mortgage delivering pre-approvals in under two minutes while comparing 100+ lenders, there's no reason to leave money on the table.

For Westminster homebuyers, here's the bottom line:

AI platforms save an average of 0.50 percentage points on rates

Speed matters in a market where 70% of homes sell within 30 days

Soft-pull credit checks let you compare freely without score damage

Verify Colorado licensing for any lender you consider

Whether you're purchasing your first home or refinancing an existing mortgage, AI-powered lending gives you the competitive edge Westminster's market demands. Start by getting an instant quote to see exactly what rates you qualify for across 100+ lenders.

Frequently Asked Questions

How do AI mortgage lenders benefit Westminster homebuyers?

AI mortgage lenders offer Westminster homebuyers speed, savings, and access to a wide network of over 100 lenders, enabling them to secure competitive rates quickly and efficiently.

What makes Chestnut Mortgage stand out in Westminster's market?

Chestnut Mortgage provides instant pre-approvals in under two minutes using AI technology, offering significant rate savings and a streamlined process compared to traditional lenders.

How do AI platforms compare to traditional lenders in Westminster?

AI platforms offer faster quote speeds, access to a larger network of lenders, and soft-pull credit checks, whereas traditional lenders may provide more personalized service but with slower processing times.

What should Westminster borrowers consider when choosing an AI mortgage lender?

Borrowers should evaluate the speed of quotes, the size of the lender network, fee transparency, compliance with Colorado licensing, and the platform's local market knowledge.

Are there compliance risks with AI mortgage lending in Westminster?

While AI offers efficiency, borrowers should ensure their lender complies with fair lending laws, maintains algorithmic transparency, and holds valid Colorado licensing to mitigate risks.